COE Analysis Oct '25: Premiums sizzle as 2026 looms over

08 Oct 2025|6,982 views

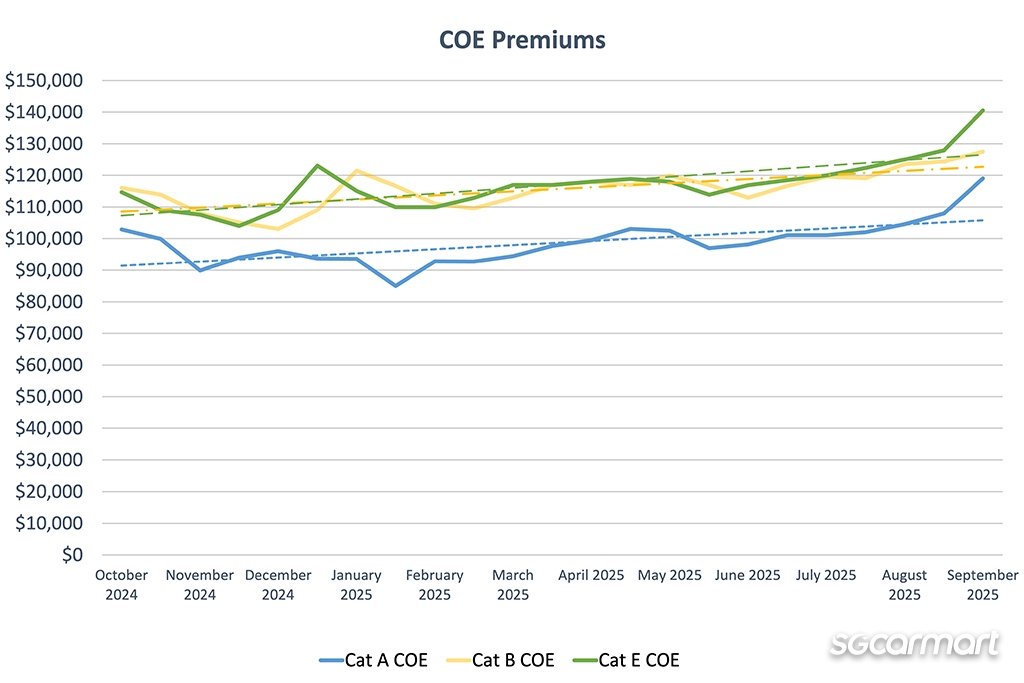

COE price trend over the past quarter: July to September vs April to June

Relentless.

As we enter the final quarter of the year, perhaps no other word better describes the manner in which COE premiums have continued to climb across 2025. And this, despite the fact that the supply pool has grown successively over the past few quarters too.

When averaged out across the three months spanning July to September, prices for all three passenger categories - A, B and E - witnessed similarly sharp rises compared to the previous quarter.

Category B and the open Category E, which are typically tied to more powerful and more premium cars, saw premiums rising by 7.1% and 7.3% respectively. Meanwhile, Category A (normally associated with mass market cars) saw a 6.3% spike.

The latter's slightly less pronounced rise is far from good news though. The conclusion of the most recent bidding round (on 17 September 2025) saw it shooting all the way up to $119,003, thus also marking its all-time high. Concurrently, Cat B is closing in again on $140,000 territory; Cat E is already there. Both represent levels that we haven't seen since October 2023, during which they simultaneously inked their highest records to date by crossing the $150,000 line.

Speaking of which, it's now been almost exactly two years ago since that point. Unfortunately, the possibility of history repeating itself this October feels very real, given that multiple prevailing circumstances within the car market appear to be cooking up a perfect storm for record COE prices. Regardless of where one looks now, there appears to be no chance of a magical 'cooling off effect' on buying demand - COE premiums will likely continue to keep climbing.

The conclusion of The Car Expo is likely to put upwards pressure on premiums as dealers try to secure COEs for buyers before the year ends

For starters, the shadow of the recently-concluded The Car Expo now looms large alongside an atypical three-week gap in COE bidding. Both threaten to put upwards pressure on premiums, with the effects of the former likely to last well into the rest of 2025 (dealers have up to six bids to secure a COE for the many customers who made their purchases with a guaranteed COE).

Still, these are but short jolts to the system when considering the larger picture of Singapore's car market today. It would be remiss not to address the two more significant stressors at play: In essence, 'panic buying' in the face of higher prices, as well as the proliferation of new budget-oriented players on the market.

Firstly, updates to the Vehicular Emissions Scheme (VES) and EV Early Adoption Incentive (EEAI), jointly announced by the LTA and NEA in early September, are expected to send car prices northwards after 2026 comes to a close.

The revised VES will see hybrids like the Nissan Serena e-POWER reclassified into the B band, and thus lose their $2,500 rebate. Meanwhile, cars like the BMW 116 will be reclassified from B to C1, incurring a new $7,500 surcharge

All at once, the revised banding of the VES from 1 January 2026 will see the lowering of rebates for electric vehicles, complete elimination of rebates for hybrid cars, new surcharges for 'mass market' combustion-powered models, as well as increased penalties for more powerful and pollutive cars.

Meanwhile, the EEAI will only be extended till the end of 2026 - and with a reduced cap of $7,500 (exactly half of the $15,000 rebate in force now) too. The incentive scheme will then cease to exist thereafter.

Between them, the LTA and NEA already seemed to have foreseen the consequence of this announcement. "We expect a short-term increase in COE prices," the joint release from the two authorities stated on 8 September, before continuing: "Potential car buyers are strongly encouraged to be prudent in bidding for COEs." Whether those seeking to buy a new car will take heed is a different situation altogether; after all, which rational buyer wants to give up rebates or be slapped with surcharges?

As such, both car dealers and potential car buyers are incentivised to lock in purchases by the end of 2025 - once more placing increased demand on limited COEs available.

Concurrently, however, the growing strength of new players in the market - specifically, fresh electric faces China - is impossible to ignore today.

As of end-August, BYD was still the bestselling brand in Singapore for 2025 based on new car registrations, while the likes of GAC, XPENG, Zeekr, Dongfeng, and Chery's Jaecoo and Omoda have each pulled numbers in the hundreds across the same period. The fact that their products are competitively priced and generously-specced is no fluke too; these are all arguably names that are hungry to establish a presence here, regardless of how premiums swing. The increased competition (every new brand certainly wants/needs to establish a foothold here; selling cars will do that) within a zero-sum market once more places upward pressure on COE premiums.

Again, the reality is thus laid bare: It doesn't appear that car-buying demand will taper off significantly any time soon - and neither will COE prices. The current numbers are scary enough as they stand, but expecting them to climb further is fully within reason; if Cat A increases by, say, $3,000 every round from hereon, we could be looking at it hitting $140,000 by year-end.

Car de-registrations over the last 12 months

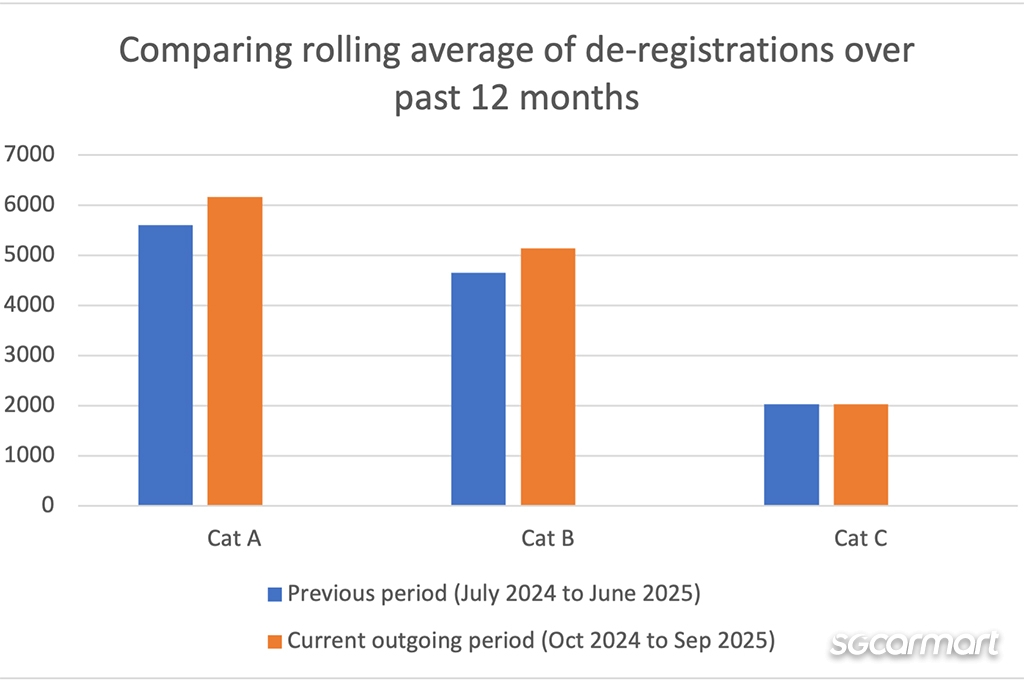

Explaining how Singapore's COE supply is calculated has become an increasingly complex task over the past few years.

Still, it bears repeating that the bulk of the COE supply consists of de-registrations (that see certificates being returned to the supply pool), which are then augmented by the dizzying array of supplementary measures introduced over the last two to three years. Prior to these augmentations, the previous calculation method was based on a 12-month rolling average of vehicle de-registrations.

Data extrapolated between October 2024 and August 2025 indicates that the overall rolling average of de-registrations for the October 2024 to September 2025 period will be 8.3% higher than that of the previous 12-month period (July 2024 to June 2025).

De-registrations in both Cat A and B are projected to rise almost evenly: By 10.1% and 10.6% respectively. Meanwhile, de-registrations in Cat C (for commercial vehicles) are estimated to creep up just slightly, by a meagre 0.3%.

Regardless of how the exact quota is calculated now, however, the LTA’s promise remains: That each successive quarter will bring with it an increase in COE supply until it reaches its expected peak sometime in 2026. The following table shows how COE supply has trended over the last few quarters:

| Period | Total quota for period | Percentage increase over previous period |

| Feb to Apr 2025 | 17,133 | +8% |

| May to July 2025 | 18,232 | +6.4% |

| Aug to Oct 2025 | 18,701 | +2.6% |

New car pricing

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

Alongside the uniform uptick in COE premiums over the past quarter, the group of models we monitor reflected a higher 3.8% increase in new car prices in Q3 2025, against the three-month average over the second quarter.

The fact that this is a three-month average, however, must be emphasised; the percentage above would be significantly higher if we were looking solely at the most recent bidding round in late-September, which saw dealers pushing prices up in step with the leap in COE premiums.

The recent descent (or ascent, depending on how you look at it) into pricing madness feels hard to believe: Bestsellers like the Toyota Corolla Altis Elegance and BYD Atto 3 have list prices of nearly $200,000 now.

Car-shopping in a market where popular family cars (again, these are categorically not premium-positioned models) are asking for more than $200,000 would arguably be unprecedented. Yet this might well be the reality that Singaporeans will have to face if COE premiums continue to shoot past their current point.

Used car listings

Over the three-month period between June to August 2025, these were the five most listed used cars on Sgcarmart.

| Car model | Year of registration | Average annual depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $13,159/yr |

| Honda Civic 1.6A VTi | 2018 | $15,723/yr |

| Nissan Qashqai 1.2A DIG-T | 2017 | $11,602/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2017 | $18,509/yr |

| Mercedes-Benz GLA-Class GLA180 Urban Edition | 2019 | $17,654/yr |

After consecutive periods of stabilising prices in the used car market, the annual depreciation figures of some of Singapore’s favourite older models appear to be on the rise again. For example, our evergreen marker, the 2016-registered Honda Vezel, now has an averaged-out annual depreciation figure of more than $13,000 again: The highest we’ve seen since last October.

Still, this may not be where things end yet. Prices for used cars need time, after all, to react to what’s happening in the new car market, and our data here notably does not include September, which is when the recent sharp spike occurred.

Likewise, the next quarter will reveal to us if our used car dealers are closely matching movements in COE premiums - or if they are choosing to keep prices down in order to ensure that cars keep moving out of their showroom lots.

Here are our COE analyses from the past three quarters!

COE Analysis July '25: More COEs, but premiums still rising

COE price trend over the past quarter: July to September vs April to June

Relentless.

As we enter the final quarter of the year, perhaps no other word better describes the manner in which COE premiums have continued to climb across 2025. And this, despite the fact that the supply pool has grown successively over the past few quarters too.

When averaged out across the three months spanning July to September, prices for all three passenger categories - A, B and E - witnessed similarly sharp rises compared to the previous quarter.

Category B and the open Category E, which are typically tied to more powerful and more premium cars, saw premiums rising by 7.1% and 7.3% respectively. Meanwhile, Category A (normally associated with mass market cars) saw a 6.3% spike.

The latter's slightly less pronounced rise is far from good news though. The conclusion of the most recent bidding round (on 17 September 2025) saw it shooting all the way up to $119,003, thus also marking its all-time high. Concurrently, Cat B is closing in again on $140,000 territory; Cat E is already there. Both represent levels that we haven't seen since October 2023, during which they simultaneously inked their highest records to date by crossing the $150,000 line.

Speaking of which, it's now been almost exactly two years ago since that point. Unfortunately, the possibility of history repeating itself this October feels very real, given that multiple prevailing circumstances within the car market appear to be cooking up a perfect storm for record COE prices. Regardless of where one looks now, there appears to be no chance of a magical 'cooling off effect' on buying demand - COE premiums will likely continue to keep climbing.

The conclusion of The Car Expo is likely to put upwards pressure on premiums as dealers try to secure COEs for buyers before the year ends

For starters, the shadow of the recently-concluded The Car Expo now looms large alongside an atypical three-week gap in COE bidding. Both threaten to put upwards pressure on premiums, with the effects of the former likely to last well into the rest of 2025 (dealers have up to six bids to secure a COE for the many customers who made their purchases with a guaranteed COE).

Still, these are but short jolts to the system when considering the larger picture of Singapore's car market today. It would be remiss not to address the two more significant stressors at play: In essence, 'panic buying' in the face of higher prices, as well as the proliferation of new budget-oriented players on the market.

Firstly, updates to the Vehicular Emissions Scheme (VES) and EV Early Adoption Incentive (EEAI), jointly announced by the LTA and NEA in early September, are expected to send car prices northwards after 2026 comes to a close.

The revised VES will see hybrids like the Nissan Serena e-POWER reclassified into the B band, and thus lose their $2,500 rebate. Meanwhile, cars like the BMW 116 will be reclassified from B to C1, incurring a new $7,500 surcharge

All at once, the revised banding of the VES from 1 January 2026 will see the lowering of rebates for electric vehicles, complete elimination of rebates for hybrid cars, new surcharges for 'mass market' combustion-powered models, as well as increased penalties for more powerful and pollutive cars.

Meanwhile, the EEAI will only be extended till the end of 2026 - and with a reduced cap of $7,500 (exactly half of the $15,000 rebate in force now) too. The incentive scheme will then cease to exist thereafter.

Between them, the LTA and NEA already seemed to have foreseen the consequence of this announcement. "We expect a short-term increase in COE prices," the joint release from the two authorities stated on 8 September, before continuing: "Potential car buyers are strongly encouraged to be prudent in bidding for COEs." Whether those seeking to buy a new car will take heed is a different situation altogether; after all, which rational buyer wants to give up rebates or be slapped with surcharges?

As such, both car dealers and potential car buyers are incentivised to lock in purchases by the end of 2025 - once more placing increased demand on limited COEs available.

Concurrently, however, the growing strength of new players in the market - specifically, fresh electric faces China - is impossible to ignore today.

As of end-August, BYD was still the bestselling brand in Singapore for 2025 based on new car registrations, while the likes of GAC, XPENG, Zeekr, Dongfeng, and Chery's Jaecoo and Omoda have each pulled numbers in the hundreds across the same period. The fact that their products are competitively priced and generously-specced is no fluke too; these are all arguably names that are hungry to establish a presence here, regardless of how premiums swing. The increased competition (every new brand certainly wants/needs to establish a foothold here; selling cars will do that) within a zero-sum market once more places upward pressure on COE premiums.

Again, the reality is thus laid bare: It doesn't appear that car-buying demand will taper off significantly any time soon - and neither will COE prices. The current numbers are scary enough as they stand, but expecting them to climb further is fully within reason; if Cat A increases by, say, $3,000 every round from hereon, we could be looking at it hitting $140,000 by year-end.

Car de-registrations over the last 12 months

Explaining how Singapore's COE supply is calculated has become an increasingly complex task over the past few years.

Still, it bears repeating that the bulk of the COE supply consists of de-registrations (that see certificates being returned to the supply pool), which are then augmented by the dizzying array of supplementary measures introduced over the last two to three years. Prior to these augmentations, the previous calculation method was based on a 12-month rolling average of vehicle de-registrations.

Data extrapolated between October 2024 and August 2025 indicates that the overall rolling average of de-registrations for the October 2024 to September 2025 period will be 8.3% higher than that of the previous 12-month period (July 2024 to June 2025).

De-registrations in both Cat A and B are projected to rise almost evenly: By 10.1% and 10.6% respectively. Meanwhile, de-registrations in Cat C (for commercial vehicles) are estimated to creep up just slightly, by a meagre 0.3%.

Regardless of how the exact quota is calculated now, however, the LTA’s promise remains: That each successive quarter will bring with it an increase in COE supply until it reaches its expected peak sometime in 2026. The following table shows how COE supply has trended over the last few quarters:

| Period | Total quota for period | Percentage increase over previous period |

| Feb to Apr 2025 | 17,133 | +8% |

| May to July 2025 | 18,232 | +6.4% |

| Aug to Oct 2025 | 18,701 | +2.6% |

New car pricing

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

Alongside the uniform uptick in COE premiums over the past quarter, the group of models we monitor reflected a higher 3.8% increase in new car prices in Q3 2025, against the three-month average over the second quarter.

The fact that this is a three-month average, however, must be emphasised; the percentage above would be significantly higher if we were looking solely at the most recent bidding round in late-September, which saw dealers pushing prices up in step with the leap in COE premiums.

The recent descent (or ascent, depending on how you look at it) into pricing madness feels hard to believe: Bestsellers like the Toyota Corolla Altis Elegance and BYD Atto 3 have list prices of nearly $200,000 now.

Car-shopping in a market where popular family cars (again, these are categorically not premium-positioned models) are asking for more than $200,000 would arguably be unprecedented. Yet this might well be the reality that Singaporeans will have to face if COE premiums continue to shoot past their current point.

Used car listings

Over the three-month period between June to August 2025, these were the five most listed used cars on Sgcarmart.

| Car model | Year of registration | Average annual depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $13,159/yr |

| Honda Civic 1.6A VTi | 2018 | $15,723/yr |

| Nissan Qashqai 1.2A DIG-T | 2017 | $11,602/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2017 | $18,509/yr |

| Mercedes-Benz GLA-Class GLA180 Urban Edition | 2019 | $17,654/yr |

After consecutive periods of stabilising prices in the used car market, the annual depreciation figures of some of Singapore’s favourite older models appear to be on the rise again. For example, our evergreen marker, the 2016-registered Honda Vezel, now has an averaged-out annual depreciation figure of more than $13,000 again: The highest we’ve seen since last October.

Still, this may not be where things end yet. Prices for used cars need time, after all, to react to what’s happening in the new car market, and our data here notably does not include September, which is when the recent sharp spike occurred.

Likewise, the next quarter will reveal to us if our used car dealers are closely matching movements in COE premiums - or if they are choosing to keep prices down in order to ensure that cars keep moving out of their showroom lots.

Here are our COE analyses from the past three quarters!

COE Analysis July '25: More COEs, but premiums still rising

Thank You For Your Subscription.