A new year: Everything new influencing car prices in 2024

10 Jan 2024|103,761 views

Ask those in the car industry how their 2023 was - whoever's left standing at least - and most should be quick to express relief at leaving the year behind.

Particularly, the new year seems to have brought with it a glimmer of hope that things are starting to look up. While this hope isn't to be taken lightly (and while we're not here to dampen the mood), 2024 also brings with it some other fresh changes to the financial landscape of car ownership - that may have faded into the background as COE prices plunged.

Here, we attempt a more in-depth analysis of what's different this year.

1) COE supply: Carving (and filling) a new path forward

Even if you're part of the LTA, nailing COE prices right down to the dollar will forever be impossible. After all, the figures that appear before our eyes every other Wednesday hinge on not just one, but two parts of the equation: Supply and demand.

Having said that, it's safe to say that it was largely the lack of supply over the past two years that sent COE premiums skywards.

In this regard, the dawn of 2024 does seem to be bringing along with good news for everyone on the hunt for a new car. Announced at the end of 2023, this will mark the first full year in which the government is carrying out an unprecedented 'cut-and-fill' approach to determining each coming quarter's COE supply.

With overall supply fixed currently due to a growth freeze in the passenger-vehicle population, the 'cut-and-fill' approach will see the government borrowing from peak supply periods in the coming years (cutting), in order to supplement prevailing periods in which supply is at its lowest (filling).

Given the gravity of discussing the affordability of car ownership in Singapore, we'll always hesitate to be definitive in our statements of how supply - and in turn, COE premiums - might swing in the quarters to come.

Nonetheless, making direct reference to the actual words used by the authorities gives us a clear indication of how things might change: "Potential buyers may want to take note that the COE quota for Categories A, B and C will continue to increase in 2024 before reaching the peak supply period from 2025." (This was from the LTA's press release, dated 3 November 2023.)

Again, note that this does not address pricing directly - but the declaration provides sufficient hope that the days of $150,000 COEs will not return this year (hopefully, they are behind us altogether).

2) 9% GST…?

Announced back in Budget 2018, hotly debated in Parliament ever since, but then delayed for a couple of years due to the pandemic, the GST (Goods and Services Tax) hike has finally hit us in full.

As any working adult will know, 1% translates to quite a fair bit of money. The figures already stack up quite a fair bit for those who dine out frequently, and will be felt even more acutely for those shifting homes or buying new appliances. It's a foregone conclusion to say that cars take that to even greater heights.

Having said that, car pricing, as we investigated very recently, is a complex process influenced by multiple determinants. These naturally include both the fluidity of car-buying, and of course, the trend of COE premiums. On the one hand, we'd take this as one of the determinants freshly affecting car prices in 2024; simply part of a larger overall picture.

On the other hand, the question still lingers: Considering everything else happening right now, could car prices be even lower without the GST hike? Potentially.

3) VES revisions: Lower rebates, for fewer cars

The Singapore Green Plan 2030 is rolling ahead at full speed. As global pressure to reduce emissions intensifies, so, too, are regulations becoming more stringent with what sorts of cars are rewarded - or punished - along the way.

Band A1 is now reserved for fully-electric models like the Ora Good Cat, while even EVs with higher power outputs - such as the Porsche Taycan 4S - have been pushed into Band A2

In 2024, drivers should take note of two main revisions to the Vehicular Emissions Scheme (VES) in Singapore. Under the VES, cleaner-energy models enjoy rebates off the Additional Registration Fees (ARF).

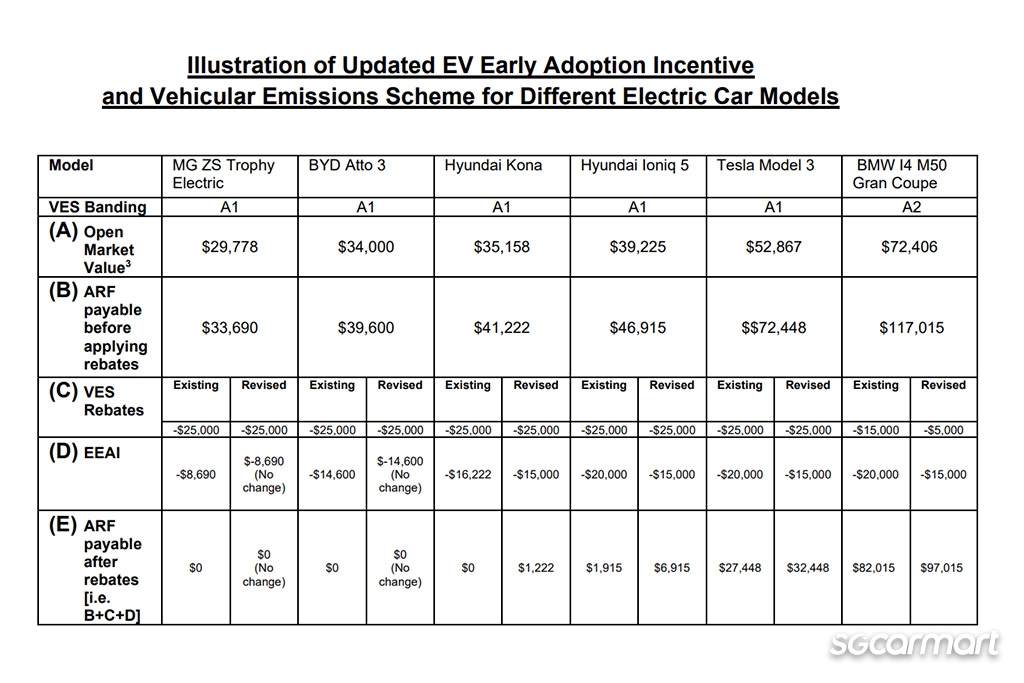

Firstly, whereas rebates in Band A1 (for the 'cleanest' cars) remain at a maximum of $25,000, the cap for those falling under Band A2 has now been lowered to $5,000 - a $10,000 dip, from $15,000 previously. (In terms of figures, the neutral Band B1, and the penalty-incurring Bands C1 and C2 remain unaffected for now.)

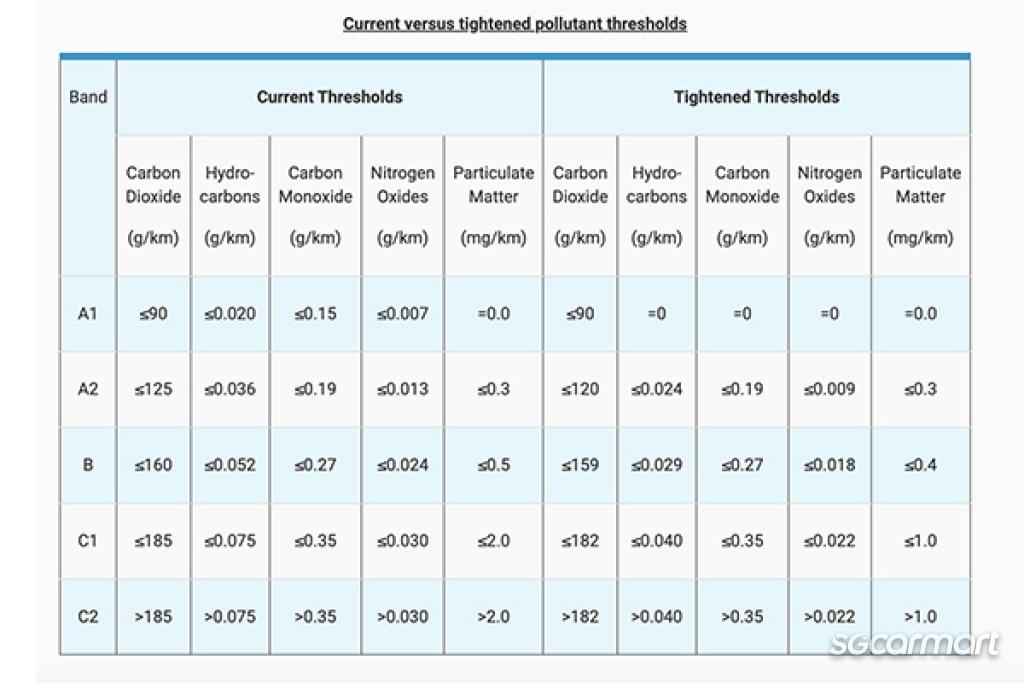

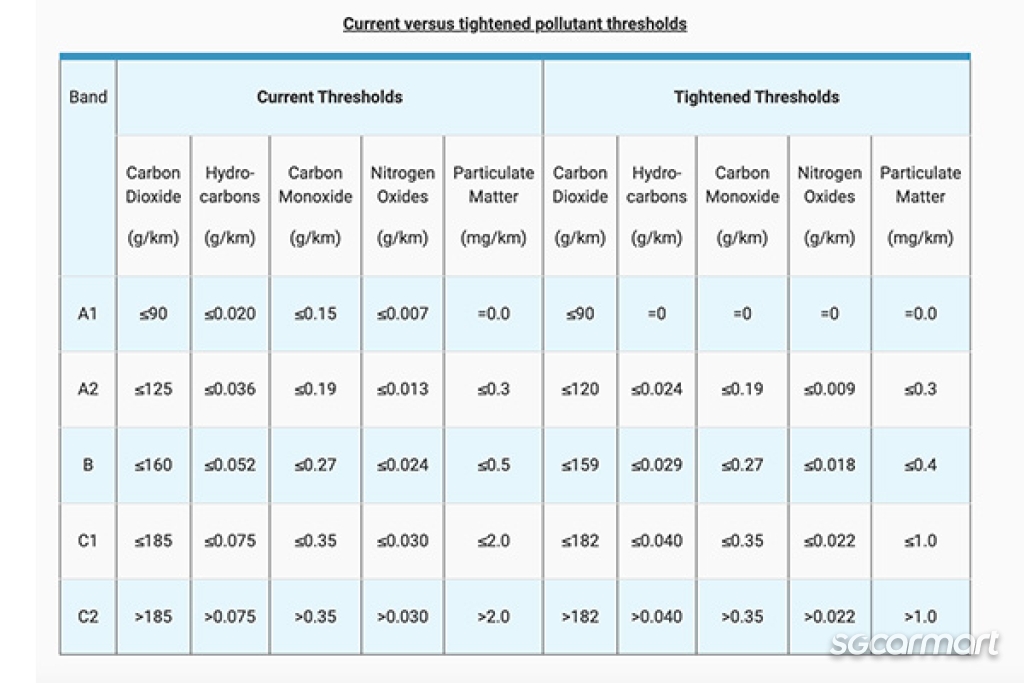

Secondly, pollutant thresholds have been tightened across all bands.

You'll notice that to qualify for A1, a car is essentially not be allowed to emit any hydrocarbons, carbon monoxide, or nitrogen oxides. Some compact hybrid models were previously eligible for this band.

The combined effects of both changes?

Only fully-electric cars (i.e. with zero tailpipe emissions) qualify for Band A1 now, while more powerful EVs like the Porsche Taycan 4S are forced down into A2. In turn, the stricter entry requirements across the board now mean that some cars have been 'downgraded' to a lower band. Examples of cars that lost rebates entirely by moving from Band A2 to Band B, for example, include the mild hybrid Volkswagen Golf, and BMW's 116i hatch.

4) A maturing EV market, Part 1: Revisions to the EEAI, too…

Even if you're not convinced by the emergence of green lots and charging cables at your HDB carpark, or by the increasing presence of Teslas and BYDs on our roads, the figures do not lie: The uptake of EVs is accelerating.

As the market matures, it also appears that the authorities are reining regulations in slightly in order to account for the growing EV population.

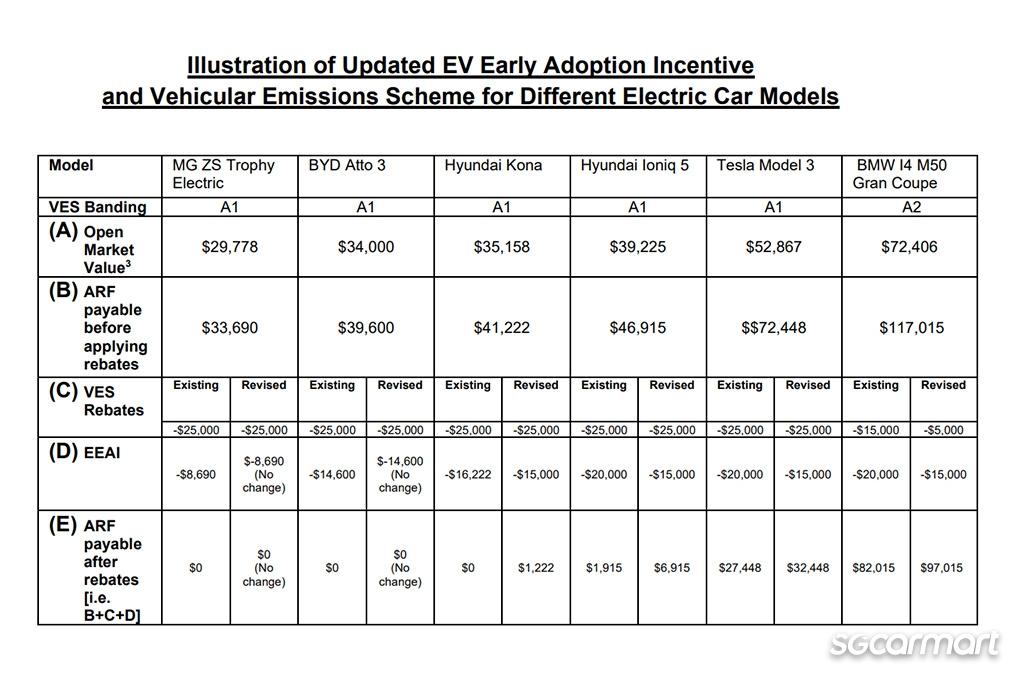

The first example of this is also rebate-centric. Announced alongside the VES revisions, the maximum rebates enjoyable by customers under the extended EV Early Adoption Incentive (EEAI) scheme have also been reduced.

Whereas additional savings of up to $20,000 off an EV's ARF were previously enjoyable under the EEAI, that figure is now capped at $15,000 instead (a decrease of $5,000).

Still, the three baseline mechanisms of the EEAI cannot be forgotten. Firstly, rebates from the EEAI are applied on top of VES rebates. Secondly, the EEAI only docks up to to 45% off an EV's ARF. Finally, your EV's ARF cannot dip below $0.

As the LTA is quick to note - and indicate as with the table it has prepared above - the prices of most 'mass market' EVs are unlikely to be affected. But inch upwards into the territory of both more powerful and more expensive models, and the sums start adding up quite quickly. As per the table above, the price of a BMW i4 M50 has gone up $15,000 simply by the crossing over of the new year.

5) A maturing EV market, Part 2: …and higher potential charging costs from the EVCA; idling fees

Of course, all that is only on the purchasing front.

As more electric models hit our roads, and as the need for charging infrastructure to be regulated intensifies, we may very well start seeing the cost of charging creep upwards gradually.

Less significantly, be prepared for idling fees to become more commonplace. No one likes hoggers - whether they're on the fast lane, or in an EV charging lot. Finished recharging your EV, but left it plugged in? For prolonging the charging anxiety of an EV driver waiting for that charger, some places are already charging errant motorists by the (extra) minute.

Even the most well-behaved EV drivers, however, may see charging costs go up over the course of 2024. With the EV Charging Act (EVCA) now in force, extra expenses now have to be borne by charging service providers for the registration and licensing of their chargers. In turn, it is likely that these will be passed on to consumers eventually too.

We hasten to add that these are less significant pieces of the puzzle in the grander scheme of EV ownership. For starters, the running costs of EVs, even if raised slightly by the EVCA, are likely to be lower than that of cars with internal combustion engines (ICE) (petrol, for example, is inarguably more expensive than electricity). Conversely, EVs are still largely more expensive to buy and own than ICE cars - for reasons not related to charging costs.

Nonetheless, every dollar counts, and these changes to the EV-ownership landscape remain noteworthy as we head fully into 2024.

Here are a few other stories that may interest you!

EVCA: How it will affect the demand for EVs in Singapore

Ask those in the car industry how their 2023 was - whoever's left standing at least - and most should be quick to express relief at leaving the year behind.

Particularly, the new year seems to have brought with it a glimmer of hope that things are starting to look up. While this hope isn't to be taken lightly (and while we're not here to dampen the mood), 2024 also brings with it some other fresh changes to the financial landscape of car ownership - that may have faded into the background as COE prices plunged.

Here, we attempt a more in-depth analysis of what's different this year.

1) COE supply: Carving (and filling) a new path forward

Even if you're part of the LTA, nailing COE prices right down to the dollar will forever be impossible. After all, the figures that appear before our eyes every other Wednesday hinge on not just one, but two parts of the equation: Supply and demand.

Having said that, it's safe to say that it was largely the lack of supply over the past two years that sent COE premiums skywards.

In this regard, the dawn of 2024 does seem to be bringing along with good news for everyone on the hunt for a new car. Announced at the end of 2023, this will mark the first full year in which the government is carrying out an unprecedented 'cut-and-fill' approach to determining each coming quarter's COE supply.

With overall supply fixed currently due to a growth freeze in the passenger-vehicle population, the 'cut-and-fill' approach will see the government borrowing from peak supply periods in the coming years (cutting), in order to supplement prevailing periods in which supply is at its lowest (filling).

Given the gravity of discussing the affordability of car ownership in Singapore, we'll always hesitate to be definitive in our statements of how supply - and in turn, COE premiums - might swing in the quarters to come.

Nonetheless, making direct reference to the actual words used by the authorities gives us a clear indication of how things might change: "Potential buyers may want to take note that the COE quota for Categories A, B and C will continue to increase in 2024 before reaching the peak supply period from 2025." (This was from the LTA's press release, dated 3 November 2023.)

Again, note that this does not address pricing directly - but the declaration provides sufficient hope that the days of $150,000 COEs will not return this year (hopefully, they are behind us altogether).

2) 9% GST…?

Announced back in Budget 2018, hotly debated in Parliament ever since, but then delayed for a couple of years due to the pandemic, the GST (Goods and Services Tax) hike has finally hit us in full.

As any working adult will know, 1% translates to quite a fair bit of money. The figures already stack up quite a fair bit for those who dine out frequently, and will be felt even more acutely for those shifting homes or buying new appliances. It's a foregone conclusion to say that cars take that to even greater heights.

Having said that, car pricing, as we investigated very recently, is a complex process influenced by multiple determinants. These naturally include both the fluidity of car-buying, and of course, the trend of COE premiums. On the one hand, we'd take this as one of the determinants freshly affecting car prices in 2024; simply part of a larger overall picture.

On the other hand, the question still lingers: Considering everything else happening right now, could car prices be even lower without the GST hike? Potentially.

3) VES revisions: Lower rebates, for fewer cars

The Singapore Green Plan 2030 is rolling ahead at full speed. As global pressure to reduce emissions intensifies, so, too, are regulations becoming more stringent with what sorts of cars are rewarded - or punished - along the way.

Band A1 is now reserved for fully-electric models like the Ora Good Cat, while even EVs with higher power outputs - such as the Porsche Taycan 4S - have been pushed into Band A2

In 2024, drivers should take note of two main revisions to the Vehicular Emissions Scheme (VES) in Singapore. Under the VES, cleaner-energy models enjoy rebates off the Additional Registration Fees (ARF).

Firstly, whereas rebates in Band A1 (for the 'cleanest' cars) remain at a maximum of $25,000, the cap for those falling under Band A2 has now been lowered to $5,000 - a $10,000 dip, from $15,000 previously. (In terms of figures, the neutral Band B1, and the penalty-incurring Bands C1 and C2 remain unaffected for now.)

Secondly, pollutant thresholds have been tightened across all bands.

You'll notice that to qualify for A1, a car is essentially not be allowed to emit any hydrocarbons, carbon monoxide, or nitrogen oxides. Some compact hybrid models were previously eligible for this band.

The combined effects of both changes?

Only fully-electric cars (i.e. with zero tailpipe emissions) qualify for Band A1 now, while more powerful EVs like the Porsche Taycan 4S are forced down into A2. In turn, the stricter entry requirements across the board now mean that some cars have been 'downgraded' to a lower band. Examples of cars that lost rebates entirely by moving from Band A2 to Band B, for example, include the mild hybrid Volkswagen Golf, and BMW's 116i hatch.

4) A maturing EV market, Part 1: Revisions to the EEAI, too…

Even if you're not convinced by the emergence of green lots and charging cables at your HDB carpark, or by the increasing presence of Teslas and BYDs on our roads, the figures do not lie: The uptake of EVs is accelerating.

As the market matures, it also appears that the authorities are reining regulations in slightly in order to account for the growing EV population.

The first example of this is also rebate-centric. Announced alongside the VES revisions, the maximum rebates enjoyable by customers under the extended EV Early Adoption Incentive (EEAI) scheme have also been reduced.

Whereas additional savings of up to $20,000 off an EV's ARF were previously enjoyable under the EEAI, that figure is now capped at $15,000 instead (a decrease of $5,000).

Still, the three baseline mechanisms of the EEAI cannot be forgotten. Firstly, rebates from the EEAI are applied on top of VES rebates. Secondly, the EEAI only docks up to to 45% off an EV's ARF. Finally, your EV's ARF cannot dip below $0.

As the LTA is quick to note - and indicate as with the table it has prepared above - the prices of most 'mass market' EVs are unlikely to be affected. But inch upwards into the territory of both more powerful and more expensive models, and the sums start adding up quite quickly. As per the table above, the price of a BMW i4 M50 has gone up $15,000 simply by the crossing over of the new year.

5) A maturing EV market, Part 2: …and higher potential charging costs from the EVCA; idling fees

Of course, all that is only on the purchasing front.

As more electric models hit our roads, and as the need for charging infrastructure to be regulated intensifies, we may very well start seeing the cost of charging creep upwards gradually.

Less significantly, be prepared for idling fees to become more commonplace. No one likes hoggers - whether they're on the fast lane, or in an EV charging lot. Finished recharging your EV, but left it plugged in? For prolonging the charging anxiety of an EV driver waiting for that charger, some places are already charging errant motorists by the (extra) minute.

Even the most well-behaved EV drivers, however, may see charging costs go up over the course of 2024. With the EV Charging Act (EVCA) now in force, extra expenses now have to be borne by charging service providers for the registration and licensing of their chargers. In turn, it is likely that these will be passed on to consumers eventually too.

We hasten to add that these are less significant pieces of the puzzle in the grander scheme of EV ownership. For starters, the running costs of EVs, even if raised slightly by the EVCA, are likely to be lower than that of cars with internal combustion engines (ICE) (petrol, for example, is inarguably more expensive than electricity). Conversely, EVs are still largely more expensive to buy and own than ICE cars - for reasons not related to charging costs.

Nonetheless, every dollar counts, and these changes to the EV-ownership landscape remain noteworthy as we head fully into 2024.

Here are a few other stories that may interest you!

EVCA: How it will affect the demand for EVs in Singapore

Thank You For Your Subscription.