Four types of car accidents in Singapore that car insurance might not cover

15 Oct 2020|15,182 views

Traffic accidents happen. But sometimes, they involve complicating factors that can make their resolution and the resultant insurance claims difficult. We look at what some of these factors can entail for you if you are unfortunate enough to get into such a situation.

Speeding

If you are not at fault in a speeding-related accident, you might still be able to make a claim if you are able justify that the accident was not due to your fault. However, it will be very difficult to limit your liability if you've been found to have been speeding excessively.

If you do get caught in such a situation, be prepared to pay an excess on your claim since you will be filing a claim against your own policy. This could easily cost you $400 to $800, depending on the excess you had set with your insurer.

Do also note that If you were found to be at fault, your insurance premium could be jacked up by 30% to 50% following a claim.

Sgcarmart

Get up to 20% off and $300 cashback when you renew with select car insurance!

Compare car insurance effortlessly with Sgcarmart. Get exclusive offers, discounts and cashback when renewing car insurance with our partner.

Get a Quote nowIf you find yourself guilty of speeding, the penalties will depend on how far above the speed limit you have been driving.

Getting caught for exceeding the speed limit by 21km/h to 30km/h will net you six demerit points and a $200 composition fine, while exceeding it by more than 60km/h will net you a handsome 24 demerit points and a summon to show up in the courts.

This means a possible suspension of your license with possible imprisonment not just for speeding, but also for other reasons like reckless driving, and driving without consideration for other road users.

On the flipside, if you get into an accident with a speeding driver, try to get all video evidence from your car or surrounding street cameras to support your case for a claim. If the opposing vehicle with which you have been involved with an accident is indeed found to have been speeding, you could end up with decreasing your liability for the accident, which will aid in keeping your insurance premiums low in the long run.

Drink driving

If you're reading this after getting in an accident while driving under the influence, you're out of luck.

Don't even bother looking to your insurer for help. As drink driving is illegal to begin with, insurers will not pay for damages, injuries or loss resulting from such accidents. You'll have to fork out the expenses yourself.

Those convicted of drink-driving are liable to a fine of between $2,000 and $10,000 and/or up to one year's jail for a first-time offence. Repeat offenders should be prepared to face fines of between $5,000 and $20,000 and up to two years' jail.

Offenders will also be disqualified from holding or obtaining a driver's licence for at least two years (or at least five years for repeat offenders).

Reckless driving

Just got into an accident resulting from reckless driving? Be prepared to have your car insurance policy be voided afterwards.

If you do get into an accident as a result of reckless driving on the road, you will have to make a claim against your own policy since you are most likely to be at-fault and will suffer additional financial losses from an NCD drop and excess payments on the repair claims. This will be the case even if your offence is not compounded by an additional illegal offence such as drink driving.

If you do get caught for reckless driving, first-time offenders should be prepared to face a fine of up to $5,000 and/or jailed for up to 12 months. Repeat offenders face up to $10,000 in fines and/or up to two years in jail. This is assuming of course, that no one has been injured from your recklessness. The penalties ramp up dramatically if persons have been injured as a result of your actions, and even more so if people are killed.

Additionally, if you want to make sure that you do not get distracted while behind the wheel, make sure that you do not pick up your phone whenever your car is on the move. A common source of distraction for drivers comes from texting or making calls without a hands-free device.

Get caught for using a mobile communication device while driving and you could be looking at a fine of up to $1,000 or imprisonment for a term not exceeding six months or both.

And if you get hit by somebody that was texting? It will be very hard to prove the other driver was on the phone leading up to an accident. Your best hope to protect yourself against other distracted drivers is by getting a quality car camera so as to capture the moments leading up to the accident.

Hit and run

Caught in a hit and run incident?

Parked cars that are damaged should be reported to the police and your insurer right away. With these accidents, you should be covered and can file a claim. If you can, drive your car to the nearest authorised reporting centre within 24 hours of discovering the damage and submit a claim form with their help.

Additionally, if you have a dashcam or in-car camera, you can use it as additional evidence of the incident and see if you can somehow identify the driver.

Here are some articles that you might be interested in

Ultimate Guide to Car Insurance in Singapore

8 recommended car workshops that help you do motor accident repair and claims

How to make a car insurance claim after a car accident in Singapore

What factors affect your car insurance quotes?

Got into an accident? Here's how to ensure a smooth insurance claim process

Sgcarmart

Get up to 20% off and $300 cashback when you renew with select car insurance!

Compare car insurance effortlessly with Sgcarmart. Get exclusive offers, discounts and cashback when renewing car insurance with our partner.

- Auto comparison for your future renewal quotes

- We provide claims support for your accident claims

Traffic accidents happen. But sometimes, they involve complicating factors that can make their resolution and the resultant insurance claims difficult. We look at what some of these factors can entail for you if you are unfortunate enough to get into such a situation.

Speeding

Involved in an accident after driving at excessive speed? Limiting your liability is going to be an uphill struggle With the circuit breaker bringing down traffic volumes, more have been caught for speeding in the first-half of this year, according to the traffic police.

Involved in an accident after driving at excessive speed? Limiting your liability is going to be an uphill struggle With the circuit breaker bringing down traffic volumes, more have been caught for speeding in the first-half of this year, according to the traffic police.

If you are not at fault in a speeding-related accident, you might still be able to make a claim if you are able justify that the accident was not due to your fault. However, it will be very difficult to limit your liability if you've been found to have been speeding excessively.

If you do get caught in such a situation, be prepared to pay an excess on your claim since you will be filing a claim against your own policy. This could easily cost you $400 to $800, depending on the excess you had set with your insurer.

Do also note that If you were found to be at fault, your insurance premium could be jacked up by 30% to 50% following a claim.

If you find yourself guilty of speeding, the penalties will depend on how far above the speed limit you have been driving.

Getting caught for exceeding the speed limit by 21km/h to 30km/h will net you six demerit points and a $200 composition fine, while exceeding it by more than 60km/h will net you a handsome 24 demerit points and a summon to show up in the courts.

This means a possible suspension of your license with possible imprisonment not just for speeding, but also for other reasons like reckless driving, and driving without consideration for other road users.

On the flipside, if you get into an accident with a speeding driver, try to get all video evidence from your car or surrounding street cameras to support your case for a claim. If the opposing vehicle with which you have been involved with an accident is indeed found to have been speeding, you could end up with decreasing your liability for the accident, which will aid in keeping your insurance premiums low in the long run.

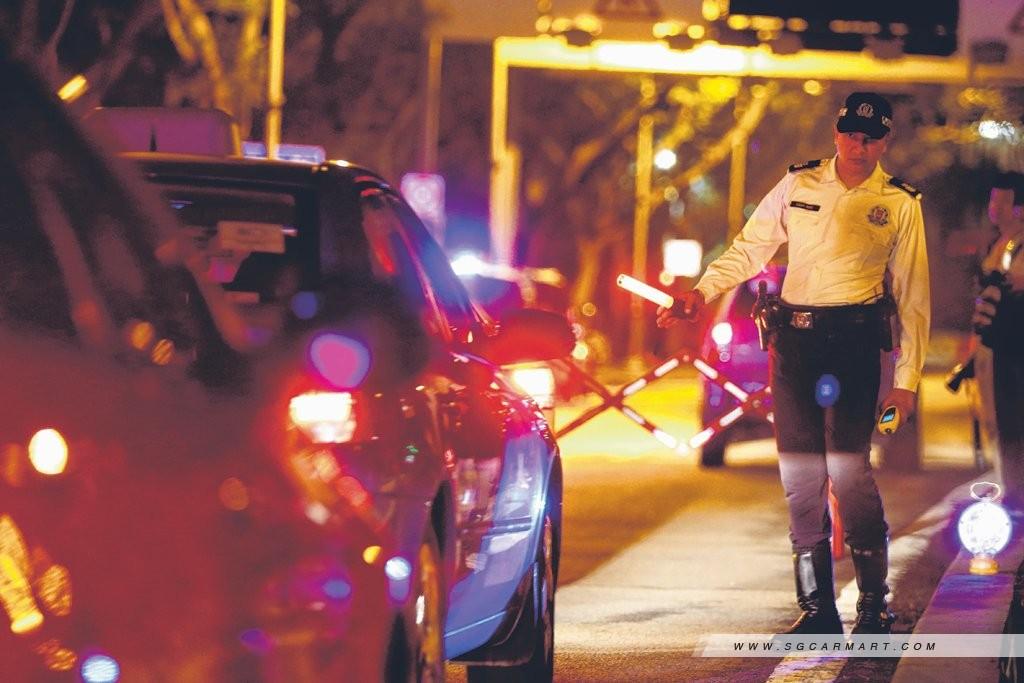

Drink driving

If you're reading this after getting in an accident while driving under the influence, you're out of luck.

Don't even bother looking to your insurer for help. As drink driving is illegal to begin with, insurers will not pay for damages, injuries or loss resulting from such accidents. You'll have to fork out the expenses yourself.

Those convicted of drink-driving are liable to a fine of between $2,000 and $10,000 and/or up to one year's jail for a first-time offence. Repeat offenders should be prepared to face fines of between $5,000 and $20,000 and up to two years' jail.

Offenders will also be disqualified from holding or obtaining a driver's licence for at least two years (or at least five years for repeat offenders).

Reckless driving

Just got into an accident resulting from reckless driving? Be prepared to have your car insurance policy be voided afterwards.

If you do get into an accident as a result of reckless driving on the road, you will have to make a claim against your own policy since you are most likely to be at-fault and will suffer additional financial losses from an NCD drop and excess payments on the repair claims. This will be the case even if your offence is not compounded by an additional illegal offence such as drink driving.

If you do get caught for reckless driving, first-time offenders should be prepared to face a fine of up to $5,000 and/or jailed for up to 12 months. Repeat offenders face up to $10,000 in fines and/or up to two years in jail. This is assuming of course, that no one has been injured from your recklessness. The penalties ramp up dramatically if persons have been injured as a result of your actions, and even more so if people are killed.

Additionally, if you want to make sure that you do not get distracted while behind the wheel, make sure that you do not pick up your phone whenever your car is on the move. A common source of distraction for drivers comes from texting or making calls without a hands-free device.

Get caught for using a mobile communication device while driving and you could be looking at a fine of up to $1,000 or imprisonment for a term not exceeding six months or both.

And if you get hit by somebody that was texting? It will be very hard to prove the other driver was on the phone leading up to an accident. Your best hope to protect yourself against other distracted drivers is by getting a quality car camera so as to capture the moments leading up to the accident.

Hit and run

Caught in a hit and run incident?

Parked cars that are damaged should be reported to the police and your insurer right away. With these accidents, you should be covered and can file a claim. If you can, drive your car to the nearest authorised reporting centre within 24 hours of discovering the damage and submit a claim form with their help.

Additionally, if you have a dashcam or in-car camera, you can use it as additional evidence of the incident and see if you can somehow identify the driver.

Here are some articles that you might be interested in

Ultimate Guide to Car Insurance in Singapore

8 recommended car workshops that help you do motor accident repair and claims

How to make a car insurance claim after a car accident in Singapore

What factors affect your car insurance quotes?

Got into an accident? Here's how to ensure a smooth insurance claim process

Speeding

If you are not at fault in a speeding-related accident, you might still be able to make a claim if you are able justify that the accident was not due to your fault. However, it will be very difficult to limit your liability if you've been found to have been speeding excessively.

If you do get caught in such a situation, be prepared to pay an excess on your claim since you will be filing a claim against your own policy. This could easily cost you $400 to $800, depending on the excess you had set with your insurer.

Do also note that If you were found to be at fault, your insurance premium could be jacked up by 30% to 50% following a claim.

Sgcarmart

Get up to 20% off and $300 cashback when you renew with select car insurance!

Compare car insurance effortlessly with Sgcarmart. Get exclusive offers, discounts and cashback when renewing car insurance with our partner.

Get a Quote nowIf you find yourself guilty of speeding, the penalties will depend on how far above the speed limit you have been driving.

Getting caught for exceeding the speed limit by 21km/h to 30km/h will net you six demerit points and a $200 composition fine, while exceeding it by more than 60km/h will net you a handsome 24 demerit points and a summon to show up in the courts.

This means a possible suspension of your license with possible imprisonment not just for speeding, but also for other reasons like reckless driving, and driving without consideration for other road users.

On the flipside, if you get into an accident with a speeding driver, try to get all video evidence from your car or surrounding street cameras to support your case for a claim. If the opposing vehicle with which you have been involved with an accident is indeed found to have been speeding, you could end up with decreasing your liability for the accident, which will aid in keeping your insurance premiums low in the long run.

Drink driving

If you're reading this after getting in an accident while driving under the influence, you're out of luck.

Don't even bother looking to your insurer for help. As drink driving is illegal to begin with, insurers will not pay for damages, injuries or loss resulting from such accidents. You'll have to fork out the expenses yourself.

Those convicted of drink-driving are liable to a fine of between $2,000 and $10,000 and/or up to one year's jail for a first-time offence. Repeat offenders should be prepared to face fines of between $5,000 and $20,000 and up to two years' jail.

Offenders will also be disqualified from holding or obtaining a driver's licence for at least two years (or at least five years for repeat offenders).

Reckless driving

Just got into an accident resulting from reckless driving? Be prepared to have your car insurance policy be voided afterwards.

If you do get into an accident as a result of reckless driving on the road, you will have to make a claim against your own policy since you are most likely to be at-fault and will suffer additional financial losses from an NCD drop and excess payments on the repair claims. This will be the case even if your offence is not compounded by an additional illegal offence such as drink driving.

If you do get caught for reckless driving, first-time offenders should be prepared to face a fine of up to $5,000 and/or jailed for up to 12 months. Repeat offenders face up to $10,000 in fines and/or up to two years in jail. This is assuming of course, that no one has been injured from your recklessness. The penalties ramp up dramatically if persons have been injured as a result of your actions, and even more so if people are killed.

Additionally, if you want to make sure that you do not get distracted while behind the wheel, make sure that you do not pick up your phone whenever your car is on the move. A common source of distraction for drivers comes from texting or making calls without a hands-free device.

Get caught for using a mobile communication device while driving and you could be looking at a fine of up to $1,000 or imprisonment for a term not exceeding six months or both.

And if you get hit by somebody that was texting? It will be very hard to prove the other driver was on the phone leading up to an accident. Your best hope to protect yourself against other distracted drivers is by getting a quality car camera so as to capture the moments leading up to the accident.

Hit and run

Caught in a hit and run incident?

Parked cars that are damaged should be reported to the police and your insurer right away. With these accidents, you should be covered and can file a claim. If you can, drive your car to the nearest authorised reporting centre within 24 hours of discovering the damage and submit a claim form with their help.

Additionally, if you have a dashcam or in-car camera, you can use it as additional evidence of the incident and see if you can somehow identify the driver.

Here are some articles that you might be interested in

Ultimate Guide to Car Insurance in Singapore

8 recommended car workshops that help you do motor accident repair and claims

How to make a car insurance claim after a car accident in Singapore

What factors affect your car insurance quotes?

Got into an accident? Here's how to ensure a smooth insurance claim process

Sgcarmart

Get up to 20% off and $300 cashback when you renew with select car insurance!

Compare car insurance effortlessly with Sgcarmart. Get exclusive offers, discounts and cashback when renewing car insurance with our partner.

- Auto comparison for your future renewal quotes

- We provide claims support for your accident claims