Are COE prices going to come down? Let's take a breath and not overreact...

08 May 2023|28,494 views

Headline news: More COEs available means prices will fall!

That is the singular takeaway most people will have after hearing the news that more COEs will be introduced in the coming quarters.

During Parliament debate on Monday, 8 May, Transport Minister S Iswaran announced a one-time adjustment to COE supply to try to reduce overall volatility. This is done by "bringing forward guaranteed deregistrations of five-year non-extendable COEs which are due to expire when supply is projected to be higher and distribute them over the next few quarters".

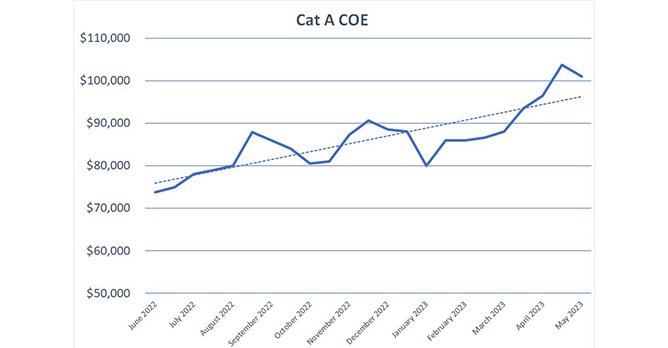

Now, the quickest conclusion that most people will jump to is that this means COE prices are set to come down! With Cat A COEs in the six figures, this kind of hope is completely understandable. But, it might also be misplaced.

Never doubt demand

No doubt, this one-time adjustment does mean that COE supply will increase in coming quarters: +24% for Cat A, and +15% for Cat B.

How does that relate to demand? Based on the most recent bidding exercise, Cat A bids exceeded supply by 40%, while for Cat B the number stands at 25%.

Obviously, we are not going to see supply suddenly exceeding demand. This adjustment in supply will certainly have an effect in softening the climbing prices we have been seeing. But will the line suddenly start trending downwards? This is quite unlikely.

First, demand has continued to stay high even as COE prices continue to climb. This means that even in this current economic climate, drivers are still buying cars. Certainly, few are actively turning away from car ownership. This announcement might even drive more buyers to showrooms this weekend.

Second, it's important to highlight that demand is often dictated by car sellers (both authorised dealers and parallel importers), rather than by the end customer. Dealers are mostly the ones bidding for COEs. More supply means dealers are more readily able to deliver cars to customers who may have been guaranteed a COE price. Or, it also represents a chance for sales people to follow up with any customers who may be on the fence. This means that demand has a chance to grow correspondingly.

Past data is some indication. The most recent instance of COE supply increasing was in Jan 2023, where COE prices fell across the board. However, cast your eye slightly further backward to 2022, where COE supply went up in both Jan and Apr, and you'll see that COE prices actually increased (meaning demand went up together with supply). So, from a historical standpoint, there is no guarantee that an uptick in supply will directly correspond with a drop in prices.

And, finally, the COE system is an opaque one - governed by economic principles of demand and supply, but with so many unclear variables that it's almost impossible to realistically draw any kind of market-clearing price.

It is for this reason that Mr. Iswaran has already laid the caveat that "the long-term upward trend of COE prices due to rising incomes and zero vehicle population growth will not abate".

So, please do not overreact!

Mathematical gymnastics

While we may see some short term 'adjustments' in terms of COE prices, we have to also be cognisant of the larger picture - this is mathematical gymnastics, not any actual functional change or improvement to the system.

The LTA is effectively moving around numbers to plug a hole now, but that will likely have a follow-on effect of leaving an unplugged hole later. COEs that would flow back into the system later could bring with them lower prices (later), and so the inverse is also likely the case. During the time when "supply is projected to be higher" (LTA has not explicitly outlined when exactly this is, but our estimations would be from 2025 onwards), prices will then perhaps not be quite as low as they could be, due to a smaller COE supply than expected.

From a graphical perspective, the effect this will have is to smoothen out the peaks and valleys, even as the average line remains the same (or climbs upwards).

Indeed, this feels like a short-term solution effectuated by moving the goal post. It might be a touch cynical to call it a purely reactionary response (though it sure feels like it), but we have to acknowledge that the basic math hasn't changed - the zero growth policy is still in place, which means that the market as a whole is still hard capped in terms of total supply.

Might COE fall in the next bidding cycle? Perhaps. Fluctuations are to be expected, as evidenced by the less than 3% drop in the most recent bidding exercise. But, again we have to look at the big picture - COE prices have been trending upwards, with an expected peak in 2024. Don't expect things to change in any significant or dramatic way immediately. This upward trend, despite this momentary adjustment, will likely be here to stay.

Don't just take it from me, the Transport Minister already said as much: "The long-term upward trend of COE prices due to rising incomes and zero vehicle population growth will not abate."

Headline news: More COEs available means prices will fall!

That is the singular takeaway most people will have after hearing the news that more COEs will be introduced in the coming quarters.

During Parliament debate on Monday, 8 May, Transport Minister S Iswaran announced a one-time adjustment to COE supply to try to reduce overall volatility. This is done by "bringing forward guaranteed deregistrations of five-year non-extendable COEs which are due to expire when supply is projected to be higher and distribute them over the next few quarters".

Now, the quickest conclusion that most people will jump to is that this means COE prices are set to come down! With Cat A COEs in the six figures, this kind of hope is completely understandable. But, it might also be misplaced.

Never doubt demand

No doubt, this one-time adjustment does mean that COE supply will increase in coming quarters: +24% for Cat A, and +15% for Cat B.

How does that relate to demand? Based on the most recent bidding exercise, Cat A bids exceeded supply by 40%, while for Cat B the number stands at 25%.

Obviously, we are not going to see supply suddenly exceeding demand. This adjustment in supply will certainly have an effect in softening the climbing prices we have been seeing. But will the line suddenly start trending downwards? This is quite unlikely.

First, demand has continued to stay high even as COE prices continue to climb. This means that even in this current economic climate, drivers are still buying cars. Certainly, few are actively turning away from car ownership. This announcement might even drive more buyers to showrooms this weekend.

Second, it's important to highlight that demand is often dictated by car sellers (both authorised dealers and parallel importers), rather than by the end customer. Dealers are mostly the ones bidding for COEs. More supply means dealers are more readily able to deliver cars to customers who may have been guaranteed a COE price. Or, it also represents a chance for sales people to follow up with any customers who may be on the fence. This means that demand has a chance to grow correspondingly.

Past data is some indication. The most recent instance of COE supply increasing was in Jan 2023, where COE prices fell across the board. However, cast your eye slightly further backward to 2022, where COE supply went up in both Jan and Apr, and you'll see that COE prices actually increased (meaning demand went up together with supply). So, from a historical standpoint, there is no guarantee that an uptick in supply will directly correspond with a drop in prices.

And, finally, the COE system is an opaque one - governed by economic principles of demand and supply, but with so many unclear variables that it's almost impossible to realistically draw any kind of market-clearing price.

It is for this reason that Mr. Iswaran has already laid the caveat that "the long-term upward trend of COE prices due to rising incomes and zero vehicle population growth will not abate".

So, please do not overreact!

Mathematical gymnastics

While we may see some short term 'adjustments' in terms of COE prices, we have to also be cognisant of the larger picture - this is mathematical gymnastics, not any actual functional change or improvement to the system.

The LTA is effectively moving around numbers to plug a hole now, but that will likely have a follow-on effect of leaving an unplugged hole later. COEs that would flow back into the system later could bring with them lower prices (later), and so the inverse is also likely the case. During the time when "supply is projected to be higher" (LTA has not explicitly outlined when exactly this is, but our estimations would be from 2025 onwards), prices will then perhaps not be quite as low as they could be, due to a smaller COE supply than expected.

From a graphical perspective, the effect this will have is to smoothen out the peaks and valleys, even as the average line remains the same (or climbs upwards).

Indeed, this feels like a short-term solution effectuated by moving the goal post. It might be a touch cynical to call it a purely reactionary response (though it sure feels like it), but we have to acknowledge that the basic math hasn't changed - the zero growth policy is still in place, which means that the market as a whole is still hard capped in terms of total supply.

Might COE fall in the next bidding cycle? Perhaps. Fluctuations are to be expected, as evidenced by the less than 3% drop in the most recent bidding exercise. But, again we have to look at the big picture - COE prices have been trending upwards, with an expected peak in 2024. Don't expect things to change in any significant or dramatic way immediately. This upward trend, despite this momentary adjustment, will likely be here to stay.

Don't just take it from me, the Transport Minister already said as much: "The long-term upward trend of COE prices due to rising incomes and zero vehicle population growth will not abate."

Thank You For Your Subscription.