A different list: Toyota is still Singapore's king, but a new name is rising

19 Jan 2022|19,760 views

The long-awaited sales figures of new cars in Singapore for 2021 are finally, finally out.

We know that the official rankings have been making their rounds recently and in them - surprise of surprises - Toyota/Lexus has retained its crown. (On a more serious note, the gold medal has actually been handed to other carmakers over the years, especially in COE premium climates eerily similar to the one that we've recently found ourselves sinking into.) The following stats have been taken from The Straits Times:

While we're not at all disputing the veracity of that bestselling list, factoring in the data used for overall new car registrations instead provides an interesting alternative viewpoint to simply focusing on our authorised dealers.

Sure, you could say that the numbers are not entirely accurate; some classic cars that meet certain standards, like this Datsun Bluebird, can ostensibly be registered under a new COE too. New cars that are privately imported, such as the famous 2014 Tesla Model S, also count here.

But the bulk of the additional units is made up of a very important part of Singapore's car populace: New models shifted through Parallel Importers (PIs). As such, the overall new car registrations are arguably just as valuable in helping us glean insights into the mindsets of Singaporean drivers in the year of 2021.

A different list

Based on data on new car registrations released by the LTA, we present: The unfiltered list for Singapore's Top 10 carmakers in 2021.

Familiar faces are still to be found here, but you'll see that where each one appears is slightly different under this particular lens. (Note: New vehicles are categorised by the LTA into their fuel types. 'Others' generally refers to hybrid and electric cars since hydrogen cars are still not widespread.)

Some things have changed. For instance, you could now dispute whether BMW or Mercedes-Benz - both already incredibly successful - actually had the upper hand in terms of brand presence. As a strong flex for parallel importers (and models exclusive to them, like the Vezel, Shuttle and Freed), Honda also suddenly places significantly far ahead of the Koreans.

But something else is certainly standing out... And don't worry if you've had to take a second look. That's Tesla alright, sitting pretty at number 10 with 924 vehicles registered/sold, based on approximately half a year of sales with Tesla Singapore in operation.

It's worth noting that an initial slip-up by our sleepy writer on a Monday morning had initially led us to omit December's numbers - and thus, also to the serendipitous observation that the 10th spot almost went to someone else.

German giant, Volkswagen, was actually still ahead of Tesla as of November... but as it happened, the latter managed to leap up to the coveted Top 10 on the strength of December's registrations. Against VW's 37 units, Tesla finished the year strong with a remarkable 129 units to make the cut. (The position is quite indisputable, since it's impossible to suggest that Tesla won on the basis of, um, classic cars.)

In this case, we're unfortunately inclined to believe that the new Golf's brilliant engine was also its weakness in terms of sales; it no longer qualifies for Category A, and this probably put a dent in its demand. As such, Volkswagen places at number 11 on this list, with SEAT rounding off the Top 25.

A parallel market: 3 interesting observations

2021 saw the grand return of legendary favourites, the persisting strength of recently-released ones, as well as new names, all converging at once.

Looking at its SUV registrations, we imagine that the subcompact Yaris Cross Hybrid held on strong through the year (alongside the Harrier Hybrid) as Toyota's golden calf, whereas BMW, Mercedes-Benz and Audi's strong and diverse slate of offerings helped them cut across market segments to appeal to a variety of different buyers. Meanwhile, aggressive improvements from Hyundai Motor Group continued to prop both Hyundai and Kia up.

Nonetheless, 2021 was a watershed year in other ways. It wasn't just the price of COEs that was on the rise, but also the push towards cleaner drivetrains. In tandem, here are three interesting observations from the numbers.

1. The category is: Others (in other words, electrification)

Mild hybrid drivetrains - offered in cars like the approachable Kia Stonic - appear to be becoming even more commonplace The 'Others' category that you see in the table has piqued our interest particularly, because we're seeing a lot of weight moving towards that portion.

Mild hybrid drivetrains - offered in cars like the approachable Kia Stonic - appear to be becoming even more commonplace The 'Others' category that you see in the table has piqued our interest particularly, because we're seeing a lot of weight moving towards that portion.

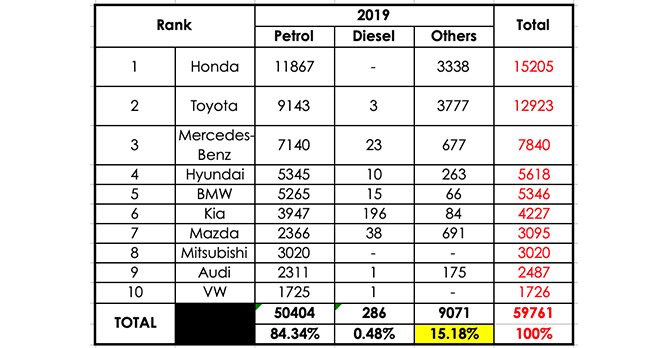

When we pulled up past data for new car registrations and zoomed in to the Top 10 performing marques, hybrids and electric cars only accounted for 15.2% in 2019, against 84.3% for pure petrol-powered cars. In 2020, that increased to 18.8%, against close to 80.7% for the latter.

In 2021, however, the scales tipped even further. The 'Others' category now takes up 37.3% of the Top 10's new car registrations, while petrol has slid even further to 62.0%. (Throughout, diesel-powered cars have made up less than 1%).

Of course, a lot of this can be chalked down, firstly, to Tesla's presence in the Top 10, and secondly, to mild hybrid cars, which generally feature a small, 48V starter-alternator to help with start-stop traffic. Still, the times are changing. If this isn't a reflection of shifting consumer mindsets - which we'd already argue against, since petrol-powered cars are still widely available - it is at least a reflection of shifting market focuses. Every carmaker in the Top 10 (sans the wholly electric Tesla) has mild hybrid or hybrid cars on offer now.

2. In relation, four of the top 10 sold more mild hybrid and hybrid cars than pure petrol-powered ones

While we're still a few years off the era of full-electrification, we may well be seeing the era of the (mild) hybrid emerge from its cocoon.

Four carmakers - or nearly half of the top 10 - sold more mild hybrids and hybrids than petrol-only cars in 2021, including Toyota, Mazda, Audi and Nissan (again, Tesla doesn't sell hybrids). This, in itself, is already an incredible leap, considering that not a single name managed this feat in 2020.

Par for the course it has taken, Toyota (and Lexus, of course) also accounted for nearly 40% of all hybrid and electric cars sold among the Top 10, with 5557 new units registered. But most impressive, perhaps, are Nissan's numbers: Its hybrid cars outsold its petrol-powered ones, five to one.

Of course, look at Singapore's lineup of Nissan cars and the news becomes less surprising, since its three latest models all feature the well-lauded e-Power hybrid drivetrain (the older Sylphy sedan and X-Trail SUV are no longer on sale). Still, it's evidence that consumers won't resist when the market is bent on a certain direction, and executes it sensibly enough.

3. The line between 'luxury' and 'mass market' continues its blurring path

The magnificent Porsche Taycan was released to Singapore last year as the marque's first-ever fully-electric car At this point, we may already be numb to seeing Germany's Big 3 - all luxury carmakers - earn a spot in the Top 10. But take a step back, and it's a reminder again of just how much the car market in Singapore has slanted towards buyers with deeper pockets over the years.

The magnificent Porsche Taycan was released to Singapore last year as the marque's first-ever fully-electric car At this point, we may already be numb to seeing Germany's Big 3 - all luxury carmakers - earn a spot in the Top 10. But take a step back, and it's a reminder again of just how much the car market in Singapore has slanted towards buyers with deeper pockets over the years.

Then, peer further down at No. 11 to 25 and you'll see an increasingly familiar name creeping up the list. At No. 13, Porsche somehow managed to leapfrog Suzuki, Subaru, Opel, Citroen and Peugeot last year to further solidify its spot in the Top 15. It's one of the few names on the entire list which managed to avoid a sales slump, and thus rises two positions again - from No. 15 in 2020, and No. 17 in 2019 (in terms of overall new car registrations).

This brings us back to the question: Where is the line, truly, between luxury and mass-market? Again, we believe that hinges on context. Going by technical definitions (numbers don't lie), and in Singapore's context, we'd like to report that the answer is as muddled as ever.

We know that the official rankings have been making their rounds recently and in them - surprise of surprises - Toyota/Lexus has retained its crown. (On a more serious note, the gold medal has actually been handed to other carmakers over the years, especially in COE premium climates eerily similar to the one that we've recently found ourselves sinking into.) The following stats have been taken from The Straits Times:

| Rank | Carmaker | Units registered (authorised dealers) |

| 1 | Toyota (including Lexus) | 5978 |

| 2 | BMW | 5127 |

| 3 | Mercedes-Benz | 4220 |

| 4 | Hyundai | 2780 |

| 5 | Mazda | 2343 |

| 6 | Audi | 1949 |

| 7 | Nissan | 1773 |

| 8 | Kia | 1435 |

| 9 | Honda | 1293 |

| 10 (tied) | Volkswagen | 903 |

| 10 (tied) | Mitsubishi | 903 |

While we're not at all disputing the veracity of that bestselling list, factoring in the data used for overall new car registrations instead provides an interesting alternative viewpoint to simply focusing on our authorised dealers.

Sure, you could say that the numbers are not entirely accurate; some classic cars that meet certain standards, like this Datsun Bluebird, can ostensibly be registered under a new COE too. New cars that are privately imported, such as the famous 2014 Tesla Model S, also count here.

But the bulk of the additional units is made up of a very important part of Singapore's car populace: New models shifted through Parallel Importers (PIs). As such, the overall new car registrations are arguably just as valuable in helping us glean insights into the mindsets of Singaporean drivers in the year of 2021.

A different list

Based on data on new car registrations released by the LTA, we present: The unfiltered list for Singapore's Top 10 carmakers in 2021.

Familiar faces are still to be found here, but you'll see that where each one appears is slightly different under this particular lens. (Note: New vehicles are categorised by the LTA into their fuel types. 'Others' generally refers to hybrid and electric cars since hydrogen cars are still not widespread.)

| Rank | Carmaker | Petrol | Diesel | Others* | Total |

| 1 | Toyota (including Lexus) | 4067 | 9 | 5557 | 9633 |

| 2 | Mercedes-Benz | 5256 | 102 | 1103 | 6421 |

| 3 | BMW | 4353 | 2 | 900 | 5255 |

| 4 | Honda | 3910 | - | 905 | 4815 |

| 5 | Hyundai | 2489 | - | 372 | 2861 |

| 6 | Mazda | 1124 | 14 | 1228 | 2366 |

| 7 | Audi | 919 | - | 1056 | 1975 |

| 8 | Nissan | 302 | - | 1519 | 1821 |

| 9 | Kia | 850 | 157 | 428 | 1435 |

| 10 | Tesla | - | - | 924 | 924 |

Some things have changed. For instance, you could now dispute whether BMW or Mercedes-Benz - both already incredibly successful - actually had the upper hand in terms of brand presence. As a strong flex for parallel importers (and models exclusive to them, like the Vezel, Shuttle and Freed), Honda also suddenly places significantly far ahead of the Koreans.

But something else is certainly standing out... And don't worry if you've had to take a second look. That's Tesla alright, sitting pretty at number 10 with 924 vehicles registered/sold, based on approximately half a year of sales with Tesla Singapore in operation.

It's worth noting that an initial slip-up by our sleepy writer on a Monday morning had initially led us to omit December's numbers - and thus, also to the serendipitous observation that the 10th spot almost went to someone else.

German giant, Volkswagen, was actually still ahead of Tesla as of November... but as it happened, the latter managed to leap up to the coveted Top 10 on the strength of December's registrations. Against VW's 37 units, Tesla finished the year strong with a remarkable 129 units to make the cut. (The position is quite indisputable, since it's impossible to suggest that Tesla won on the basis of, um, classic cars.)

In this case, we're unfortunately inclined to believe that the new Golf's brilliant engine was also its weakness in terms of sales; it no longer qualifies for Category A, and this probably put a dent in its demand. As such, Volkswagen places at number 11 on this list, with SEAT rounding off the Top 25.

| Rank | Carmaker | Petrol | Diesel | Others* | Total |

| 11 | Volkswagen | 810 | - | 105 | 915 |

| 12 | Mitsubishi | 905 | - | - | 905 |

| 13 | Porsche | 549 | - | 131 | 680 |

| 14 | MG | 395 | - | 129 | 524 |

| 15 | Volvo | 376 | - | 134 | 510 |

| 16 | Skoda | 377 | - | 93 | 470 |

| 17 | MINI | 421 | - | 39 | 460 |

| 18 | Suzuki | 154 | - | 224 | 378 |

| 19 | Opel | 321 | 52 | - | 373 |

| 20 | Peugeot | 368 | - | - | 368 |

| 21 | Subaru | 335 | - | 11 | 346 |

| 22 | Land Rover | 86 | 10 | 189 | 285 |

| 23 | Citroen | 240 | - | - | 240 |

| 24 | Jaguar | 137 | 1 | 81 | 219 |

| 25 | SEAT | 194 | - | 11 | 205 |

2021 saw the grand return of legendary favourites, the persisting strength of recently-released ones, as well as new names, all converging at once.

Looking at its SUV registrations, we imagine that the subcompact Yaris Cross Hybrid held on strong through the year (alongside the Harrier Hybrid) as Toyota's golden calf, whereas BMW, Mercedes-Benz and Audi's strong and diverse slate of offerings helped them cut across market segments to appeal to a variety of different buyers. Meanwhile, aggressive improvements from Hyundai Motor Group continued to prop both Hyundai and Kia up.

Nonetheless, 2021 was a watershed year in other ways. It wasn't just the price of COEs that was on the rise, but also the push towards cleaner drivetrains. In tandem, here are three interesting observations from the numbers.

1. The category is: Others (in other words, electrification)

When we pulled up past data for new car registrations and zoomed in to the Top 10 performing marques, hybrids and electric cars only accounted for 15.2% in 2019, against 84.3% for pure petrol-powered cars. In 2020, that increased to 18.8%, against close to 80.7% for the latter.

In 2021, however, the scales tipped even further. The 'Others' category now takes up 37.3% of the Top 10's new car registrations, while petrol has slid even further to 62.0%. (Throughout, diesel-powered cars have made up less than 1%).

Of course, a lot of this can be chalked down, firstly, to Tesla's presence in the Top 10, and secondly, to mild hybrid cars, which generally feature a small, 48V starter-alternator to help with start-stop traffic. Still, the times are changing. If this isn't a reflection of shifting consumer mindsets - which we'd already argue against, since petrol-powered cars are still widely available - it is at least a reflection of shifting market focuses. Every carmaker in the Top 10 (sans the wholly electric Tesla) has mild hybrid or hybrid cars on offer now.

2. In relation, four of the top 10 sold more mild hybrid and hybrid cars than pure petrol-powered ones

While we're still a few years off the era of full-electrification, we may well be seeing the era of the (mild) hybrid emerge from its cocoon.

Four carmakers - or nearly half of the top 10 - sold more mild hybrids and hybrids than petrol-only cars in 2021, including Toyota, Mazda, Audi and Nissan (again, Tesla doesn't sell hybrids). This, in itself, is already an incredible leap, considering that not a single name managed this feat in 2020.

Par for the course it has taken, Toyota (and Lexus, of course) also accounted for nearly 40% of all hybrid and electric cars sold among the Top 10, with 5557 new units registered. But most impressive, perhaps, are Nissan's numbers: Its hybrid cars outsold its petrol-powered ones, five to one.

Of course, look at Singapore's lineup of Nissan cars and the news becomes less surprising, since its three latest models all feature the well-lauded e-Power hybrid drivetrain (the older Sylphy sedan and X-Trail SUV are no longer on sale). Still, it's evidence that consumers won't resist when the market is bent on a certain direction, and executes it sensibly enough.

3. The line between 'luxury' and 'mass market' continues its blurring path

Then, peer further down at No. 11 to 25 and you'll see an increasingly familiar name creeping up the list. At No. 13, Porsche somehow managed to leapfrog Suzuki, Subaru, Opel, Citroen and Peugeot last year to further solidify its spot in the Top 15. It's one of the few names on the entire list which managed to avoid a sales slump, and thus rises two positions again - from No. 15 in 2020, and No. 17 in 2019 (in terms of overall new car registrations).

This brings us back to the question: Where is the line, truly, between luxury and mass-market? Again, we believe that hinges on context. Going by technical definitions (numbers don't lie), and in Singapore's context, we'd like to report that the answer is as muddled as ever.

The long-awaited sales figures of new cars in Singapore for 2021 are finally, finally out.

We know that the official rankings have been making their rounds recently and in them - surprise of surprises - Toyota/Lexus has retained its crown. (On a more serious note, the gold medal has actually been handed to other carmakers over the years, especially in COE premium climates eerily similar to the one that we've recently found ourselves sinking into.) The following stats have been taken from The Straits Times:

While we're not at all disputing the veracity of that bestselling list, factoring in the data used for overall new car registrations instead provides an interesting alternative viewpoint to simply focusing on our authorised dealers.

Sure, you could say that the numbers are not entirely accurate; some classic cars that meet certain standards, like this Datsun Bluebird, can ostensibly be registered under a new COE too. New cars that are privately imported, such as the famous 2014 Tesla Model S, also count here.

But the bulk of the additional units is made up of a very important part of Singapore's car populace: New models shifted through Parallel Importers (PIs). As such, the overall new car registrations are arguably just as valuable in helping us glean insights into the mindsets of Singaporean drivers in the year of 2021.

A different list

Based on data on new car registrations released by the LTA, we present: The unfiltered list for Singapore's Top 10 carmakers in 2021.

Familiar faces are still to be found here, but you'll see that where each one appears is slightly different under this particular lens. (Note: New vehicles are categorised by the LTA into their fuel types. 'Others' generally refers to hybrid and electric cars since hydrogen cars are still not widespread.)

Some things have changed. For instance, you could now dispute whether BMW or Mercedes-Benz - both already incredibly successful - actually had the upper hand in terms of brand presence. As a strong flex for parallel importers (and models exclusive to them, like the Vezel, Shuttle and Freed), Honda also suddenly places significantly far ahead of the Koreans.

But something else is certainly standing out... And don't worry if you've had to take a second look. That's Tesla alright, sitting pretty at number 10 with 924 vehicles registered/sold, based on approximately half a year of sales with Tesla Singapore in operation.

It's worth noting that an initial slip-up by our sleepy writer on a Monday morning had initially led us to omit December's numbers - and thus, also to the serendipitous observation that the 10th spot almost went to someone else.

German giant, Volkswagen, was actually still ahead of Tesla as of November... but as it happened, the latter managed to leap up to the coveted Top 10 on the strength of December's registrations. Against VW's 37 units, Tesla finished the year strong with a remarkable 129 units to make the cut. (The position is quite indisputable, since it's impossible to suggest that Tesla won on the basis of, um, classic cars.)

In this case, we're unfortunately inclined to believe that the new Golf's brilliant engine was also its weakness in terms of sales; it no longer qualifies for Category A, and this probably put a dent in its demand. As such, Volkswagen places at number 11 on this list, with SEAT rounding off the Top 25.

A parallel market: 3 interesting observations

2021 saw the grand return of legendary favourites, the persisting strength of recently-released ones, as well as new names, all converging at once.

Looking at its SUV registrations, we imagine that the subcompact Yaris Cross Hybrid held on strong through the year (alongside the Harrier Hybrid) as Toyota's golden calf, whereas BMW, Mercedes-Benz and Audi's strong and diverse slate of offerings helped them cut across market segments to appeal to a variety of different buyers. Meanwhile, aggressive improvements from Hyundai Motor Group continued to prop both Hyundai and Kia up.

Nonetheless, 2021 was a watershed year in other ways. It wasn't just the price of COEs that was on the rise, but also the push towards cleaner drivetrains. In tandem, here are three interesting observations from the numbers.

1. The category is: Others (in other words, electrification)

Mild hybrid drivetrains - offered in cars like the approachable Kia Stonic - appear to be becoming even more commonplace The 'Others' category that you see in the table has piqued our interest particularly, because we're seeing a lot of weight moving towards that portion.

Mild hybrid drivetrains - offered in cars like the approachable Kia Stonic - appear to be becoming even more commonplace The 'Others' category that you see in the table has piqued our interest particularly, because we're seeing a lot of weight moving towards that portion.

When we pulled up past data for new car registrations and zoomed in to the Top 10 performing marques, hybrids and electric cars only accounted for 15.2% in 2019, against 84.3% for pure petrol-powered cars. In 2020, that increased to 18.8%, against close to 80.7% for the latter.

In 2021, however, the scales tipped even further. The 'Others' category now takes up 37.3% of the Top 10's new car registrations, while petrol has slid even further to 62.0%. (Throughout, diesel-powered cars have made up less than 1%).

Of course, a lot of this can be chalked down, firstly, to Tesla's presence in the Top 10, and secondly, to mild hybrid cars, which generally feature a small, 48V starter-alternator to help with start-stop traffic. Still, the times are changing. If this isn't a reflection of shifting consumer mindsets - which we'd already argue against, since petrol-powered cars are still widely available - it is at least a reflection of shifting market focuses. Every carmaker in the Top 10 (sans the wholly electric Tesla) has mild hybrid or hybrid cars on offer now.

2. In relation, four of the top 10 sold more mild hybrid and hybrid cars than pure petrol-powered ones

While we're still a few years off the era of full-electrification, we may well be seeing the era of the (mild) hybrid emerge from its cocoon.

Four carmakers - or nearly half of the top 10 - sold more mild hybrids and hybrids than petrol-only cars in 2021, including Toyota, Mazda, Audi and Nissan (again, Tesla doesn't sell hybrids). This, in itself, is already an incredible leap, considering that not a single name managed this feat in 2020.

Par for the course it has taken, Toyota (and Lexus, of course) also accounted for nearly 40% of all hybrid and electric cars sold among the Top 10, with 5557 new units registered. But most impressive, perhaps, are Nissan's numbers: Its hybrid cars outsold its petrol-powered ones, five to one.

Of course, look at Singapore's lineup of Nissan cars and the news becomes less surprising, since its three latest models all feature the well-lauded e-Power hybrid drivetrain (the older Sylphy sedan and X-Trail SUV are no longer on sale). Still, it's evidence that consumers won't resist when the market is bent on a certain direction, and executes it sensibly enough.

3. The line between 'luxury' and 'mass market' continues its blurring path

The magnificent Porsche Taycan was released to Singapore last year as the marque's first-ever fully-electric car At this point, we may already be numb to seeing Germany's Big 3 - all luxury carmakers - earn a spot in the Top 10. But take a step back, and it's a reminder again of just how much the car market in Singapore has slanted towards buyers with deeper pockets over the years.

The magnificent Porsche Taycan was released to Singapore last year as the marque's first-ever fully-electric car At this point, we may already be numb to seeing Germany's Big 3 - all luxury carmakers - earn a spot in the Top 10. But take a step back, and it's a reminder again of just how much the car market in Singapore has slanted towards buyers with deeper pockets over the years.

Then, peer further down at No. 11 to 25 and you'll see an increasingly familiar name creeping up the list. At No. 13, Porsche somehow managed to leapfrog Suzuki, Subaru, Opel, Citroen and Peugeot last year to further solidify its spot in the Top 15. It's one of the few names on the entire list which managed to avoid a sales slump, and thus rises two positions again - from No. 15 in 2020, and No. 17 in 2019 (in terms of overall new car registrations).

This brings us back to the question: Where is the line, truly, between luxury and mass-market? Again, we believe that hinges on context. Going by technical definitions (numbers don't lie), and in Singapore's context, we'd like to report that the answer is as muddled as ever.

We know that the official rankings have been making their rounds recently and in them - surprise of surprises - Toyota/Lexus has retained its crown. (On a more serious note, the gold medal has actually been handed to other carmakers over the years, especially in COE premium climates eerily similar to the one that we've recently found ourselves sinking into.) The following stats have been taken from The Straits Times:

| Rank | Carmaker | Units registered (authorised dealers) |

| 1 | Toyota (including Lexus) | 5978 |

| 2 | BMW | 5127 |

| 3 | Mercedes-Benz | 4220 |

| 4 | Hyundai | 2780 |

| 5 | Mazda | 2343 |

| 6 | Audi | 1949 |

| 7 | Nissan | 1773 |

| 8 | Kia | 1435 |

| 9 | Honda | 1293 |

| 10 (tied) | Volkswagen | 903 |

| 10 (tied) | Mitsubishi | 903 |

While we're not at all disputing the veracity of that bestselling list, factoring in the data used for overall new car registrations instead provides an interesting alternative viewpoint to simply focusing on our authorised dealers.

Sure, you could say that the numbers are not entirely accurate; some classic cars that meet certain standards, like this Datsun Bluebird, can ostensibly be registered under a new COE too. New cars that are privately imported, such as the famous 2014 Tesla Model S, also count here.

But the bulk of the additional units is made up of a very important part of Singapore's car populace: New models shifted through Parallel Importers (PIs). As such, the overall new car registrations are arguably just as valuable in helping us glean insights into the mindsets of Singaporean drivers in the year of 2021.

A different list

Based on data on new car registrations released by the LTA, we present: The unfiltered list for Singapore's Top 10 carmakers in 2021.

Familiar faces are still to be found here, but you'll see that where each one appears is slightly different under this particular lens. (Note: New vehicles are categorised by the LTA into their fuel types. 'Others' generally refers to hybrid and electric cars since hydrogen cars are still not widespread.)

| Rank | Carmaker | Petrol | Diesel | Others* | Total |

| 1 | Toyota (including Lexus) | 4067 | 9 | 5557 | 9633 |

| 2 | Mercedes-Benz | 5256 | 102 | 1103 | 6421 |

| 3 | BMW | 4353 | 2 | 900 | 5255 |

| 4 | Honda | 3910 | - | 905 | 4815 |

| 5 | Hyundai | 2489 | - | 372 | 2861 |

| 6 | Mazda | 1124 | 14 | 1228 | 2366 |

| 7 | Audi | 919 | - | 1056 | 1975 |

| 8 | Nissan | 302 | - | 1519 | 1821 |

| 9 | Kia | 850 | 157 | 428 | 1435 |

| 10 | Tesla | - | - | 924 | 924 |

Some things have changed. For instance, you could now dispute whether BMW or Mercedes-Benz - both already incredibly successful - actually had the upper hand in terms of brand presence. As a strong flex for parallel importers (and models exclusive to them, like the Vezel, Shuttle and Freed), Honda also suddenly places significantly far ahead of the Koreans.

But something else is certainly standing out... And don't worry if you've had to take a second look. That's Tesla alright, sitting pretty at number 10 with 924 vehicles registered/sold, based on approximately half a year of sales with Tesla Singapore in operation.

It's worth noting that an initial slip-up by our sleepy writer on a Monday morning had initially led us to omit December's numbers - and thus, also to the serendipitous observation that the 10th spot almost went to someone else.

German giant, Volkswagen, was actually still ahead of Tesla as of November... but as it happened, the latter managed to leap up to the coveted Top 10 on the strength of December's registrations. Against VW's 37 units, Tesla finished the year strong with a remarkable 129 units to make the cut. (The position is quite indisputable, since it's impossible to suggest that Tesla won on the basis of, um, classic cars.)

In this case, we're unfortunately inclined to believe that the new Golf's brilliant engine was also its weakness in terms of sales; it no longer qualifies for Category A, and this probably put a dent in its demand. As such, Volkswagen places at number 11 on this list, with SEAT rounding off the Top 25.

| Rank | Carmaker | Petrol | Diesel | Others* | Total |

| 11 | Volkswagen | 810 | - | 105 | 915 |

| 12 | Mitsubishi | 905 | - | - | 905 |

| 13 | Porsche | 549 | - | 131 | 680 |

| 14 | MG | 395 | - | 129 | 524 |

| 15 | Volvo | 376 | - | 134 | 510 |

| 16 | Skoda | 377 | - | 93 | 470 |

| 17 | MINI | 421 | - | 39 | 460 |

| 18 | Suzuki | 154 | - | 224 | 378 |

| 19 | Opel | 321 | 52 | - | 373 |

| 20 | Peugeot | 368 | - | - | 368 |

| 21 | Subaru | 335 | - | 11 | 346 |

| 22 | Land Rover | 86 | 10 | 189 | 285 |

| 23 | Citroen | 240 | - | - | 240 |

| 24 | Jaguar | 137 | 1 | 81 | 219 |

| 25 | SEAT | 194 | - | 11 | 205 |

A parallel market: 3 interesting observations

2021 saw the grand return of legendary favourites, the persisting strength of recently-released ones, as well as new names, all converging at once.

Looking at its SUV registrations, we imagine that the subcompact Yaris Cross Hybrid held on strong through the year (alongside the Harrier Hybrid) as Toyota's golden calf, whereas BMW, Mercedes-Benz and Audi's strong and diverse slate of offerings helped them cut across market segments to appeal to a variety of different buyers. Meanwhile, aggressive improvements from Hyundai Motor Group continued to prop both Hyundai and Kia up.

Nonetheless, 2021 was a watershed year in other ways. It wasn't just the price of COEs that was on the rise, but also the push towards cleaner drivetrains. In tandem, here are three interesting observations from the numbers.

1. The category is: Others (in other words, electrification)

When we pulled up past data for new car registrations and zoomed in to the Top 10 performing marques, hybrids and electric cars only accounted for 15.2% in 2019, against 84.3% for pure petrol-powered cars. In 2020, that increased to 18.8%, against close to 80.7% for the latter.

In 2021, however, the scales tipped even further. The 'Others' category now takes up 37.3% of the Top 10's new car registrations, while petrol has slid even further to 62.0%. (Throughout, diesel-powered cars have made up less than 1%).

Of course, a lot of this can be chalked down, firstly, to Tesla's presence in the Top 10, and secondly, to mild hybrid cars, which generally feature a small, 48V starter-alternator to help with start-stop traffic. Still, the times are changing. If this isn't a reflection of shifting consumer mindsets - which we'd already argue against, since petrol-powered cars are still widely available - it is at least a reflection of shifting market focuses. Every carmaker in the Top 10 (sans the wholly electric Tesla) has mild hybrid or hybrid cars on offer now.

2. In relation, four of the top 10 sold more mild hybrid and hybrid cars than pure petrol-powered ones

While we're still a few years off the era of full-electrification, we may well be seeing the era of the (mild) hybrid emerge from its cocoon.

Four carmakers - or nearly half of the top 10 - sold more mild hybrids and hybrids than petrol-only cars in 2021, including Toyota, Mazda, Audi and Nissan (again, Tesla doesn't sell hybrids). This, in itself, is already an incredible leap, considering that not a single name managed this feat in 2020.

Par for the course it has taken, Toyota (and Lexus, of course) also accounted for nearly 40% of all hybrid and electric cars sold among the Top 10, with 5557 new units registered. But most impressive, perhaps, are Nissan's numbers: Its hybrid cars outsold its petrol-powered ones, five to one.

Of course, look at Singapore's lineup of Nissan cars and the news becomes less surprising, since its three latest models all feature the well-lauded e-Power hybrid drivetrain (the older Sylphy sedan and X-Trail SUV are no longer on sale). Still, it's evidence that consumers won't resist when the market is bent on a certain direction, and executes it sensibly enough.

3. The line between 'luxury' and 'mass market' continues its blurring path

Then, peer further down at No. 11 to 25 and you'll see an increasingly familiar name creeping up the list. At No. 13, Porsche somehow managed to leapfrog Suzuki, Subaru, Opel, Citroen and Peugeot last year to further solidify its spot in the Top 15. It's one of the few names on the entire list which managed to avoid a sales slump, and thus rises two positions again - from No. 15 in 2020, and No. 17 in 2019 (in terms of overall new car registrations).

This brings us back to the question: Where is the line, truly, between luxury and mass-market? Again, we believe that hinges on context. Going by technical definitions (numbers don't lie), and in Singapore's context, we'd like to report that the answer is as muddled as ever.

Thank You For Your Subscription.