June 2022: Cat B and E over $100k now, supply for next period projected to shrink further

23 Jun 2022|14,370 views

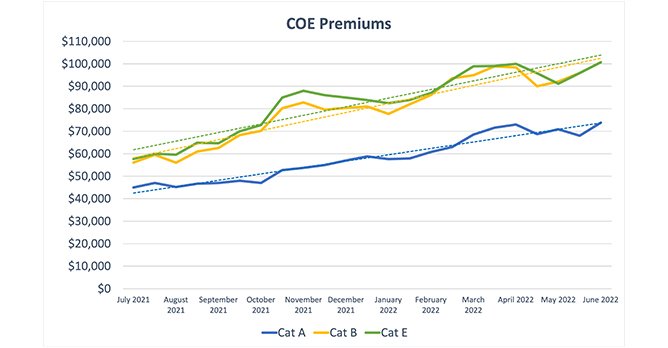

COE price trend over the past quarter: April to June 2022 vs Jan to Mar 2022

LTA's mid-April announcement that the COE supply would be increasing for May to July surprised - and delighted - many. Nonetheless, the news presented a mixed picture if one actually zoomed in.

Although the 15% rise in Cat A supply suggested some relief for mass market models, quotas in both Cat B and Cat E were in fact set to shrink.

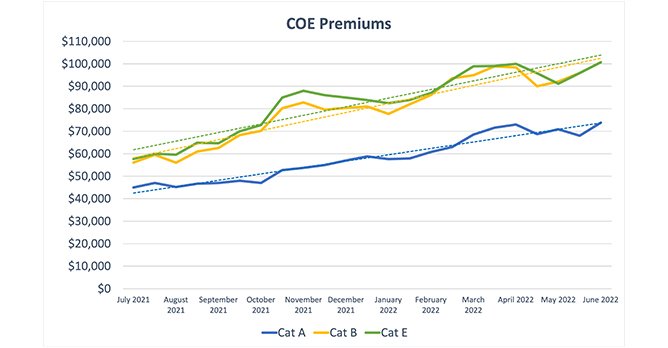

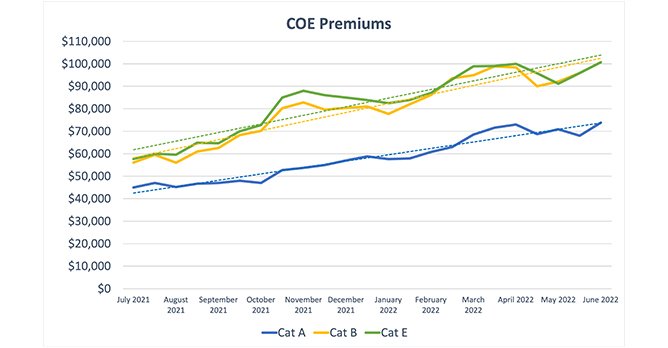

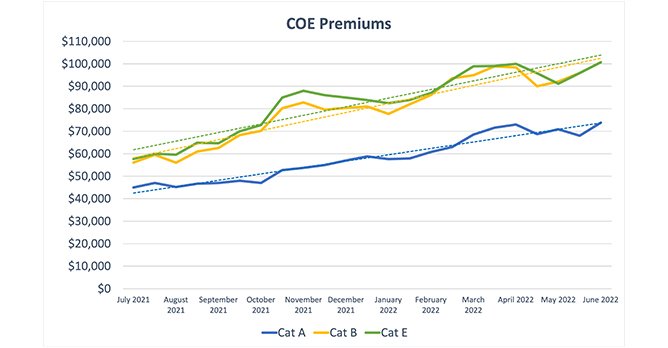

Cats B and E crossed the unholy figure of $100,000 at the start of June, and have continued their climb As it turns out, however, premiums in all categories have continued to climb. The average COE price across April to June 2022 is 13% higher for Cat A, and around 8% higher for both Cat B and Cat E.

Cats B and E crossed the unholy figure of $100,000 at the start of June, and have continued their climb As it turns out, however, premiums in all categories have continued to climb. The average COE price across April to June 2022 is 13% higher for Cat A, and around 8% higher for both Cat B and Cat E.

For the first time in nearly two decades, Cat B and Cat E crossed the six-figure line in both bidding rounds of June. Yet despite all attention falling on that eye-popping $100,000 figure, it's worth noting that the increased supply in Cat A hasn't taken the heat off prices.

Premiums for cars with smaller engines are now closing in on $75,000. The last time the numbers were this high was in the first quarter of 2014.

In the opaque world of COE bidding, it's hard to say exactly what drove the price spike despite the supply increase. But as the authorities try to make EVs more accessible, having a few more all-electric models in Cat A presents itself as a possible factor.

Once again, the jumps in average COE prices in the period of April to June 2022 were actually lower than previously seen. Particularly, the growth rate for Cat B appears to be slowing, dipping below 10% for the first time in two quarters.

Other than the continued concretisation of Singapore's EV roadmap, things have been a little quieter on the regulatory front. It does appear, though, that the unexpected revision of the ARF structure has (expectedly) had no dampening effect on demand for luxury cars.

Vehicle de-registration and COE supply forecasting

As mentioned earlier, the COE supply actually bucked our predictions of a very slight 3% shrinkage for May to July. Instead, it rose by more than 14%. This was led by a 35% bump in Cat D COEs for motorcycles, although Cat A also helped to contribute to this.

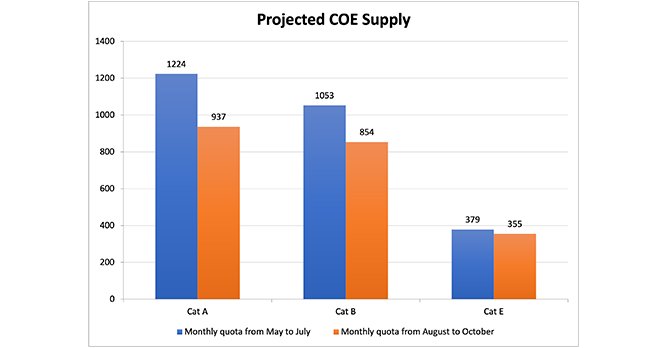

Based on data extrapolated from three months of de-registrations spanning April to June, our statistical forecasting once again suggests that the COE quota will shrink for the August to October period. This time, however, the dip seems more certain: Overall supply is projected to shrink by 19%.

Cat A and Cat B appear to be the most affected currently. The COE quota for smaller-engined cars is forecast to drop the most - by 24% - from the outgoing monthly average of 1,224. The quota for Cat B will likely experience a gentler though nonetheless significant fall, to drop by 19% from the current average of 1,053.

On the other hand, Cat E should only drop by 6%, from the monthly average of 379. All of the projected changes can be viewed in the bar graph appended.

New car pricing: April 2022 to June 2022

sgCarMart uses a pool of popular models from authorised dealers to analyse the general price trends of new cars.

The last time the Kia Cerato EX was asking for around $100,000 was in October 2021 (GT Line pictured) Based on our sample, there was a 4% quarter-on quarter-increase, compared to the previous tri-monthly average between January to March 2022.

The last time the Kia Cerato EX was asking for around $100,000 was in October 2021 (GT Line pictured) Based on our sample, there was a 4% quarter-on quarter-increase, compared to the previous tri-monthly average between January to March 2022.

The rate of increase appears to be also hovering steady now that the climbs in COE premiums haven't been as steep.

For context, the highest quarter-on-quarter increase was observed for the October to December 2021 period, when prices rose by 12%. That marked the transitionary phase during which even mid-tier variants of our perennial Korean sedans - the Kia Cerato, and Hyundai Avante - crossed the $100,000 point (of no return).

Most popular used cars: March 2022 to May 2022

Over the three-month period between March 2022 to May 2022, these were the five most listed used cars on sgCarMart.

The trickle-down effects of the burning new car market continue to be felt in the pre-owned arena as well.

For instance, although the 2016 Honda Vezel 1.5A X continues to retain its crown, it does so with an increasingly steep asking price.

The current depreciation figures of the Vezel are on par with what you would have seen from the Volkswagen Golf Variant back in 2016 Whereas the annual depreciation of the car was petering off at $12,000/year in March 2022, the model was being listed in May 2022 with an average depreciation of more than $13,000/year. Back in 2016, those sorts of figures were seen on decidedly more upmarket models, like the Volkswagen Golf Variant.

The current depreciation figures of the Vezel are on par with what you would have seen from the Volkswagen Golf Variant back in 2016 Whereas the annual depreciation of the car was petering off at $12,000/year in March 2022, the model was being listed in May 2022 with an average depreciation of more than $13,000/year. Back in 2016, those sorts of figures were seen on decidedly more upmarket models, like the Volkswagen Golf Variant.

Another interesting note is the continuing strength of luxury cars in the listings. Merc's GLA-Class crossover was among the top five listed cars in February. With the 2017 C-Class C180 Avantgarde maintaining its spot, the 2014 520i variant of the F10 BMW 5 Series has also entered the Top 5 for the first time ever since our tracking started in 2020.

As budget cars continue to be priced out of what average buyers are willing to fork out, the current COE era may well be marked by the renaissance of premium marques.

Curious about how the car market was trending just a few months back? Check out our COE analyses for the previous periods below!

Mar 2022: Cat B and E threaten $100k barrier, supply for next period projected to shrink slightly

Jan 2022: COE prices continue to climb, and supply for upcoming quarter expected to increase slightly

LTA's mid-April announcement that the COE supply would be increasing for May to July surprised - and delighted - many. Nonetheless, the news presented a mixed picture if one actually zoomed in.

Although the 15% rise in Cat A supply suggested some relief for mass market models, quotas in both Cat B and Cat E were in fact set to shrink.

For the first time in nearly two decades, Cat B and Cat E crossed the six-figure line in both bidding rounds of June. Yet despite all attention falling on that eye-popping $100,000 figure, it's worth noting that the increased supply in Cat A hasn't taken the heat off prices.

Premiums for cars with smaller engines are now closing in on $75,000. The last time the numbers were this high was in the first quarter of 2014.

In the opaque world of COE bidding, it's hard to say exactly what drove the price spike despite the supply increase. But as the authorities try to make EVs more accessible, having a few more all-electric models in Cat A presents itself as a possible factor.

Once again, the jumps in average COE prices in the period of April to June 2022 were actually lower than previously seen. Particularly, the growth rate for Cat B appears to be slowing, dipping below 10% for the first time in two quarters.

Other than the continued concretisation of Singapore's EV roadmap, things have been a little quieter on the regulatory front. It does appear, though, that the unexpected revision of the ARF structure has (expectedly) had no dampening effect on demand for luxury cars.

Vehicle de-registration and COE supply forecasting

As mentioned earlier, the COE supply actually bucked our predictions of a very slight 3% shrinkage for May to July. Instead, it rose by more than 14%. This was led by a 35% bump in Cat D COEs for motorcycles, although Cat A also helped to contribute to this.

Based on data extrapolated from three months of de-registrations spanning April to June, our statistical forecasting once again suggests that the COE quota will shrink for the August to October period. This time, however, the dip seems more certain: Overall supply is projected to shrink by 19%.

Cat A and Cat B appear to be the most affected currently. The COE quota for smaller-engined cars is forecast to drop the most - by 24% - from the outgoing monthly average of 1,224. The quota for Cat B will likely experience a gentler though nonetheless significant fall, to drop by 19% from the current average of 1,053.

On the other hand, Cat E should only drop by 6%, from the monthly average of 379. All of the projected changes can be viewed in the bar graph appended.

New car pricing: April 2022 to June 2022

sgCarMart uses a pool of popular models from authorised dealers to analyse the general price trends of new cars.

The rate of increase appears to be also hovering steady now that the climbs in COE premiums haven't been as steep.

For context, the highest quarter-on-quarter increase was observed for the October to December 2021 period, when prices rose by 12%. That marked the transitionary phase during which even mid-tier variants of our perennial Korean sedans - the Kia Cerato, and Hyundai Avante - crossed the $100,000 point (of no return).

Most popular used cars: March 2022 to May 2022

Over the three-month period between March 2022 to May 2022, these were the five most listed used cars on sgCarMart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $12,640/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2017 | $19,233/yr |

| Honda Civic 1.6A VTi | 2018 | $13,000/yr |

| BMW 5 Series 520i | 2014 | $20,173/yr |

| Nissan Qashqai 1.2A DIG-T | 2017 | $12,486/yr |

The trickle-down effects of the burning new car market continue to be felt in the pre-owned arena as well.

For instance, although the 2016 Honda Vezel 1.5A X continues to retain its crown, it does so with an increasingly steep asking price.

Another interesting note is the continuing strength of luxury cars in the listings. Merc's GLA-Class crossover was among the top five listed cars in February. With the 2017 C-Class C180 Avantgarde maintaining its spot, the 2014 520i variant of the F10 BMW 5 Series has also entered the Top 5 for the first time ever since our tracking started in 2020.

As budget cars continue to be priced out of what average buyers are willing to fork out, the current COE era may well be marked by the renaissance of premium marques.

Curious about how the car market was trending just a few months back? Check out our COE analyses for the previous periods below!

Mar 2022: Cat B and E threaten $100k barrier, supply for next period projected to shrink slightly

Jan 2022: COE prices continue to climb, and supply for upcoming quarter expected to increase slightly

COE price trend over the past quarter: April to June 2022 vs Jan to Mar 2022

LTA's mid-April announcement that the COE supply would be increasing for May to July surprised - and delighted - many. Nonetheless, the news presented a mixed picture if one actually zoomed in.

Although the 15% rise in Cat A supply suggested some relief for mass market models, quotas in both Cat B and Cat E were in fact set to shrink.

Cats B and E crossed the unholy figure of $100,000 at the start of June, and have continued their climb As it turns out, however, premiums in all categories have continued to climb. The average COE price across April to June 2022 is 13% higher for Cat A, and around 8% higher for both Cat B and Cat E.

Cats B and E crossed the unholy figure of $100,000 at the start of June, and have continued their climb As it turns out, however, premiums in all categories have continued to climb. The average COE price across April to June 2022 is 13% higher for Cat A, and around 8% higher for both Cat B and Cat E.

For the first time in nearly two decades, Cat B and Cat E crossed the six-figure line in both bidding rounds of June. Yet despite all attention falling on that eye-popping $100,000 figure, it's worth noting that the increased supply in Cat A hasn't taken the heat off prices.

Premiums for cars with smaller engines are now closing in on $75,000. The last time the numbers were this high was in the first quarter of 2014.

In the opaque world of COE bidding, it's hard to say exactly what drove the price spike despite the supply increase. But as the authorities try to make EVs more accessible, having a few more all-electric models in Cat A presents itself as a possible factor.

Once again, the jumps in average COE prices in the period of April to June 2022 were actually lower than previously seen. Particularly, the growth rate for Cat B appears to be slowing, dipping below 10% for the first time in two quarters.

Other than the continued concretisation of Singapore's EV roadmap, things have been a little quieter on the regulatory front. It does appear, though, that the unexpected revision of the ARF structure has (expectedly) had no dampening effect on demand for luxury cars.

Vehicle de-registration and COE supply forecasting

As mentioned earlier, the COE supply actually bucked our predictions of a very slight 3% shrinkage for May to July. Instead, it rose by more than 14%. This was led by a 35% bump in Cat D COEs for motorcycles, although Cat A also helped to contribute to this.

Based on data extrapolated from three months of de-registrations spanning April to June, our statistical forecasting once again suggests that the COE quota will shrink for the August to October period. This time, however, the dip seems more certain: Overall supply is projected to shrink by 19%.

Cat A and Cat B appear to be the most affected currently. The COE quota for smaller-engined cars is forecast to drop the most - by 24% - from the outgoing monthly average of 1,224. The quota for Cat B will likely experience a gentler though nonetheless significant fall, to drop by 19% from the current average of 1,053.

On the other hand, Cat E should only drop by 6%, from the monthly average of 379. All of the projected changes can be viewed in the bar graph appended.

New car pricing: April 2022 to June 2022

sgCarMart uses a pool of popular models from authorised dealers to analyse the general price trends of new cars.

The last time the Kia Cerato EX was asking for around $100,000 was in October 2021 (GT Line pictured) Based on our sample, there was a 4% quarter-on quarter-increase, compared to the previous tri-monthly average between January to March 2022.

The last time the Kia Cerato EX was asking for around $100,000 was in October 2021 (GT Line pictured) Based on our sample, there was a 4% quarter-on quarter-increase, compared to the previous tri-monthly average between January to March 2022.

The rate of increase appears to be also hovering steady now that the climbs in COE premiums haven't been as steep.

For context, the highest quarter-on-quarter increase was observed for the October to December 2021 period, when prices rose by 12%. That marked the transitionary phase during which even mid-tier variants of our perennial Korean sedans - the Kia Cerato, and Hyundai Avante - crossed the $100,000 point (of no return).

Most popular used cars: March 2022 to May 2022

Over the three-month period between March 2022 to May 2022, these were the five most listed used cars on sgCarMart.

The trickle-down effects of the burning new car market continue to be felt in the pre-owned arena as well.

For instance, although the 2016 Honda Vezel 1.5A X continues to retain its crown, it does so with an increasingly steep asking price.

The current depreciation figures of the Vezel are on par with what you would have seen from the Volkswagen Golf Variant back in 2016 Whereas the annual depreciation of the car was petering off at $12,000/year in March 2022, the model was being listed in May 2022 with an average depreciation of more than $13,000/year. Back in 2016, those sorts of figures were seen on decidedly more upmarket models, like the Volkswagen Golf Variant.

Another interesting note is the continuing strength of luxury cars in the listings. Merc's GLA-Class crossover was among the top five listed cars in February. With the 2017 C-Class C180 Avantgarde maintaining its spot, the 2014 520i variant of the F10 BMW 5 Series has also entered the Top 5 for the first time ever since our tracking started in 2020.

As budget cars continue to be priced out of what average buyers are willing to fork out, the current COE era may well be marked by the renaissance of premium marques.

Curious about how the car market was trending just a few months back? Check out our COE analyses for the previous periods below!

Mar 2022: Cat B and E threaten $100k barrier, supply for next period projected to shrink slightly

Jan 2022: COE prices continue to climb, and supply for upcoming quarter expected to increase slightly

LTA's mid-April announcement that the COE supply would be increasing for May to July surprised - and delighted - many. Nonetheless, the news presented a mixed picture if one actually zoomed in.

Although the 15% rise in Cat A supply suggested some relief for mass market models, quotas in both Cat B and Cat E were in fact set to shrink.

For the first time in nearly two decades, Cat B and Cat E crossed the six-figure line in both bidding rounds of June. Yet despite all attention falling on that eye-popping $100,000 figure, it's worth noting that the increased supply in Cat A hasn't taken the heat off prices.

Premiums for cars with smaller engines are now closing in on $75,000. The last time the numbers were this high was in the first quarter of 2014.

In the opaque world of COE bidding, it's hard to say exactly what drove the price spike despite the supply increase. But as the authorities try to make EVs more accessible, having a few more all-electric models in Cat A presents itself as a possible factor.

Once again, the jumps in average COE prices in the period of April to June 2022 were actually lower than previously seen. Particularly, the growth rate for Cat B appears to be slowing, dipping below 10% for the first time in two quarters.

Other than the continued concretisation of Singapore's EV roadmap, things have been a little quieter on the regulatory front. It does appear, though, that the unexpected revision of the ARF structure has (expectedly) had no dampening effect on demand for luxury cars.

Vehicle de-registration and COE supply forecasting

As mentioned earlier, the COE supply actually bucked our predictions of a very slight 3% shrinkage for May to July. Instead, it rose by more than 14%. This was led by a 35% bump in Cat D COEs for motorcycles, although Cat A also helped to contribute to this.

Based on data extrapolated from three months of de-registrations spanning April to June, our statistical forecasting once again suggests that the COE quota will shrink for the August to October period. This time, however, the dip seems more certain: Overall supply is projected to shrink by 19%.

Cat A and Cat B appear to be the most affected currently. The COE quota for smaller-engined cars is forecast to drop the most - by 24% - from the outgoing monthly average of 1,224. The quota for Cat B will likely experience a gentler though nonetheless significant fall, to drop by 19% from the current average of 1,053.

On the other hand, Cat E should only drop by 6%, from the monthly average of 379. All of the projected changes can be viewed in the bar graph appended.

New car pricing: April 2022 to June 2022

sgCarMart uses a pool of popular models from authorised dealers to analyse the general price trends of new cars.

The rate of increase appears to be also hovering steady now that the climbs in COE premiums haven't been as steep.

For context, the highest quarter-on-quarter increase was observed for the October to December 2021 period, when prices rose by 12%. That marked the transitionary phase during which even mid-tier variants of our perennial Korean sedans - the Kia Cerato, and Hyundai Avante - crossed the $100,000 point (of no return).

Most popular used cars: March 2022 to May 2022

Over the three-month period between March 2022 to May 2022, these were the five most listed used cars on sgCarMart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $12,640/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2017 | $19,233/yr |

| Honda Civic 1.6A VTi | 2018 | $13,000/yr |

| BMW 5 Series 520i | 2014 | $20,173/yr |

| Nissan Qashqai 1.2A DIG-T | 2017 | $12,486/yr |

The trickle-down effects of the burning new car market continue to be felt in the pre-owned arena as well.

For instance, although the 2016 Honda Vezel 1.5A X continues to retain its crown, it does so with an increasingly steep asking price.

The current depreciation figures of the Vezel are on par with what you would have seen from the Volkswagen Golf Variant back in 2016

Another interesting note is the continuing strength of luxury cars in the listings. Merc's GLA-Class crossover was among the top five listed cars in February. With the 2017 C-Class C180 Avantgarde maintaining its spot, the 2014 520i variant of the F10 BMW 5 Series has also entered the Top 5 for the first time ever since our tracking started in 2020.

As budget cars continue to be priced out of what average buyers are willing to fork out, the current COE era may well be marked by the renaissance of premium marques.

Curious about how the car market was trending just a few months back? Check out our COE analyses for the previous periods below!

Mar 2022: Cat B and E threaten $100k barrier, supply for next period projected to shrink slightly

Jan 2022: COE prices continue to climb, and supply for upcoming quarter expected to increase slightly

Thank You For Your Subscription.