2023 round-up: Toyota, Merc lead again; BYD makes huge waves

31 Jan 2024|9,855 views

There are only three things certain in life: Death, (car) taxes, and a routine revelation by the LTA every end-Jan: About how our favourite carmakers have fared in Singapore over the past year.

As the dust continues to settle on the Motor Show weekend - and as the industry looks forward to a COE quota boost in the upcoming quarter - the figures for the new registrations of cars in 2023 are finally out. Following our normal drill, we'll start again with those centred solely on our authorised dealers.

| Rank | Carmaker | Units registered (Authorised Dealers) |

| 1 | Toyota (including Lexus) | 3,857 |

| 2 | Mercedes-Benz | 3,850 |

| 3 | BMW | 3,379 |

| 4 | BYD | 1,416 |

| 5 | Nissan | 1,329 |

| 6 | Mazda | 1,173 |

| 7 | Hyundai | 1,143 |

| 8 | Kia | 1,074 |

| 9 | Tesla | 940 |

| 10 | Audi | 678 |

After ceding the grand trophy to Mercedes-Benz in 2022, Toyota (including Lexus) re-clinches pole position for 2023 - but with 3,857 units registered across the 12 months, does so with a slight 3.5% decline.

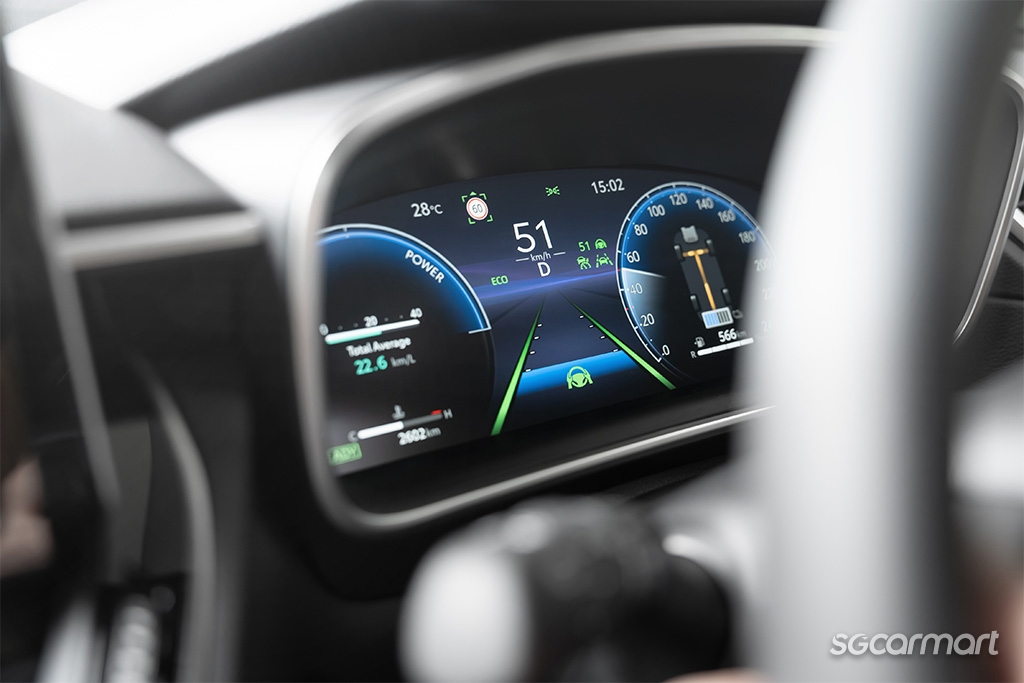

From its sedans to its crossovers and SUVs, Toyota's lineup has been thoroughly hybridised in Singapore

Expressing the company's pride at the victory, and attributing it to extensive hybridisation across the lineup, Mr. Khee Siong Ng, Managing Director of Inchcape Singapore, said, "We believe the popularity of hybrid vehicles will increase even further in 2024", citing the benefits offered to customers "in terms of improved fuel efficiency, better range confidence, [and a] smooth driving experience". He also promised an expansion of "hybrid as well as electric vehicle offerings in the foreseeable future".

Mercedes-Benz isn't too far behind, though - just seven units off, to be exact, with 3,850 units registered. Mr. Claudius Steinhoff, President and CEO of Daimler Southeast Asia, also expressed gratitude to customers, who "continue to place trust behind the Three-pointed Star".

But that's in the past for now; more important is the fact that Merc's strong performance looks set to continue, with the all-new E-Class freshly slowly rolling onto our roads. Mr. Steinhoff was also quick to point customers to "a slate of exciting new model launches that span our entire range" in 2024, before reiterating the firm's focus on "[reinvigorating] consumers' physical and digital experiences with our brand", as well as its "commitment to EV education and advocacy". He ended off by teasing the firm's concentration "on our top-end segment". (An electric G-Class concept car was showcased at the 2024 Motor Show.)

Rounding off the podium, BMW places third for a second consecutive year, with 3,379 units registered. (At this point, it's worth noting that like Toyota, both luxury brands also experienced slight declines.)

Outside of the top three, however, is where things start to get really interesting.

Registering 1,416 units via its authorised dealers, BYD vaults not just into the Top 10 for the first time, but confidently nestles in among the more exclusive Top 5-crew, placing at number four.

In the process, BYD clinches another accolade: It puts itself clearly ahead of arch-rival Tesla, after months of tussling, to officially become the bestselling electric-car brand in Singapore. (Tesla places further down, at ninth.) Back in June, the duo had been neck-at-neck - but BYD eventually (and decisively) gained the upper hand as the Q3 and Q4 progressed along. If your eyes aren't on the Chinese carmaker yet, there should be no better time to start paying attention than now.

Right on BYD's tail is an older name whose stronger-than-expected showing last year might surprise some: Nissan, with 1,336 units registered. The all-new X-Trail e-POWER and a facelifted Kicks e-POWER were both launched in 2023, even as the firm's existing e-POWER models continue to make ground. Thereafter, the rest of the names - the Koreans, the Japanese, and Audi - should likely be familiar once more.

Nonetheless, an interesting phenomenon to point out is that the mid-table players, when taken altogether, seem to have had a stronger year in 2023. This stands in direct contrast to what we've seen with the Top 3. In 2022, only the Top 5 managed a 1,000 or more units individually; in 2023, that accolade has been extended through the Top 8.

In case you were wondering, this isn't necessarily a clear indication that the market has remained impervious to the forces of COE premiums - but we'll get more into that later. But instead of questioning that for now, we suspect one question should be pressing more urgently on everyone's minds:

If BYD has now made it into the Top 10… Who has been forced out?

The answer? Honda. Registering just 673 units via its authorised dealer in 2023, it places at Number 11. Audi, on the other hand, holds on to the Top 10 with 678 AD units registered in 2023.

A different 2023 list - again

Again, it shouldn't be forgotten that the numbers from our authorised dealers only tell half the story. As such, the following is the Top 10 list for newly registered cars across the board in Singapore for 2023 (including parallel imported cars):

| Rank | Carmaker | Units registered (Overall) | Percentage change from 2022 |

| 1 | Toyota (including Lexus) | 7,248 | +13% |

| 2 | Mercedes-Benz | 4,317 | -18% |

| 3 | BMW | 3,436 | -8% |

| 4 | Honda | 2,631 | -20% |

| 5 | BYD | 1,416 | +80% |

| 6 | Nissan | 1,336 | +54% |

| 7 | Mazda | 1,176 | +4% |

| 8 | Hyundai | 1,143 | -32% |

| 9 | Kia | 1,074 | +28% |

| 10 | Tesla | 941 | +8% |

While most of the names and figures here look largely similar, peer closer and a few things should jump out clearly.

For starters, it's no longer surprising - but always worth mentioning - that Honda's brand presence in Singapore continues to be propped up by the parallel import market.

In fact, models like the Honda Vezel, Fit and Freed (also sold as the Freed by Honda's authorised dealer) seem so popular that they drove a total registration of 1,949 units in 2023 - or a good 74% of the 2,631 Hondas registered on the whole. Consequently, Honda supplants BYD for fourth place overall. (Audi, in turn, slips into 11th, with far less power in the grey import market).

Conversely, Toyota's popularity holds strong across the board even when taking into account parallel imports. The brand's authorised dealer-only figures may have fallen in 2023, but the 7,248 units registered in total translate to a 13% year-on-year increase.

To be clear, 53% of the numbers were still owed to Borneo Motors. Nonetheless, the larger rise on the whole suggests that parallel imported models fared better in 2023 than they did in 2022. (Notably, the past half-year has seen an influx of the latest-generation Toyota Aqua, and Voxy/Noah twins onto our roads.)

On this topic of authorised dealer versus parallel importer(s), Mercedes-Benz appears to have had its star power centralised more within its longtime appointed distributor, Cycle & Carriage, this time round. Only 467 units were registered with parallel importers in 2023 - compared to 926 units a year earlier.

Still, despite these varying trends, one overarching observation can be used to sum up the 2023 registrations… which is that the rise in COE premiums appears to have had no consistent effect on how each brand performed in Singapore last year.

| Rank | Carmaker | Units registered (Overall) | Percentage change from 2022 |

| 11 | Audi | 701 | -18% |

| 12 | Porsche | 595 | -29% |

| 13 | Volkswagen | 515 | +14% |

| 14 | Suzuki | 431 | +168% |

| 15 | Volvo | 404 | +20% |

| 16 | Peugeot | 314 | +4% |

| 17 | Citroen | 308 | -12% |

| 18 | MG | 301 | +11% |

| 19 | Skoda | 282 | +61% |

| 20 | Opel | 218 | -3% |

| 21 | MINI | 186 | -27% |

| 22 | Land Rover | 178 | -5% |

| 23 | Subaru | 140 | -7% |

| 24 | Polestar | 101 | -36% |

| 25 | Ferrari | 97 | +2% |

Consider this: Amidst $130,000 COEs in Cat B, and $100,000 COEs in Cat A, one would have expected luxury brands to clearly thrive, and conversely, 'mass market' marques to fall uniformly by the wayside.

This, however, hasn't turned out to be true - especially when one looks at the Top 25 in its entirety. In fact, the split between losers and winners is almost even, with 13 brands out of the Top 25 logging increased registrations in 2023.

While Honda, Hyundai and Citroen did all see registrations sliding, the same fate was suffered among Germany's luxury-centred Big Three: Audi, BMW and Merc. After two years of increased growth, Porsche also saw a 29% decline in 2023 - although its 12th-place positioning still isn't anything to scoff at. (The world-stopping arrival of the all-electric Macan just last week should likely help too, moving forward.)

On the other hand, however, brands you'd have expected to be hit severely by the COE price crisis actually managed some growth last year.

These include - as mentioned earlier - Toyota, BYD and Nissan, but also the likes of Kia, Mazda, Skoda, Suzuki and Volkswagen.

Blanket takes are incapable of nailing down why particular brands have lagged behind, even as others have moved forward. Still, delving deeper into who's won big(ger) this time may illuminate certain swaying factors in the market.

The biggest winners

In terms of relative growth, Suzuki was the biggest overall winner. With registrations jumping from just 161 units in 2022 to 431 units in 2023, it experienced a whopping 168% year-on-year bump.

On the one hand, the 258 units registered by authorised-dealer Champion Motors already greatly surpass the overall total of 161 units for 2022 - suggesting that the arrival of the S-Cross may have done the brand some favours.

In fact, this very factor - a revitalised lineup with either reintroduced or all-new models - appears to have helped names such as Volkswagen and Skoda, too.

Both brands, which saw registrations increase in 2023, reintroduced models (the 129bhp Volkswagen Golf, and the mild hybrid 1.0-litre Skoda Octavia) with tax-friendlier engines over the last 12 months. Skoda appears to have had a particularly impressive increase, with registrations growing by 60%.

As we return to Suzuki, however, the good 173 units registered by parallel importers also turns our attention to another new name: The Suzuki Landy Hybrid.

This, in turn, brings us to possible factor Number Two: Ride-hailing. Thanks to its hybrid drivetrain and ability to seat seven, the Landy Hybrid has quickly found favour as a private-hire vehicle (PHV).

Likewise, it's also not unreasonable to suspect that fellow-gainers such as Kia (with its latest Niro Hybrid and quirky Niro Plus Hybrid) and Mazda (with its Mazda3 Sedan) managed to find favours among buyers working for Grab and Gojek.

Having said all that, there was likely a third factor contributing to the rises and falls we saw in 2023…

A taller, bigger electric wave

BYD, of course, was another big winner. Although its relative 80% rise doesn't seem as drastic as Suzuki's, it did log the largest numerical increase of 636 additional units in 2023.

Here's where we think the perfect confluence of factors ushered the winds of prosperity in for the Chinese carmaker.

Firstly, BYD's marathoning e6 MPV continues to be a favourite among PHV-drivers. Secondly, the brand injected new life into its lineup in 2023, with introductions of the Dolphin, the Seal, and finally, a 100kW variant of the Atto 3 (the latter was refreshed for a second time just at the beginning of the 2024).

Apart from introducing a Cat A variant of the Atto 3, BYD also celebrated the launch of the Dolphin and the Seal in 2023

And finally, of course, it helps that all of these cars are fully electric.

| Rank | Carmaker | Fully electric units registered (overall) | Percentage change from 2022 |

| 1 | BYD | 1,416 | +80% |

| 2 | Tesla | 941 | +8% |

| 3 | BMW | 789 | +60% |

| 4 | Hyundai | 694 | +451% |

| 5 | Mercedes-Benz | 537 | +64% |

| 6 | MG | 178 | -22% |

| 7 | Volvo | 159 | +152% |

| 8 | Porsche | 131 | -29% |

| 9 | Peugeot | 119 | +250% |

| 10 | Opel | 106 | +45% |

| 11 | Polestar | 101 | -36% |

| 12 | Audi | 61 | -34% |

| 13 | ORA | 54 | N.A. |

| 14 | Kia | 53 | +1,667% |

| 15 | Toyota (including Lexus) | 43 | +617% |

Electric cars accounted for 18% of the total new cars registered in 2023. Last year, they took up 11.7%. In 2021, that number was a mere 3.8%.

A quick look at these figures will show that most carmakers have benefited from having electric models in their lineups.

Again, nothing is a surefire guarantee; Porsche, MG, Audi and Polestar all saw lower registrations for their electric offerings in 2023. Nonetheless, we'd argue that a large part of this was down to the lack of (brand) new options.

Instead of focusing on them, however, observe the winners. BMW and Mercedes-Benz both saw growth in the 60% range. Peugeot and Volvo gained even more still, posting high three-digit percentage increases. Even ORA, entirely fresh to Singapore and with only the Good Cat under its care so far, managed an impressive 54 units.

The most noteworthy brand, however, was a name that's recently become very closely-linked to Western Singapore.

It's hard to imagine how differently Hyundai's year would have played out without the presence of the Ioniq 5 and Ioniq 6. In fact, the 694 electric units it registered in 2023 - a 451% year-on-year rise - contributing to an overwhelming 61% of its total sum. As if that weren't enough, the all-electric lineup for the Korean brand expanded yet again just two weeks ago: When the new Kona Electric, and a single-motor Ioniq 6, were revealed at the Motor Show.

The Ioniq 5 and Ioniq 6 have both played a pivotal role in taking the Hyundai brand into a modern, all-electric era

We'll end off with this: The electric wave is well and truly upon us. And as many of these carmakers show, those ready to catch it stand to gain.

Don't forget to check out our previous analyses!

Mid-2023 leaderboard: Toyota leads, BYD and Tesla in Top 10

A different 2022 list: Toyota still leading, as Porsche and BYD knock on the Top 10's door

A different 2021 list: Toyota is still Singapore's king, but a new name is rising

There are only three things certain in life: Death, (car) taxes, and a routine revelation by the LTA every end-Jan: About how our favourite carmakers have fared in Singapore over the past year.

As the dust continues to settle on the Motor Show weekend - and as the industry looks forward to a COE quota boost in the upcoming quarter - the figures for the new registrations of cars in 2023 are finally out. Following our normal drill, we'll start again with those centred solely on our authorised dealers.

| Rank | Carmaker | Units registered (Authorised Dealers) |

| 1 | Toyota (including Lexus) | 3,857 |

| 2 | Mercedes-Benz | 3,850 |

| 3 | BMW | 3,379 |

| 4 | BYD | 1,416 |

| 5 | Nissan | 1,329 |

| 6 | Mazda | 1,173 |

| 7 | Hyundai | 1,143 |

| 8 | Kia | 1,074 |

| 9 | Tesla | 940 |

| 10 | Audi | 678 |

After ceding the grand trophy to Mercedes-Benz in 2022, Toyota (including Lexus) re-clinches pole position for 2023 - but with 3,857 units registered across the 12 months, does so with a slight 3.5% decline.

From its sedans to its crossovers and SUVs, Toyota's lineup has been thoroughly hybridised in Singapore

Expressing the company's pride at the victory, and attributing it to extensive hybridisation across the lineup, Mr. Khee Siong Ng, Managing Director of Inchcape Singapore, said, "We believe the popularity of hybrid vehicles will increase even further in 2024", citing the benefits offered to customers "in terms of improved fuel efficiency, better range confidence, [and a] smooth driving experience". He also promised an expansion of "hybrid as well as electric vehicle offerings in the foreseeable future".

Mercedes-Benz isn't too far behind, though - just seven units off, to be exact, with 3,850 units registered. Mr. Claudius Steinhoff, President and CEO of Daimler Southeast Asia, also expressed gratitude to customers, who "continue to place trust behind the Three-pointed Star".

But that's in the past for now; more important is the fact that Merc's strong performance looks set to continue, with the all-new E-Class freshly slowly rolling onto our roads. Mr. Steinhoff was also quick to point customers to "a slate of exciting new model launches that span our entire range" in 2024, before reiterating the firm's focus on "[reinvigorating] consumers' physical and digital experiences with our brand", as well as its "commitment to EV education and advocacy". He ended off by teasing the firm's concentration "on our top-end segment". (An electric G-Class concept car was showcased at the 2024 Motor Show.)

Rounding off the podium, BMW places third for a second consecutive year, with 3,379 units registered. (At this point, it's worth noting that like Toyota, both luxury brands also experienced slight declines.)

Outside of the top three, however, is where things start to get really interesting.

Registering 1,416 units via its authorised dealers, BYD vaults not just into the Top 10 for the first time, but confidently nestles in among the more exclusive Top 5-crew, placing at number four.

In the process, BYD clinches another accolade: It puts itself clearly ahead of arch-rival Tesla, after months of tussling, to officially become the bestselling electric-car brand in Singapore. (Tesla places further down, at ninth.) Back in June, the duo had been neck-at-neck - but BYD eventually (and decisively) gained the upper hand as the Q3 and Q4 progressed along. If your eyes aren't on the Chinese carmaker yet, there should be no better time to start paying attention than now.

Right on BYD's tail is an older name whose stronger-than-expected showing last year might surprise some: Nissan, with 1,336 units registered. The all-new X-Trail e-POWER and a facelifted Kicks e-POWER were both launched in 2023, even as the firm's existing e-POWER models continue to make ground. Thereafter, the rest of the names - the Koreans, the Japanese, and Audi - should likely be familiar once more.

Nonetheless, an interesting phenomenon to point out is that the mid-table players, when taken altogether, seem to have had a stronger year in 2023. This stands in direct contrast to what we've seen with the Top 3. In 2022, only the Top 5 managed a 1,000 or more units individually; in 2023, that accolade has been extended through the Top 8.

In case you were wondering, this isn't necessarily a clear indication that the market has remained impervious to the forces of COE premiums - but we'll get more into that later. But instead of questioning that for now, we suspect one question should be pressing more urgently on everyone's minds:

If BYD has now made it into the Top 10… Who has been forced out?

The answer? Honda. Registering just 673 units via its authorised dealer in 2023, it places at Number 11. Audi, on the other hand, holds on to the Top 10 with 678 AD units registered in 2023.

A different 2023 list - again

Again, it shouldn't be forgotten that the numbers from our authorised dealers only tell half the story. As such, the following is the Top 10 list for newly registered cars across the board in Singapore for 2023 (including parallel imported cars):

| Rank | Carmaker | Units registered (Overall) | Percentage change from 2022 |

| 1 | Toyota (including Lexus) | 7,248 | +13% |

| 2 | Mercedes-Benz | 4,317 | -18% |

| 3 | BMW | 3,436 | -8% |

| 4 | Honda | 2,631 | -20% |

| 5 | BYD | 1,416 | +80% |

| 6 | Nissan | 1,336 | +54% |

| 7 | Mazda | 1,176 | +4% |

| 8 | Hyundai | 1,143 | -32% |

| 9 | Kia | 1,074 | +28% |

| 10 | Tesla | 941 | +8% |

While most of the names and figures here look largely similar, peer closer and a few things should jump out clearly.

For starters, it's no longer surprising - but always worth mentioning - that Honda's brand presence in Singapore continues to be propped up by the parallel import market.

In fact, models like the Honda Vezel, Fit and Freed (also sold as the Freed by Honda's authorised dealer) seem so popular that they drove a total registration of 1,949 units in 2023 - or a good 74% of the 2,631 Hondas registered on the whole. Consequently, Honda supplants BYD for fourth place overall. (Audi, in turn, slips into 11th, with far less power in the grey import market).

Conversely, Toyota's popularity holds strong across the board even when taking into account parallel imports. The brand's authorised dealer-only figures may have fallen in 2023, but the 7,248 units registered in total translate to a 13% year-on-year increase.

To be clear, 53% of the numbers were still owed to Borneo Motors. Nonetheless, the larger rise on the whole suggests that parallel imported models fared better in 2023 than they did in 2022. (Notably, the past half-year has seen an influx of the latest-generation Toyota Aqua, and Voxy/Noah twins onto our roads.)

On this topic of authorised dealer versus parallel importer(s), Mercedes-Benz appears to have had its star power centralised more within its longtime appointed distributor, Cycle & Carriage, this time round. Only 467 units were registered with parallel importers in 2023 - compared to 926 units a year earlier.

Still, despite these varying trends, one overarching observation can be used to sum up the 2023 registrations… which is that the rise in COE premiums appears to have had no consistent effect on how each brand performed in Singapore last year.

| Rank | Carmaker | Units registered (Overall) | Percentage change from 2022 |

| 11 | Audi | 701 | -18% |

| 12 | Porsche | 595 | -29% |

| 13 | Volkswagen | 515 | +14% |

| 14 | Suzuki | 431 | +168% |

| 15 | Volvo | 404 | +20% |

| 16 | Peugeot | 314 | +4% |

| 17 | Citroen | 308 | -12% |

| 18 | MG | 301 | +11% |

| 19 | Skoda | 282 | +61% |

| 20 | Opel | 218 | -3% |

| 21 | MINI | 186 | -27% |

| 22 | Land Rover | 178 | -5% |

| 23 | Subaru | 140 | -7% |

| 24 | Polestar | 101 | -36% |

| 25 | Ferrari | 97 | +2% |

Consider this: Amidst $130,000 COEs in Cat B, and $100,000 COEs in Cat A, one would have expected luxury brands to clearly thrive, and conversely, 'mass market' marques to fall uniformly by the wayside.

This, however, hasn't turned out to be true - especially when one looks at the Top 25 in its entirety. In fact, the split between losers and winners is almost even, with 13 brands out of the Top 25 logging increased registrations in 2023.

While Honda, Hyundai and Citroen did all see registrations sliding, the same fate was suffered among Germany's luxury-centred Big Three: Audi, BMW and Merc. After two years of increased growth, Porsche also saw a 29% decline in 2023 - although its 12th-place positioning still isn't anything to scoff at. (The world-stopping arrival of the all-electric Macan just last week should likely help too, moving forward.)

On the other hand, however, brands you'd have expected to be hit severely by the COE price crisis actually managed some growth last year.

These include - as mentioned earlier - Toyota, BYD and Nissan, but also the likes of Kia, Mazda, Skoda, Suzuki and Volkswagen.

Blanket takes are incapable of nailing down why particular brands have lagged behind, even as others have moved forward. Still, delving deeper into who's won big(ger) this time may illuminate certain swaying factors in the market.

The biggest winners

In terms of relative growth, Suzuki was the biggest overall winner. With registrations jumping from just 161 units in 2022 to 431 units in 2023, it experienced a whopping 168% year-on-year bump.

On the one hand, the 258 units registered by authorised-dealer Champion Motors already greatly surpass the overall total of 161 units for 2022 - suggesting that the arrival of the S-Cross may have done the brand some favours.

In fact, this very factor - a revitalised lineup with either reintroduced or all-new models - appears to have helped names such as Volkswagen and Skoda, too.

Both brands, which saw registrations increase in 2023, reintroduced models (the 129bhp Volkswagen Golf, and the mild hybrid 1.0-litre Skoda Octavia) with tax-friendlier engines over the last 12 months. Skoda appears to have had a particularly impressive increase, with registrations growing by 60%.

As we return to Suzuki, however, the good 173 units registered by parallel importers also turns our attention to another new name: The Suzuki Landy Hybrid.

This, in turn, brings us to possible factor Number Two: Ride-hailing. Thanks to its hybrid drivetrain and ability to seat seven, the Landy Hybrid has quickly found favour as a private-hire vehicle (PHV).

Likewise, it's also not unreasonable to suspect that fellow-gainers such as Kia (with its latest Niro Hybrid and quirky Niro Plus Hybrid) and Mazda (with its Mazda3 Sedan) managed to find favours among buyers working for Grab and Gojek.

Having said all that, there was likely a third factor contributing to the rises and falls we saw in 2023…

A taller, bigger electric wave

BYD, of course, was another big winner. Although its relative 80% rise doesn't seem as drastic as Suzuki's, it did log the largest numerical increase of 636 additional units in 2023.

Here's where we think the perfect confluence of factors ushered the winds of prosperity in for the Chinese carmaker.

Firstly, BYD's marathoning e6 MPV continues to be a favourite among PHV-drivers. Secondly, the brand injected new life into its lineup in 2023, with introductions of the Dolphin, the Seal, and finally, a 100kW variant of the Atto 3 (the latter was refreshed for a second time just at the beginning of the 2024).

Apart from introducing a Cat A variant of the Atto 3, BYD also celebrated the launch of the Dolphin and the Seal in 2023

And finally, of course, it helps that all of these cars are fully electric.

| Rank | Carmaker | Fully electric units registered (overall) | Percentage change from 2022 |

| 1 | BYD | 1,416 | +80% |

| 2 | Tesla | 941 | +8% |

| 3 | BMW | 789 | +60% |

| 4 | Hyundai | 694 | +451% |

| 5 | Mercedes-Benz | 537 | +64% |

| 6 | MG | 178 | -22% |

| 7 | Volvo | 159 | +152% |

| 8 | Porsche | 131 | -29% |

| 9 | Peugeot | 119 | +250% |

| 10 | Opel | 106 | +45% |

| 11 | Polestar | 101 | -36% |

| 12 | Audi | 61 | -34% |

| 13 | ORA | 54 | N.A. |

| 14 | Kia | 53 | +1,667% |

| 15 | Toyota (including Lexus) | 43 | +617% |

Electric cars accounted for 18% of the total new cars registered in 2023. Last year, they took up 11.7%. In 2021, that number was a mere 3.8%.

A quick look at these figures will show that most carmakers have benefited from having electric models in their lineups.

Again, nothing is a surefire guarantee; Porsche, MG, Audi and Polestar all saw lower registrations for their electric offerings in 2023. Nonetheless, we'd argue that a large part of this was down to the lack of (brand) new options.

Instead of focusing on them, however, observe the winners. BMW and Mercedes-Benz both saw growth in the 60% range. Peugeot and Volvo gained even more still, posting high three-digit percentage increases. Even ORA, entirely fresh to Singapore and with only the Good Cat under its care so far, managed an impressive 54 units.

The most noteworthy brand, however, was a name that's recently become very closely-linked to Western Singapore.

It's hard to imagine how differently Hyundai's year would have played out without the presence of the Ioniq 5 and Ioniq 6. In fact, the 694 electric units it registered in 2023 - a 451% year-on-year rise - contributing to an overwhelming 61% of its total sum. As if that weren't enough, the all-electric lineup for the Korean brand expanded yet again just two weeks ago: When the new Kona Electric, and a single-motor Ioniq 6, were revealed at the Motor Show.

The Ioniq 5 and Ioniq 6 have both played a pivotal role in taking the Hyundai brand into a modern, all-electric era

We'll end off with this: The electric wave is well and truly upon us. And as many of these carmakers show, those ready to catch it stand to gain.

Don't forget to check out our previous analyses!

Mid-2023 leaderboard: Toyota leads, BYD and Tesla in Top 10

A different 2022 list: Toyota still leading, as Porsche and BYD knock on the Top 10's door

A different 2021 list: Toyota is still Singapore's king, but a new name is rising

Thank You For Your Subscription.