Carbon Emissions-Based Vehicle Scheme (CEVS) surcharge starts today

01 Jul 2013|7,225 views

Registration surcharges will be levied on new cars, taxis and newly imported used cars with high carbon emission (equal to or more than 211g CO2/km) registered with effect from today, 1st July 2013.

This move comes after a new Carbon Emissions-Based Vehicle Scheme (CEVS) was announced by the Minister for Finance during the 2012 Budget Statement and the Minister for Transport during the Committee of Supply 2012.

The CEVS adopts a broader outcome-based approach that takes into consideration vehicles' carbon emissions and fuel efficiency to encourage consumers to shift to low emission models.

CEVS rebates were implemented from 1st January 2013 whereas the surcharges, which do not affect the Open Market Value (OMV) or Additional Registration Fee (ARF), were scheduled to take effect six months later, from today, to give consumers and the motoring industry more time to adjust.

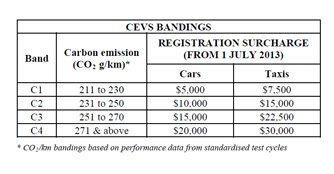

Under CEVS, high carbon emission car models will incur registration surcharges of between $5,000 and $20,000. For example, a Lexus RX270 which emits 226g/km of CO2, falls under band C1 and will incur a $5,000 surcharge. An Infiniti FX37, on the other hand, incurs a hefty $20,000 surcharge for falling under band C4, with 284g/km of CO2 emission.

As for taxis, registration surcharges for taxi models with high carbon emission are set 50 percent higher between $7,500 and $30,000 considering that taxis generally clock higher mileage than cars.

On the other hand, diesel models, whether Euro V-compliant or not, that fall within the surcharge bands will incur the appropriate registration surcharge. This applies to both diesel cars and diesel taxis.

The CEVS will be applicable till 31st December 2014. The scheme will be reviewed, taking into consideration its impact on motorists' purchasing decision, technological advances and the progress in Singapore's overall mitigation efforts on climate change.

Registration surcharges will be levied on new cars, taxis and newly imported used cars with high carbon emission (equal to or more than 211g CO2/km) registered with effect from today, 1st July 2013.

This move comes after a new Carbon Emissions-Based Vehicle Scheme (CEVS) was announced by the Minister for Finance during the 2012 Budget Statement and the Minister for Transport during the Committee of Supply 2012.

The CEVS adopts a broader outcome-based approach that takes into consideration vehicles' carbon emissions and fuel efficiency to encourage consumers to shift to low emission models.

CEVS rebates were implemented from 1st January 2013 whereas the surcharges, which do not affect the Open Market Value (OMV) or Additional Registration Fee (ARF), were scheduled to take effect six months later, from today, to give consumers and the motoring industry more time to adjust.

Under CEVS, high carbon emission car models will incur registration surcharges of between $5,000 and $20,000. For example, a Lexus RX270 which emits 226g/km of CO2, falls under band C1 and will incur a $5,000 surcharge. An Infiniti FX37, on the other hand, incurs a hefty $20,000 surcharge for falling under band C4, with 284g/km of CO2 emission.

As for taxis, registration surcharges for taxi models with high carbon emission are set 50 percent higher between $7,500 and $30,000 considering that taxis generally clock higher mileage than cars.

On the other hand, diesel models, whether Euro V-compliant or not, that fall within the surcharge bands will incur the appropriate registration surcharge. This applies to both diesel cars and diesel taxis.

The CEVS will be applicable till 31st December 2014. The scheme will be reviewed, taking into consideration its impact on motorists' purchasing decision, technological advances and the progress in Singapore's overall mitigation efforts on climate change.

Latest COE Prices

July 2025 | 1st BIDDING

NEXT TENDER: 23 Jul 2025

CAT A$101,102

CAT B$119,600

CAT C$66,689

CAT E$118,500

View Full Results Thank You For Your Subscription.