Road tax rebate of 30% for buses, commercial vehicles and taxis

09 May 2009|11,046 views

The revised road tax rates will be indicated on the road tax renewal notices or GIRO payment schedules issued to affected vehicle owners.

Vehicle owners who have received road tax renewal notices or GIRO payment schedules prior to 10 May 2009, and renew their road tax on or after 10 May 2009 will pay based on the revised rates. They can refer to the aforesaid portal for the new rates. A new notice or GIRO payment schedule is not required for the road tax renewal.

There may be vehicle owners who have paid the road tax for their commercial vehicles, buses or taxis based on the old road tax rates. In such cases, the excess amount paid would be indicated on the vehicle's next road tax renewal notice, and would automatically be used to offset the road tax payable at the next renewal.

Vehicles transferred before its next road tax renewal would automatically have the excess road tax paid used to offset the total transfer fees payable. The remaining road tax, including excess road tax paid, will be transferred with the vehicle to the new registered owner.

In cases when the vehicle has been de-registered, the remaining unused portion of the road tax and any excess road tax paid will be automatically refunded to the last registered owner of the vehicle.

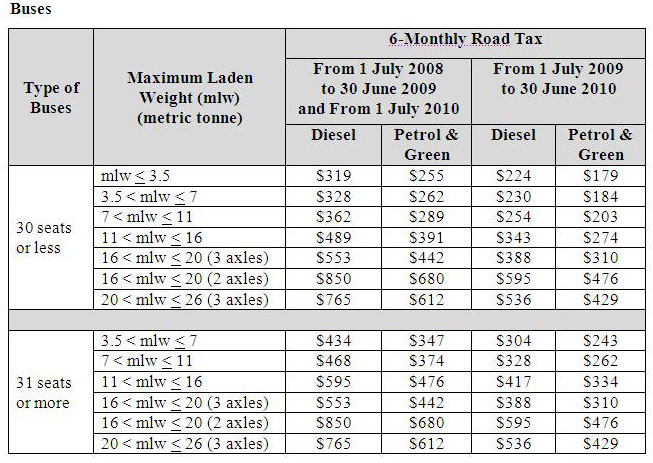

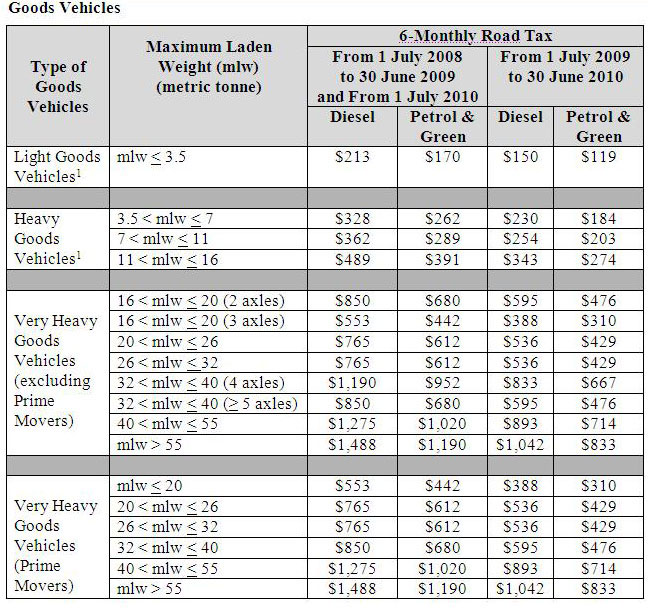

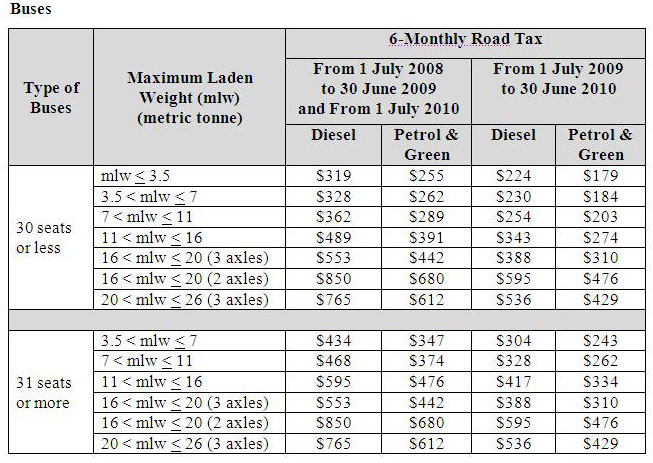

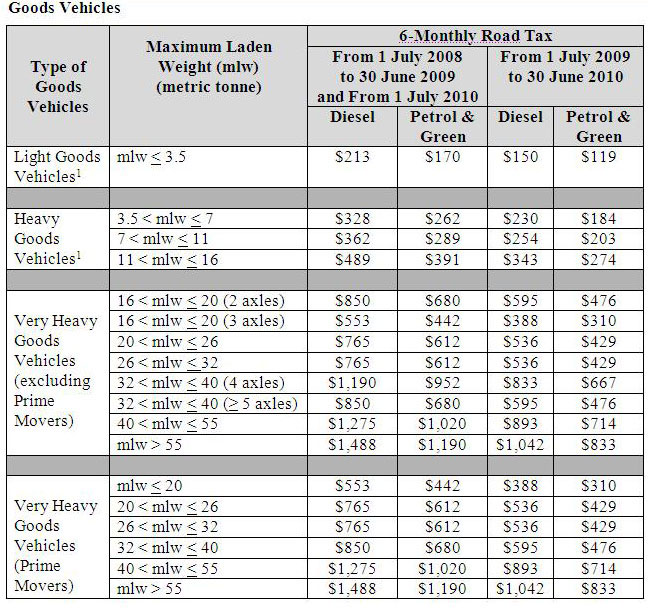

The revised road tax for buses, commercial vehicles and taxis as below.

Vehicle owners who have received road tax renewal notices or GIRO payment schedules prior to 10 May 2009, and renew their road tax on or after 10 May 2009 will pay based on the revised rates. They can refer to the aforesaid portal for the new rates. A new notice or GIRO payment schedule is not required for the road tax renewal.

There may be vehicle owners who have paid the road tax for their commercial vehicles, buses or taxis based on the old road tax rates. In such cases, the excess amount paid would be indicated on the vehicle's next road tax renewal notice, and would automatically be used to offset the road tax payable at the next renewal.

Vehicles transferred before its next road tax renewal would automatically have the excess road tax paid used to offset the total transfer fees payable. The remaining road tax, including excess road tax paid, will be transferred with the vehicle to the new registered owner.

In cases when the vehicle has been de-registered, the remaining unused portion of the road tax and any excess road tax paid will be automatically refunded to the last registered owner of the vehicle.

The revised road tax for buses, commercial vehicles and taxis as below.

|

The revised road tax rates will be indicated on the road tax renewal notices or GIRO payment schedules issued to affected vehicle owners.

Vehicle owners who have received road tax renewal notices or GIRO payment schedules prior to 10 May 2009, and renew their road tax on or after 10 May 2009 will pay based on the revised rates. They can refer to the aforesaid portal for the new rates. A new notice or GIRO payment schedule is not required for the road tax renewal.

There may be vehicle owners who have paid the road tax for their commercial vehicles, buses or taxis based on the old road tax rates. In such cases, the excess amount paid would be indicated on the vehicle's next road tax renewal notice, and would automatically be used to offset the road tax payable at the next renewal.

Vehicles transferred before its next road tax renewal would automatically have the excess road tax paid used to offset the total transfer fees payable. The remaining road tax, including excess road tax paid, will be transferred with the vehicle to the new registered owner.

In cases when the vehicle has been de-registered, the remaining unused portion of the road tax and any excess road tax paid will be automatically refunded to the last registered owner of the vehicle.

The revised road tax for buses, commercial vehicles and taxis as below.

Vehicle owners who have received road tax renewal notices or GIRO payment schedules prior to 10 May 2009, and renew their road tax on or after 10 May 2009 will pay based on the revised rates. They can refer to the aforesaid portal for the new rates. A new notice or GIRO payment schedule is not required for the road tax renewal.

There may be vehicle owners who have paid the road tax for their commercial vehicles, buses or taxis based on the old road tax rates. In such cases, the excess amount paid would be indicated on the vehicle's next road tax renewal notice, and would automatically be used to offset the road tax payable at the next renewal.

Vehicles transferred before its next road tax renewal would automatically have the excess road tax paid used to offset the total transfer fees payable. The remaining road tax, including excess road tax paid, will be transferred with the vehicle to the new registered owner.

In cases when the vehicle has been de-registered, the remaining unused portion of the road tax and any excess road tax paid will be automatically refunded to the last registered owner of the vehicle.

The revised road tax for buses, commercial vehicles and taxis as below.

|

Latest COE Prices

May 2025 | 1st BIDDING

NEXT TENDER: 21 May 2025

CAT A$103,009

CAT B$119,890

CAT C$62,590

CAT E$118,889

View Full Results Thank You For Your Subscription.