COE renewal: What costs can you expect?

More are opting to keep their cars beyond the initial 10 years, and it is for good reason. Car prices are soaring and you can keep car ownership costs to a minimum if you were to opt for a COE renewal. Now, you might be tempted to opt for a COE renewal for your current car yourself, but you should find out more about this topic.

Here's a quick rundown of the costs associated so you know just what you will be facing should you opt to do so as well!

Prevailing Quota Premium

The first and largest item you'll be forking out for when opting for COE renewal is the Prevailing Quota Premium (PQP).

Unlike when buying a new car, you won’t have to bid for a new COE. Instead, the PQP is computed from the moving average of the previous three months of COE prices from the month you intend to renew your car's COE.

While this might remove some of the fun of trying to submitting a bid yourself and speculating on upcoming prices, it also means that those choosing COE renewal on their cars are granted more predictability of the current prices.

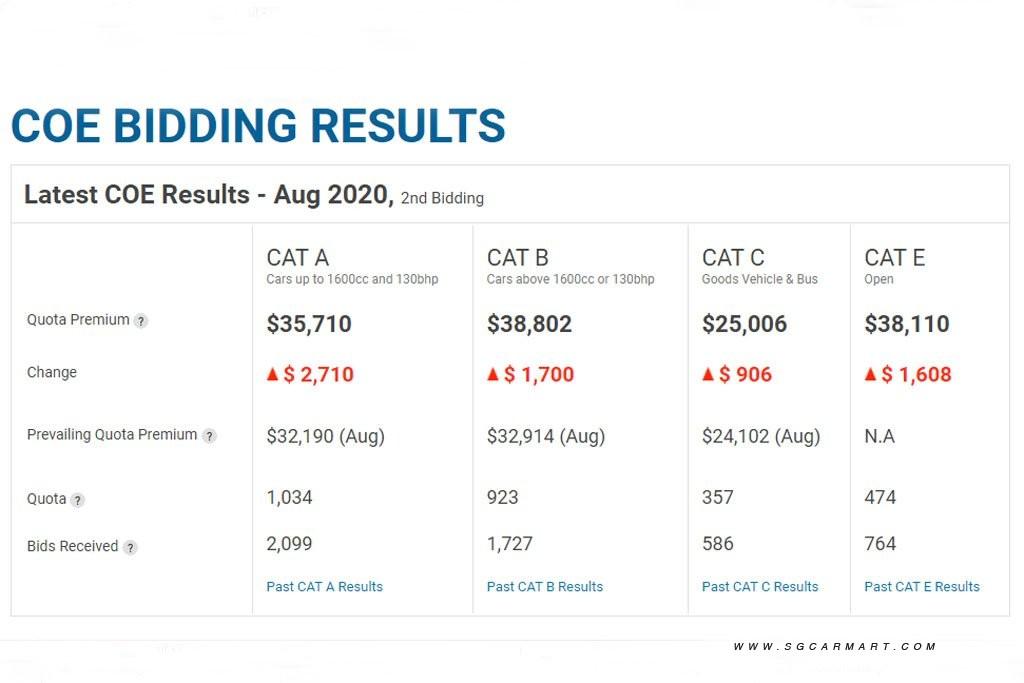

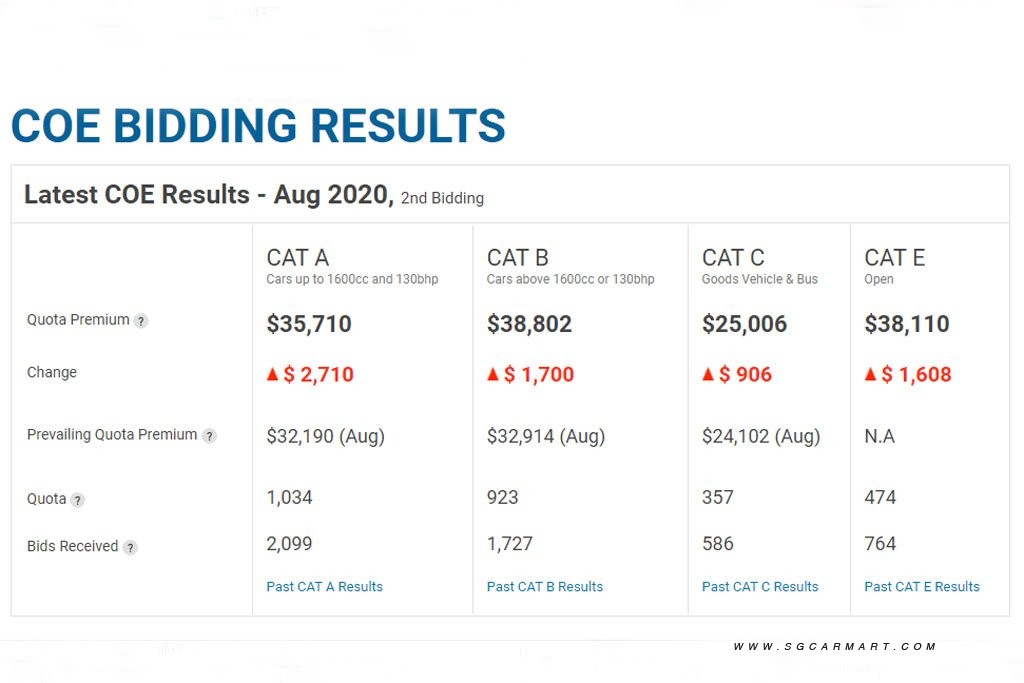

With COE prices currently trending upwards (as of August 2020) our advice for those with cars already approaching a decade old and thinking of renewing their cars would do well to bookmark our page here and start keeping track of the PQP prices.

This way you can strike whenever the PQP price reaches a level that is acceptable to your budgeting needs. And for those looking to get their PQP at the absolute lowest prices, stay away from the months where LTA makes new restrictions to the car population, as they tend to result in higher COE premiums for the following bidding session.

Forfeited PARF rebate and outstanding COE rebate

The PQP prices may look like a harsh price to pay just to keep a car you already own. But if your car has not approached the full 10 years of age, you'll also need to bear in mind that there are some 'loses' you will additionally incur after you opt for COE renewal on yor your car.

If you do decide to renew your car's COE before its first 10 years are consumed and then subsequently keep the car beyond 10-years old, those additional loses will come in the form of the forfeited Preferential Additional Registration Fee (PARF), which is paid out when a car younger than 10-years old is deregistered.

This rebate is forfeited when you opt for COE renewal on your car as it is awarded by the LTA in order to incentivise car owners to keep Singapore's fleet of cars young as part of our policy to ease congestion. (In the LTA's eyes a relatively young and roadworthy fleet is essential for maintaining smooth flowing traffic). So if you opt to keep your car beyond the initial 10 years, and contribute to Singapore's ageing car population, these incentives are naturally forfeited.

You can calculate just how much in rebates you will eventually be losing out by following the guide below.

The PARF rebate is calculated as a percentage of the Additional Registration Fee (ARF) paid when you purchased the car:

| Age at deregistration | PARF rebate |

| Not more than 5 years | 75% of ARF paid |

| Above 5 but not more than 6 years | 70% of ARF paid |

| Above 6 but not more than 7 years | 65% of ARF paid |

| Above 7 but not more than 8 years | 60% of ARF paid |

| Above 8 but not more than 9 years | 55% of ARF paid |

| Above 9 but not more than 10 years | 50% of ARF paid |

| More than 10 years | Nil |

Something else worth considering is that when you deregister a car younger than 10-years old, you will also be eligible for a COE rebate, which is calculated based on the Quota Premium (QP) or the Prevailing Quota Premium (PQP) paid for the car, and is pro-rated according to the time remaining on your vehicle's COE.

We replicate the example from OneMotoring here. Supposing you have a vehicle with the details as follows:

| QP or PQP of 10-year COE paid | $16,897 |

| Deregistration date | 2 January 2013 |

| COE expiry date | 5 June 2015 |

And you opt to deregister this vehicle, the unused period of COE is calculated as follows:

| From 3 January 2013 to 2 June 2015 (counting in full calendar months) | 29 months |

| From 3 June 2015 to 5 June 2015 (counting 30 days as one full month in June) | 3 days or 0.1 month |

| Total unused period of COE | 29.1 months |

And the subsequent COE rebate will be calculated as follows:

COE rebate = QP or PQP of 10-year COE paid x Total unused period of COE /120 months

In this case that would mean (16,897 x 29.1 months) / 120 months = $4,097

Of course, the flipside of not getting that COE rebate is that you keep your car for the full 10 years you initially paid the COE for. So it isn't necessarily a loss per se, but it is still worth considering if you're undecided between COE renewal for your current car or purchasing another second-hand vehicle, since you could have more cash to plough into your next purchase than you think.

Our advice? If you think COE prices are going to rise and never come back down, and if you got your current car with COE on the cheap, it might be well worth to forfeit the lower COE rebate you can enjoy now to shield yourself from higher future PQP prices.

Obviously, if you think the inverse is true: That current COE prices are not sustainable and if your car was purchased at record-high COE prices, then it will be well worth your time to wait and see, and only to renew your car's COE when you are dead sure that the current PQP prices have reached rock bottom.

Sgcarmart

Get COE Renewal Advice, Loans & Paperwork

We help you renew your COE and find the best loan rates in Singapore.

Get startedIncreasing annual road tax

Another significant cost to consider when deciding for or against the COE renewal of your car is the increasing annual road tax due.

Our advice here is simple: You'll want to take note that many older cars typically have larger engines while newer ones are generally becoming more efficient, allowing them to make use of smaller engines to produce the same amount of power. So if money flow is an issue, but outright capital for a replacement car is not, it might actually be worth your time considering purchasing a second-hand COE car and forfeiting that 20-year old 2.8-litre dinosaur.

The additional road tax payable for cars than 10-years old is produced in the table below:

| Age of vehicle | Annual road tax surcharge |

| More than 10-years old | 10% of road tax |

| More than 11-years old | 20% of road tax |

| More than 12-years old | 30% of road tax |

| More than 13-years old | 40% of road tax |

| More than 14-years old | 50% of road tax |

Comprehensive insurance for COE renewed cars

For those that want complete piece of mind for what is soon becoming a motorised family heirloom, you'll also want to take note that shopping for comprehensive insurance will become increasingly difficult.

AXA, for instance, will not insure cars older than 25-years old, while others like NTUC Income, MSIG and Tokio Marine will offer comprehensive cover for cars older than 10 years only on a case-by-case basis.

This is because there simply isn't as much demand for comprehensive insurance for COE cars as many owners deem it unfeasible to pay a hefty premium, which is disproportionate to the value of the car. Insurers themselves are also reluctant to offer anything more than just third-party insurance (which covers claims by third parties only) for older cars, as they deem them to be more problematic and more susceptible to claims.

Vehicle wear and tear

One other expense that you'll want to consider before opting to renew your car is the additional cost involved in maintaining a vehicle beyond 10 years. Beyond this point, more components that might not have been considered as consumables will begin to fail and this will cost you not only in repair bills, but also in lost time and reliability of your vehicle.

One important thing to consider is the fact that at this point, for example, is that the dampers on your car may already need replacement. Furthermore, your car's upholstery and interior may also be in need of a refresh.

Do consider if these things matter to you and if you think they need replacing, there is always the option of shopping for replacement part from our own extensive directory.

Interested in COE renewal for your car? There are three ways to do it by yourself

1. Online via OneMotoring here.

2. Snail Mail to LTA at this address:

Land Transport Authority (LTA)

Customer Service Centre

10 Sin Ming Drive

Singapore 575701

3. Or, you can manually apply at the LTA Customer Service centre at this address:

10 Sin Ming Drive Singapore (575701)

Here are some COE renewal articles that you might be interested in

COE renewal - should you choose a bank loan or in-house loan

A simple guide to COE renewal

Should you renew your car in 2020?

5 cars in Singapore that are worth renewing COE for (2020 Edition)

Sgcarmart

Get COE Renewal Advice, Loans & Paperwork

We help you renew your COE and find the best loan rates in Singapore.

- Complimentary pre-COE inspection

- Settlement of entire COE renewal paperwork

*This article was updated on 30 September 2022

More are opting to keep their cars beyond the initial 10 years, and it is for good reason. Car prices are soaring and you can keep car ownership costs to a minimum if you were to opt for a COE renewal. Now, you might be tempted to opt for a COE renewal for your current car yourself, but you should find out more about this topic.

Here's a quick rundown of the costs associated so you know just what you will be facing should you opt to do so as well!

Prevailing Quota Premium

The first and largest item you'll be forking out for when opting for COE renewal is the Prevailing Quota Premium (PQP).

Unlike when buying a new car, you won’t have to bid for a new COE. Instead, the PQP is computed from the moving average of the previous three months of COE prices from the month you intend to renew your car's COE.

While this might remove some of the fun of trying to submitting a bid yourself and speculating on upcoming prices, it also means that those choosing COE renewal on their cars are granted more predictability of the current prices.

With COE prices currently trending upwards (as of August 2020) our advice for those with cars already approaching a decade old and thinking of renewing their cars would do well to bookmark our page here and start keeping track of the PQP prices.

This way you can strike whenever the PQP price reaches a level that is acceptable to your budgeting needs. And for those looking to get their PQP at the absolute lowest prices, stay away from the months where LTA makes new restrictions to the car population, as they tend to result in higher COE premiums for the following bidding session.

Forfeited PARF rebate and outstanding COE rebate

The PQP prices may look like a harsh price to pay just to keep a car you already own. But if your car has not approached the full 10 years of age, you'll also need to bear in mind that there are some 'loses' you will additionally incur after you opt for COE renewal on yor your car.

If you do decide to renew your car's COE before its first 10 years are consumed and then subsequently keep the car beyond 10-years old, those additional loses will come in the form of the forfeited Preferential Additional Registration Fee (PARF), which is paid out when a car younger than 10-years old is deregistered.

This rebate is forfeited when you opt for COE renewal on your car as it is awarded by the LTA in order to incentivise car owners to keep Singapore's fleet of cars young as part of our policy to ease congestion. (In the LTA's eyes a relatively young and roadworthy fleet is essential for maintaining smooth flowing traffic). So if you opt to keep your car beyond the initial 10 years, and contribute to Singapore's ageing car population, these incentives are naturally forfeited.

You can calculate just how much in rebates you will eventually be losing out by following the guide below.

The PARF rebate is calculated as a percentage of the Additional Registration Fee (ARF) paid when you purchased the car:

| Age at deregistration | PARF rebate |

| Not more than 5 years | 75% of ARF paid |

| Above 5 but not more than 6 years | 70% of ARF paid |

| Above 6 but not more than 7 years | 65% of ARF paid |

| Above 7 but not more than 8 years | 60% of ARF paid |

| Above 8 but not more than 9 years | 55% of ARF paid |

| Above 9 but not more than 10 years | 50% of ARF paid |

| More than 10 years | Nil |

Something else worth considering is that when you deregister a car younger than 10-years old, you will also be eligible for a COE rebate, which is calculated based on the Quota Premium (QP) or the Prevailing Quota Premium (PQP) paid for the car, and is pro-rated according to the time remaining on your vehicle's COE.

We replicate the example from OneMotoring here. Supposing you have a vehicle with the details as follows:

| QP or PQP of 10-year COE paid | $16,897 |

| Deregistration date | 2 January 2013 |

| COE expiry date | 5 June 2015 |

And you opt to deregister this vehicle, the unused period of COE is calculated as follows:

| From 3 January 2013 to 2 June 2015 (counting in full calendar months) | 29 months |

| From 3 June 2015 to 5 June 2015 (counting 30 days as one full month in June) | 3 days or 0.1 month |

| Total unused period of COE | 29.1 months |

And the subsequent COE rebate will be calculated as follows:

COE rebate = QP or PQP of 10-year COE paid x Total unused period of COE /120 months

In this case that would mean (16,897 x 29.1 months) / 120 months = $4,097

Of course, the flipside of not getting that COE rebate is that you keep your car for the full 10 years you initially paid the COE for. So it isn't necessarily a loss per se, but it is still worth considering if you're undecided between COE renewal for your current car or purchasing another second-hand vehicle, since you could have more cash to plough into your next purchase than you think.

Our advice? If you think COE prices are going to rise and never come back down, and if you got your current car with COE on the cheap, it might be well worth to forfeit the lower COE rebate you can enjoy now to shield yourself from higher future PQP prices.

Obviously, if you think the inverse is true: That current COE prices are not sustainable and if your car was purchased at record-high COE prices, then it will be well worth your time to wait and see, and only to renew your car's COE when you are dead sure that the current PQP prices have reached rock bottom.

Sgcarmart

Get COE Renewal Advice, Loans & Paperwork

We help you renew your COE and find the best loan rates in Singapore.

Get startedIncreasing annual road tax

Another significant cost to consider when deciding for or against the COE renewal of your car is the increasing annual road tax due.

Our advice here is simple: You'll want to take note that many older cars typically have larger engines while newer ones are generally becoming more efficient, allowing them to make use of smaller engines to produce the same amount of power. So if money flow is an issue, but outright capital for a replacement car is not, it might actually be worth your time considering purchasing a second-hand COE car and forfeiting that 20-year old 2.8-litre dinosaur.

The additional road tax payable for cars than 10-years old is produced in the table below:

| Age of vehicle | Annual road tax surcharge |

| More than 10-years old | 10% of road tax |

| More than 11-years old | 20% of road tax |

| More than 12-years old | 30% of road tax |

| More than 13-years old | 40% of road tax |

| More than 14-years old | 50% of road tax |

Comprehensive insurance for COE renewed cars

For those that want complete piece of mind for what is soon becoming a motorised family heirloom, you'll also want to take note that shopping for comprehensive insurance will become increasingly difficult.

AXA, for instance, will not insure cars older than 25-years old, while others like NTUC Income, MSIG and Tokio Marine will offer comprehensive cover for cars older than 10 years only on a case-by-case basis.

This is because there simply isn't as much demand for comprehensive insurance for COE cars as many owners deem it unfeasible to pay a hefty premium, which is disproportionate to the value of the car. Insurers themselves are also reluctant to offer anything more than just third-party insurance (which covers claims by third parties only) for older cars, as they deem them to be more problematic and more susceptible to claims.

Vehicle wear and tear

One other expense that you'll want to consider before opting to renew your car is the additional cost involved in maintaining a vehicle beyond 10 years. Beyond this point, more components that might not have been considered as consumables will begin to fail and this will cost you not only in repair bills, but also in lost time and reliability of your vehicle.

One important thing to consider is the fact that at this point, for example, is that the dampers on your car may already need replacement. Furthermore, your car's upholstery and interior may also be in need of a refresh.

Do consider if these things matter to you and if you think they need replacing, there is always the option of shopping for replacement part from our own extensive directory.

Interested in COE renewal for your car? There are three ways to do it by yourself

1. Online via OneMotoring here.

2. Snail Mail to LTA at this address:

Land Transport Authority (LTA)

Customer Service Centre

10 Sin Ming Drive

Singapore 575701

3. Or, you can manually apply at the LTA Customer Service centre at this address:

10 Sin Ming Drive Singapore (575701)

Here are some COE renewal articles that you might be interested in

COE renewal - should you choose a bank loan or in-house loan

A simple guide to COE renewal

Should you renew your car in 2020?

5 cars in Singapore that are worth renewing COE for (2020 Edition)

Sgcarmart

Get COE Renewal Advice, Loans & Paperwork

We help you renew your COE and find the best loan rates in Singapore.

- Complimentary pre-COE inspection

- Settlement of entire COE renewal paperwork

*This article was updated on 30 September 2022