A fixed road tax should apply to all EVs in Singapore

10 Jun 2021|31,139 views

Earlier this year, Electric Vehicle (EV) incentives were enhanced, when bigger rebates under the Vehicular Emissions Scheme as well as the Electric Vehicle Early Adoption Incentive (EEVI) kicked in. Together, they accord an electric car buyer as much as $45,000 in tax breaks.

The EEVI provides an ARF rebate of 45% when car buyers purchase a fully electric car from 1 January 2021 to 31 December 2023. This is capped at a maximum rebate of $20,000.

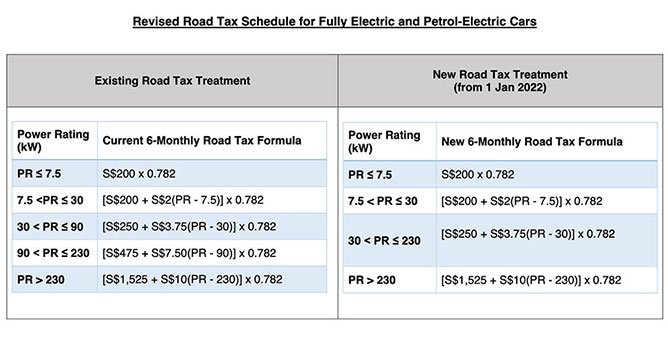

Then in March, in a move to remove another hurdle to adoption of cleaner vehicles, the Government announced that from January 1st 2022, road taxes for e-cars in the 90kW to 230kW power band would be adjusted further.

This will be achieved by merging the current electric car road tax bands of 30kW to 90kW and 90kW to 230kW, and subject them to the current road tax formula of the lower band.

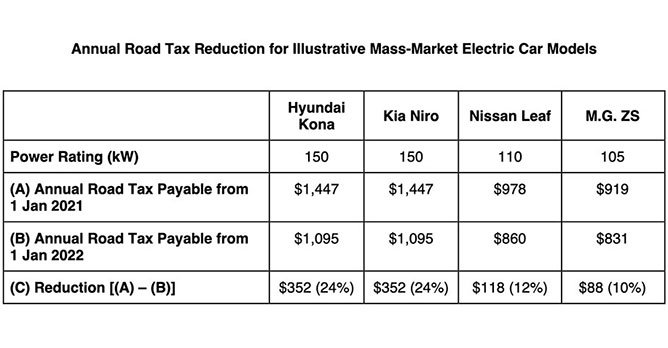

This will enable buyers of cars such as the Hyundai Kona Electric and Kia Niro Electric to save up to 24% on road tax.

"This way, we bring down the road taxes of electric cars in the upper band," Transport Minister Ong Ye Kung said, noting that with the change, the Hyundai Kona Electric will see its annual road tax fall from about $1,400 to $1,100.

Tiered road tax system for EVs makes no sense

While Mr. Ong added that this solution will make their road taxes comparable to Internal Combustion Engine (ICE) models with a similar look and feel, luxury EVs have been left out - to which Mr. Ong said these being "big luxurious cars... I prefer to leave them alone for now".

The Government, while doing its part to promote electric vehicles, is finding solutions that are temporary and isn't giving a proper explanation as to why these cars are being left out.

EVs that have a power rating of above 230kW will not see a change in their road tax. Yes, mass market electric cars that fall under the electric car road tax band of 90kW to 230kW benefit the most, but are the "big luxurious electric cars" any different from the 'mass market' ones?

Luxurious or not, big or small, electric vehicles all produce the same thing - zero tailpipe emissions. Car dealers are the ones who set the differences in costs, so the decision of paying more for a big luxurious car is on the buyers themselves.

Currently, there are a total of 18 electric vehicles offered by authorised dealers in Singapore. These include commercial vehicles from Maxus and BYD. With the revised solution offered by our Government, more than a quarter or over 27% of these electric models have been left out due to them being "big luxurious car".

These include the Audi e-tron, Audi e-tron Sportback, Porsche Taycan, Jaguar I-PACE and the Tesla Model 3. Upcoming electric vehicles such as the BMW i4, the BMW iX SUV as well as the Mercedes-Benz EQC will also sport an output rating of more than 230kW.

To make matter worse, there is also an additional charge of $700 per annum that will be added to the road tax for fully electric cars, since these cars do not pay fuel excise duties. This will be phased in over the next three years.

| Licensing Period | Annual Rate |

| 1 January 2021 to 31 December 2021 | $200 |

| 1 January 2022 to 31 December 2022 | $400 |

| 1 January 2023 onwards | $700 |

As a result, a Jaguar I-PACE's road tax will amount to $3,586 year compared to the Hyundai Kona Electric's most powerful variant of $1,646. That's 54% more expensive every year. On the other end of the spectrum, the Porsche Taycan's road tax can go up to as much as $7,746 per year.

A tiered road tax system for EVs is a senseless solution as an EV on-road environmental impact has absolutely no correlation to its power output.

Road tax should be a fixed amount for all EVs

Thus, in order to level the playing field and avoid complications, road tax for all EVs should be a fixed amount and should not exceed the road tax of a 1.0-litre ICE car, since a 1.0-litre ICE car has currently the lowest payable road tax of $390 a year, barring 660cc kei cars, which are far and few between in Singapore. Plus, the on-road environmental impact of any EV, regardless of power output, does not exceed that of a 1.0-litre ICE car.

All EVs should be pegged to the road tax of 90kW rating because the Government has already acknowledged that this is the highest rating before it qualifies to the next banding. After all, the Government did decide to combine the current electric car road tax bands of 30kW to 90kW and 90kW to 230kW, and subject them to the current road tax formula of the lower band.

This will set buyers back $371 a year on road tax, which is affordable and thus encouraging. However, if you were to consider the additional annual charge of $700, from 2023 onwards, EV owners will have to fork out slightly over $1,000 for their annual taxes.

However, this doesn't mean that it's comparable to a 1.8-litre ICE car, which has an annual road tax of $978, because an ICE owner is still paying for fuel excise duty when they pump petrol, which will add up to much more than just the payable road tax.

Hence, owning an EV with this solution will be more comparable to owning, but not exceeding, a 1.0-litre ICE car.

Arguably, these figures are arbitrary, but again, most figures that are currently put in place are also arbitrary (think 130bhp for Cat B COE). But taxes, be it for fuel, electricity or for the usage of our roads must be in place. After all, road tax in Singapore is a progressive system that serves its purpose of emission control, whereby bigger displacement capacity cars are taxed more due to a higher level of pollution.

However, because electric cars emit zero emissions, owners should not be paying based on power output, but they should nevertheless still pay because road tax also serves as an ownership tax, where owners of cars will have to pay whether the car is being utilised or not.

Not only will this help encourage the switch from ICE cars to EVs, all EVs - whether luxurious or not - can be included. And since EVs are less polluting, if a car has to be on the road, it is better to be an EV than ICE.

Earlier this year, Electric Vehicle (EV) incentives were enhanced, when bigger rebates under the Vehicular Emissions Scheme as well as the Electric Vehicle Early Adoption Incentive (EEVI) kicked in. Together, they accord an electric car buyer as much as $45,000 in tax breaks.

The EEVI provides an ARF rebate of 45% when car buyers purchase a fully electric car from 1 January 2021 to 31 December 2023. This is capped at a maximum rebate of $20,000.

Then in March, in a move to remove another hurdle to adoption of cleaner vehicles, the Government announced that from January 1st 2022, road taxes for e-cars in the 90kW to 230kW power band would be adjusted further.

This will be achieved by merging the current electric car road tax bands of 30kW to 90kW and 90kW to 230kW, and subject them to the current road tax formula of the lower band.

This will enable buyers of cars such as the Hyundai Kona Electric and Kia Niro Electric to save up to 24% on road tax.

"This way, we bring down the road taxes of electric cars in the upper band," Transport Minister Ong Ye Kung said, noting that with the change, the Hyundai Kona Electric will see its annual road tax fall from about $1,400 to $1,100.

Tiered road tax system for EVs makes no sense

While Mr. Ong added that this solution will make their road taxes comparable to Internal Combustion Engine (ICE) models with a similar look and feel, luxury EVs have been left out - to which Mr. Ong said these being "big luxurious cars... I prefer to leave them alone for now".

The Government, while doing its part to promote electric vehicles, is finding solutions that are temporary and isn't giving a proper explanation as to why these cars are being left out.

EVs that have a power rating of above 230kW will not see a change in their road tax. Yes, mass market electric cars that fall under the electric car road tax band of 90kW to 230kW benefit the most, but are the "big luxurious electric cars" any different from the 'mass market' ones?

Luxurious or not, big or small, electric vehicles all produce the same thing - zero tailpipe emissions. Car dealers are the ones who set the differences in costs, so the decision of paying more for a big luxurious car is on the buyers themselves.

Currently, there are a total of 18 electric vehicles offered by authorised dealers in Singapore. These include commercial vehicles from Maxus and BYD. With the revised solution offered by our Government, more than a quarter or over 27% of these electric models have been left out due to them being "big luxurious car".

These include the Audi e-tron, Audi e-tron Sportback, Porsche Taycan, Jaguar I-PACE and the Tesla Model 3. Upcoming electric vehicles such as the BMW i4, the BMW iX SUV as well as the Mercedes-Benz EQC will also sport an output rating of more than 230kW.

To make matter worse, there is also an additional charge of $700 per annum that will be added to the road tax for fully electric cars, since these cars do not pay fuel excise duties. This will be phased in over the next three years.

| Licensing Period | Annual Rate |

| 1 January 2021 to 31 December 2021 | $200 |

| 1 January 2022 to 31 December 2022 | $400 |

| 1 January 2023 onwards | $700 |

As a result, a Jaguar I-PACE's road tax will amount to $3,586 year compared to the Hyundai Kona Electric's most powerful variant of $1,646. That's 54% more expensive every year. On the other end of the spectrum, the Porsche Taycan's road tax can go up to as much as $7,746 per year.

A tiered road tax system for EVs is a senseless solution as an EV on-road environmental impact has absolutely no correlation to its power output.

Road tax should be a fixed amount for all EVs

Thus, in order to level the playing field and avoid complications, road tax for all EVs should be a fixed amount and should not exceed the road tax of a 1.0-litre ICE car, since a 1.0-litre ICE car has currently the lowest payable road tax of $390 a year, barring 660cc kei cars, which are far and few between in Singapore. Plus, the on-road environmental impact of any EV, regardless of power output, does not exceed that of a 1.0-litre ICE car.

All EVs should be pegged to the road tax of 90kW rating because the Government has already acknowledged that this is the highest rating before it qualifies to the next banding. After all, the Government did decide to combine the current electric car road tax bands of 30kW to 90kW and 90kW to 230kW, and subject them to the current road tax formula of the lower band.

This will set buyers back $371 a year on road tax, which is affordable and thus encouraging. However, if you were to consider the additional annual charge of $700, from 2023 onwards, EV owners will have to fork out slightly over $1,000 for their annual taxes.

However, this doesn't mean that it's comparable to a 1.8-litre ICE car, which has an annual road tax of $978, because an ICE owner is still paying for fuel excise duty when they pump petrol, which will add up to much more than just the payable road tax.

Hence, owning an EV with this solution will be more comparable to owning, but not exceeding, a 1.0-litre ICE car.

Arguably, these figures are arbitrary, but again, most figures that are currently put in place are also arbitrary (think 130bhp for Cat B COE). But taxes, be it for fuel, electricity or for the usage of our roads must be in place. After all, road tax in Singapore is a progressive system that serves its purpose of emission control, whereby bigger displacement capacity cars are taxed more due to a higher level of pollution.

However, because electric cars emit zero emissions, owners should not be paying based on power output, but they should nevertheless still pay because road tax also serves as an ownership tax, where owners of cars will have to pay whether the car is being utilised or not.

Not only will this help encourage the switch from ICE cars to EVs, all EVs - whether luxurious or not - can be included. And since EVs are less polluting, if a car has to be on the road, it is better to be an EV than ICE.

Thank You For Your Subscription.