COE Analysis July '25: More COEs, but premiums still rising

08 Jul 2025|11,972 views

COE price trend over the past quarter: April to June vs Jan to March

Back in April, the announcement that the COE quota was set to rise yet again by a healthy 6.4% for the May to July period may have spelled reprieve for those on the hunt for a new car.

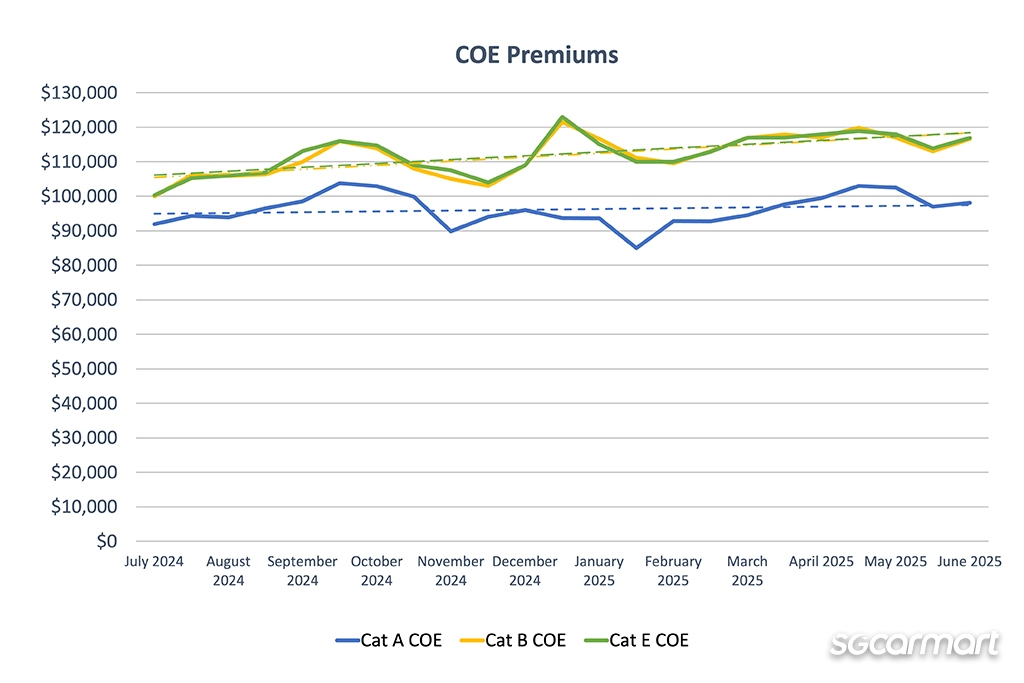

Two months on, however, the reality that we have perhaps gotten used to over the last few years was laid bare (again). The trend lines for COE premiums across all three passenger car categories - A, B and E - are still positive, meaning that prices have also continued to climb.

The most significant movements were seen in Category A (largely designated for mass market cars), which saw premiums rising by 8.2% when averaged out across the three months spanning April to June.

This marks the largest increase we've seen for the category since the second quarter of 2024. In our previous analysis, released in April this year, Cat A had experienced a 5.8% decline.

The averaged-out rise in Cat A can largely be attributed to the two bidding sessions in May, which saw premiums shooting over the $100,000 line again. In fact, the $103,009 figure that Cat A climbed to in the first of the two sessions marked a seven-month high - its highest point since October 2024.

When averaged out across April to June, Category B (for larger and more powerful cars) and E (the open category) also saw premiums rising, albeit more gently by 1.8% and 2.1% respectively, compared to the first quarter of 2025.

As for what may have sustained demand over the past quarter, it's worth remembering that the start of May saw the return of The Car Expo, at which 34 authorised and commercial distributors were present.

The Car Expo is often seen as a massive driver of sales for dealers, with the same holding true with May's iteration. Following the event, organiser SPH Media revealed that close to 900 cars (comprising those from both authorised dealers and used car dealers) were sold across the two days, garnering about $190 million in sales.

Electric models that were originally launched in Cat B but were recently reintroduced with Cat A variants include the facelifted Tesla Model Y and the Maxus MIFA 7

It's likely that the orders that flooded in over that weekend in early-May were instrumental keeping the pedal on rising COE prices.

With specific regard to Cat A, however, the relentless growth of competition - especially within the electric-only sphere - has likely had a huge impact on the market too.

Amongst recent electric models that were launched in Cat B, then later reintroduced into Cat with modified powertrains, are the Maxus MIFA 7, Volvo EX30, and facelifted Tesla Model Y RWD 110. Vertex Automobile is soon also set to welcome a single-motor rear-wheel drive variant of the Jaecoo J6, with a Cat A-friendly power output of 99kW.

Car de-registrations over the last 12 months

Worth reiterating is the LTA's promise that the COE quota will rise for every successive quarter until the COE supply reaches its expected peak sometime in 2026. Across the past three quarters, the quota has indeed climbed steadily: By 4% for the November 2024 to January 2025 period; 8% for the February to April 2025; and 6.4% for the current May 2025 to July 2025.

To jolt your memory slightly, a multitude of new measures including the cut-and-fill method and an additional injection of 20,000 COEs (set to be spread out over the next few years) have made predicting the COE quota for the upcoming period more and more of an uphill task.

Nonetheless, the fact remains that the bulk of the COE supply still consists of de-registrations, which see certificates being returned to the supply pool. (Specifically, the previous calculation method - prior to the cut-and-fill method and additional injection - depended on the 12-month rolling average of vehicle de-registrations.)

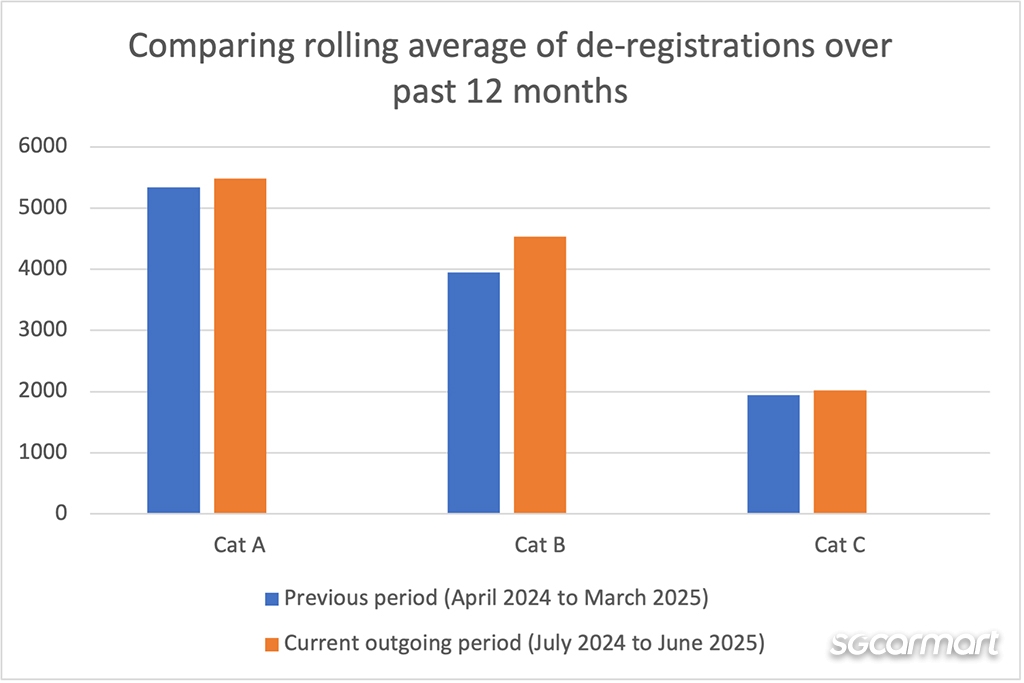

By extrapolating data from July 2024 to May 2025 out across 12 months, the data indicates that the overall rolling average of de-registrations for the July 2024 to June 2025 period will be 7.3% higher than that of the previous 12-month period (April 2024 to March 2025).

The increase in de-registrations is forecast to be led most strongly by Cat B, whose rolling average is set to rise by 14.9% from 3,951.

The data suggests that de-registrations in Cat A and Cat C (for commercial vehicles) are also set to increase respectively by 2.7% from 5,338 and by 4.4% from 1,939.

Omitting the interventions by the LTA, the projected increase in de-registrations would have contributed to an increase in the COE quota for the upcoming quarter.

New car pricing

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

As COE premiums trended upwards earlier, the sample of models we monitor reflected a 2% increase in new car prices over the second quarter of 2025, compared to the three-month average over the first quarter.

Unsurprisingly, prices for most Cat A models saw significant upticks in May when premiums for the category stood above $100,000. Following the month's uniform spike in COE premiums regardless of category, prices have softened slightly since - suggesting that car dealers are continuing to keep their pricing decisions in close step with how premiums swing.

As of end-June, mass market models including the Toyota Corolla Altis Elegance and BYD Atto 3 were retailing with listed prices north of $170,000 with COE.

Used car listings

Over the three-month period between March to May 2025, these were the five most listed used cars on Sgcarmart.

| Car model | Year of registration | Average annual depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $12,587 |

| Honda Civic 1.6A VTi | 2018 | $15,078 |

| Nissan Qashqai 1.2A DIG-T | 2016 | $10,874 |

| Mercedes-Benz C-Class C180 Avantgarde | 2017 | $18,745 |

| Mercedes-Benz C-Class C180 Avantgarde | 2016 | $17,640 |

As new car prices stabilised slightly over the past few quarters - and as Singaporean buyers appeared to be slowly adapting to and accepting the climate of six-figure COEs - we also noted that demand for used cars was starting to soften gradually. For instance, the average annual depreciation of the 2016-registered Honda Vezel stood at just $12,612 in our April 2025 analysis, compared to $15,430 in April 2024.

The latest listings, however, indicate that the annual depreciation figures for Sgcarmart's top listed used cars within the three-month period were effectively the same as the previous period (from December 2024 to this February). Once again, while April saw a slight dip, used car prices crept back upwards in May, in apparent response to the surge in COE premiums.

The slowing decline in used car prices - especially in May - may reflect a renewed interest in used cars as buyers are put off once again by the thought of forking out more than $100,000 just for the COE of a new car.

Given the relentlessness with which new electric brands are still entering the local market, it's possible that even an increased COE quota may not be able to outpace demand - and that the used car market may become more alluring again, as new car prices continue to creep upwards.

Here's a recount of our past three analyses!

COE Analysis Apr '25: Higher COE quota, high premiums still

COE Analysis Dec '24 : Recounting another unprecedented year

Late COE Analysis Oct '24: Premiums still trending upwards

COE price trend over the past quarter: April to June vs Jan to March

Back in April, the announcement that the COE quota was set to rise yet again by a healthy 6.4% for the May to July period may have spelled reprieve for those on the hunt for a new car.

Two months on, however, the reality that we have perhaps gotten used to over the last few years was laid bare (again). The trend lines for COE premiums across all three passenger car categories - A, B and E - are still positive, meaning that prices have also continued to climb.

The most significant movements were seen in Category A (largely designated for mass market cars), which saw premiums rising by 8.2% when averaged out across the three months spanning April to June.

This marks the largest increase we've seen for the category since the second quarter of 2024. In our previous analysis, released in April this year, Cat A had experienced a 5.8% decline.

The averaged-out rise in Cat A can largely be attributed to the two bidding sessions in May, which saw premiums shooting over the $100,000 line again. In fact, the $103,009 figure that Cat A climbed to in the first of the two sessions marked a seven-month high - its highest point since October 2024.

When averaged out across April to June, Category B (for larger and more powerful cars) and E (the open category) also saw premiums rising, albeit more gently by 1.8% and 2.1% respectively, compared to the first quarter of 2025.

As for what may have sustained demand over the past quarter, it's worth remembering that the start of May saw the return of The Car Expo, at which 34 authorised and commercial distributors were present.

The Car Expo is often seen as a massive driver of sales for dealers, with the same holding true with May's iteration. Following the event, organiser SPH Media revealed that close to 900 cars (comprising those from both authorised dealers and used car dealers) were sold across the two days, garnering about $190 million in sales.

Electric models that were originally launched in Cat B but were recently reintroduced with Cat A variants include the facelifted Tesla Model Y and the Maxus MIFA 7

It's likely that the orders that flooded in over that weekend in early-May were instrumental keeping the pedal on rising COE prices.

With specific regard to Cat A, however, the relentless growth of competition - especially within the electric-only sphere - has likely had a huge impact on the market too.

Amongst recent electric models that were launched in Cat B, then later reintroduced into Cat with modified powertrains, are the Maxus MIFA 7, Volvo EX30, and facelifted Tesla Model Y RWD 110. Vertex Automobile is soon also set to welcome a single-motor rear-wheel drive variant of the Jaecoo J6, with a Cat A-friendly power output of 99kW.

Car de-registrations over the last 12 months

Worth reiterating is the LTA's promise that the COE quota will rise for every successive quarter until the COE supply reaches its expected peak sometime in 2026. Across the past three quarters, the quota has indeed climbed steadily: By 4% for the November 2024 to January 2025 period; 8% for the February to April 2025; and 6.4% for the current May 2025 to July 2025.

To jolt your memory slightly, a multitude of new measures including the cut-and-fill method and an additional injection of 20,000 COEs (set to be spread out over the next few years) have made predicting the COE quota for the upcoming period more and more of an uphill task.

Nonetheless, the fact remains that the bulk of the COE supply still consists of de-registrations, which see certificates being returned to the supply pool. (Specifically, the previous calculation method - prior to the cut-and-fill method and additional injection - depended on the 12-month rolling average of vehicle de-registrations.)

By extrapolating data from July 2024 to May 2025 out across 12 months, the data indicates that the overall rolling average of de-registrations for the July 2024 to June 2025 period will be 7.3% higher than that of the previous 12-month period (April 2024 to March 2025).

The increase in de-registrations is forecast to be led most strongly by Cat B, whose rolling average is set to rise by 14.9% from 3,951.

The data suggests that de-registrations in Cat A and Cat C (for commercial vehicles) are also set to increase respectively by 2.7% from 5,338 and by 4.4% from 1,939.

Omitting the interventions by the LTA, the projected increase in de-registrations would have contributed to an increase in the COE quota for the upcoming quarter.

New car pricing

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

As COE premiums trended upwards earlier, the sample of models we monitor reflected a 2% increase in new car prices over the second quarter of 2025, compared to the three-month average over the first quarter.

Unsurprisingly, prices for most Cat A models saw significant upticks in May when premiums for the category stood above $100,000. Following the month's uniform spike in COE premiums regardless of category, prices have softened slightly since - suggesting that car dealers are continuing to keep their pricing decisions in close step with how premiums swing.

As of end-June, mass market models including the Toyota Corolla Altis Elegance and BYD Atto 3 were retailing with listed prices north of $170,000 with COE.

Used car listings

Over the three-month period between March to May 2025, these were the five most listed used cars on Sgcarmart.

| Car model | Year of registration | Average annual depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $12,587 |

| Honda Civic 1.6A VTi | 2018 | $15,078 |

| Nissan Qashqai 1.2A DIG-T | 2016 | $10,874 |

| Mercedes-Benz C-Class C180 Avantgarde | 2017 | $18,745 |

| Mercedes-Benz C-Class C180 Avantgarde | 2016 | $17,640 |

As new car prices stabilised slightly over the past few quarters - and as Singaporean buyers appeared to be slowly adapting to and accepting the climate of six-figure COEs - we also noted that demand for used cars was starting to soften gradually. For instance, the average annual depreciation of the 2016-registered Honda Vezel stood at just $12,612 in our April 2025 analysis, compared to $15,430 in April 2024.

The latest listings, however, indicate that the annual depreciation figures for Sgcarmart's top listed used cars within the three-month period were effectively the same as the previous period (from December 2024 to this February). Once again, while April saw a slight dip, used car prices crept back upwards in May, in apparent response to the surge in COE premiums.

The slowing decline in used car prices - especially in May - may reflect a renewed interest in used cars as buyers are put off once again by the thought of forking out more than $100,000 just for the COE of a new car.

Given the relentlessness with which new electric brands are still entering the local market, it's possible that even an increased COE quota may not be able to outpace demand - and that the used car market may become more alluring again, as new car prices continue to creep upwards.

Here's a recount of our past three analyses!

COE Analysis Apr '25: Higher COE quota, high premiums still

COE Analysis Dec '24 : Recounting another unprecedented year

Late COE Analysis Oct '24: Premiums still trending upwards

Thank You For Your Subscription.