OCBC reverses the car loan application process

23 Jan 2021|13,504 views

OCBC REVERSES THE CAR LOAN APPLICATION PROCESS

Text: Clarence Seow

Photos: Newslink, OCBC, Clarence Seow

Photos: Newslink, OCBC, Clarence Seow

23 JANUARY 2021

OCBC turns the car loan approval process on its head so you can purchase your next car with confidence!

Shopping for a new car but not entirely certain about what you can afford or whether your loan will be approved? Now there's a new, smarter way to purchase a car thanks to OCBC's simple, fast, and secure car loan application process!

Shopping for a new car but not entirely certain about what you can afford or whether your loan will be approved? Now there's a new, smarter way to purchase a car thanks to OCBC's simple, fast, and secure car loan application process!

Buy with confidence

Buying a new car can be daunting. Not only will you have to shop for a vehicle that will be suitable for you and your family's needs, but you will also be making a significant financial commitment.

And with that comes the added uncertainty of securing a car loan from your bank.

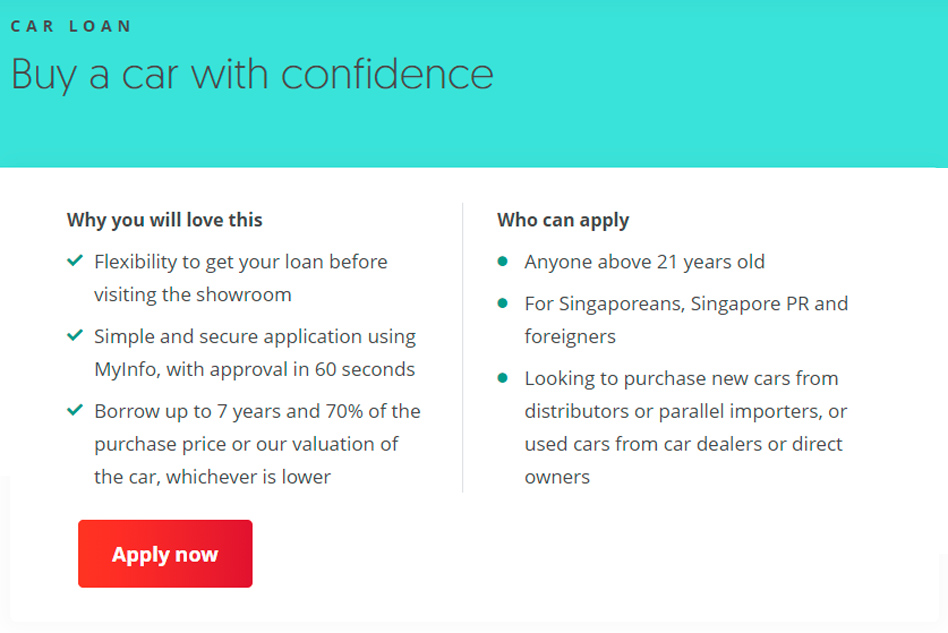

Thankfully, OCBC takes the uncertainty out of the latter with its redefined car loan application process. OCBC's new redefined process now allows you to get approval for your car loan, even before you decide on a car, so you can concentrate on getting the right car when you're strolling through the showrooms!

A simple, fast and secure application

And as if shopping with the utmost confidence isn't appealing enough, OCBC's car loan application process is mighty easy as well.

All you will need to do is apply online with MyInfo using your SingPass, and you can expect approval to be returned to you within 60 seconds, so long as all bank checks and application details are in order. How is that for speedy!

The loan is only effective when you have finalised the car you wish to purchase and accepted the Hire Purchase Agreement so fret not that any penalty or fees will be incurred with your application.

All personal information sent through this process goes directly to OCBC as well, so you can rest assured that the entire process is safe and secure.

A hassle-free process

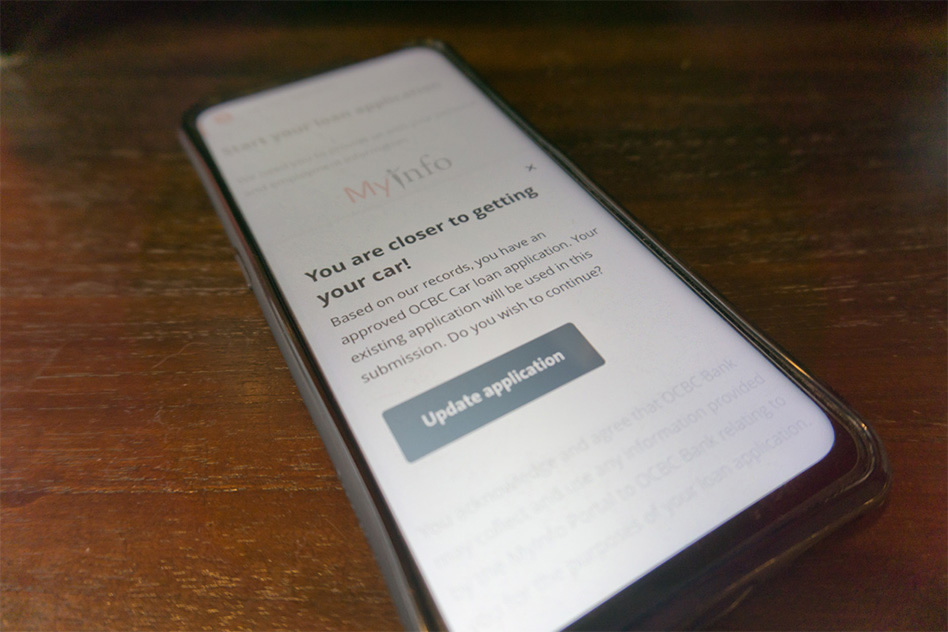

And once you have decided on your perfect car, the rest of the process is as easy as pie.

Simply inform your dealer that you already have an approved OCBC Car Loan, and the dealer will submit all the necessary car details over to OCBC. All you will need to do now is verify the information and you're good to go.

OCBC will then send you the Hire Purchase Agreement immediately via SMS, further speeding up the process. Once you have reviewed and accepted the agreement digitally, you can start to look forward to receiving your car!

Competitive loan terms and flexible payment options

OCBC is offering shoppers the options to borrow at loan tenures of up to seven years and at up to 70% of the total car price, at market competitive interest rates.

And after you get behind the wheel of your car, you can still take heart in knowing that there a plethora of options available for you to repay your loan.

OCBC deposit account holders will be able to opt to pay their monthly installments via a variety of options including a Direct Debit Account instruction, via an OCBC ATM or through mobile or internet banking. Additionally, you can also choose to use Interbank GIRO or drop off a cheque, which are available for non-OCBC deposit account holders as well.

Tired of the slow, tedious, and uncertain approvals involved with purchasing a car? Turn those frowns upside down yourself with OCBC's redefined car loan application process.

Apply here, get an approved OCBC Car Loan and you could be driving away with a car immediately!

Shopping for a new car but not entirely certain about what you can afford or whether your loan will be approved? Now there's a new, smarter way to purchase a car thanks to OCBC's simple, fast and secure car loan application process!

Buy with confidence

Buying a new car can be daunting. Not only will you have to shop for a vehicle that will be suitable for you and your family's needs, but you will also be making a significant financial commitment.

And with that comes the added uncertainty of securing a car loan from your bank.

Thankfully, OCBC takes the uncertainty out of the latter with its redefined car loan application process. OCBC's new redefined process now allows you to get approval for your car loan, even before you decide on a car, so you can concentrate on getting the right car when you're strolling through the showrooms!

Buying a new car can be daunting. Not only will you have to shop for a vehicle that will be suitable for you and your family's needs, but you will also be making a significant financial commitment.

And with that comes the added uncertainty of securing a car loan from your bank.

Thankfully, OCBC takes the uncertainty out of the latter with its redefined car loan application process. OCBC's new redefined process now allows you to get approval for your car loan, even before you decide on a car, so you can concentrate on getting the right car when you're strolling through the showrooms!

A simple, fast and secure application

And as if shopping with the utmost confidence isn't appealing enough, OCBC's car loan application process is mighty easy as well.

All you will need to do is apply online with MyInfo using your SingPass, and you can expect approval to be returned to you within 60 seconds, so long as all bank checks and application details are in order. How is that for speedy!

The loan is only effective when you have finalised the car you wish to purchase and accepted the Hire Purchase Agreement so fret not that any penalty or fees will be incurred with your application.

All personal information sent through this process goes directly to OCBC as well, so you can rest assured that the entire process is safe and secure.

And as if shopping with the utmost confidence isn't appealing enough, OCBC's car loan application process is mighty easy as well.

All you will need to do is apply online with MyInfo using your SingPass, and you can expect approval to be returned to you within 60 seconds, so long as all bank checks and application details are in order. How is that for speedy!

The loan is only effective when you have finalised the car you wish to purchase and accepted the Hire Purchase Agreement so fret not that any penalty or fees will be incurred with your application.

All personal information sent through this process goes directly to OCBC as well, so you can rest assured that the entire process is safe and secure.

A hassle-free process

And once you have decided on your perfect car, the rest of the process is as easy as pie.

Simply inform your dealer that you already have an approved OCBC Car Loan, and the dealer will submit all the necessary car details over to OCBC. All you will need to do now is verify the information and you're good to go.

OCBC will then send you the Hire Purchase Agreement immediately via SMS, further speeding up the process. Once you have reviewed and accepted the agreement digitally, you can start to look forward to receiving your car!

And once you have decided on your perfect car, the rest of the process is as easy as pie.

Simply inform your dealer that you already have an approved OCBC Car Loan, and the dealer will submit all the necessary car details over to OCBC. All you will need to do now is verify the information and you're good to go.

OCBC will then send you the Hire Purchase Agreement immediately via SMS, further speeding up the process. Once you have reviewed and accepted the agreement digitally, you can start to look forward to receiving your car!

Competitive loan terms and flexible payment options

OCBC is offering shoppers the options to borrow at loan tenures of up to seven years and at up to 70% of the total car price, at market competitive interest rates.

And after you get behind the wheel of your car, you can still take heart in knowing that there a plethora of options available for you to repay your loan.

OCBC deposit account holders will be able to opt to pay their monthly installments via a variety of options including a Direct Debit Account instruction, via an OCBC ATM or through mobile or internet banking. Additionally, you can also choose to use Interbank GIRO or drop off a cheque, which are available for non-OCBC deposit account holders as well.

Tired of the slow, tedious, and uncertain approvals involved with purchasing a car? Turn those frowns upside down yourself with OCBC's redefined car loan application process.

Apply here, get an approved OCBC Car Loan and you could be driving away with a car immediately!

OCBC is offering shoppers the options to borrow at loan tenures of up to seven years and at up to 70% of the total car price, at market competitive interest rates.

And after you get behind the wheel of your car, you can still take heart in knowing that there a plethora of options available for you to repay your loan.

OCBC deposit account holders will be able to opt to pay their monthly installments via a variety of options including a Direct Debit Account instruction, via an OCBC ATM or through mobile or internet banking. Additionally, you can also choose to use Interbank GIRO or drop off a cheque, which are available for non-OCBC deposit account holders as well.

Tired of the slow, tedious, and uncertain approvals involved with purchasing a car? Turn those frowns upside down yourself with OCBC's redefined car loan application process.

Apply here, get an approved OCBC Car Loan and you could be driving away with a car immediately!