COE supply projected to decrease for Feb to Apr 2021

29 Dec 2020|21,697 views

COE supply projected to decrease in the next quota period

Based on statistical forecasting using latest data released by the LTA and adjusting for the return of quota from the suspended April to June bidding exercises, the quota for the upcoming next Feb-2021 to Apr-2021 is expected to decrease by 11% for passenger cars (excluding commercial vehicle and motorbikes). This is extrapolated from the lower vehicle deregistration figures in Oct and Nov-2020.

For Cat A, COE supply is projected to decrease by 7% from the monthly average of 1,925. For Cat B, COE supply is projected to decrease by 6% from the monthly average of 2,014. For Cat E, COE supply is projected to decrease by 32% from a monthly average of 926.

Passenger car deregistration in November fell once more, dropping 2.8% compared to October. The average monthly passenger car deregistration in October and November is 8.2% lower than the monthly average from the past three-month period.

COE premiums rise for Cat B and E continue rise, while Cat A drops marginally

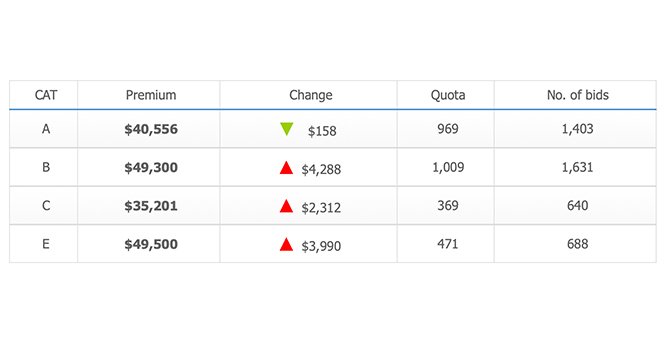

In the most recent 23 December COE bidding exercise, COE premiums increased for Cat B and E, while Cat A premiums fell slightly.

Premiums for Cat A, for cars up to 1,600cc in engine capacity and with an output of no more than 130bhp, decreased by $158 (0.4%) to end at $40,556 this bidding round. The slight drop has brought premiums for the category down to 18.3% above the 12-month trailing average.

Premiums for Cat B, for larger cars with more than 130bhp or engine displacements larger than 1,600cc, however, took a large jump this bidding round, rising by $4,288 (9.6%) to reach $49,300. Cat B premiums are now at a three-year high.

In Cat E, the open category, premiums climbed by $3,990 (8.8%), closing at $49,500. The last time premiums reached this high was in May of 2019.

New car buying interest falls slightly

In December, there has been a slight drop in showroom enquiries, based on SGCM's monitoring of sales enquiries to new car dealers. Compared to the previous month, sales enquiries in December fell by 7.8%.

The demand for new cars, notably in Cat A, may be tempered by the pending changes in VES regulations that will take effect in 2021. Cleaner cars will net a larger rebate, and buyers may be holding out till the new regulations are in place.

Cat B new car prices increase for most dealers

After the latest COE bidding, across a selected panel of new car dealerships monitored by sgCarMart, new car prices have been adjusted to match the change in COE prices.

For Cat A cars, with the minimal change in COE premiums, most brands did not change prices.

For Cat B cars, all monitored brands adjusted prices upwards to match the increase in Cat B and E prices. Seven brands, including BMW, Honda and Lexus, increased prices by $4,000, while other brands including Skoda and Volkswagen increased prices by $5,000.

*This article was updated on 30 September 2022

Based on statistical forecasting using latest data released by the LTA and adjusting for the return of quota from the suspended April to June bidding exercises, the quota for the upcoming next Feb-2021 to Apr-2021 is expected to decrease by 11% for passenger cars (excluding commercial vehicle and motorbikes). This is extrapolated from the lower vehicle deregistration figures in Oct and Nov-2020.

For Cat A, COE supply is projected to decrease by 7% from the monthly average of 1,925. For Cat B, COE supply is projected to decrease by 6% from the monthly average of 2,014. For Cat E, COE supply is projected to decrease by 32% from a monthly average of 926.

Passenger car deregistration in November fell once more, dropping 2.8% compared to October. The average monthly passenger car deregistration in October and November is 8.2% lower than the monthly average from the past three-month period.

COE premiums rise for Cat B and E continue rise, while Cat A drops marginally

In the most recent 23 December COE bidding exercise, COE premiums increased for Cat B and E, while Cat A premiums fell slightly.

Premiums for Cat A, for cars up to 1,600cc in engine capacity and with an output of no more than 130bhp, decreased by $158 (0.4%) to end at $40,556 this bidding round. The slight drop has brought premiums for the category down to 18.3% above the 12-month trailing average.

Premiums for Cat B, for larger cars with more than 130bhp or engine displacements larger than 1,600cc, however, took a large jump this bidding round, rising by $4,288 (9.6%) to reach $49,300. Cat B premiums are now at a three-year high.

In Cat E, the open category, premiums climbed by $3,990 (8.8%), closing at $49,500. The last time premiums reached this high was in May of 2019.

New car buying interest falls slightly

In December, there has been a slight drop in showroom enquiries, based on SGCM's monitoring of sales enquiries to new car dealers. Compared to the previous month, sales enquiries in December fell by 7.8%.

The demand for new cars, notably in Cat A, may be tempered by the pending changes in VES regulations that will take effect in 2021. Cleaner cars will net a larger rebate, and buyers may be holding out till the new regulations are in place.

Cat B new car prices increase for most dealers

After the latest COE bidding, across a selected panel of new car dealerships monitored by sgCarMart, new car prices have been adjusted to match the change in COE prices.

For Cat A cars, with the minimal change in COE premiums, most brands did not change prices.

For Cat B cars, all monitored brands adjusted prices upwards to match the increase in Cat B and E prices. Seven brands, including BMW, Honda and Lexus, increased prices by $4,000, while other brands including Skoda and Volkswagen increased prices by $5,000.

*This article was updated on 30 September 2022

COE supply projected to decrease in the next quota period

Based on statistical forecasting using latest data released by the LTA and adjusting for the return of quota from the suspended April to June bidding exercises, the quota for the upcoming next Feb-2021 to Apr-2021 is expected to decrease by 11% for passenger cars (excluding commercial vehicle and motorbikes). This is extrapolated from the lower vehicle deregistration figures in Oct and Nov-2020.

For Cat A, COE supply is projected to decrease by 7% from the monthly average of 1,925. For Cat B, COE supply is projected to decrease by 6% from the monthly average of 2,014. For Cat E, COE supply is projected to decrease by 32% from a monthly average of 926.

Passenger car deregistration in November fell once more, dropping 2.8% compared to October. The average monthly passenger car deregistration in October and November is 8.2% lower than the monthly average from the past three-month period.

COE premiums rise for Cat B and E continue rise, while Cat A drops marginally

In the most recent 23 December COE bidding exercise, COE premiums increased for Cat B and E, while Cat A premiums fell slightly.

Premiums for Cat A, for cars up to 1,600cc in engine capacity and with an output of no more than 130bhp, decreased by $158 (0.4%) to end at $40,556 this bidding round. The slight drop has brought premiums for the category down to 18.3% above the 12-month trailing average.

Premiums for Cat B, for larger cars with more than 130bhp or engine displacements larger than 1,600cc, however, took a large jump this bidding round, rising by $4,288 (9.6%) to reach $49,300. Cat B premiums are now at a three-year high.

In Cat E, the open category, premiums climbed by $3,990 (8.8%), closing at $49,500. The last time premiums reached this high was in May of 2019.

New car buying interest falls slightly

In December, there has been a slight drop in showroom enquiries, based on SGCM's monitoring of sales enquiries to new car dealers. Compared to the previous month, sales enquiries in December fell by 7.8%.

The demand for new cars, notably in Cat A, may be tempered by the pending changes in VES regulations that will take effect in 2021. Cleaner cars will net a larger rebate, and buyers may be holding out till the new regulations are in place.

Cat B new car prices increase for most dealers

After the latest COE bidding, across a selected panel of new car dealerships monitored by sgCarMart, new car prices have been adjusted to match the change in COE prices.

For Cat A cars, with the minimal change in COE premiums, most brands did not change prices.

For Cat B cars, all monitored brands adjusted prices upwards to match the increase in Cat B and E prices. Seven brands, including BMW, Honda and Lexus, increased prices by $4,000, while other brands including Skoda and Volkswagen increased prices by $5,000.

*This article was updated on 30 September 2022

Based on statistical forecasting using latest data released by the LTA and adjusting for the return of quota from the suspended April to June bidding exercises, the quota for the upcoming next Feb-2021 to Apr-2021 is expected to decrease by 11% for passenger cars (excluding commercial vehicle and motorbikes). This is extrapolated from the lower vehicle deregistration figures in Oct and Nov-2020.

For Cat A, COE supply is projected to decrease by 7% from the monthly average of 1,925. For Cat B, COE supply is projected to decrease by 6% from the monthly average of 2,014. For Cat E, COE supply is projected to decrease by 32% from a monthly average of 926.

Passenger car deregistration in November fell once more, dropping 2.8% compared to October. The average monthly passenger car deregistration in October and November is 8.2% lower than the monthly average from the past three-month period.

COE premiums rise for Cat B and E continue rise, while Cat A drops marginally

In the most recent 23 December COE bidding exercise, COE premiums increased for Cat B and E, while Cat A premiums fell slightly.

Premiums for Cat A, for cars up to 1,600cc in engine capacity and with an output of no more than 130bhp, decreased by $158 (0.4%) to end at $40,556 this bidding round. The slight drop has brought premiums for the category down to 18.3% above the 12-month trailing average.

Premiums for Cat B, for larger cars with more than 130bhp or engine displacements larger than 1,600cc, however, took a large jump this bidding round, rising by $4,288 (9.6%) to reach $49,300. Cat B premiums are now at a three-year high.

In Cat E, the open category, premiums climbed by $3,990 (8.8%), closing at $49,500. The last time premiums reached this high was in May of 2019.

New car buying interest falls slightly

In December, there has been a slight drop in showroom enquiries, based on SGCM's monitoring of sales enquiries to new car dealers. Compared to the previous month, sales enquiries in December fell by 7.8%.

The demand for new cars, notably in Cat A, may be tempered by the pending changes in VES regulations that will take effect in 2021. Cleaner cars will net a larger rebate, and buyers may be holding out till the new regulations are in place.

Cat B new car prices increase for most dealers

After the latest COE bidding, across a selected panel of new car dealerships monitored by sgCarMart, new car prices have been adjusted to match the change in COE prices.

For Cat A cars, with the minimal change in COE premiums, most brands did not change prices.

For Cat B cars, all monitored brands adjusted prices upwards to match the increase in Cat B and E prices. Seven brands, including BMW, Honda and Lexus, increased prices by $4,000, while other brands including Skoda and Volkswagen increased prices by $5,000.

*This article was updated on 30 September 2022

Thank You For Your Subscription.