COE Analysis July '23: COE supply forecast to rise in August

05 Jul 2023|28,105 views

COE price trend over the past quarter: April to June 2023 vs January to March 2023

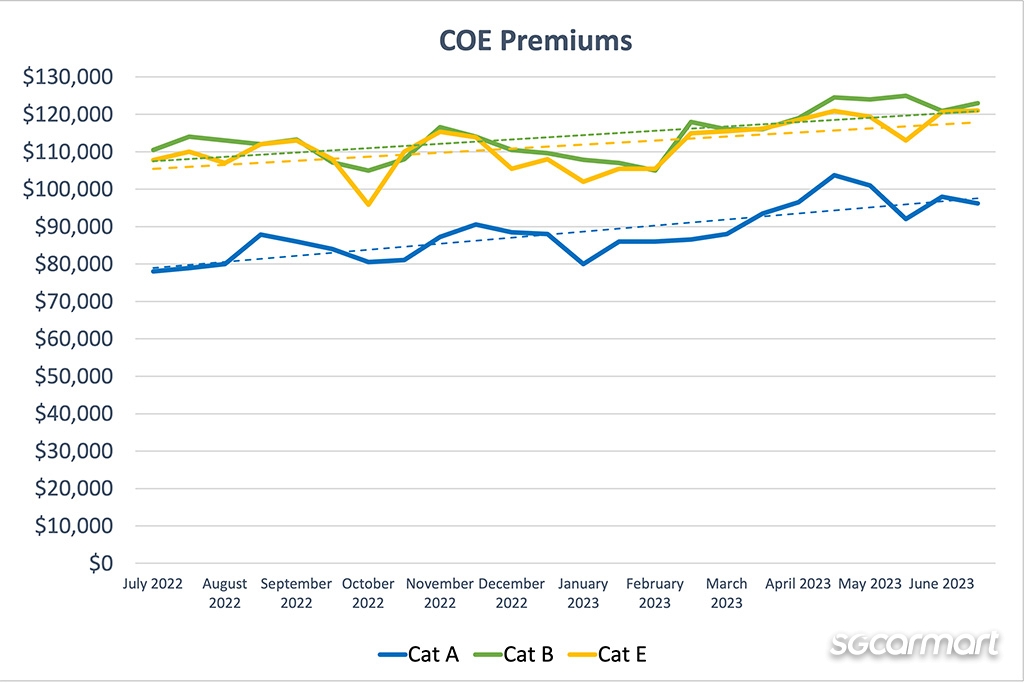

The warning signs were all there - that COE premiums would not be tapering off any time soon. Then, the inevitable finally happened for Category A.

In the second bidding round of April, premiums for smaller cars (with engine capacities of up to 1,600cc and power outputs capped at 130bhp) crossed the $100,000 mark. Landing at $103,721, it marked the first time that Category A had ever breached the six-figure barrier. Simultaneously, both Category B for larger cars and the open Category E crossed new highs of more than $120,000.

Dips in COE premiums in May and June - that were likely artificially triggered (we'll explain why it's phrased as such soon) - were unable to mitigate these insane increases. As a result, when compared to the period of January to March this year, COE premiums were significantly steeper when averaged out across April to June. Cat A saw a whopping spike of 13%, although Cats B and E were not far behind either: At an 8.2% and 10% increase respectively.

Coming back to April, however, it seemed that the worst was still ahead then. Just as COE premiums were breaking new records, the LTA had announced around almost the same time that the quota for private passenger cars was set to shrink still, in the May to July quota period.

And so, the LTA pulled its most drastic move yet. In an unprecedented move, the authority announced that it would be making a one-time adjustment to the quota pool, by bringing forward 6,000 COEs that were set to come from de-registrations of cars with five-year non-extendable COEs. Doing so, it said, would help "reduce the volatility in supply for Categories A and B".

As you'll see in the next section, this exponentially increases the difficulty of any form of forecasting for how COE supply is set to shape up. Did that provide any reprieve? We'll let you decide: Five bidding rounds in with the bolstered supply, Cats B and E have climbed back above $120,000, while Cat A is still at $96,000. The situation might certainly change still moving forward, but as of now, things still look rather bleak.

In relation to these prices, one particular phenomenon we've noted to have been slowly bubbling beneath the surface of the industry was the surging Cat A segment. Local dealers have increasingly either brought in or tuned their models so that they would meet the 130bhp power cap; seven separate models were shifted, in fact, from Cat B to Cat A between May 2022 and May 2023.

Vehicle de-registration and COE supply forecasting - now with a twist

Over the past year, attempting to arrive at an accurate forecast for the next period's quota has become extremely difficult as the goalposts have been shifted time and again. After it was first changed in July 2022, the calculation methodology for COE quota was revised yet again in January 2023.

But the one-time adjustment of those 6,000 additional COEs throws the largest spanner into the works yet, with forecasting over the next few quarters now made an extremely opaque exercise.

How many quarters will this sum of 6,000 really stretch across? And when does the LTA decide how much to assign to each quarter?

These were questions the Sgcarmart team pondered, before deciding we'd operate on two main assumptions: Firstly, we're taking it that the LTA will indeed divide the additional supply out in equal parts across each upcoming quarter. Secondly, we'll also take the COEs added to the May to July period as an indication of how much the LTA will be assigning to each upcoming quarter.

The previous bumper crop included 856 additional COEs, spread out across only five bidding rounds - from late-May to end-July. Roughly 65% of these went to Cat A, and the other 35% to Cat B. Using this ratio, and extrapolating that 856 figure to six bidding rounds will give us 1,027 additional COEs.

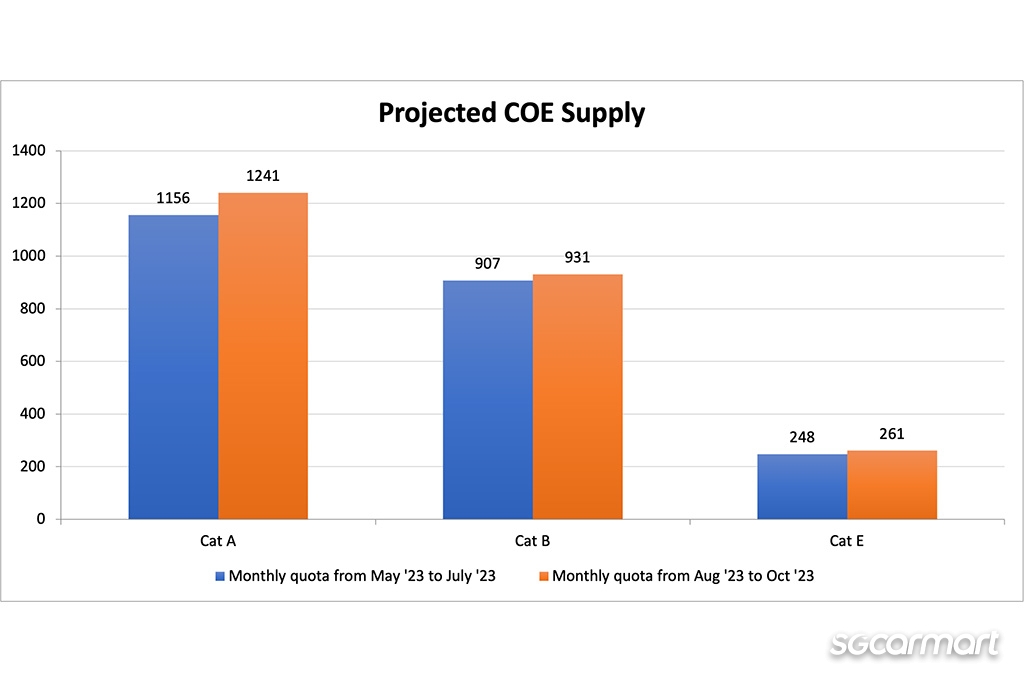

Adding this adjustment on to the data extrapolated from de-registrations across July 2022 to May 2023, suggests that COE supply for private passenger cars is set to rise 5% for the August to October 2023 quota period - and across all categories too.

Cat A should rise the highest based on this logic - by 7% from the current monthly average of 1,156. Percentage-wise, it is followed by the open Cat E, which should rise 5% from the current monthly quota of 248. Cat B is forecast to rise a more-gentle 3%, from 907 per month at the moment.

Again, it must be cautioned that the opacity of how exactly the LTA intends to redistribute COEs from the one-time adjustment makes any sort of precise forecasting nearly impossible. Nonetheless, the slight rise reflected in these figures does feel coherent with the overarching intention to give the quota pool a gentle boost.

New car pricing: April to June 2023

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

Based on our sample, there was an even steeper 5.4% increase in new car prices over the past quarter, when compared to the tri-monthly average between January to March 2023. (Back in March, a 2.6% increase was logged.)

Consequently, we've reached a point of seeing the retail prices of our favourite family cars - such as the Toyota Corolla Altis Elegance, and the Nissan Kicks e-POWER - start with $16X,XXX.

Most popular used cars: March 2023 to May 2023

Over the three-month period between March 2023 to May 2023, these were the five most listed used cars on Sgcarmart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $15,010/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2018 | $19,847/yr |

| Honda Civic 1.6A VTi | 2018 | $14,600/yr |

| Nissan Qashqai 1.2A DIG-T | 2016 | $14,057/yr |

| Toyota Corolla Altis 1.6A Elegance | 2015 | $15,384/yr |

With new car prices reaching unprecedented peaks, it comes as no surprise too that the used car market dutifully followed suit. The annual depreciation figure for the Honda Vezel 1.5A X, registered in 2016, finally breached the $15,000 line when averaged out across the three months.

The retail prices of other mass market models were no less mind-boggling, especially if we zoom into other months. In April, for instance, the annual depreciation of a Toyota Corolla Altis Elegance registered in 2015 - in other words, a seven to eight-year old car - was almost $16,000.

An interesting data point note is the significant increase in used car listings in March to May. Combined, the volume of listings for the top five used models represented a 98.4% jump over the previous three-month period. It may appear that existing car owners, too, have noted the steadily heating used car market, and are seizing the opportunity.

As with our previous analysis, the previous generation Mazda 3 1.5A Sedan continued to make a splash on our listings from March to May.

As a brief refresher, here's what we noted in our previous COE analyses:

COE price trend over the past quarter: April to June 2023 vs January to March 2023

The warning signs were all there - that COE premiums would not be tapering off any time soon. Then, the inevitable finally happened for Category A.

In the second bidding round of April, premiums for smaller cars (with engine capacities of up to 1,600cc and power outputs capped at 130bhp) crossed the $100,000 mark. Landing at $103,721, it marked the first time that Category A had ever breached the six-figure barrier. Simultaneously, both Category B for larger cars and the open Category E crossed new highs of more than $120,000.

Dips in COE premiums in May and June - that were likely artificially triggered (we'll explain why it's phrased as such soon) - were unable to mitigate these insane increases. As a result, when compared to the period of January to March this year, COE premiums were significantly steeper when averaged out across April to June. Cat A saw a whopping spike of 13%, although Cats B and E were not far behind either: At an 8.2% and 10% increase respectively.

Coming back to April, however, it seemed that the worst was still ahead then. Just as COE premiums were breaking new records, the LTA had announced around almost the same time that the quota for private passenger cars was set to shrink still, in the May to July quota period.

And so, the LTA pulled its most drastic move yet. In an unprecedented move, the authority announced that it would be making a one-time adjustment to the quota pool, by bringing forward 6,000 COEs that were set to come from de-registrations of cars with five-year non-extendable COEs. Doing so, it said, would help "reduce the volatility in supply for Categories A and B".

As you'll see in the next section, this exponentially increases the difficulty of any form of forecasting for how COE supply is set to shape up. Did that provide any reprieve? We'll let you decide: Five bidding rounds in with the bolstered supply, Cats B and E have climbed back above $120,000, while Cat A is still at $96,000. The situation might certainly change still moving forward, but as of now, things still look rather bleak.

In relation to these prices, one particular phenomenon we've noted to have been slowly bubbling beneath the surface of the industry was the surging Cat A segment. Local dealers have increasingly either brought in or tuned their models so that they would meet the 130bhp power cap; seven separate models were shifted, in fact, from Cat B to Cat A between May 2022 and May 2023.

Vehicle de-registration and COE supply forecasting - now with a twist

Over the past year, attempting to arrive at an accurate forecast for the next period's quota has become extremely difficult as the goalposts have been shifted time and again. After it was first changed in July 2022, the calculation methodology for COE quota was revised yet again in January 2023.

But the one-time adjustment of those 6,000 additional COEs throws the largest spanner into the works yet, with forecasting over the next few quarters now made an extremely opaque exercise.

How many quarters will this sum of 6,000 really stretch across? And when does the LTA decide how much to assign to each quarter?

These were questions the Sgcarmart team pondered, before deciding we'd operate on two main assumptions: Firstly, we're taking it that the LTA will indeed divide the additional supply out in equal parts across each upcoming quarter. Secondly, we'll also take the COEs added to the May to July period as an indication of how much the LTA will be assigning to each upcoming quarter.

The previous bumper crop included 856 additional COEs, spread out across only five bidding rounds - from late-May to end-July. Roughly 65% of these went to Cat A, and the other 35% to Cat B. Using this ratio, and extrapolating that 856 figure to six bidding rounds will give us 1,027 additional COEs.

Adding this adjustment on to the data extrapolated from de-registrations across July 2022 to May 2023, suggests that COE supply for private passenger cars is set to rise 5% for the August to October 2023 quota period - and across all categories too.

Cat A should rise the highest based on this logic - by 7% from the current monthly average of 1,156. Percentage-wise, it is followed by the open Cat E, which should rise 5% from the current monthly quota of 248. Cat B is forecast to rise a more-gentle 3%, from 907 per month at the moment.

Again, it must be cautioned that the opacity of how exactly the LTA intends to redistribute COEs from the one-time adjustment makes any sort of precise forecasting nearly impossible. Nonetheless, the slight rise reflected in these figures does feel coherent with the overarching intention to give the quota pool a gentle boost.

New car pricing: April to June 2023

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

Based on our sample, there was an even steeper 5.4% increase in new car prices over the past quarter, when compared to the tri-monthly average between January to March 2023. (Back in March, a 2.6% increase was logged.)

Consequently, we've reached a point of seeing the retail prices of our favourite family cars - such as the Toyota Corolla Altis Elegance, and the Nissan Kicks e-POWER - start with $16X,XXX.

Most popular used cars: March 2023 to May 2023

Over the three-month period between March 2023 to May 2023, these were the five most listed used cars on Sgcarmart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $15,010/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2018 | $19,847/yr |

| Honda Civic 1.6A VTi | 2018 | $14,600/yr |

| Nissan Qashqai 1.2A DIG-T | 2016 | $14,057/yr |

| Toyota Corolla Altis 1.6A Elegance | 2015 | $15,384/yr |

With new car prices reaching unprecedented peaks, it comes as no surprise too that the used car market dutifully followed suit. The annual depreciation figure for the Honda Vezel 1.5A X, registered in 2016, finally breached the $15,000 line when averaged out across the three months.

The retail prices of other mass market models were no less mind-boggling, especially if we zoom into other months. In April, for instance, the annual depreciation of a Toyota Corolla Altis Elegance registered in 2015 - in other words, a seven to eight-year old car - was almost $16,000.

An interesting data point note is the significant increase in used car listings in March to May. Combined, the volume of listings for the top five used models represented a 98.4% jump over the previous three-month period. It may appear that existing car owners, too, have noted the steadily heating used car market, and are seizing the opportunity.

As with our previous analysis, the previous generation Mazda 3 1.5A Sedan continued to make a splash on our listings from March to May.

As a brief refresher, here's what we noted in our previous COE analyses:

Thank You For Your Subscription.