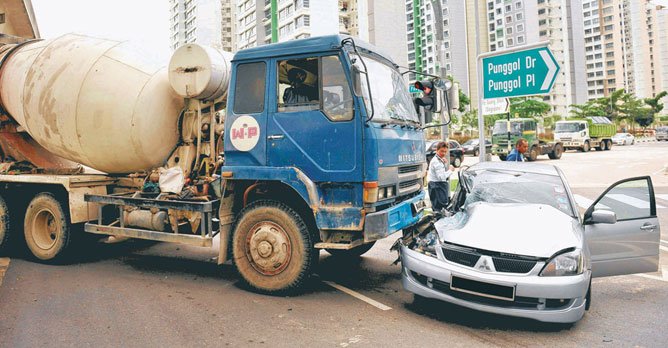

Car Insurance: What's taking so long to get your claims?

31 Mar 2020|9,249 views

We created this detailed guide for drivers struggling to make speedy and successful insurance claims. Here are some of the most common causes of delayed claims pay-out:

- Failing to submit a proper claim within 24 hours

- Failing to seek advice from your insurer

- Admitting to fault or liability

- Not getting the full picture

- Submitting bad quality pictures

- Not having a dash camera

- Unnecessarily moving the vehicle

- Visiting an unauthorised workshop

Failing to submit a proper claim in 24 hours

Submit your NRIC, a copy of your driving licence and well-documented evidence within 24 hours of the accident. Sounds easy? Not quite.

Missing out key evidence, which proves that you're not at fault, could cost you your No Claims Discount (NCD) and jeopardise your cheap car insurance plan.

Here's all you need to know about NCD for car insurance.

Failing to seek advice from your insurer

Aviva, AXA and NTUC Income car insurance have emergency hotlines that are especially handy when the accident occurs at ungodly hours. Not every insurer offers such easily available assistance - this is one of the common car insurance myths.

If you've decided not to opt for car insurance renewal because you want immediate assistance, consider checking out some of the best car insurance policies for 2020.

Admitting to fault or liability

Don't negotiate, admit to any liability or make offers of settlement to the third party. They may use this against you to shirk responsibility from the accident.

Taking matters into your own hands affects the claims process and puts your cheap car insurance plan at risk. Leave it to your insurer to decide who's at fault.

Sgcarmart

Get up to 20% off and $300 cashback when you renew with select car insurance!

Compare car insurance effortlessly with Sgcarmart. Get exclusive offers, discounts and cashback when renewing car insurance with our partner.

Get a Quote nowNot getting the full picture

Document everything. It's better to be safe than sorry.

You'll need:

- The licence plate number of vehicles involved

- Make, model and colour of vehicles involved

- Name, address and NRIC of the other drivers

- Contact number and insurance companies of the involved drivers

- Particulars of all injured persons and the extent of their injuries

- Was the traffic particularly heavy?

- Were the roads slippery from a heavy downpour?

- Was there anything unusual?

Submitting bad quality photos

If you don't have a dashcam, you'll need many photos of the accident and its damage.

Having a variety of shots/angles will be useful in your claim.

- Close-up shots

Examples: Damaged areas like dents and scratches on the involved cars

Why: To avoid missing out on the most incriminating evidence

Number of shots: At least four

- Medium-range shots

Examples: Show either car and its damages in a frame

Why: Helps the specialist understand the damage done

Number of shots: Three. Ensure licence plates are visible

- Wide angle shots

Examples: Both cars on the particular street in the wet weather

Why: Gives the insurer a good sense of the accident

Number of shots: Three photos or maybe a video, if useful

Not having a dash camera

Invest in a dash camera if you don't have one. It assists your insurer in piecing the story together.

Even if someone rams into your car's rear, but the dash camera is only in front, it can still prove that your car was travelling steadily before you were hit.

In such cases, a dash camera saves you from paying car insurance excess because it proves your liability to be 20% or less. Consider this an investment for retaining your cheap car insurance privileges.

Direct Asia car insurance offers a small discount for clients with dash cameras. Factor this in when you compare car insurance quotes to make sure you're not getting ripped off on your car insurance premium. Don't just opt for car insurance renewal because your next one might be your best car insurance yet.

Moving the vehicle unnecessarily

Don't touch your vehicle until all crucial evidence is noted down! Unnecessarily moving your car gives the other party a chance to dispute your claim.

Unless you're in the middle of a road, leave it there until instructed to move. Get a witness if your moved vehicle is a potential disruption to your claim.

Visiting an unauthorised workshop

Using an insurer-unauthorised workshop or tow service complicates your claim. You might need to foot the whole repair bill if insurers cannot ascertain that they haven't been overcharged.

Good news is that you can try to make a claim despite using an unauthorised workshop, but it depends on your insurer. If they're kind enough, they'll send a surveyor down to assess the repairs.

Too troublesome to sort all that out? Here's a list of workshops that help you do motor accident repair and claims so you don't have to.

Other Considerations

After filing your claim, check if you need to bring your vehicle down for your insurer's inspection by a certain day.

Last but not least, inform your insurer about the accident even if you don't plan to make a claim. AIG car insurance takes such matters seriously and will reduce your NCD discount if you fail to disclose it.

While takes a lot of effort to file a proper claim within 24-hours, you'll be so glad you did it properly when you quickly receive your claims pay-out.

*This article was updated by Alexandra Cheung on 16th October 2020

Here are some car insurance-related articles that might interest you

Ultimate Guide to Car Insurance in Singapore

What factors affect your car insurance quotes?

Car insurance quotes comparison: are you getting ripped off?

9 ways to lower your car insurance premiums

Best car insurance policies in Singapore for 2020

Sgcarmart

Get up to 20% off and $300 cashback when you renew with select car insurance!

Compare car insurance effortlessly with Sgcarmart. Get exclusive offers, discounts and cashback when renewing car insurance with our partner.

- Auto comparison for your future renewal quotes

- We provide claims support for your accident claims

We created this detailed guide for drivers struggling to make speedy and successful insurance claims. Here are some of the most common causes of delayed claims pay-out:

- Failing to submit a proper claim within 24 hours

- Failing to seek advice from your insurer

- Admitting to fault or liability

- Not getting the full picture

- Submitting bad quality pictures

- Not having a dash camera

- Unnecessarily moving the vehicle

- Visiting an unauthorised workshop

Failing to submit a proper claim in 24 hours

Submit your NRIC, a copy of your driving licence and well-documented evidence within 24 hours of the accident. Sounds easy? Not quite.

Missing out key evidence, which proves that you're not at fault, could cost you your No Claims Discount (NCD) and jeopardise your cheap car insurance plan.

Here's all you need to know about NCD for car insurance.

Failing to seek advice from your insurer

Aviva, AXA and NTUC Income car insurance have emergency hotlines that are especially handy when the accident occurs at ungodly hours. Not every insurer offers such easily available assistance - this is one of the common car insurance myths.

If you've decided not to opt for car insurance renewal because you want immediate assistance, consider checking out some of the best car insurance policies for 2020.

Admitting to fault or liability

Don't negotiate, admit to any liability or make offers of settlement to the third party. They may use this against you to shirk responsibility from the accident.

Taking matters into your own hands affects the claims process and puts your cheap car insurance plan at risk. Leave it to your insurer to decide who's at fault.

Sgcarmart

Get up to 20% off and $300 cashback when you renew with select car insurance!

Compare car insurance effortlessly with Sgcarmart. Get exclusive offers, discounts and cashback when renewing car insurance with our partner.

Get a Quote nowNot getting the full picture

Document everything. It's better to be safe than sorry.

You'll need:

- The licence plate number of vehicles involved

- Make, model and colour of vehicles involved

- Name, address and NRIC of the other drivers

- Contact number and insurance companies of the involved drivers

- Particulars of all injured persons and the extent of their injuries

- Was the traffic particularly heavy?

- Were the roads slippery from a heavy downpour?

- Was there anything unusual?

Submitting bad quality photos

If you don't have a dashcam, you'll need many photos of the accident and its damage.

Having a variety of shots/angles will be useful in your claim.

- Close-up shots

Examples: Damaged areas like dents and scratches on the involved cars

Why: To avoid missing out on the most incriminating evidence

Number of shots: At least four

- Medium-range shots

Examples: Show either car and its damages in a frame

Why: Helps the specialist understand the damage done

Number of shots: Three. Ensure licence plates are visible

- Wide angle shots

Examples: Both cars on the particular street in the wet weather

Why: Gives the insurer a good sense of the accident

Number of shots: Three photos or maybe a video, if useful

Not having a dash camera

Invest in a dash camera if you don't have one. It assists your insurer in piecing the story together.

Even if someone rams into your car's rear, but the dash camera is only in front, it can still prove that your car was travelling steadily before you were hit.

In such cases, a dash camera saves you from paying car insurance excess because it proves your liability to be 20% or less. Consider this an investment for retaining your cheap car insurance privileges.

Direct Asia car insurance offers a small discount for clients with dash cameras. Factor this in when you compare car insurance quotes to make sure you're not getting ripped off on your car insurance premium. Don't just opt for car insurance renewal because your next one might be your best car insurance yet.

Moving the vehicle unnecessarily

Don't touch your vehicle until all crucial evidence is noted down! Unnecessarily moving your car gives the other party a chance to dispute your claim.

Unless you're in the middle of a road, leave it there until instructed to move. Get a witness if your moved vehicle is a potential disruption to your claim.

Visiting an unauthorised workshop

Using an insurer-unauthorised workshop or tow service complicates your claim. You might need to foot the whole repair bill if insurers cannot ascertain that they haven't been overcharged.

Good news is that you can try to make a claim despite using an unauthorised workshop, but it depends on your insurer. If they're kind enough, they'll send a surveyor down to assess the repairs.

Too troublesome to sort all that out? Here's a list of workshops that help you do motor accident repair and claims so you don't have to.

Other Considerations

After filing your claim, check if you need to bring your vehicle down for your insurer's inspection by a certain day.

Last but not least, inform your insurer about the accident even if you don't plan to make a claim. AIG car insurance takes such matters seriously and will reduce your NCD discount if you fail to disclose it.

While takes a lot of effort to file a proper claim within 24-hours, you'll be so glad you did it properly when you quickly receive your claims pay-out.

*This article was updated by Alexandra Cheung on 16th October 2020

Here are some car insurance-related articles that might interest you

Ultimate Guide to Car Insurance in SingaporeWhat factors affect your car insurance quotes?

Car insurance quotes comparison: are you getting ripped off?

9 ways to lower your car insurance premiums

Best car insurance policies in Singapore for 2020

Sgcarmart

Get up to 20% off and $300 cashback when you renew with select car insurance!

Compare car insurance effortlessly with Sgcarmart. Get exclusive offers, discounts and cashback when renewing car insurance with our partner.

- Auto comparison for your future renewal quotes

- We provide claims support for your accident claims