December 2022: As premiums stabilise slightly, COE supply for Cat A and E projected to increase slightly in Feb

30 Dec 2022|31,003 views

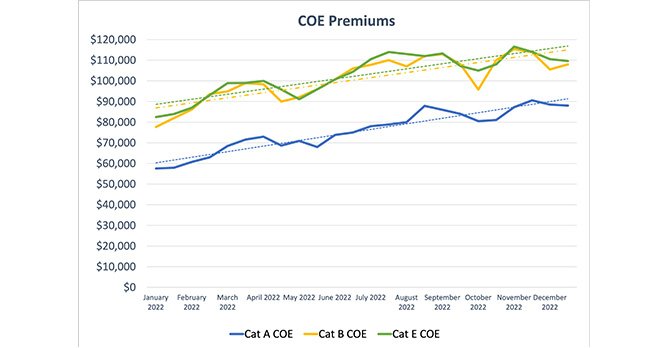

COE price trend over the past quarter: October to December 2022 vs July to September 2022

Is the worst over?

That's not a question we can definitively answer with confidence, but the numbers indicate that COE premiums appear to be levelling out. For the first time over the last two years, premiums in Categories B and E - when averaged out across the three months - were actually lower than in the preceding quarter.

The October to December average for Category B COE prices was 1.6% lower than in the previous quarter. Meanwhile, those in open Category E were (a meagre) 0.9% lower.

An increase was only witnessed in Category A, where average prices across October to December were 4.3% higher than the previous period.

To be fair, this isn't much to celebrate about. Premiums in both Categories B and E are still hovering around $100,000, and broke records yet again in the first bidding round of November, when the former hit $115,388, and the latter hit $116,577.

Any significant increase beyond these points would have meant prices settling within the region north of $115,000, and perhaps even $120,000. As such, it has been at the very least reassuring to not see that happen.

Where the eyebrow-raising has also occurred notably is in Category A. Premiums for cars with smaller engines/lower power outputs crossed $90,000 in late November, almost breaching their all-time high of $92,100 back in early 2013.

In the background over the last few months, calls for stronger governmental intervention have also amplified as official data indicated that fleet car registrations were increasing in significant proportion to those from private owners.

Worth noting is that even non-passenger cars haven't escaped from the woes of a COE supply shortage, even as the local automotive industry has been left in (unprecedented) shambles. COE premiums for both commercial vehicles (CVs) and motorcycles hit fresh highs over the last three months.

In other news, the relaxation of safety distancing measures over 2022 has also marked the steady return of roadshows and large-scale events, and will culminate in the 2023 Singapore Motorshow, returning after a two-year hiatus. That brings us on to what we have to say next…

Vehicle de-registration and COE supply forecasting

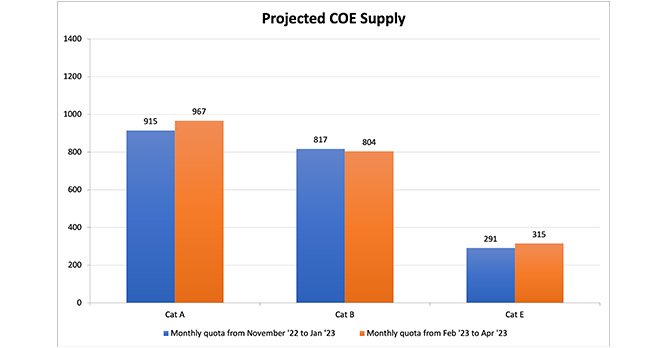

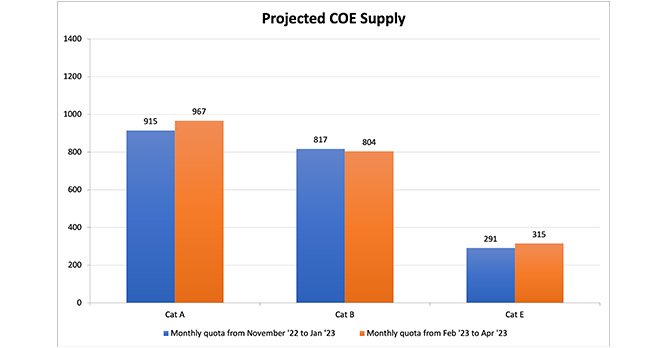

Data suggests that supply for passenger car COEs is set to rise 3%, led by increases in Cats A and E For Cats A and B, our previous forecast hit the nail right on its head when projecting the contraction in supply. Quota in both categories dropped by 16% and 13% respectively.

Data suggests that supply for passenger car COEs is set to rise 3%, led by increases in Cats A and E For Cats A and B, our previous forecast hit the nail right on its head when projecting the contraction in supply. Quota in both categories dropped by 16% and 13% respectively.

The only area where we missed the mark slightly was with the open Cat E, for which supply shrank by 11%, as opposed to the 8% growth we had predicted.

Now, data extrapolated from de-registrations between July and December 2022 (remember, LTA now uses the rolling average of the two previous quarters) is bearing some promising news. For passenger car COEs, an overall increase of 3% has been projected.

Before you scoff at the number, it's worth remembering that the past year has presented us almost entirely with shrinkages. As such, we'd argue that any potential growth in the quota pool is to be received with some relief.

Nonetheless, the caveat is that the COE quota for Cat B still appears set to fall - by 2% from the current monthly average of 817.

The increases are likely to be seen instead in Cat A and Cat E. In Cat A, the quota is projected to rise almost 6% from a monthly average of 915. With similar magnitude, our data suggests an 8% increase in Open Category premiums from a current monthly average of 291. Considering the surge in registrations that might soon be witnessed as the Motorshow returns, it's likely that these increases will be welcome as dealers continue to fulfill orders in the weeks and even months thereafter.

New car pricing: October to December 2022

After peaking in late Nov, listed prices of the Cat B-classified VW Golf have subsided to June levels Sgcarmart uses a pool of popular models from authorised dealers to analyse the general price trends of new cars.

After peaking in late Nov, listed prices of the Cat B-classified VW Golf have subsided to June levels Sgcarmart uses a pool of popular models from authorised dealers to analyse the general price trends of new cars.

Based on our sample, there was a much gentler 1.3% quarter-on-quarter increase, compared to the previous tri-monthly average between July to September 2022. This marks a far slower rate of increase than seen across the previous two periods.

In view of how premiums have risen in Cat A, but dipped slightly in Cats B and E, this new car pricing trend is exactly in line with one might expect when looking at COE charts.

In other words, dealers appear to be simply mirroring those premium increases, with neither drastic mark-ups nor price slashes (at least officially).

While any increase is still undesirable to consumers, it's worth noting such a gentle rise has not been observed since early 2021. (Between the periods of Jan to March and April to June 2021, new car prices had risen just 0.7%.)

While the numbers suggest that prices are (sadly) still where one expects them to be currently - around $150,000 for something like a Nissan Kicks e-Power - they thankfully also haven't shot very much further through the roof.

Most popular used cars: September 2022 to November 2022

Over the three-month period between September 2022 to November 2022, these were the five most listed used cars on Sgcarmart.

The previous generation Mazda 3 returns to the Top 5 of our three-month averaged list for this period Even as the brakes have been slowly applied to new car prices over the past few months, used car prices have continued to creep upwards.

The previous generation Mazda 3 returns to the Top 5 of our three-month averaged list for this period Even as the brakes have been slowly applied to new car prices over the past few months, used car prices have continued to creep upwards.

Using our evergreen leader as the yardstick, the annual average depreciation figure for the Honda Vezel 1.5A X, registered in 2016, has officially crossed $14,000. Exactly one year ago, that number was hovering around $10,500.

After a brief surge of luxury models, mass market models have also slowly clawed their way back to the top, with the Mazda3 returning to this list for the first time since October 2021. Outside of the overall Top 5 for the three-month period, other similarly positioned models have witnessed a resurgence of sorts, with names such as the Cat A-friendly Nissan Qashqai 1.2 and previous generation Toyota Corolla Altis placing quite high up.

Curious about what we had to say in our previous forecasts? Here's a look back on our earlier COE analyses for 2022!

October 2022: COE supply projected to shrink again come November, despite change of quota counting method

June 2022: Cat B and E over $100k now, supply for next period projected to shrink further

Mar 2022: Cat B and E threaten $100k barrier, supply for next period projected to shrink slightly

COE prices continue to climb, and supply for upcoming quarter expected to increase slightly

Is the worst over?

That's not a question we can definitively answer with confidence, but the numbers indicate that COE premiums appear to be levelling out. For the first time over the last two years, premiums in Categories B and E - when averaged out across the three months - were actually lower than in the preceding quarter.

The October to December average for Category B COE prices was 1.6% lower than in the previous quarter. Meanwhile, those in open Category E were (a meagre) 0.9% lower.

An increase was only witnessed in Category A, where average prices across October to December were 4.3% higher than the previous period.

To be fair, this isn't much to celebrate about. Premiums in both Categories B and E are still hovering around $100,000, and broke records yet again in the first bidding round of November, when the former hit $115,388, and the latter hit $116,577.

Any significant increase beyond these points would have meant prices settling within the region north of $115,000, and perhaps even $120,000. As such, it has been at the very least reassuring to not see that happen.

Where the eyebrow-raising has also occurred notably is in Category A. Premiums for cars with smaller engines/lower power outputs crossed $90,000 in late November, almost breaching their all-time high of $92,100 back in early 2013.

In the background over the last few months, calls for stronger governmental intervention have also amplified as official data indicated that fleet car registrations were increasing in significant proportion to those from private owners.

Worth noting is that even non-passenger cars haven't escaped from the woes of a COE supply shortage, even as the local automotive industry has been left in (unprecedented) shambles. COE premiums for both commercial vehicles (CVs) and motorcycles hit fresh highs over the last three months.

In other news, the relaxation of safety distancing measures over 2022 has also marked the steady return of roadshows and large-scale events, and will culminate in the 2023 Singapore Motorshow, returning after a two-year hiatus. That brings us on to what we have to say next…

Vehicle de-registration and COE supply forecasting

The only area where we missed the mark slightly was with the open Cat E, for which supply shrank by 11%, as opposed to the 8% growth we had predicted.

Now, data extrapolated from de-registrations between July and December 2022 (remember, LTA now uses the rolling average of the two previous quarters) is bearing some promising news. For passenger car COEs, an overall increase of 3% has been projected.

Before you scoff at the number, it's worth remembering that the past year has presented us almost entirely with shrinkages. As such, we'd argue that any potential growth in the quota pool is to be received with some relief.

Nonetheless, the caveat is that the COE quota for Cat B still appears set to fall - by 2% from the current monthly average of 817.

The increases are likely to be seen instead in Cat A and Cat E. In Cat A, the quota is projected to rise almost 6% from a monthly average of 915. With similar magnitude, our data suggests an 8% increase in Open Category premiums from a current monthly average of 291. Considering the surge in registrations that might soon be witnessed as the Motorshow returns, it's likely that these increases will be welcome as dealers continue to fulfill orders in the weeks and even months thereafter.

New car pricing: October to December 2022

Based on our sample, there was a much gentler 1.3% quarter-on-quarter increase, compared to the previous tri-monthly average between July to September 2022. This marks a far slower rate of increase than seen across the previous two periods.

In view of how premiums have risen in Cat A, but dipped slightly in Cats B and E, this new car pricing trend is exactly in line with one might expect when looking at COE charts.

In other words, dealers appear to be simply mirroring those premium increases, with neither drastic mark-ups nor price slashes (at least officially).

While any increase is still undesirable to consumers, it's worth noting such a gentle rise has not been observed since early 2021. (Between the periods of Jan to March and April to June 2021, new car prices had risen just 0.7%.)

While the numbers suggest that prices are (sadly) still where one expects them to be currently - around $150,000 for something like a Nissan Kicks e-Power - they thankfully also haven't shot very much further through the roof.

Most popular used cars: September 2022 to November 2022

Over the three-month period between September 2022 to November 2022, these were the five most listed used cars on Sgcarmart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $14,193/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2017 | $19,327/yr |

| Mazda3 1.5A Sunroof | 2017 | $12,604/yr |

| Honda Civic 1.6A VTi | 2018 | $14,027/yr |

| Honda Civic 1.6A VTi | 2017 | $13,688/yr |

Using our evergreen leader as the yardstick, the annual average depreciation figure for the Honda Vezel 1.5A X, registered in 2016, has officially crossed $14,000. Exactly one year ago, that number was hovering around $10,500.

After a brief surge of luxury models, mass market models have also slowly clawed their way back to the top, with the Mazda3 returning to this list for the first time since October 2021. Outside of the overall Top 5 for the three-month period, other similarly positioned models have witnessed a resurgence of sorts, with names such as the Cat A-friendly Nissan Qashqai 1.2 and previous generation Toyota Corolla Altis placing quite high up.

Sgcarmart

Get COE Renewal Advice, Loans & Paperwork

We help you renew your COE and find the best loan rates in Singapore.

- Complimentary pre-COE inspection

- Settlement of entire COE renewal paperwork

Curious about what we had to say in our previous forecasts? Here's a look back on our earlier COE analyses for 2022!

October 2022: COE supply projected to shrink again come November, despite change of quota counting method

June 2022: Cat B and E over $100k now, supply for next period projected to shrink further

Mar 2022: Cat B and E threaten $100k barrier, supply for next period projected to shrink slightly

COE prices continue to climb, and supply for upcoming quarter expected to increase slightly

COE price trend over the past quarter: October to December 2022 vs July to September 2022

Is the worst over?

That's not a question we can definitively answer with confidence, but the numbers indicate that COE premiums appear to be levelling out. For the first time over the last two years, premiums in Categories B and E - when averaged out across the three months - were actually lower than in the preceding quarter.

The October to December average for Category B COE prices was 1.6% lower than in the previous quarter. Meanwhile, those in open Category E were (a meagre) 0.9% lower.

An increase was only witnessed in Category A, where average prices across October to December were 4.3% higher than the previous period.

To be fair, this isn't much to celebrate about. Premiums in both Categories B and E are still hovering around $100,000, and broke records yet again in the first bidding round of November, when the former hit $115,388, and the latter hit $116,577.

Any significant increase beyond these points would have meant prices settling within the region north of $115,000, and perhaps even $120,000. As such, it has been at the very least reassuring to not see that happen.

Where the eyebrow-raising has also occurred notably is in Category A. Premiums for cars with smaller engines/lower power outputs crossed $90,000 in late November, almost breaching their all-time high of $92,100 back in early 2013.

In the background over the last few months, calls for stronger governmental intervention have also amplified as official data indicated that fleet car registrations were increasing in significant proportion to those from private owners.

Worth noting is that even non-passenger cars haven't escaped from the woes of a COE supply shortage, even as the local automotive industry has been left in (unprecedented) shambles. COE premiums for both commercial vehicles (CVs) and motorcycles hit fresh highs over the last three months.

In other news, the relaxation of safety distancing measures over 2022 has also marked the steady return of roadshows and large-scale events, and will culminate in the 2023 Singapore Motorshow, returning after a two-year hiatus. That brings us on to what we have to say next…

Vehicle de-registration and COE supply forecasting

Data suggests that supply for passenger car COEs is set to rise 3%, led by increases in Cats A and E For Cats A and B, our previous forecast hit the nail right on its head when projecting the contraction in supply. Quota in both categories dropped by 16% and 13% respectively.

Data suggests that supply for passenger car COEs is set to rise 3%, led by increases in Cats A and E For Cats A and B, our previous forecast hit the nail right on its head when projecting the contraction in supply. Quota in both categories dropped by 16% and 13% respectively.

The only area where we missed the mark slightly was with the open Cat E, for which supply shrank by 11%, as opposed to the 8% growth we had predicted.

Now, data extrapolated from de-registrations between July and December 2022 (remember, LTA now uses the rolling average of the two previous quarters) is bearing some promising news. For passenger car COEs, an overall increase of 3% has been projected.

Before you scoff at the number, it's worth remembering that the past year has presented us almost entirely with shrinkages. As such, we'd argue that any potential growth in the quota pool is to be received with some relief.

Nonetheless, the caveat is that the COE quota for Cat B still appears set to fall - by 2% from the current monthly average of 817.

The increases are likely to be seen instead in Cat A and Cat E. In Cat A, the quota is projected to rise almost 6% from a monthly average of 915. With similar magnitude, our data suggests an 8% increase in Open Category premiums from a current monthly average of 291. Considering the surge in registrations that might soon be witnessed as the Motorshow returns, it's likely that these increases will be welcome as dealers continue to fulfill orders in the weeks and even months thereafter.

New car pricing: October to December 2022

After peaking in late Nov, listed prices of the Cat B-classified VW Golf have subsided to June levels Sgcarmart uses a pool of popular models from authorised dealers to analyse the general price trends of new cars.

After peaking in late Nov, listed prices of the Cat B-classified VW Golf have subsided to June levels Sgcarmart uses a pool of popular models from authorised dealers to analyse the general price trends of new cars.

Based on our sample, there was a much gentler 1.3% quarter-on-quarter increase, compared to the previous tri-monthly average between July to September 2022. This marks a far slower rate of increase than seen across the previous two periods.

In view of how premiums have risen in Cat A, but dipped slightly in Cats B and E, this new car pricing trend is exactly in line with one might expect when looking at COE charts.

In other words, dealers appear to be simply mirroring those premium increases, with neither drastic mark-ups nor price slashes (at least officially).

While any increase is still undesirable to consumers, it's worth noting such a gentle rise has not been observed since early 2021. (Between the periods of Jan to March and April to June 2021, new car prices had risen just 0.7%.)

While the numbers suggest that prices are (sadly) still where one expects them to be currently - around $150,000 for something like a Nissan Kicks e-Power - they thankfully also haven't shot very much further through the roof.

Most popular used cars: September 2022 to November 2022

Over the three-month period between September 2022 to November 2022, these were the five most listed used cars on Sgcarmart.

The previous generation Mazda 3 returns to the Top 5 of our three-month averaged list for this period Even as the brakes have been slowly applied to new car prices over the past few months, used car prices have continued to creep upwards.

The previous generation Mazda 3 returns to the Top 5 of our three-month averaged list for this period Even as the brakes have been slowly applied to new car prices over the past few months, used car prices have continued to creep upwards.

Using our evergreen leader as the yardstick, the annual average depreciation figure for the Honda Vezel 1.5A X, registered in 2016, has officially crossed $14,000. Exactly one year ago, that number was hovering around $10,500.

After a brief surge of luxury models, mass market models have also slowly clawed their way back to the top, with the Mazda3 returning to this list for the first time since October 2021. Outside of the overall Top 5 for the three-month period, other similarly positioned models have witnessed a resurgence of sorts, with names such as the Cat A-friendly Nissan Qashqai 1.2 and previous generation Toyota Corolla Altis placing quite high up.

Curious about what we had to say in our previous forecasts? Here's a look back on our earlier COE analyses for 2022!

October 2022: COE supply projected to shrink again come November, despite change of quota counting method

June 2022: Cat B and E over $100k now, supply for next period projected to shrink further

Mar 2022: Cat B and E threaten $100k barrier, supply for next period projected to shrink slightly

COE prices continue to climb, and supply for upcoming quarter expected to increase slightly

Is the worst over?

That's not a question we can definitively answer with confidence, but the numbers indicate that COE premiums appear to be levelling out. For the first time over the last two years, premiums in Categories B and E - when averaged out across the three months - were actually lower than in the preceding quarter.

The October to December average for Category B COE prices was 1.6% lower than in the previous quarter. Meanwhile, those in open Category E were (a meagre) 0.9% lower.

An increase was only witnessed in Category A, where average prices across October to December were 4.3% higher than the previous period.

To be fair, this isn't much to celebrate about. Premiums in both Categories B and E are still hovering around $100,000, and broke records yet again in the first bidding round of November, when the former hit $115,388, and the latter hit $116,577.

Any significant increase beyond these points would have meant prices settling within the region north of $115,000, and perhaps even $120,000. As such, it has been at the very least reassuring to not see that happen.

Where the eyebrow-raising has also occurred notably is in Category A. Premiums for cars with smaller engines/lower power outputs crossed $90,000 in late November, almost breaching their all-time high of $92,100 back in early 2013.

In the background over the last few months, calls for stronger governmental intervention have also amplified as official data indicated that fleet car registrations were increasing in significant proportion to those from private owners.

Worth noting is that even non-passenger cars haven't escaped from the woes of a COE supply shortage, even as the local automotive industry has been left in (unprecedented) shambles. COE premiums for both commercial vehicles (CVs) and motorcycles hit fresh highs over the last three months.

In other news, the relaxation of safety distancing measures over 2022 has also marked the steady return of roadshows and large-scale events, and will culminate in the 2023 Singapore Motorshow, returning after a two-year hiatus. That brings us on to what we have to say next…

Vehicle de-registration and COE supply forecasting

The only area where we missed the mark slightly was with the open Cat E, for which supply shrank by 11%, as opposed to the 8% growth we had predicted.

Now, data extrapolated from de-registrations between July and December 2022 (remember, LTA now uses the rolling average of the two previous quarters) is bearing some promising news. For passenger car COEs, an overall increase of 3% has been projected.

Before you scoff at the number, it's worth remembering that the past year has presented us almost entirely with shrinkages. As such, we'd argue that any potential growth in the quota pool is to be received with some relief.

Nonetheless, the caveat is that the COE quota for Cat B still appears set to fall - by 2% from the current monthly average of 817.

The increases are likely to be seen instead in Cat A and Cat E. In Cat A, the quota is projected to rise almost 6% from a monthly average of 915. With similar magnitude, our data suggests an 8% increase in Open Category premiums from a current monthly average of 291. Considering the surge in registrations that might soon be witnessed as the Motorshow returns, it's likely that these increases will be welcome as dealers continue to fulfill orders in the weeks and even months thereafter.

New car pricing: October to December 2022

Based on our sample, there was a much gentler 1.3% quarter-on-quarter increase, compared to the previous tri-monthly average between July to September 2022. This marks a far slower rate of increase than seen across the previous two periods.

In view of how premiums have risen in Cat A, but dipped slightly in Cats B and E, this new car pricing trend is exactly in line with one might expect when looking at COE charts.

In other words, dealers appear to be simply mirroring those premium increases, with neither drastic mark-ups nor price slashes (at least officially).

While any increase is still undesirable to consumers, it's worth noting such a gentle rise has not been observed since early 2021. (Between the periods of Jan to March and April to June 2021, new car prices had risen just 0.7%.)

While the numbers suggest that prices are (sadly) still where one expects them to be currently - around $150,000 for something like a Nissan Kicks e-Power - they thankfully also haven't shot very much further through the roof.

Most popular used cars: September 2022 to November 2022

Over the three-month period between September 2022 to November 2022, these were the five most listed used cars on Sgcarmart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $14,193/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2017 | $19,327/yr |

| Mazda3 1.5A Sunroof | 2017 | $12,604/yr |

| Honda Civic 1.6A VTi | 2018 | $14,027/yr |

| Honda Civic 1.6A VTi | 2017 | $13,688/yr |

Using our evergreen leader as the yardstick, the annual average depreciation figure for the Honda Vezel 1.5A X, registered in 2016, has officially crossed $14,000. Exactly one year ago, that number was hovering around $10,500.

After a brief surge of luxury models, mass market models have also slowly clawed their way back to the top, with the Mazda3 returning to this list for the first time since October 2021. Outside of the overall Top 5 for the three-month period, other similarly positioned models have witnessed a resurgence of sorts, with names such as the Cat A-friendly Nissan Qashqai 1.2 and previous generation Toyota Corolla Altis placing quite high up.

Sgcarmart

Get COE Renewal Advice, Loans & Paperwork

We help you renew your COE and find the best loan rates in Singapore.

- Complimentary pre-COE inspection

- Settlement of entire COE renewal paperwork

Curious about what we had to say in our previous forecasts? Here's a look back on our earlier COE analyses for 2022!

October 2022: COE supply projected to shrink again come November, despite change of quota counting method

June 2022: Cat B and E over $100k now, supply for next period projected to shrink further

Mar 2022: Cat B and E threaten $100k barrier, supply for next period projected to shrink slightly

COE prices continue to climb, and supply for upcoming quarter expected to increase slightly

Thank You For Your Subscription.