eDrivo Car Insurance: Tailored insurance for electric cars

09 Jul 2025|8,289 views

Income Insurance's eDrivo Car Insurance provides coverage that's tailored to the unique characteristics of electric cars.

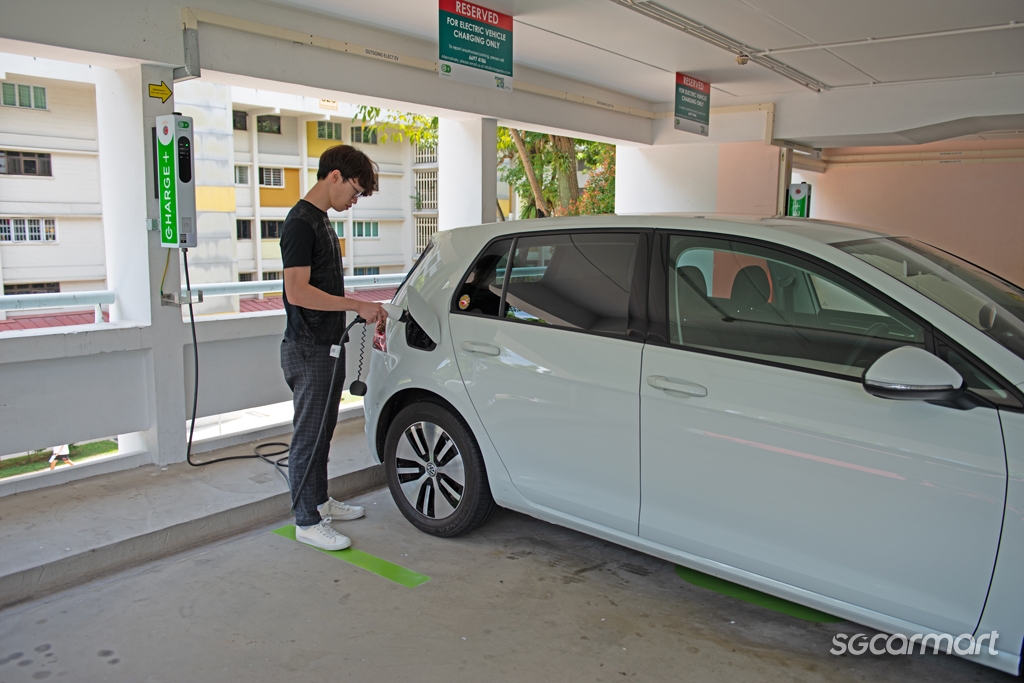

As Singapore shifts towards sustainable forms of transportation, electric vehicles (EVs) are continually growing in popularity with more and more drivers switching from internal combustion engine (ICE) cars to fully electric.

EVs contribute positively not only to individual users but also to the environment, and society. Apart from a smoother and quieter ride, they don't produce any tailpipe emissions. This helps reduce localised air pollution, especially around residential areas.

EVs are clearly unlike ICE cars, and that is why they need insurance coverage that's tailored to them. These needs are exactly what eDrivo Car Insurance, which offers comprehensive coverage for EVs, is designed for.

Why do EVs require specialised coverage?

It is important to get suitable coverage tailored for your EV, not just a regular car insurance, which may not be sufficient for your electric car.

Think of insurance policies for ICE cars as 'off-the-rack' clothes for casual wear. On the other hand, eDrivo Car Insurance is a tailored suit. It's a better fit because it matches what an EV needs.

Unlike ICE cars, the biggest component in an EV is its battery pack, which according to this Reuters article, accounts for around 40% of the vehicle's cost.

With eDrivo Car Insurance, you get peace of mind as it gives unlimited battery replacement1 coverage in the event it is damaged in an accident, so you don't have to worry about paying to replace your battery pack.

You can also rest assured that your EV is protected against loss or damage due to malicious cyber acts with eDrivo Car Insurance's cyber hacking coverage2.

Charging on the go

Although most EVs today offer a driving range of 400km, with some even able to deliver over 500km, your busy lifestyle could cause you to forget to charge your vehicle. Income Insurance understands this, which is why eDrivo Car Insurance offers Emergency Mobile Rescue3 service.

So should your EV's battery run out of juice while you're on the move, you won't have to run around to find assistance because a mobile charging station vehicle will be sent your way.

Income Insurance's service provider will arrive at your location to provide DC fast charging until your battery reaches up to 20% capacity. Within Singapore, that's more than enough range for you to reach the nearest, or even the most convenient charging station, safely.

Choosing eDrivo Car Insurance means safeguarding your EV with a policy that's tailored to its unique features. This lets you embrace the benefits of EVs with peace of mind.

Sign up now and receive up to 440,000 STAR$®^. More importantly, you'll start enjoying the protection and convenience of eDrivo Car Insurance - the comprehensive coverage for your electric car's needs.

This post was brought to you by Income Insurance.

Footnotes

^ 1,000 STAR$® = $1 eCapitaVoucher. Promotion Ts&Cs apply.

1. The battery replacement must be covered under Section 1 of the policy.

2. Cyber hacking by malicious act of gaining unauthorised access to your vehicle systems by any unauthorised person or entity.

3. Emergency Mobile Rescue

– We are entitled to modify or alter the manner this service is delivered without notice.

– The geographical coverage and contact details of the Emergency Mobile Rescue Service Provider is available on Income Insurance's website, which will be updated from time to time at Income Insurance's sole discretion.

– This benefit is applicable to you only one time per period of insurance. Subsequent usage will be chargeable.

– This benefit is not applicable for AC charging cars.

All opinions expressed in this article are those of Sgcarmart and not of Income Insurance Limited ("Income Insurance"). Sgcarmart assumes full responsibility and control over the accuracy and completeness of all information provided in this article.

Sgcarmart is responsible for the accuracy and completeness of all information provided and intellectual property used in this article. Income Insurance is neither responsible nor liable to any party for the content of this article and intellectual property used in this article.

This article is purely for informational purposes only and does not constitute an offer, recommendation, solicitation or advice to buy or sell any product(s). This article does not have regard to the specific investment objectives, financial situation and particular needs of any individual, and it should not be relied upon as financial advice.

The precise terms, conditions and exclusions of the Income Insurance product mentioned are specified in the policy contract at: income.com.sg/edrivo-car-insurance-policy-conditions.pdf. All Income Insurance products are developed to benefit their customers but not all may be suitable for your specific needs.

If you are unsure if this product is suitable for you, we strongly encourage you to speak to a qualified insurance advisor. Otherwise, you may end up buying a product that does not meet your expectations or needs. As a result, you may not be able to afford the premiums or get the insurance protection you want.

Protected up to specified limits by SDIC. Information is correct as at 9 July 2025.

Income Insurance's eDrivo Car Insurance provides coverage that's tailored to the unique characteristics of electric cars.

As Singapore shifts towards sustainable forms of transportation, electric vehicles (EVs) are continually growing in popularity with more and more drivers switching from internal combustion engine (ICE) cars to fully electric.

EVs contribute positively not only to individual users but also to the environment, and society. Apart from a smoother and quieter ride, they don't produce any tailpipe emissions. This helps reduce localised air pollution, especially around residential areas.

EVs are clearly unlike ICE cars, and that is why they need insurance coverage that's tailored to them. These needs are exactly what eDrivo Car Insurance, which offers comprehensive coverage for EVs, is designed for.

Why do EVs require specialised coverage?

It is important to get suitable coverage tailored for your EV, not just a regular car insurance, which may not be sufficient for your electric car.

Think of insurance policies for ICE cars as 'off-the-rack' clothes for casual wear. On the other hand, eDrivo Car Insurance is a tailored suit. It's a better fit because it matches what an EV needs.

Unlike ICE cars, the biggest component in an EV is its battery pack, which according to this Reuters article, accounts for around 40% of the vehicle's cost.

With eDrivo Car Insurance, you get peace of mind as it gives unlimited battery replacement1 coverage in the event it is damaged in an accident, so you don't have to worry about paying to replace your battery pack.

You can also rest assured that your EV is protected against loss or damage due to malicious cyber acts with eDrivo Car Insurance's cyber hacking coverage2.

Charging on the go

Although most EVs today offer a driving range of 400km, with some even able to deliver over 500km, your busy lifestyle could cause you to forget to charge your vehicle. Income Insurance understands this, which is why eDrivo Car Insurance offers Emergency Mobile Rescue3 service.

So should your EV's battery run out of juice while you're on the move, you won't have to run around to find assistance because a mobile charging station vehicle will be sent your way.

Income Insurance's service provider will arrive at your location to provide DC fast charging until your battery reaches up to 20% capacity. Within Singapore, that's more than enough range for you to reach the nearest, or even the most convenient charging station, safely.

Choosing eDrivo Car Insurance means safeguarding your EV with a policy that's tailored to its unique features. This lets you embrace the benefits of EVs with peace of mind.

Sign up now and receive up to 440,000 STAR$®^. More importantly, you'll start enjoying the protection and convenience of eDrivo Car Insurance - the comprehensive coverage for your electric car's needs.

This post was brought to you by Income Insurance.

Footnotes

^ 1,000 STAR$® = $1 eCapitaVoucher. Promotion Ts&Cs apply.

1. The battery replacement must be covered under Section 1 of the policy.

2. Cyber hacking by malicious act of gaining unauthorised access to your vehicle systems by any unauthorised person or entity.

3. Emergency Mobile Rescue

– We are entitled to modify or alter the manner this service is delivered without notice.

– The geographical coverage and contact details of the Emergency Mobile Rescue Service Provider is available on Income Insurance's website, which will be updated from time to time at Income Insurance's sole discretion.

– This benefit is applicable to you only one time per period of insurance. Subsequent usage will be chargeable.

– This benefit is not applicable for AC charging cars.

All opinions expressed in this article are those of Sgcarmart and not of Income Insurance Limited ("Income Insurance"). Sgcarmart assumes full responsibility and control over the accuracy and completeness of all information provided in this article.

Sgcarmart is responsible for the accuracy and completeness of all information provided and intellectual property used in this article. Income Insurance is neither responsible nor liable to any party for the content of this article and intellectual property used in this article.

This article is purely for informational purposes only and does not constitute an offer, recommendation, solicitation or advice to buy or sell any product(s). This article does not have regard to the specific investment objectives, financial situation and particular needs of any individual, and it should not be relied upon as financial advice.

The precise terms, conditions and exclusions of the Income Insurance product mentioned are specified in the policy contract at: income.com.sg/edrivo-car-insurance-policy-conditions.pdf. All Income Insurance products are developed to benefit their customers but not all may be suitable for your specific needs.

If you are unsure if this product is suitable for you, we strongly encourage you to speak to a qualified insurance advisor. Otherwise, you may end up buying a product that does not meet your expectations or needs. As a result, you may not be able to afford the premiums or get the insurance protection you want.

Protected up to specified limits by SDIC. Information is correct as at 9 July 2025.