COE prices continue to climb, and supply for upcoming quarter expected to increase slightly

05 Jan 2022|3,176 views

COE price trend over the past quarter

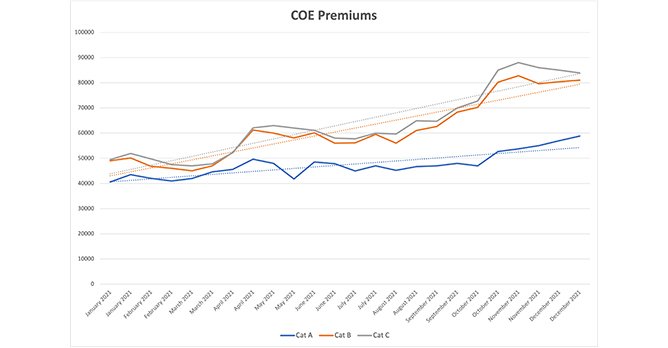

In the past quarter, COE premiums have continued to climb across the board.

Compared to the preceding quarter (Jul to Sep 2021), the average COE price across Oct to Dec 2021 is 16% higher for Cat A, 30% higher for Cat B, and 33% higher for Cat E. Across the board, COE prices have reached their highest mark in the past six years.

The trend for COE premiums is projected to continue to rise upwards. COE premiums across the past 10 years peaked from 2012-2014, so premiums in the coming years are expected to continue to rise accordingly. Many owners who reach the end of their 10-year COE cycle will likely be looking to purchase new cars. For buyers who are in the market for a new car right now, it would be prudent to buy now instead of waiting further, or to hold off on a new purchase until the peak has passed.

Vehicle deregistration data and COE supply projection

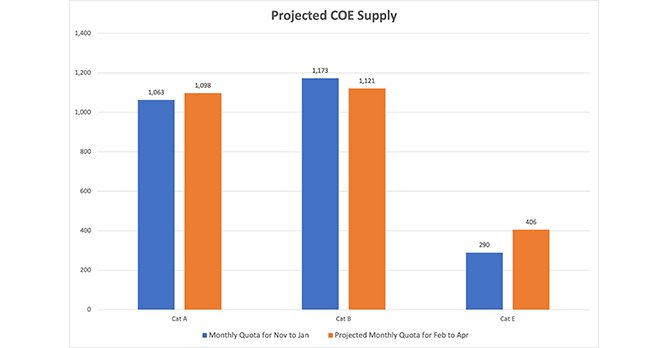

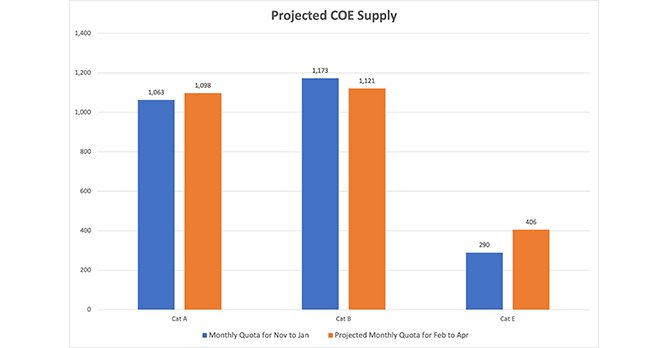

COE supply is projected to increase slightly due to higher vehicle deregistrations in Oct to Dec 2021 Based on statistical forecasting using latest data released by the LTA, the quota for the upcoming next Feb to Apr quarter is expected to increase by 4% for passenger cars (excluding commercial vehicle and motorbikes). This is extrapolated from the slightly higher vehicle deregistration figures in Oct to Dec 2021.

COE supply is projected to increase slightly due to higher vehicle deregistrations in Oct to Dec 2021 Based on statistical forecasting using latest data released by the LTA, the quota for the upcoming next Feb to Apr quarter is expected to increase by 4% for passenger cars (excluding commercial vehicle and motorbikes). This is extrapolated from the slightly higher vehicle deregistration figures in Oct to Dec 2021.

For Cat A, COE quota is projected to increase by 3% from a monthly average of 1,063. For Cat B, COE quota is projected to decrease by 4% from a monthly average of 1,173. For Cat E, COE quota is projected to increase by 40% from a monthly average of 290.

The slight increase in COE supply may help slow the climb in COE prices in the upcoming quarter, but prices are unlikely to move downwards. The extension of the zero growth rate until 2025 means that the total COE supply will continue to remain fixed.

New car pricing trend

Comparing car prices for popular new cars across authorised dealers, there was a 12% quarter on quarter increase in new car prices.

The average increase in new car prices is actually smaller than the overall increase in COE premiums. This indicates that there’s currently an outsized demand for COEs, partially driven by the surge in Tesla sales, as well as some uncertainty about potential future changes in COE supply in 2022.

Most popular used cars

Over the past three month period, these are the five most listed used cars on sgCarMart.

The Honda Vezel and Toyota Corolla Altis continue to the most popular used cars on sgCarMart. There continues to be a significant number of 2016 Vezels on the used car market, and this looks to continue into the new year.

Across the board, the average depreciation for used cars have increased slightly compared to the previous quarter. With COE prices rising to new highs, more buyers will likely turn to the used car market now, which then sees an understandable increase in prices across the board.

In the past quarter, COE premiums have continued to climb across the board.

Compared to the preceding quarter (Jul to Sep 2021), the average COE price across Oct to Dec 2021 is 16% higher for Cat A, 30% higher for Cat B, and 33% higher for Cat E. Across the board, COE prices have reached their highest mark in the past six years.

The trend for COE premiums is projected to continue to rise upwards. COE premiums across the past 10 years peaked from 2012-2014, so premiums in the coming years are expected to continue to rise accordingly. Many owners who reach the end of their 10-year COE cycle will likely be looking to purchase new cars. For buyers who are in the market for a new car right now, it would be prudent to buy now instead of waiting further, or to hold off on a new purchase until the peak has passed.

Vehicle deregistration data and COE supply projection

For Cat A, COE quota is projected to increase by 3% from a monthly average of 1,063. For Cat B, COE quota is projected to decrease by 4% from a monthly average of 1,173. For Cat E, COE quota is projected to increase by 40% from a monthly average of 290.

The slight increase in COE supply may help slow the climb in COE prices in the upcoming quarter, but prices are unlikely to move downwards. The extension of the zero growth rate until 2025 means that the total COE supply will continue to remain fixed.

New car pricing trend

Comparing car prices for popular new cars across authorised dealers, there was a 12% quarter on quarter increase in new car prices.

The average increase in new car prices is actually smaller than the overall increase in COE premiums. This indicates that there’s currently an outsized demand for COEs, partially driven by the surge in Tesla sales, as well as some uncertainty about potential future changes in COE supply in 2022.

Most popular used cars

Over the past three month period, these are the five most listed used cars on sgCarMart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $10,532/yr |

| Honda Vezel 1.5A X | 2017 | $10,557/yr |

| Toyota Corolla Altis 1.6A Elegance | 2016 | $10,590/yr |

| Honda Civic 1.6A VTi | 2018 | $11,152/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2015 | $17,505/yr |

The Honda Vezel and Toyota Corolla Altis continue to the most popular used cars on sgCarMart. There continues to be a significant number of 2016 Vezels on the used car market, and this looks to continue into the new year.

Across the board, the average depreciation for used cars have increased slightly compared to the previous quarter. With COE prices rising to new highs, more buyers will likely turn to the used car market now, which then sees an understandable increase in prices across the board.

COE price trend over the past quarter

In the past quarter, COE premiums have continued to climb across the board.

Compared to the preceding quarter (Jul to Sep 2021), the average COE price across Oct to Dec 2021 is 16% higher for Cat A, 30% higher for Cat B, and 33% higher for Cat E. Across the board, COE prices have reached their highest mark in the past six years.

The trend for COE premiums is projected to continue to rise upwards. COE premiums across the past 10 years peaked from 2012-2014, so premiums in the coming years are expected to continue to rise accordingly. Many owners who reach the end of their 10-year COE cycle will likely be looking to purchase new cars. For buyers who are in the market for a new car right now, it would be prudent to buy now instead of waiting further, or to hold off on a new purchase until the peak has passed.

Vehicle deregistration data and COE supply projection

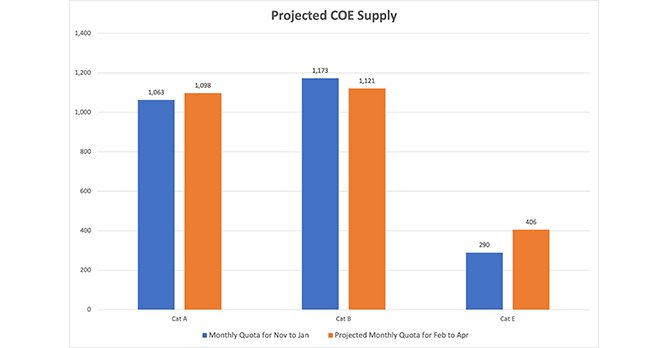

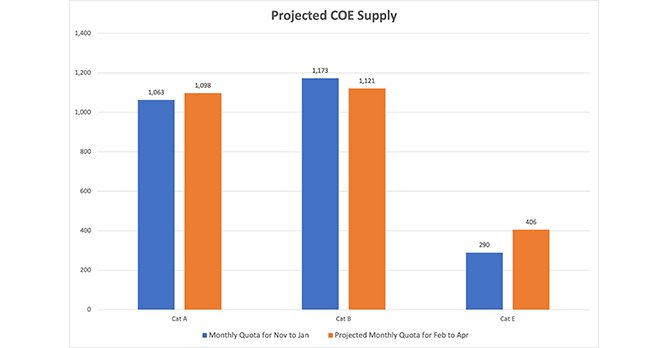

COE supply is projected to increase slightly due to higher vehicle deregistrations in Oct to Dec 2021 Based on statistical forecasting using latest data released by the LTA, the quota for the upcoming next Feb to Apr quarter is expected to increase by 4% for passenger cars (excluding commercial vehicle and motorbikes). This is extrapolated from the slightly higher vehicle deregistration figures in Oct to Dec 2021.

COE supply is projected to increase slightly due to higher vehicle deregistrations in Oct to Dec 2021 Based on statistical forecasting using latest data released by the LTA, the quota for the upcoming next Feb to Apr quarter is expected to increase by 4% for passenger cars (excluding commercial vehicle and motorbikes). This is extrapolated from the slightly higher vehicle deregistration figures in Oct to Dec 2021.

For Cat A, COE quota is projected to increase by 3% from a monthly average of 1,063. For Cat B, COE quota is projected to decrease by 4% from a monthly average of 1,173. For Cat E, COE quota is projected to increase by 40% from a monthly average of 290.

The slight increase in COE supply may help slow the climb in COE prices in the upcoming quarter, but prices are unlikely to move downwards. The extension of the zero growth rate until 2025 means that the total COE supply will continue to remain fixed.

New car pricing trend

Comparing car prices for popular new cars across authorised dealers, there was a 12% quarter on quarter increase in new car prices.

The average increase in new car prices is actually smaller than the overall increase in COE premiums. This indicates that there’s currently an outsized demand for COEs, partially driven by the surge in Tesla sales, as well as some uncertainty about potential future changes in COE supply in 2022.

Most popular used cars

Over the past three month period, these are the five most listed used cars on sgCarMart.

The Honda Vezel and Toyota Corolla Altis continue to the most popular used cars on sgCarMart. There continues to be a significant number of 2016 Vezels on the used car market, and this looks to continue into the new year.

Across the board, the average depreciation for used cars have increased slightly compared to the previous quarter. With COE prices rising to new highs, more buyers will likely turn to the used car market now, which then sees an understandable increase in prices across the board.

In the past quarter, COE premiums have continued to climb across the board.

Compared to the preceding quarter (Jul to Sep 2021), the average COE price across Oct to Dec 2021 is 16% higher for Cat A, 30% higher for Cat B, and 33% higher for Cat E. Across the board, COE prices have reached their highest mark in the past six years.

The trend for COE premiums is projected to continue to rise upwards. COE premiums across the past 10 years peaked from 2012-2014, so premiums in the coming years are expected to continue to rise accordingly. Many owners who reach the end of their 10-year COE cycle will likely be looking to purchase new cars. For buyers who are in the market for a new car right now, it would be prudent to buy now instead of waiting further, or to hold off on a new purchase until the peak has passed.

Vehicle deregistration data and COE supply projection

For Cat A, COE quota is projected to increase by 3% from a monthly average of 1,063. For Cat B, COE quota is projected to decrease by 4% from a monthly average of 1,173. For Cat E, COE quota is projected to increase by 40% from a monthly average of 290.

The slight increase in COE supply may help slow the climb in COE prices in the upcoming quarter, but prices are unlikely to move downwards. The extension of the zero growth rate until 2025 means that the total COE supply will continue to remain fixed.

New car pricing trend

Comparing car prices for popular new cars across authorised dealers, there was a 12% quarter on quarter increase in new car prices.

The average increase in new car prices is actually smaller than the overall increase in COE premiums. This indicates that there’s currently an outsized demand for COEs, partially driven by the surge in Tesla sales, as well as some uncertainty about potential future changes in COE supply in 2022.

Most popular used cars

Over the past three month period, these are the five most listed used cars on sgCarMart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $10,532/yr |

| Honda Vezel 1.5A X | 2017 | $10,557/yr |

| Toyota Corolla Altis 1.6A Elegance | 2016 | $10,590/yr |

| Honda Civic 1.6A VTi | 2018 | $11,152/yr |

| Mercedes-Benz C-Class C180 Avantgarde | 2015 | $17,505/yr |

The Honda Vezel and Toyota Corolla Altis continue to the most popular used cars on sgCarMart. There continues to be a significant number of 2016 Vezels on the used car market, and this looks to continue into the new year.

Across the board, the average depreciation for used cars have increased slightly compared to the previous quarter. With COE prices rising to new highs, more buyers will likely turn to the used car market now, which then sees an understandable increase in prices across the board.

Thank You For Your Subscription.