"Bricks and clicks": While you weren't looking, your car-buying experience has been changing. Whether we benefit depends on your perspective...

23 May 2022|2,881 views

To say that Singapore's car industry is awash with upheaval may be putting things lightly. In the past week alone, bombshell after bombshell has dropped in a string of announcements that is seeing brands themselves - the actual motherships - taking wide strides onto centerstage.

Still, you may be forgiven for not noticing - or even caring. So what if you can't purchase the all-electric Ioniq 5 through Komoco Motors when it rolls out of our very own Singaporean factory this Q4 - only through Hyundai? Why would it matter if BMWs can be bought through two authorised dealers now instead of just one? And isn't the potential of ordering your new Merc online quite fun and enticing?

News broke recently that Merc and Hyundai are exploring direct-to-consumer retail approaches locally As they say, the devil is in the details.

News broke recently that Merc and Hyundai are exploring direct-to-consumer retail approaches locally As they say, the devil is in the details.

Carried to the surface by the ever-expanding possibilities of digitalisation, new dimensions of the car-buying experience are surging to the forefront. In tandem, what we've always known and expected - a showroom-centric, dealership model that's been in force for decades - is all but guaranteed to fade into the background. The change is imminent.

Pause. And er, also rewind. Remind me how we normally buy cars again?

Those of us who enjoy our cars brand new will surely know by now that even though it's the product of a certain brand that we buy, it's not really directly with the brand that we deal.

Apart from the brands' logos, we've thus also seen names like 'Borneo Motors', 'Eurokars' and 'Performance Motors Limited' tacked in bright chrome on the shimmering exteriors, and inside on the walls of showrooms. When those automatic doors slide open as you walk through, sales and service representatives of the dealer greet you - not of the brands (or manufacturers) themselves. In tandem, marketing campaigns, and naturally, promotions and retail prices are ultimately in the hands of the dealer.

Of course - it's not that the brand completely relinquishes control to whichever dealer it's tasked with distributing their car; showrooms, for instance, are mostly designed in collaboration to arrive at an aesthetic as well as an experience befitting of the brand's image.

But as mentioned, most of the touch points with the brand are ultimately filtered through the dealer. That's also meant that for as long as most of us can remember, getting up close with the cars we're interested in and test driving them can only take place where the dealers are concentrated - mostly along the eastern belt at Ubi, and the western one at Leng Kee/Alexandra.

Right. Now that we're up to speed, how exactly are things changing now? And… why?

To be fair, the writing's been on the wall for quite a while now: Dealers are wrestling back control. In full.

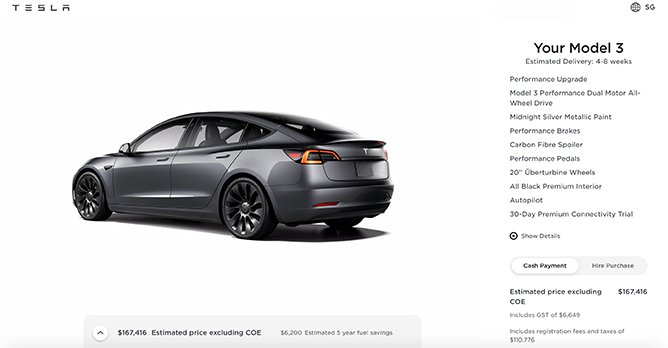

For that, we have a business model birthed via the Internet to thank. Called 'direct-to-consumer' retail (buzzily abbreviated into 'D2C'), Tesla's modus operandi serves as the clearest example in our local context.

Rather than appoint a distributor and operate out of a showroom along Ubi, Tesla Singapore does everything in-house. Its mega site in Toa Payoh is purely for servicing and delivery appointments. And its 'retail store' isn't some high-ceilinged multiplex in Alexandra, but just another unit in Millenia Walk, right next to garment stores and F&B outlets.

Staff on the ground are meant to clarify details and facilitate test drives - not actually sell you the cars Most importantly, there are no salespeople on the ground. The service staff are there to explain the car, accompany you for test drives, and clarify details with you - not haggle with you over the price. After which you go back home, enter the URL for the Tesla site on your computer, and build and order your Tesla.

Staff on the ground are meant to clarify details and facilitate test drives - not actually sell you the cars Most importantly, there are no salespeople on the ground. The service staff are there to explain the car, accompany you for test drives, and clarify details with you - not haggle with you over the price. After which you go back home, enter the URL for the Tesla site on your computer, and build and order your Tesla.

So, yes, all that isn't very new. Instead, what's new now is the pace and extent at which developments are concretising. There are already other examples of the dealer (and its salespeople) taking more of a backseat; Polestar's showroom is designed mostly for you to acquaint yourself with the Polestar 2, while Merc's new Concept Store in Great World City mirrors Tesla's approach to blending the cars into just another part of weekend shopping.

This week, news also broke that Porsche is now likely to be directly dipping its toes directly into sales through a new collaborative retail centre with its longtime distributor, Eurokars Group. That Hyundai and Mercedes-Benz now appear to be explicitly skirting around dealers to explore D2C approaches appears to be the next logical step.

You still haven't answered the question of 'why'.

Dealerships sprouted forth in the pre-Internet era, and helped to do much of the legwork on behalf of manufacturers Sorry - let's get to the 'why' part now. Most of the dealers that you see in Singapore have been in the industry for decades. They sprouted up at a time when something called the Internet didn't exist, and when reaching out to customers on a global scale was more complex and resource-intensive for brands.

Dealerships sprouted forth in the pre-Internet era, and helped to do much of the legwork on behalf of manufacturers Sorry - let's get to the 'why' part now. Most of the dealers that you see in Singapore have been in the industry for decades. They sprouted up at a time when something called the Internet didn't exist, and when reaching out to customers on a global scale was more complex and resource-intensive for brands.

That's where the dealers came into the picture to get their hands dirty and feet wet, carrying out all the legwork to reach out to customers while keeping tabs on how to best weaponise the gears that grind buying mindsets. Is this middleman function as valid and necessary as it was before, at a time where virtual premieres have become the norm and e-commerce is booming? Now, even test drives don't require an additional serviceperson on board.

But that's only one aspect. One of the upshots of re-asserting control is that the manufacturer retains full autonomy of the customer's experience, allowing them to dictate all your touchpoints with the brand. (The keen-eyed will note that Volkswagen Group takes full charge locally - of subsidiary Skoda too - handling marketing, sales, delivery and servicing altogether.) Reducing margin erosion is also another concern, since substantial amounts ultimately slip away through the hands of multiple third parties.

But the Biggest Thing, perhaps, is data. Being closer to the customer allows manufacturers to better understand consumer habits while building relationships with them. As the face of mobility changes and alternative options like car-sharing and leasing threaten to upend private car ownership, the ability to track what makes customers tick in real time remains key to the enduring success - and dominance - of manufacturers.

Oof… that can't be good news for dealers, can it?

Let's return briefly to the conventional experience of car ownership here.

Selling us our cars is inarguably the crown jewel of operations for authorised dealers, but it doesn't start and end at the point of sale. Preceding that, salespeople often need to become acquainted with the cars themselves - and to quite a sophisticated level of knowledge as well. That sets the runway up for them becoming 'product geniuses' or 'product experts' pretty well.

What comes after is also important. With warranties normally bundled into new car sales, our authorised dealers also run large workshops all over the island, which, likewise, rely on a sizeable workforce of technicians and mechanics that have often been steadily amassed over the years. Rather than completely do away with the talent already narrowed down by the dealers, it might be sensible to operate on hybrid models first. Collaborative efforts that see dealers taking more of a back seat - not exiting the vehicle entirely - are thus likely to crop up.

Separately, Singapore's market is also unique in presenting its very own multiverse of madness: COE bidding (and car taxes). Not every carmaker may take it upon itself to steer itself through the complexities of our system - at least not immediately.

It's also worth noting that Tesla capitalised greatly on its newcomer status by using the sheen of its tech-y, zippy cars to draw eyeballs and customers in. So far, it's also only had a few models on sale worldwide, and just one (the Model 3) in Singapore. Whether that can be replicated by other brands with both more diverse product line-ups and customer bases - and whether customers want that to be replicated - remains to be seen.

Biggest question, though - how does this affect all of us, as car buyers?

That depends on your perspective.

Consulting firm McKinsey refers to the impending model as a 'bricks and clicks' one - mixing brick and mortar stores with e-commerce. This doesn't just comprise a mixture of virtual and physical touchpoints, but also greater variety within each type of touchpoint.

If the entire experience of hauling yourself down to one of our car shopping belts and arranging a test drive through a salesperson has felt rather one-note and tiring, then things may indeed be looking up for you. The retail experience is undoubtedly shaping up to become more colourful and multifaceted.

Expect new retail ideas like Polestar's minimalist, gallery-like showrooms to quickly become more common To take the example of the news on Porsche, getting behind the wheel of a 718 Boxster on a special track - as appears to be the case here soon - sounds infinitely more exciting and in fact, commensurate to what the car is actually built for, than just plying a normal test drive route. As manufacturers step up and in to shape the experience more, 'experience' or 'concept stores' are also likely to become more commonplace.

Expect new retail ideas like Polestar's minimalist, gallery-like showrooms to quickly become more common To take the example of the news on Porsche, getting behind the wheel of a 718 Boxster on a special track - as appears to be the case here soon - sounds infinitely more exciting and in fact, commensurate to what the car is actually built for, than just plying a normal test drive route. As manufacturers step up and in to shape the experience more, 'experience' or 'concept stores' are also likely to become more commonplace.

Of note too is that the D2C-influenced virtual-physical hybrid business model will not elude the used car market. Larger names like Carro (dealing in second-hand cars) and Carzuno (leasing) are already solidifying their digital approaches to offer more convenience to customers.

But then here's where the good news may end. Haggling may not be the most fun way to spend 30 minutes of your day, but what it does promise is the potential of cost savings. With dealers slowly retreating into the background, and brands taking control of even pricing, it's likely that we'll see less flexibility with things like rebates, or trade-ins. That may ultimately mean higher premiums for us too.

The road ahead: Manufacturers back on the podium

Care by Volvo, in the U.S.A., is an example of a D2C-based subscription model that is seeing Volvo dabbling into leasing its cars out on its own The trend of brands asserting more control is definitely not going away.

Care by Volvo, in the U.S.A., is an example of a D2C-based subscription model that is seeing Volvo dabbling into leasing its cars out on its own The trend of brands asserting more control is definitely not going away.

That also appears to be one of the reasons why BMW appears to be mixing its strategy up with its appointment of Eurokars Group as its second authorised dealer, ending the multi-decade monopoly that Performance Motors Limited has had. Already, a Retail Next store - basically another buzzy name a la Tesla's Retail Stores, Merc's Concept Store, or Porsche's Porsche Studios - has been confirmed in the pipeline at the new Eurokars showroom. That some D2C-DNA will be blended in at some point is a foregone conclusion.

It's foolish to assume that the brands aren't aware of the risks of adopting a direct-to-consumer sales approach after decades of relying on the same strategy. That may be the reason why not everyone has thrown all their eggs into that basket yet.

Nonetheless, the potential benefits of D2C are not to be undermined. The fact that efforts to apply this model in markets abroad have found success also bodes well - especially in a modern metropolis like Singapore, where buyers are tech-savvy, and where even physical retail itself is ripe for transformation.

We'll be watching the headlines to see how quickly the shift comes into place, but it's only a matter of time before 'bricks and clicks' defines the new normal of car buying.

Still, you may be forgiven for not noticing - or even caring. So what if you can't purchase the all-electric Ioniq 5 through Komoco Motors when it rolls out of our very own Singaporean factory this Q4 - only through Hyundai? Why would it matter if BMWs can be bought through two authorised dealers now instead of just one? And isn't the potential of ordering your new Merc online quite fun and enticing?

Carried to the surface by the ever-expanding possibilities of digitalisation, new dimensions of the car-buying experience are surging to the forefront. In tandem, what we've always known and expected - a showroom-centric, dealership model that's been in force for decades - is all but guaranteed to fade into the background. The change is imminent.

Pause. And er, also rewind. Remind me how we normally buy cars again?

Those of us who enjoy our cars brand new will surely know by now that even though it's the product of a certain brand that we buy, it's not really directly with the brand that we deal.

Apart from the brands' logos, we've thus also seen names like 'Borneo Motors', 'Eurokars' and 'Performance Motors Limited' tacked in bright chrome on the shimmering exteriors, and inside on the walls of showrooms. When those automatic doors slide open as you walk through, sales and service representatives of the dealer greet you - not of the brands (or manufacturers) themselves. In tandem, marketing campaigns, and naturally, promotions and retail prices are ultimately in the hands of the dealer.

Of course - it's not that the brand completely relinquishes control to whichever dealer it's tasked with distributing their car; showrooms, for instance, are mostly designed in collaboration to arrive at an aesthetic as well as an experience befitting of the brand's image.

But as mentioned, most of the touch points with the brand are ultimately filtered through the dealer. That's also meant that for as long as most of us can remember, getting up close with the cars we're interested in and test driving them can only take place where the dealers are concentrated - mostly along the eastern belt at Ubi, and the western one at Leng Kee/Alexandra.

Right. Now that we're up to speed, how exactly are things changing now? And… why?

To be fair, the writing's been on the wall for quite a while now: Dealers are wrestling back control. In full.

For that, we have a business model birthed via the Internet to thank. Called 'direct-to-consumer' retail (buzzily abbreviated into 'D2C'), Tesla's modus operandi serves as the clearest example in our local context.

Rather than appoint a distributor and operate out of a showroom along Ubi, Tesla Singapore does everything in-house. Its mega site in Toa Payoh is purely for servicing and delivery appointments. And its 'retail store' isn't some high-ceilinged multiplex in Alexandra, but just another unit in Millenia Walk, right next to garment stores and F&B outlets.

So, yes, all that isn't very new. Instead, what's new now is the pace and extent at which developments are concretising. There are already other examples of the dealer (and its salespeople) taking more of a backseat; Polestar's showroom is designed mostly for you to acquaint yourself with the Polestar 2, while Merc's new Concept Store in Great World City mirrors Tesla's approach to blending the cars into just another part of weekend shopping.

This week, news also broke that Porsche is now likely to be directly dipping its toes directly into sales through a new collaborative retail centre with its longtime distributor, Eurokars Group. That Hyundai and Mercedes-Benz now appear to be explicitly skirting around dealers to explore D2C approaches appears to be the next logical step.

You still haven't answered the question of 'why'.

That's where the dealers came into the picture to get their hands dirty and feet wet, carrying out all the legwork to reach out to customers while keeping tabs on how to best weaponise the gears that grind buying mindsets. Is this middleman function as valid and necessary as it was before, at a time where virtual premieres have become the norm and e-commerce is booming? Now, even test drives don't require an additional serviceperson on board.

But that's only one aspect. One of the upshots of re-asserting control is that the manufacturer retains full autonomy of the customer's experience, allowing them to dictate all your touchpoints with the brand. (The keen-eyed will note that Volkswagen Group takes full charge locally - of subsidiary Skoda too - handling marketing, sales, delivery and servicing altogether.) Reducing margin erosion is also another concern, since substantial amounts ultimately slip away through the hands of multiple third parties.

But the Biggest Thing, perhaps, is data. Being closer to the customer allows manufacturers to better understand consumer habits while building relationships with them. As the face of mobility changes and alternative options like car-sharing and leasing threaten to upend private car ownership, the ability to track what makes customers tick in real time remains key to the enduring success - and dominance - of manufacturers.

Oof… that can't be good news for dealers, can it?

Let's return briefly to the conventional experience of car ownership here.

Selling us our cars is inarguably the crown jewel of operations for authorised dealers, but it doesn't start and end at the point of sale. Preceding that, salespeople often need to become acquainted with the cars themselves - and to quite a sophisticated level of knowledge as well. That sets the runway up for them becoming 'product geniuses' or 'product experts' pretty well.

What comes after is also important. With warranties normally bundled into new car sales, our authorised dealers also run large workshops all over the island, which, likewise, rely on a sizeable workforce of technicians and mechanics that have often been steadily amassed over the years. Rather than completely do away with the talent already narrowed down by the dealers, it might be sensible to operate on hybrid models first. Collaborative efforts that see dealers taking more of a back seat - not exiting the vehicle entirely - are thus likely to crop up.

Separately, Singapore's market is also unique in presenting its very own multiverse of madness: COE bidding (and car taxes). Not every carmaker may take it upon itself to steer itself through the complexities of our system - at least not immediately.

It's also worth noting that Tesla capitalised greatly on its newcomer status by using the sheen of its tech-y, zippy cars to draw eyeballs and customers in. So far, it's also only had a few models on sale worldwide, and just one (the Model 3) in Singapore. Whether that can be replicated by other brands with both more diverse product line-ups and customer bases - and whether customers want that to be replicated - remains to be seen.

Biggest question, though - how does this affect all of us, as car buyers?

That depends on your perspective.

Consulting firm McKinsey refers to the impending model as a 'bricks and clicks' one - mixing brick and mortar stores with e-commerce. This doesn't just comprise a mixture of virtual and physical touchpoints, but also greater variety within each type of touchpoint.

If the entire experience of hauling yourself down to one of our car shopping belts and arranging a test drive through a salesperson has felt rather one-note and tiring, then things may indeed be looking up for you. The retail experience is undoubtedly shaping up to become more colourful and multifaceted.

Of note too is that the D2C-influenced virtual-physical hybrid business model will not elude the used car market. Larger names like Carro (dealing in second-hand cars) and Carzuno (leasing) are already solidifying their digital approaches to offer more convenience to customers.

But then here's where the good news may end. Haggling may not be the most fun way to spend 30 minutes of your day, but what it does promise is the potential of cost savings. With dealers slowly retreating into the background, and brands taking control of even pricing, it's likely that we'll see less flexibility with things like rebates, or trade-ins. That may ultimately mean higher premiums for us too.

The road ahead: Manufacturers back on the podium

That also appears to be one of the reasons why BMW appears to be mixing its strategy up with its appointment of Eurokars Group as its second authorised dealer, ending the multi-decade monopoly that Performance Motors Limited has had. Already, a Retail Next store - basically another buzzy name a la Tesla's Retail Stores, Merc's Concept Store, or Porsche's Porsche Studios - has been confirmed in the pipeline at the new Eurokars showroom. That some D2C-DNA will be blended in at some point is a foregone conclusion.

It's foolish to assume that the brands aren't aware of the risks of adopting a direct-to-consumer sales approach after decades of relying on the same strategy. That may be the reason why not everyone has thrown all their eggs into that basket yet.

Nonetheless, the potential benefits of D2C are not to be undermined. The fact that efforts to apply this model in markets abroad have found success also bodes well - especially in a modern metropolis like Singapore, where buyers are tech-savvy, and where even physical retail itself is ripe for transformation.

We'll be watching the headlines to see how quickly the shift comes into place, but it's only a matter of time before 'bricks and clicks' defines the new normal of car buying.

To say that Singapore's car industry is awash with upheaval may be putting things lightly. In the past week alone, bombshell after bombshell has dropped in a string of announcements that is seeing brands themselves - the actual motherships - taking wide strides onto centerstage.

Still, you may be forgiven for not noticing - or even caring. So what if you can't purchase the all-electric Ioniq 5 through Komoco Motors when it rolls out of our very own Singaporean factory this Q4 - only through Hyundai? Why would it matter if BMWs can be bought through two authorised dealers now instead of just one? And isn't the potential of ordering your new Merc online quite fun and enticing?

News broke recently that Merc and Hyundai are exploring direct-to-consumer retail approaches locally As they say, the devil is in the details.

News broke recently that Merc and Hyundai are exploring direct-to-consumer retail approaches locally As they say, the devil is in the details.

Carried to the surface by the ever-expanding possibilities of digitalisation, new dimensions of the car-buying experience are surging to the forefront. In tandem, what we've always known and expected - a showroom-centric, dealership model that's been in force for decades - is all but guaranteed to fade into the background. The change is imminent.

Pause. And er, also rewind. Remind me how we normally buy cars again?

Those of us who enjoy our cars brand new will surely know by now that even though it's the product of a certain brand that we buy, it's not really directly with the brand that we deal.

Apart from the brands' logos, we've thus also seen names like 'Borneo Motors', 'Eurokars' and 'Performance Motors Limited' tacked in bright chrome on the shimmering exteriors, and inside on the walls of showrooms. When those automatic doors slide open as you walk through, sales and service representatives of the dealer greet you - not of the brands (or manufacturers) themselves. In tandem, marketing campaigns, and naturally, promotions and retail prices are ultimately in the hands of the dealer.

Of course - it's not that the brand completely relinquishes control to whichever dealer it's tasked with distributing their car; showrooms, for instance, are mostly designed in collaboration to arrive at an aesthetic as well as an experience befitting of the brand's image.

But as mentioned, most of the touch points with the brand are ultimately filtered through the dealer. That's also meant that for as long as most of us can remember, getting up close with the cars we're interested in and test driving them can only take place where the dealers are concentrated - mostly along the eastern belt at Ubi, and the western one at Leng Kee/Alexandra.

Right. Now that we're up to speed, how exactly are things changing now? And… why?

To be fair, the writing's been on the wall for quite a while now: Dealers are wrestling back control. In full.

For that, we have a business model birthed via the Internet to thank. Called 'direct-to-consumer' retail (buzzily abbreviated into 'D2C'), Tesla's modus operandi serves as the clearest example in our local context.

Rather than appoint a distributor and operate out of a showroom along Ubi, Tesla Singapore does everything in-house. Its mega site in Toa Payoh is purely for servicing and delivery appointments. And its 'retail store' isn't some high-ceilinged multiplex in Alexandra, but just another unit in Millenia Walk, right next to garment stores and F&B outlets.

Staff on the ground are meant to clarify details and facilitate test drives - not actually sell you the cars Most importantly, there are no salespeople on the ground. The service staff are there to explain the car, accompany you for test drives, and clarify details with you - not haggle with you over the price. After which you go back home, enter the URL for the Tesla site on your computer, and build and order your Tesla.

Staff on the ground are meant to clarify details and facilitate test drives - not actually sell you the cars Most importantly, there are no salespeople on the ground. The service staff are there to explain the car, accompany you for test drives, and clarify details with you - not haggle with you over the price. After which you go back home, enter the URL for the Tesla site on your computer, and build and order your Tesla.

So, yes, all that isn't very new. Instead, what's new now is the pace and extent at which developments are concretising. There are already other examples of the dealer (and its salespeople) taking more of a backseat; Polestar's showroom is designed mostly for you to acquaint yourself with the Polestar 2, while Merc's new Concept Store in Great World City mirrors Tesla's approach to blending the cars into just another part of weekend shopping.

This week, news also broke that Porsche is now likely to be directly dipping its toes directly into sales through a new collaborative retail centre with its longtime distributor, Eurokars Group. That Hyundai and Mercedes-Benz now appear to be explicitly skirting around dealers to explore D2C approaches appears to be the next logical step.

You still haven't answered the question of 'why'.

Dealerships sprouted forth in the pre-Internet era, and helped to do much of the legwork on behalf of manufacturers Sorry - let's get to the 'why' part now. Most of the dealers that you see in Singapore have been in the industry for decades. They sprouted up at a time when something called the Internet didn't exist, and when reaching out to customers on a global scale was more complex and resource-intensive for brands.

Dealerships sprouted forth in the pre-Internet era, and helped to do much of the legwork on behalf of manufacturers Sorry - let's get to the 'why' part now. Most of the dealers that you see in Singapore have been in the industry for decades. They sprouted up at a time when something called the Internet didn't exist, and when reaching out to customers on a global scale was more complex and resource-intensive for brands.

That's where the dealers came into the picture to get their hands dirty and feet wet, carrying out all the legwork to reach out to customers while keeping tabs on how to best weaponise the gears that grind buying mindsets. Is this middleman function as valid and necessary as it was before, at a time where virtual premieres have become the norm and e-commerce is booming? Now, even test drives don't require an additional serviceperson on board.

But that's only one aspect. One of the upshots of re-asserting control is that the manufacturer retains full autonomy of the customer's experience, allowing them to dictate all your touchpoints with the brand. (The keen-eyed will note that Volkswagen Group takes full charge locally - of subsidiary Skoda too - handling marketing, sales, delivery and servicing altogether.) Reducing margin erosion is also another concern, since substantial amounts ultimately slip away through the hands of multiple third parties.

But the Biggest Thing, perhaps, is data. Being closer to the customer allows manufacturers to better understand consumer habits while building relationships with them. As the face of mobility changes and alternative options like car-sharing and leasing threaten to upend private car ownership, the ability to track what makes customers tick in real time remains key to the enduring success - and dominance - of manufacturers.

Oof… that can't be good news for dealers, can it?

Let's return briefly to the conventional experience of car ownership here.

Selling us our cars is inarguably the crown jewel of operations for authorised dealers, but it doesn't start and end at the point of sale. Preceding that, salespeople often need to become acquainted with the cars themselves - and to quite a sophisticated level of knowledge as well. That sets the runway up for them becoming 'product geniuses' or 'product experts' pretty well.

What comes after is also important. With warranties normally bundled into new car sales, our authorised dealers also run large workshops all over the island, which, likewise, rely on a sizeable workforce of technicians and mechanics that have often been steadily amassed over the years. Rather than completely do away with the talent already narrowed down by the dealers, it might be sensible to operate on hybrid models first. Collaborative efforts that see dealers taking more of a back seat - not exiting the vehicle entirely - are thus likely to crop up.

Separately, Singapore's market is also unique in presenting its very own multiverse of madness: COE bidding (and car taxes). Not every carmaker may take it upon itself to steer itself through the complexities of our system - at least not immediately.

It's also worth noting that Tesla capitalised greatly on its newcomer status by using the sheen of its tech-y, zippy cars to draw eyeballs and customers in. So far, it's also only had a few models on sale worldwide, and just one (the Model 3) in Singapore. Whether that can be replicated by other brands with both more diverse product line-ups and customer bases - and whether customers want that to be replicated - remains to be seen.

Biggest question, though - how does this affect all of us, as car buyers?

That depends on your perspective.

Consulting firm McKinsey refers to the impending model as a 'bricks and clicks' one - mixing brick and mortar stores with e-commerce. This doesn't just comprise a mixture of virtual and physical touchpoints, but also greater variety within each type of touchpoint.

If the entire experience of hauling yourself down to one of our car shopping belts and arranging a test drive through a salesperson has felt rather one-note and tiring, then things may indeed be looking up for you. The retail experience is undoubtedly shaping up to become more colourful and multifaceted.

Expect new retail ideas like Polestar's minimalist, gallery-like showrooms to quickly become more common To take the example of the news on Porsche, getting behind the wheel of a 718 Boxster on a special track - as appears to be the case here soon - sounds infinitely more exciting and in fact, commensurate to what the car is actually built for, than just plying a normal test drive route. As manufacturers step up and in to shape the experience more, 'experience' or 'concept stores' are also likely to become more commonplace.

Of note too is that the D2C-influenced virtual-physical hybrid business model will not elude the used car market. Larger names like Carro (dealing in second-hand cars) and Carzuno (leasing) are already solidifying their digital approaches to offer more convenience to customers.

But then here's where the good news may end. Haggling may not be the most fun way to spend 30 minutes of your day, but what it does promise is the potential of cost savings. With dealers slowly retreating into the background, and brands taking control of even pricing, it's likely that we'll see less flexibility with things like rebates, or trade-ins. That may ultimately mean higher premiums for us too.

The road ahead: Manufacturers back on the podium

Care by Volvo, in the U.S.A., is an example of a D2C-based subscription model that is seeing Volvo dabbling into leasing its cars out on its own The trend of brands asserting more control is definitely not going away.

Care by Volvo, in the U.S.A., is an example of a D2C-based subscription model that is seeing Volvo dabbling into leasing its cars out on its own The trend of brands asserting more control is definitely not going away.

That also appears to be one of the reasons why BMW appears to be mixing its strategy up with its appointment of Eurokars Group as its second authorised dealer, ending the multi-decade monopoly that Performance Motors Limited has had. Already, a Retail Next store - basically another buzzy name a la Tesla's Retail Stores, Merc's Concept Store, or Porsche's Porsche Studios - has been confirmed in the pipeline at the new Eurokars showroom. That some D2C-DNA will be blended in at some point is a foregone conclusion.

It's foolish to assume that the brands aren't aware of the risks of adopting a direct-to-consumer sales approach after decades of relying on the same strategy. That may be the reason why not everyone has thrown all their eggs into that basket yet.

Nonetheless, the potential benefits of D2C are not to be undermined. The fact that efforts to apply this model in markets abroad have found success also bodes well - especially in a modern metropolis like Singapore, where buyers are tech-savvy, and where even physical retail itself is ripe for transformation.

We'll be watching the headlines to see how quickly the shift comes into place, but it's only a matter of time before 'bricks and clicks' defines the new normal of car buying.

Still, you may be forgiven for not noticing - or even caring. So what if you can't purchase the all-electric Ioniq 5 through Komoco Motors when it rolls out of our very own Singaporean factory this Q4 - only through Hyundai? Why would it matter if BMWs can be bought through two authorised dealers now instead of just one? And isn't the potential of ordering your new Merc online quite fun and enticing?

Carried to the surface by the ever-expanding possibilities of digitalisation, new dimensions of the car-buying experience are surging to the forefront. In tandem, what we've always known and expected - a showroom-centric, dealership model that's been in force for decades - is all but guaranteed to fade into the background. The change is imminent.

Pause. And er, also rewind. Remind me how we normally buy cars again?

Those of us who enjoy our cars brand new will surely know by now that even though it's the product of a certain brand that we buy, it's not really directly with the brand that we deal.

Apart from the brands' logos, we've thus also seen names like 'Borneo Motors', 'Eurokars' and 'Performance Motors Limited' tacked in bright chrome on the shimmering exteriors, and inside on the walls of showrooms. When those automatic doors slide open as you walk through, sales and service representatives of the dealer greet you - not of the brands (or manufacturers) themselves. In tandem, marketing campaigns, and naturally, promotions and retail prices are ultimately in the hands of the dealer.

Of course - it's not that the brand completely relinquishes control to whichever dealer it's tasked with distributing their car; showrooms, for instance, are mostly designed in collaboration to arrive at an aesthetic as well as an experience befitting of the brand's image.

But as mentioned, most of the touch points with the brand are ultimately filtered through the dealer. That's also meant that for as long as most of us can remember, getting up close with the cars we're interested in and test driving them can only take place where the dealers are concentrated - mostly along the eastern belt at Ubi, and the western one at Leng Kee/Alexandra.

Right. Now that we're up to speed, how exactly are things changing now? And… why?

To be fair, the writing's been on the wall for quite a while now: Dealers are wrestling back control. In full.

For that, we have a business model birthed via the Internet to thank. Called 'direct-to-consumer' retail (buzzily abbreviated into 'D2C'), Tesla's modus operandi serves as the clearest example in our local context.

Rather than appoint a distributor and operate out of a showroom along Ubi, Tesla Singapore does everything in-house. Its mega site in Toa Payoh is purely for servicing and delivery appointments. And its 'retail store' isn't some high-ceilinged multiplex in Alexandra, but just another unit in Millenia Walk, right next to garment stores and F&B outlets.

So, yes, all that isn't very new. Instead, what's new now is the pace and extent at which developments are concretising. There are already other examples of the dealer (and its salespeople) taking more of a backseat; Polestar's showroom is designed mostly for you to acquaint yourself with the Polestar 2, while Merc's new Concept Store in Great World City mirrors Tesla's approach to blending the cars into just another part of weekend shopping.

This week, news also broke that Porsche is now likely to be directly dipping its toes directly into sales through a new collaborative retail centre with its longtime distributor, Eurokars Group. That Hyundai and Mercedes-Benz now appear to be explicitly skirting around dealers to explore D2C approaches appears to be the next logical step.

You still haven't answered the question of 'why'.

That's where the dealers came into the picture to get their hands dirty and feet wet, carrying out all the legwork to reach out to customers while keeping tabs on how to best weaponise the gears that grind buying mindsets. Is this middleman function as valid and necessary as it was before, at a time where virtual premieres have become the norm and e-commerce is booming? Now, even test drives don't require an additional serviceperson on board.

But that's only one aspect. One of the upshots of re-asserting control is that the manufacturer retains full autonomy of the customer's experience, allowing them to dictate all your touchpoints with the brand. (The keen-eyed will note that Volkswagen Group takes full charge locally - of subsidiary Skoda too - handling marketing, sales, delivery and servicing altogether.) Reducing margin erosion is also another concern, since substantial amounts ultimately slip away through the hands of multiple third parties.

But the Biggest Thing, perhaps, is data. Being closer to the customer allows manufacturers to better understand consumer habits while building relationships with them. As the face of mobility changes and alternative options like car-sharing and leasing threaten to upend private car ownership, the ability to track what makes customers tick in real time remains key to the enduring success - and dominance - of manufacturers.

Oof… that can't be good news for dealers, can it?

Let's return briefly to the conventional experience of car ownership here.

Selling us our cars is inarguably the crown jewel of operations for authorised dealers, but it doesn't start and end at the point of sale. Preceding that, salespeople often need to become acquainted with the cars themselves - and to quite a sophisticated level of knowledge as well. That sets the runway up for them becoming 'product geniuses' or 'product experts' pretty well.

What comes after is also important. With warranties normally bundled into new car sales, our authorised dealers also run large workshops all over the island, which, likewise, rely on a sizeable workforce of technicians and mechanics that have often been steadily amassed over the years. Rather than completely do away with the talent already narrowed down by the dealers, it might be sensible to operate on hybrid models first. Collaborative efforts that see dealers taking more of a back seat - not exiting the vehicle entirely - are thus likely to crop up.

Separately, Singapore's market is also unique in presenting its very own multiverse of madness: COE bidding (and car taxes). Not every carmaker may take it upon itself to steer itself through the complexities of our system - at least not immediately.

It's also worth noting that Tesla capitalised greatly on its newcomer status by using the sheen of its tech-y, zippy cars to draw eyeballs and customers in. So far, it's also only had a few models on sale worldwide, and just one (the Model 3) in Singapore. Whether that can be replicated by other brands with both more diverse product line-ups and customer bases - and whether customers want that to be replicated - remains to be seen.

Biggest question, though - how does this affect all of us, as car buyers?

That depends on your perspective.

Consulting firm McKinsey refers to the impending model as a 'bricks and clicks' one - mixing brick and mortar stores with e-commerce. This doesn't just comprise a mixture of virtual and physical touchpoints, but also greater variety within each type of touchpoint.

If the entire experience of hauling yourself down to one of our car shopping belts and arranging a test drive through a salesperson has felt rather one-note and tiring, then things may indeed be looking up for you. The retail experience is undoubtedly shaping up to become more colourful and multifaceted.

Expect new retail ideas like Polestar's minimalist, gallery-like showrooms to quickly become more common

Of note too is that the D2C-influenced virtual-physical hybrid business model will not elude the used car market. Larger names like Carro (dealing in second-hand cars) and Carzuno (leasing) are already solidifying their digital approaches to offer more convenience to customers.

But then here's where the good news may end. Haggling may not be the most fun way to spend 30 minutes of your day, but what it does promise is the potential of cost savings. With dealers slowly retreating into the background, and brands taking control of even pricing, it's likely that we'll see less flexibility with things like rebates, or trade-ins. That may ultimately mean higher premiums for us too.

The road ahead: Manufacturers back on the podium

That also appears to be one of the reasons why BMW appears to be mixing its strategy up with its appointment of Eurokars Group as its second authorised dealer, ending the multi-decade monopoly that Performance Motors Limited has had. Already, a Retail Next store - basically another buzzy name a la Tesla's Retail Stores, Merc's Concept Store, or Porsche's Porsche Studios - has been confirmed in the pipeline at the new Eurokars showroom. That some D2C-DNA will be blended in at some point is a foregone conclusion.

It's foolish to assume that the brands aren't aware of the risks of adopting a direct-to-consumer sales approach after decades of relying on the same strategy. That may be the reason why not everyone has thrown all their eggs into that basket yet.

Nonetheless, the potential benefits of D2C are not to be undermined. The fact that efforts to apply this model in markets abroad have found success also bodes well - especially in a modern metropolis like Singapore, where buyers are tech-savvy, and where even physical retail itself is ripe for transformation.

We'll be watching the headlines to see how quickly the shift comes into place, but it's only a matter of time before 'bricks and clicks' defines the new normal of car buying.

Thank You For Your Subscription.