COE Renewal: 10 things you wish you knew

03 May 2017|343,613 views

Car owners these days are opting for COE renewals for their aged cars, and it is easy to see why. New car prices are at an all time high with the record high COE these days. This situation makes it extremely cost to even purchase an economy car - the cash outlay is substantial and monthly instalments will be tough to handle.

While renewing your existing car's COE might be a more affordable way to continue your car ownership journey, here are ten things that you need to know before you financially commit to COE renewal for five or 10 years:

You’re forgoing PARF rebates

If you opt for COE renewal with the intention of extending your car's life beyond 10 years, you’ll be forgoing your PARF rebate. You'll only get PARF rebates if you deregister your car within the first 10 years.

To determine if it's worth forgoing your PARF rebate for COE renewal, you need to calculate how much Additional Registration Fees (ARF) you're paying for your vehicle.

For a premium car like a 2007 Mercedes-Benz E200 with an ARF $50,000, you'll be losing $25,000 (if your car is nine to ten years old, you'll get back 50% of your ARF) of PARF rebates if you choose COE renewal over deregistration.

On the other hand, for a family car like a 2007 Honda Civic with an ARF of about $20,000, you'll be forgoing about $10,000 of PARF rebates upon COE renewal.

Before opting for COE renewal, familiarise yourself with the costs you can expect if you renew your COE and OMV, PARF and COE rebates. It'll help you understand what you’re getting yourself into.

You're still eligible for COE rebate

If you've missed the window to get back your PARF rebates, don't worry, you can still get some money back from deregistering your car - COE rebates.

You will be refunded the pro-rated amount of the remaining COE if you scrap or deregister your car before the renewed COE expires. Find out what’s the difference between PARF cars and COE cars.

Suppose you renew your car's COE for 10 years at $50,000. When you scrap it five years later, you will earn back the unused portion of the car's COE, which is $25,000 upon deregistration on the fifth year.

You’ll need to pay additional road tax

Cars above 10 years old have an additional surcharge levied on their road tax. It increases by 10% over the car's regular road tax every year, up to a maximum of 50%.

How much you pay for your road tax is dependent on the your engine capacity. The bigger the engine, the more you pay. Simple.

Suppose a 2.4-litre car has an engine capacity of 2,362cc. The initial payable annual road tax is $1,638. On the 11th year, it increases to $1,802. On the 12th year, it increases to $1,966. By the 15th year, where it reaches the maximum of 150% of $1,638, the payable annual road tax would be $2,457.

You forfeit your remaining balance of COE upon renewal

Should you renew your COE before it expires, you will be forfeiting any 'unused' COE that you've already paid for.

In order to minimise this 'loss', drivers tend to renew their COE closer to, or even on the day of expiry. Just remember to do it though. Driving a car without COE is illegal and punishable by law.

You need to pay the PQP

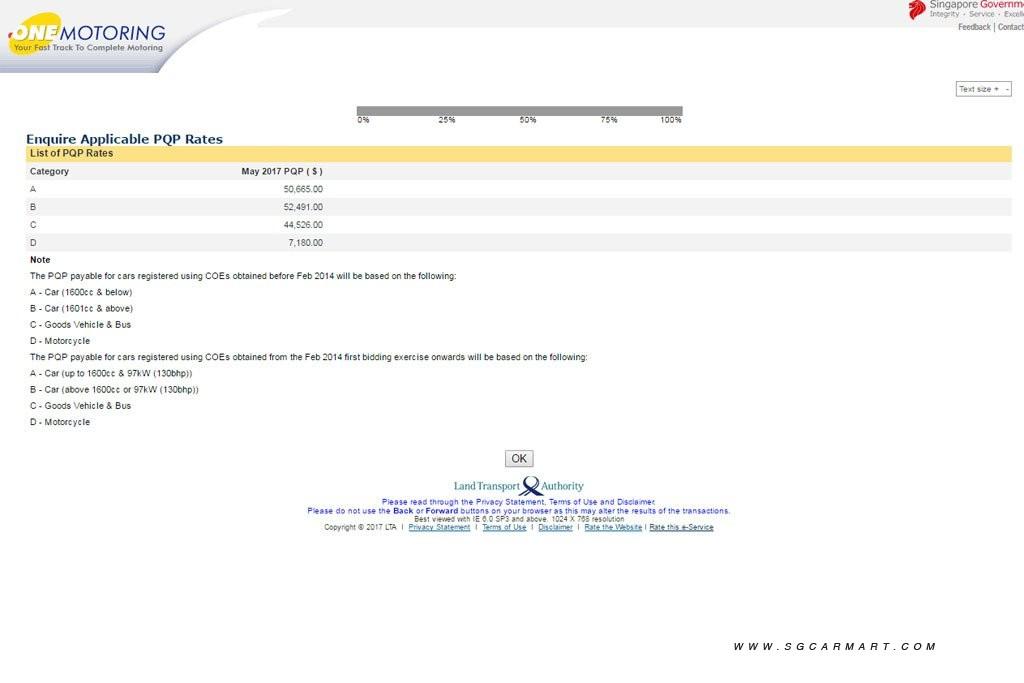

Opting for COE renewal means paying the Prevailing Quota Premium (PQP), which is the average of the COE prices over the last three months. Here are the current PQP rates.

For drivers with vehicles under Category E Open COE, your PQP is based on the respective category that your vehicle belongs to (Category A, B or C).

Cars under the Weekend Car (WEC), Off-Peak Car (OPC) or Revised Off-Peak Car (ROPC) scheme must pay the PQP of the relevant normal car category. No discounts or rebates will be given for the COE renewal of such cars. These cars will remain under its current scheme. You will need to pay a top-up fee for any unused upfront rebates to convert it to a normal car.

Unlimited COE renewal only applies to 10-year renewals

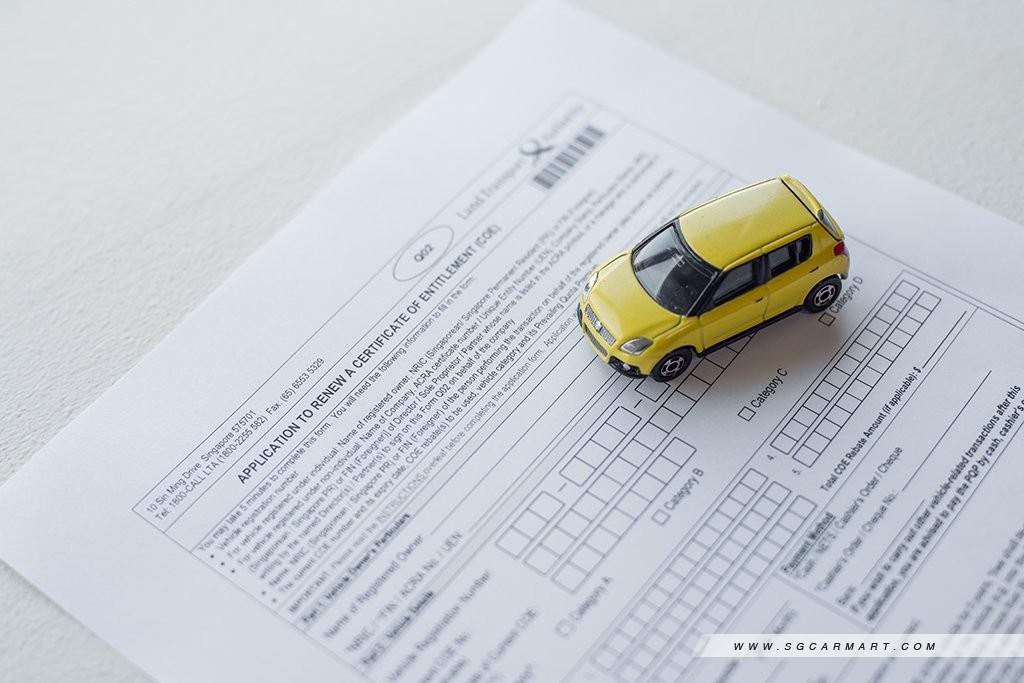

Be it five-years or 10 years, before you renew your COE, you'll have to 'ask LTA for permission' and submit and application form If you renew your COE for five years, you'll have to deregister your car once that five-year duration is up. If you renew your COE for 10 years, you're eligible for unlimited renewals thereafter.

Be it five-years or 10 years, before you renew your COE, you'll have to 'ask LTA for permission' and submit and application form If you renew your COE for five years, you'll have to deregister your car once that five-year duration is up. If you renew your COE for 10 years, you're eligible for unlimited renewals thereafter.

The bright side of renewing your COE for five years is that you only pay for half the PQP at the point of renewal. For those who do not have readily available cash, this is a more financially sound decision, given that loans are not a viable option.

For those who want to renew it for 10 years, however, you can rest assured that there are COE renewal loans easily available.

Do note that while a 10-year COE can be renewed in perpetuity, commercial vehicles have a statutory lifespan of 20 years and its COE cannot be renewed any further.

You can get a COE renewal loan

Some banks and financial institutions allow you to take COE renewal loans. Financial institutions like Hong Leong Finance, Tokyo Century Leasing and United Overseas Bank may all offer different rates though, so do your research.

In general, you can get a COE renewal loan to cover your full COE renewal amount. Loan repayments have typical tenures of 59 months for five-year COE renewals and 83 months for 10-year COE renewals. Interest rates vary from 3.25% to 4.75%.

For COE renewals made through finance companies, an additional transfer count will be added to the vehicle, meaning that it will be deemed to have changed owners.

Your car's rate of depreciation decreases

Since you're only paying for PQP, your car will depreciate at a slower rate over the next 10 years compared to a newly purchased car.

Suppose a new Honda Civic retails for $114,999 (inclusive of COE) and has an ARF of about $20,000. It's annual depreciation will be around $10,500 a year.

On the other hand, if you choose to renew the COE of your existing Honda Civic, the depreciation will just be a straight-line division of the renewal premium over the next 10 years. Even if you're taking into the account the loss of PARF rebate, the depreciation of the car will be less than $6,000 annually.

You can renew your COE even after expiry

Yes, you can renew your COE up to a month after expiration. You will pay for the PQP from the month the COE expired and incur a late renewal fee. If you're any later than one month, you’ll need to dispose your vehicle.

COE renewal can be done online, except from midnight to 6am daily, and you will require an internet banking account. You will also need to ensure that you have sufficient funds in your bank account and that your maximum daily payment limit permits the transaction.

Alternatively, you can renew your COE by post. You must mail the completed application form and your PQP payment to the LTA Customer service centre at Sin Ming Drive. Payment can be made by cheque or by Cashier's Order.

If you choose to renew your COE just on time, you should do it at least two weeks before the expiration date.

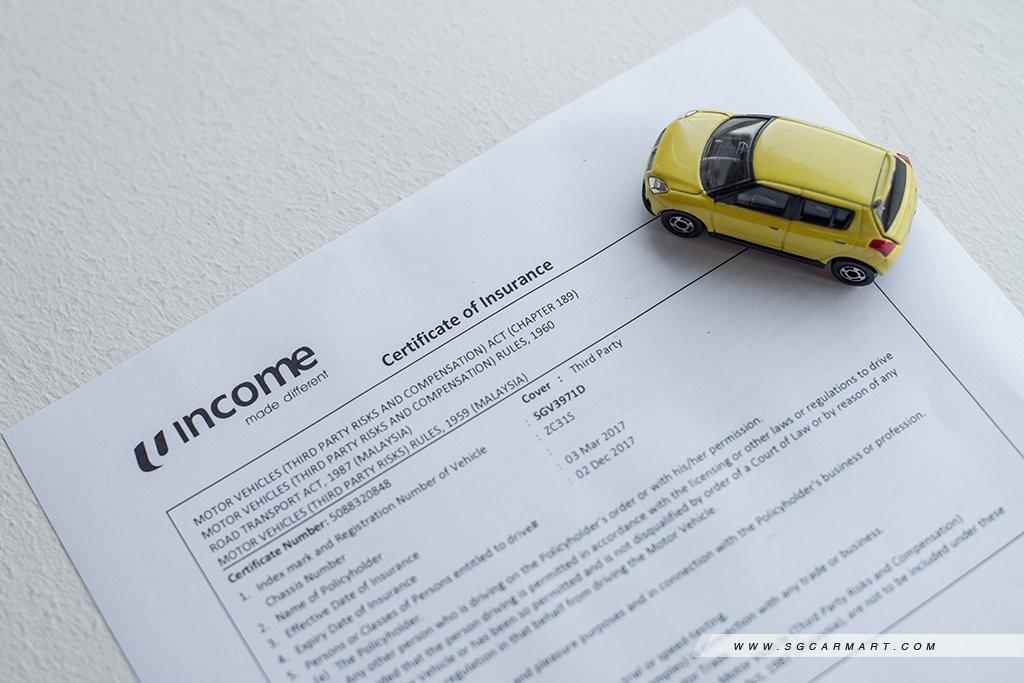

You can still purchase comprehensive insurance

It is possible to get comprehensive insurance for COE renewed cars, although they may be harder to source and slightly more expensive There's a myth that COE cars would be ineligible for comprehensive insurance coverage. This is largely due to the fact that car owners find it impractical to pay a disproportionate premium for older cars with lower market value, resulting in a decreased demand for comprehensive insurance for COE cars.

It is possible to get comprehensive insurance for COE renewed cars, although they may be harder to source and slightly more expensive There's a myth that COE cars would be ineligible for comprehensive insurance coverage. This is largely due to the fact that car owners find it impractical to pay a disproportionate premium for older cars with lower market value, resulting in a decreased demand for comprehensive insurance for COE cars.

Plus, should the car be involved in a major accident, the insurer may write off the car entirely rather than pay for repairs - assuming that the car's market value is not worth much more than the residual value.

Insurers generally would not want to offer more than third-party insurance for older cars, deeming them to be more problematic and susceptible to claims.

Despite all that, the truth is that you can still buy comprehensive car insurance, but it may be slightly more expensive. If you're getting COE renewal loans from a finance company, they may require you to obtain comprehensive insurance coverage from them as part of their terms and conditions.

Here are some COE renewal articles that you might be interested in:

Ultimate Guide to Car Insurance in Singapore

Six things to note before you renew your COE for five or 10 years

Should I renew my car COE in 2020?

A simple guide to COE renewal: How & When you should renew

*This article was updated on 30 September 2022

While renewing your existing car's COE might be a more affordable way to continue your car ownership journey, here are ten things that you need to know before you financially commit to COE renewal for five or 10 years:

- PARF rebates would be forfeited (if your existing car is on its first COE cycle)

- You're still eligible for COE rebates

- You will forfeit your remaining balance of COE upon renewal

- You will need to pay the PQP

- You will need to pay additional road tax

- You can get a COE renewal loan

- Unlimited COE renewal only applies to 10-year renewals

- Your car's rate of depreciation decreases

- You can renew your COE even after expiry

- You can still purchase comprehensive insurance

You’re forgoing PARF rebates

If you opt for COE renewal with the intention of extending your car's life beyond 10 years, you’ll be forgoing your PARF rebate. You'll only get PARF rebates if you deregister your car within the first 10 years.

To determine if it's worth forgoing your PARF rebate for COE renewal, you need to calculate how much Additional Registration Fees (ARF) you're paying for your vehicle.

For a premium car like a 2007 Mercedes-Benz E200 with an ARF $50,000, you'll be losing $25,000 (if your car is nine to ten years old, you'll get back 50% of your ARF) of PARF rebates if you choose COE renewal over deregistration.

On the other hand, for a family car like a 2007 Honda Civic with an ARF of about $20,000, you'll be forgoing about $10,000 of PARF rebates upon COE renewal.

Before opting for COE renewal, familiarise yourself with the costs you can expect if you renew your COE and OMV, PARF and COE rebates. It'll help you understand what you’re getting yourself into.

You're still eligible for COE rebate

If you've missed the window to get back your PARF rebates, don't worry, you can still get some money back from deregistering your car - COE rebates.

You will be refunded the pro-rated amount of the remaining COE if you scrap or deregister your car before the renewed COE expires. Find out what’s the difference between PARF cars and COE cars.

Suppose you renew your car's COE for 10 years at $50,000. When you scrap it five years later, you will earn back the unused portion of the car's COE, which is $25,000 upon deregistration on the fifth year.

You’ll need to pay additional road tax

Cars above 10 years old have an additional surcharge levied on their road tax. It increases by 10% over the car's regular road tax every year, up to a maximum of 50%.

How much you pay for your road tax is dependent on the your engine capacity. The bigger the engine, the more you pay. Simple.

Suppose a 2.4-litre car has an engine capacity of 2,362cc. The initial payable annual road tax is $1,638. On the 11th year, it increases to $1,802. On the 12th year, it increases to $1,966. By the 15th year, where it reaches the maximum of 150% of $1,638, the payable annual road tax would be $2,457.

You forfeit your remaining balance of COE upon renewal

Should you renew your COE before it expires, you will be forfeiting any 'unused' COE that you've already paid for.

In order to minimise this 'loss', drivers tend to renew their COE closer to, or even on the day of expiry. Just remember to do it though. Driving a car without COE is illegal and punishable by law.

Sgcarmart

Get COE Renewal Advice, Loans & Paperwork

We help you renew your COE and find the best loan rates in Singapore.

Get startedYou need to pay the PQP

Opting for COE renewal means paying the Prevailing Quota Premium (PQP), which is the average of the COE prices over the last three months. Here are the current PQP rates.

For drivers with vehicles under Category E Open COE, your PQP is based on the respective category that your vehicle belongs to (Category A, B or C).

Cars under the Weekend Car (WEC), Off-Peak Car (OPC) or Revised Off-Peak Car (ROPC) scheme must pay the PQP of the relevant normal car category. No discounts or rebates will be given for the COE renewal of such cars. These cars will remain under its current scheme. You will need to pay a top-up fee for any unused upfront rebates to convert it to a normal car.

Unlimited COE renewal only applies to 10-year renewals

The bright side of renewing your COE for five years is that you only pay for half the PQP at the point of renewal. For those who do not have readily available cash, this is a more financially sound decision, given that loans are not a viable option.

For those who want to renew it for 10 years, however, you can rest assured that there are COE renewal loans easily available.

Do note that while a 10-year COE can be renewed in perpetuity, commercial vehicles have a statutory lifespan of 20 years and its COE cannot be renewed any further.

You can get a COE renewal loan

Some banks and financial institutions allow you to take COE renewal loans. Financial institutions like Hong Leong Finance, Tokyo Century Leasing and United Overseas Bank may all offer different rates though, so do your research.

In general, you can get a COE renewal loan to cover your full COE renewal amount. Loan repayments have typical tenures of 59 months for five-year COE renewals and 83 months for 10-year COE renewals. Interest rates vary from 3.25% to 4.75%.

For COE renewals made through finance companies, an additional transfer count will be added to the vehicle, meaning that it will be deemed to have changed owners.

Your car's rate of depreciation decreases

Since you're only paying for PQP, your car will depreciate at a slower rate over the next 10 years compared to a newly purchased car.

Suppose a new Honda Civic retails for $114,999 (inclusive of COE) and has an ARF of about $20,000. It's annual depreciation will be around $10,500 a year.

On the other hand, if you choose to renew the COE of your existing Honda Civic, the depreciation will just be a straight-line division of the renewal premium over the next 10 years. Even if you're taking into the account the loss of PARF rebate, the depreciation of the car will be less than $6,000 annually.

You can renew your COE even after expiry

Yes, you can renew your COE up to a month after expiration. You will pay for the PQP from the month the COE expired and incur a late renewal fee. If you're any later than one month, you’ll need to dispose your vehicle.

COE renewal can be done online, except from midnight to 6am daily, and you will require an internet banking account. You will also need to ensure that you have sufficient funds in your bank account and that your maximum daily payment limit permits the transaction.

Alternatively, you can renew your COE by post. You must mail the completed application form and your PQP payment to the LTA Customer service centre at Sin Ming Drive. Payment can be made by cheque or by Cashier's Order.

If you choose to renew your COE just on time, you should do it at least two weeks before the expiration date.

You can still purchase comprehensive insurance

Plus, should the car be involved in a major accident, the insurer may write off the car entirely rather than pay for repairs - assuming that the car's market value is not worth much more than the residual value.

Insurers generally would not want to offer more than third-party insurance for older cars, deeming them to be more problematic and susceptible to claims.

Despite all that, the truth is that you can still buy comprehensive car insurance, but it may be slightly more expensive. If you're getting COE renewal loans from a finance company, they may require you to obtain comprehensive insurance coverage from them as part of their terms and conditions.

Sgcarmart

Get COE Renewal Advice, Loans & Paperwork

We help you renew your COE and find the best loan rates in Singapore.

- Complimentary pre-COE inspection

- Settlement of entire COE renewal paperwork

Here are some COE renewal articles that you might be interested in:

Ultimate Guide to Car Insurance in Singapore

Six things to note before you renew your COE for five or 10 years

Should I renew my car COE in 2020?

A simple guide to COE renewal: How & When you should renew

*This article was updated on 30 September 2022

Car owners these days are opting for COE renewals for their aged cars, and it is easy to see why. New car prices are at an all time high with the record high COE these days. This situation makes it extremely cost to even purchase an economy car - the cash outlay is substantial and monthly instalments will be tough to handle.

While renewing your existing car's COE might be a more affordable way to continue your car ownership journey, here are ten things that you need to know before you financially commit to COE renewal for five or 10 years:

You’re forgoing PARF rebates

If you opt for COE renewal with the intention of extending your car's life beyond 10 years, you’ll be forgoing your PARF rebate. You'll only get PARF rebates if you deregister your car within the first 10 years.

To determine if it's worth forgoing your PARF rebate for COE renewal, you need to calculate how much Additional Registration Fees (ARF) you're paying for your vehicle.

For a premium car like a 2007 Mercedes-Benz E200 with an ARF $50,000, you'll be losing $25,000 (if your car is nine to ten years old, you'll get back 50% of your ARF) of PARF rebates if you choose COE renewal over deregistration.

On the other hand, for a family car like a 2007 Honda Civic with an ARF of about $20,000, you'll be forgoing about $10,000 of PARF rebates upon COE renewal.

Before opting for COE renewal, familiarise yourself with the costs you can expect if you renew your COE and OMV, PARF and COE rebates. It'll help you understand what you’re getting yourself into.

You're still eligible for COE rebate

If you've missed the window to get back your PARF rebates, don't worry, you can still get some money back from deregistering your car - COE rebates.

You will be refunded the pro-rated amount of the remaining COE if you scrap or deregister your car before the renewed COE expires. Find out what’s the difference between PARF cars and COE cars.

Suppose you renew your car's COE for 10 years at $50,000. When you scrap it five years later, you will earn back the unused portion of the car's COE, which is $25,000 upon deregistration on the fifth year.

You’ll need to pay additional road tax

Cars above 10 years old have an additional surcharge levied on their road tax. It increases by 10% over the car's regular road tax every year, up to a maximum of 50%.

How much you pay for your road tax is dependent on the your engine capacity. The bigger the engine, the more you pay. Simple.

Suppose a 2.4-litre car has an engine capacity of 2,362cc. The initial payable annual road tax is $1,638. On the 11th year, it increases to $1,802. On the 12th year, it increases to $1,966. By the 15th year, where it reaches the maximum of 150% of $1,638, the payable annual road tax would be $2,457.

You forfeit your remaining balance of COE upon renewal

Should you renew your COE before it expires, you will be forfeiting any 'unused' COE that you've already paid for.

In order to minimise this 'loss', drivers tend to renew their COE closer to, or even on the day of expiry. Just remember to do it though. Driving a car without COE is illegal and punishable by law.

You need to pay the PQP

Opting for COE renewal means paying the Prevailing Quota Premium (PQP), which is the average of the COE prices over the last three months. Here are the current PQP rates.

For drivers with vehicles under Category E Open COE, your PQP is based on the respective category that your vehicle belongs to (Category A, B or C).

Cars under the Weekend Car (WEC), Off-Peak Car (OPC) or Revised Off-Peak Car (ROPC) scheme must pay the PQP of the relevant normal car category. No discounts or rebates will be given for the COE renewal of such cars. These cars will remain under its current scheme. You will need to pay a top-up fee for any unused upfront rebates to convert it to a normal car.

Unlimited COE renewal only applies to 10-year renewals

Be it five-years or 10 years, before you renew your COE, you'll have to 'ask LTA for permission' and submit and application form If you renew your COE for five years, you'll have to deregister your car once that five-year duration is up. If you renew your COE for 10 years, you're eligible for unlimited renewals thereafter.

Be it five-years or 10 years, before you renew your COE, you'll have to 'ask LTA for permission' and submit and application form If you renew your COE for five years, you'll have to deregister your car once that five-year duration is up. If you renew your COE for 10 years, you're eligible for unlimited renewals thereafter.

The bright side of renewing your COE for five years is that you only pay for half the PQP at the point of renewal. For those who do not have readily available cash, this is a more financially sound decision, given that loans are not a viable option.

For those who want to renew it for 10 years, however, you can rest assured that there are COE renewal loans easily available.

Do note that while a 10-year COE can be renewed in perpetuity, commercial vehicles have a statutory lifespan of 20 years and its COE cannot be renewed any further.

You can get a COE renewal loan

Some banks and financial institutions allow you to take COE renewal loans. Financial institutions like Hong Leong Finance, Tokyo Century Leasing and United Overseas Bank may all offer different rates though, so do your research.

In general, you can get a COE renewal loan to cover your full COE renewal amount. Loan repayments have typical tenures of 59 months for five-year COE renewals and 83 months for 10-year COE renewals. Interest rates vary from 3.25% to 4.75%.

For COE renewals made through finance companies, an additional transfer count will be added to the vehicle, meaning that it will be deemed to have changed owners.

Your car's rate of depreciation decreases

Since you're only paying for PQP, your car will depreciate at a slower rate over the next 10 years compared to a newly purchased car.

Suppose a new Honda Civic retails for $114,999 (inclusive of COE) and has an ARF of about $20,000. It's annual depreciation will be around $10,500 a year.

On the other hand, if you choose to renew the COE of your existing Honda Civic, the depreciation will just be a straight-line division of the renewal premium over the next 10 years. Even if you're taking into the account the loss of PARF rebate, the depreciation of the car will be less than $6,000 annually.

You can renew your COE even after expiry

Yes, you can renew your COE up to a month after expiration. You will pay for the PQP from the month the COE expired and incur a late renewal fee. If you're any later than one month, you’ll need to dispose your vehicle.

COE renewal can be done online, except from midnight to 6am daily, and you will require an internet banking account. You will also need to ensure that you have sufficient funds in your bank account and that your maximum daily payment limit permits the transaction.

Alternatively, you can renew your COE by post. You must mail the completed application form and your PQP payment to the LTA Customer service centre at Sin Ming Drive. Payment can be made by cheque or by Cashier's Order.

If you choose to renew your COE just on time, you should do it at least two weeks before the expiration date.

You can still purchase comprehensive insurance

It is possible to get comprehensive insurance for COE renewed cars, although they may be harder to source and slightly more expensive There's a myth that COE cars would be ineligible for comprehensive insurance coverage. This is largely due to the fact that car owners find it impractical to pay a disproportionate premium for older cars with lower market value, resulting in a decreased demand for comprehensive insurance for COE cars.

It is possible to get comprehensive insurance for COE renewed cars, although they may be harder to source and slightly more expensive There's a myth that COE cars would be ineligible for comprehensive insurance coverage. This is largely due to the fact that car owners find it impractical to pay a disproportionate premium for older cars with lower market value, resulting in a decreased demand for comprehensive insurance for COE cars.

Plus, should the car be involved in a major accident, the insurer may write off the car entirely rather than pay for repairs - assuming that the car's market value is not worth much more than the residual value.

Insurers generally would not want to offer more than third-party insurance for older cars, deeming them to be more problematic and susceptible to claims.

Despite all that, the truth is that you can still buy comprehensive car insurance, but it may be slightly more expensive. If you're getting COE renewal loans from a finance company, they may require you to obtain comprehensive insurance coverage from them as part of their terms and conditions.

Here are some COE renewal articles that you might be interested in:

Ultimate Guide to Car Insurance in SingaporeSix things to note before you renew your COE for five or 10 years

Should I renew my car COE in 2020?

A simple guide to COE renewal: How & When you should renew

*This article was updated on 30 September 2022

While renewing your existing car's COE might be a more affordable way to continue your car ownership journey, here are ten things that you need to know before you financially commit to COE renewal for five or 10 years:

- PARF rebates would be forfeited (if your existing car is on its first COE cycle)

- You're still eligible for COE rebates

- You will forfeit your remaining balance of COE upon renewal

- You will need to pay the PQP

- You will need to pay additional road tax

- You can get a COE renewal loan

- Unlimited COE renewal only applies to 10-year renewals

- Your car's rate of depreciation decreases

- You can renew your COE even after expiry

- You can still purchase comprehensive insurance

You’re forgoing PARF rebates

If you opt for COE renewal with the intention of extending your car's life beyond 10 years, you’ll be forgoing your PARF rebate. You'll only get PARF rebates if you deregister your car within the first 10 years.

To determine if it's worth forgoing your PARF rebate for COE renewal, you need to calculate how much Additional Registration Fees (ARF) you're paying for your vehicle.

For a premium car like a 2007 Mercedes-Benz E200 with an ARF $50,000, you'll be losing $25,000 (if your car is nine to ten years old, you'll get back 50% of your ARF) of PARF rebates if you choose COE renewal over deregistration.

On the other hand, for a family car like a 2007 Honda Civic with an ARF of about $20,000, you'll be forgoing about $10,000 of PARF rebates upon COE renewal.

Before opting for COE renewal, familiarise yourself with the costs you can expect if you renew your COE and OMV, PARF and COE rebates. It'll help you understand what you’re getting yourself into.

You're still eligible for COE rebate

If you've missed the window to get back your PARF rebates, don't worry, you can still get some money back from deregistering your car - COE rebates.

You will be refunded the pro-rated amount of the remaining COE if you scrap or deregister your car before the renewed COE expires. Find out what’s the difference between PARF cars and COE cars.

Suppose you renew your car's COE for 10 years at $50,000. When you scrap it five years later, you will earn back the unused portion of the car's COE, which is $25,000 upon deregistration on the fifth year.

You’ll need to pay additional road tax

Cars above 10 years old have an additional surcharge levied on their road tax. It increases by 10% over the car's regular road tax every year, up to a maximum of 50%.

How much you pay for your road tax is dependent on the your engine capacity. The bigger the engine, the more you pay. Simple.

Suppose a 2.4-litre car has an engine capacity of 2,362cc. The initial payable annual road tax is $1,638. On the 11th year, it increases to $1,802. On the 12th year, it increases to $1,966. By the 15th year, where it reaches the maximum of 150% of $1,638, the payable annual road tax would be $2,457.

You forfeit your remaining balance of COE upon renewal

Should you renew your COE before it expires, you will be forfeiting any 'unused' COE that you've already paid for.

In order to minimise this 'loss', drivers tend to renew their COE closer to, or even on the day of expiry. Just remember to do it though. Driving a car without COE is illegal and punishable by law.

Sgcarmart

Get COE Renewal Advice, Loans & Paperwork

We help you renew your COE and find the best loan rates in Singapore.

Get startedYou need to pay the PQP

Opting for COE renewal means paying the Prevailing Quota Premium (PQP), which is the average of the COE prices over the last three months. Here are the current PQP rates.

For drivers with vehicles under Category E Open COE, your PQP is based on the respective category that your vehicle belongs to (Category A, B or C).

Cars under the Weekend Car (WEC), Off-Peak Car (OPC) or Revised Off-Peak Car (ROPC) scheme must pay the PQP of the relevant normal car category. No discounts or rebates will be given for the COE renewal of such cars. These cars will remain under its current scheme. You will need to pay a top-up fee for any unused upfront rebates to convert it to a normal car.

Unlimited COE renewal only applies to 10-year renewals

The bright side of renewing your COE for five years is that you only pay for half the PQP at the point of renewal. For those who do not have readily available cash, this is a more financially sound decision, given that loans are not a viable option.

For those who want to renew it for 10 years, however, you can rest assured that there are COE renewal loans easily available.

Do note that while a 10-year COE can be renewed in perpetuity, commercial vehicles have a statutory lifespan of 20 years and its COE cannot be renewed any further.

You can get a COE renewal loan

Some banks and financial institutions allow you to take COE renewal loans. Financial institutions like Hong Leong Finance, Tokyo Century Leasing and United Overseas Bank may all offer different rates though, so do your research.

In general, you can get a COE renewal loan to cover your full COE renewal amount. Loan repayments have typical tenures of 59 months for five-year COE renewals and 83 months for 10-year COE renewals. Interest rates vary from 3.25% to 4.75%.

For COE renewals made through finance companies, an additional transfer count will be added to the vehicle, meaning that it will be deemed to have changed owners.

Your car's rate of depreciation decreases

Since you're only paying for PQP, your car will depreciate at a slower rate over the next 10 years compared to a newly purchased car.

Suppose a new Honda Civic retails for $114,999 (inclusive of COE) and has an ARF of about $20,000. It's annual depreciation will be around $10,500 a year.

On the other hand, if you choose to renew the COE of your existing Honda Civic, the depreciation will just be a straight-line division of the renewal premium over the next 10 years. Even if you're taking into the account the loss of PARF rebate, the depreciation of the car will be less than $6,000 annually.

You can renew your COE even after expiry

Yes, you can renew your COE up to a month after expiration. You will pay for the PQP from the month the COE expired and incur a late renewal fee. If you're any later than one month, you’ll need to dispose your vehicle.

COE renewal can be done online, except from midnight to 6am daily, and you will require an internet banking account. You will also need to ensure that you have sufficient funds in your bank account and that your maximum daily payment limit permits the transaction.

Alternatively, you can renew your COE by post. You must mail the completed application form and your PQP payment to the LTA Customer service centre at Sin Ming Drive. Payment can be made by cheque or by Cashier's Order.

If you choose to renew your COE just on time, you should do it at least two weeks before the expiration date.

You can still purchase comprehensive insurance

Plus, should the car be involved in a major accident, the insurer may write off the car entirely rather than pay for repairs - assuming that the car's market value is not worth much more than the residual value.

Insurers generally would not want to offer more than third-party insurance for older cars, deeming them to be more problematic and susceptible to claims.

Despite all that, the truth is that you can still buy comprehensive car insurance, but it may be slightly more expensive. If you're getting COE renewal loans from a finance company, they may require you to obtain comprehensive insurance coverage from them as part of their terms and conditions.

Sgcarmart

Get COE Renewal Advice, Loans & Paperwork

We help you renew your COE and find the best loan rates in Singapore.

- Complimentary pre-COE inspection

- Settlement of entire COE renewal paperwork

Here are some COE renewal articles that you might be interested in:

Ultimate Guide to Car Insurance in SingaporeSix things to note before you renew your COE for five or 10 years

Should I renew my car COE in 2020?

A simple guide to COE renewal: How & When you should renew

*This article was updated on 30 September 2022