This tyre manufacturer prides itself more on providing value than being known as a 'premium' brand

04 Apr 2023|3,024 views

In an industry wherein there appears to be constant, heated competition among the biggest names as to who holds the most prestige, Triangle Tyre isn't bothered with striving towards the premium label.

That's not to say, however, that the company isn't established in its own right.

While it doesn't boast the same century-transcending history of other names, it's nonetheless amassed a fair bit of expertise and experience since its founding in 1976. Annual production stands at around 25 million tyres; its products are sold in close to 180 markets around the world.

Seven years ago - and exactly 40 years after it came into being - the company was even listed on the highly-coveted Shanghai Stock Exchange (SSE).

Rooted in China, but propagated far beyond into the reaches of the world - Singapore included

Prototype winter tyres are taken all the way to the heart of Ivalo, Finland, to get their limits pushed Perhaps more important, however, is the commitment Triangle has shown towards consistent yet also targeted growth since it first broke onto the scene.

Prototype winter tyres are taken all the way to the heart of Ivalo, Finland, to get their limits pushed Perhaps more important, however, is the commitment Triangle has shown towards consistent yet also targeted growth since it first broke onto the scene.

It hasn't forgotten its roots; the company is still headquartered where it first started, in the Chinese city of Weihai, Shandong, where its main research centre is located. But it's also been strategic with its expansion plans.

Another technical centre in the American city of Akron (known as the 'Rubber Capital of the World') has helped serve research and development efforts for a decade now. Special facilities in Spain and Finland are also utilised for testing summer and winter tyres respectively - ensuring that products are pushed to their limits, then refined, before they reach customers.

Triangle Tyre's products go through a strict testing regime before market release to ensure top quality If you ask the team, however, about where the business matters, the answer is even more ambitious: Everywhere. After official inroads into Europe, the U.S.A., the Middle East, and Australia, Triangle set up its first ever Asia Pacific office in Singapore over the pandemic period, signalling that it was becoming even more serious about strengthening its presence in the region.

Triangle Tyre's products go through a strict testing regime before market release to ensure top quality If you ask the team, however, about where the business matters, the answer is even more ambitious: Everywhere. After official inroads into Europe, the U.S.A., the Middle East, and Australia, Triangle set up its first ever Asia Pacific office in Singapore over the pandemic period, signalling that it was becoming even more serious about strengthening its presence in the region.

"Every office that we have around the world is localised - run by people from the region who know the market, who have been well experienced in the market for many years," Adrian Thio, General Manager of Triangle Tyre Asia Pacific (TTAP), tells us. This is crucial to business because even within Southeast Asia, cultures, the way of doing business, and even road and market conditions vary vastly.

Adrian Thio, GM of TTAP (left), believes the attention to specific market needs helps to differentiate Triangle "We collect market information; we bring the right networks and partnership in the market; and also, we bring the market demands and conditions back to headquarters," Adrian says of the globalisation plan. "That actually makes us, over time, more differentiated from the rest of the manufacturers from China."

Adrian Thio, GM of TTAP (left), believes the attention to specific market needs helps to differentiate Triangle "We collect market information; we bring the right networks and partnership in the market; and also, we bring the market demands and conditions back to headquarters," Adrian says of the globalisation plan. "That actually makes us, over time, more differentiated from the rest of the manufacturers from China."

To take an example hyper-specific to Singapore, the team, like you, has been watching the line between the private-hire vehicle model and the traditional model of strictly private car ownership blur over the past decade.

"In terms of commercially driven consumers, I think [our proposition] complements what they want in their vehicles and their day-to-day driving as well," Adrian says, as he points out that Triangle has always been focused on providing value.

The company already supplies tyres to Grab via its partners. "We need tyres for this kind of application; for fleet running," he asserts, before going to reiterate their presence here helps to translate this specific market trend to Triangle's headquarters for further product development.

The litheness and alertness of a tech-oriented and younger company

Wayne Foster (right), GM Global Marketing and GM Australia NZ, believes the tech that goes into tyres is likely to change dramatically with time Bearing the weight of their own legacies and also the sunk cost of investment in older production methods, some older competitors may be slower to pivot to what the market is shifting towards now.

Wayne Foster (right), GM Global Marketing and GM Australia NZ, believes the tech that goes into tyres is likely to change dramatically with time Bearing the weight of their own legacies and also the sunk cost of investment in older production methods, some older competitors may be slower to pivot to what the market is shifting towards now.

But on the note of changing trends in the industry, Triangle Tyre, as a younger company, is also demonstrating its light-footedness by embracing an ethos of rejuvenation and renewal rather than tradition and prestige.

As the competition only continues to stiffen, both profit margins and quality control have to remain. "Tyres is an industry that doesn't really go away - as long as there's cars, there will be tyres - but I think the technology that goes into them will change dramatically as vehicles change," Wayne Foster, General Manager Global Marketing and General Manager of Australia New Zealand, says.

The firm's manufacturing facility incorporates high levels of smart automation for efficiency and quality He points to one of Triangle's tyre factories: The facility makes 10 million tyres there annually, but employs only 300 people onsite, thanks to a system of automation. Terms like 'machine learning' and 'AI (articial intelligence)' are thrown in.

The firm's manufacturing facility incorporates high levels of smart automation for efficiency and quality He points to one of Triangle's tyre factories: The facility makes 10 million tyres there annually, but employs only 300 people onsite, thanks to a system of automation. Terms like 'machine learning' and 'AI (articial intelligence)' are thrown in.

In reference to Triangle's older contemporaries, Wayne says, "The technology base in that factory is completely different, and it's still a lot of manual processes that rely on operators building tyres." On the other hand, "a fully automated factory relies on the 100 engineers that are programming the stuff," he continues.

This helps consistency in quality, too - a bugbear that Chinese manufacturers had faced just 15 to 20 years ago.

EVs, as we all already know, will also form the bedrock of the auto industry very, very soon. And in tandem, manufacturing practices that are more environmentally sustainable will also take centrestage. "The Chinese are big on this - zero-waste, to landfill recycling, environmentally safe disposal," Wayne notes.

The duo believes that over the next few years, the divide between those who committed early - and those who are just seeing the light now - will start to show more clearly.

"We were one of the early adaptors of renewable energy among the tyre manufacturers," Adrian notes, pointing out that sustainable initatives the group had implemented early on (the plants run partially on solar power) are more steadily gaining traction today.

Honest value above all

To return to the brand's refusal to slap a 'premium' label onto itself, understanding the duo's reasoning behind this may help explain why.

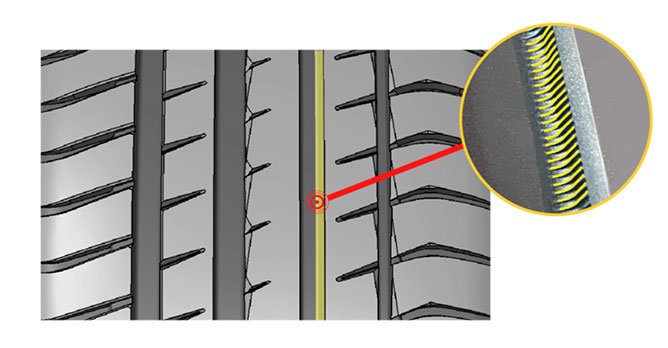

It's not so much that being perceived as high-end is negative in itself - in fact, the EffeX Sport tyre launched at its recent APAC conference targets the performance segment, and even boasts 'mute technology' on its longitudinal grooves for EV application.

But the company's focus is on value first and foremost.

Regardless of which segment it is present in, the firm's focus remains on providing value to customers Wayne points to Samsung's meteoric rise over the years as an example: "When they first started, they were a value brand. They used to make components for other names… Is it perceived as premium now? Yeah, probably. The distinctions will change (naturally) over time."

Regardless of which segment it is present in, the firm's focus remains on providing value to customers Wayne points to Samsung's meteoric rise over the years as an example: "When they first started, they were a value brand. They used to make components for other names… Is it perceived as premium now? Yeah, probably. The distinctions will change (naturally) over time."

"To tell people, 'Hey, we are very good, we are this' - I think that's not the point," Adrian adds. "We know where we are and where we stand."

"The good value for this price, on the other hand? Yes, that's our value proposition, that you know you get what you're paying for."

That's not to say, however, that the company isn't established in its own right.

While it doesn't boast the same century-transcending history of other names, it's nonetheless amassed a fair bit of expertise and experience since its founding in 1976. Annual production stands at around 25 million tyres; its products are sold in close to 180 markets around the world.

Seven years ago - and exactly 40 years after it came into being - the company was even listed on the highly-coveted Shanghai Stock Exchange (SSE).

Rooted in China, but propagated far beyond into the reaches of the world - Singapore included

It hasn't forgotten its roots; the company is still headquartered where it first started, in the Chinese city of Weihai, Shandong, where its main research centre is located. But it's also been strategic with its expansion plans.

Another technical centre in the American city of Akron (known as the 'Rubber Capital of the World') has helped serve research and development efforts for a decade now. Special facilities in Spain and Finland are also utilised for testing summer and winter tyres respectively - ensuring that products are pushed to their limits, then refined, before they reach customers.

"Every office that we have around the world is localised - run by people from the region who know the market, who have been well experienced in the market for many years," Adrian Thio, General Manager of Triangle Tyre Asia Pacific (TTAP), tells us. This is crucial to business because even within Southeast Asia, cultures, the way of doing business, and even road and market conditions vary vastly.

To take an example hyper-specific to Singapore, the team, like you, has been watching the line between the private-hire vehicle model and the traditional model of strictly private car ownership blur over the past decade.

"In terms of commercially driven consumers, I think [our proposition] complements what they want in their vehicles and their day-to-day driving as well," Adrian says, as he points out that Triangle has always been focused on providing value.

The company already supplies tyres to Grab via its partners. "We need tyres for this kind of application; for fleet running," he asserts, before going to reiterate their presence here helps to translate this specific market trend to Triangle's headquarters for further product development.

The litheness and alertness of a tech-oriented and younger company

But on the note of changing trends in the industry, Triangle Tyre, as a younger company, is also demonstrating its light-footedness by embracing an ethos of rejuvenation and renewal rather than tradition and prestige.

As the competition only continues to stiffen, both profit margins and quality control have to remain. "Tyres is an industry that doesn't really go away - as long as there's cars, there will be tyres - but I think the technology that goes into them will change dramatically as vehicles change," Wayne Foster, General Manager Global Marketing and General Manager of Australia New Zealand, says.

In reference to Triangle's older contemporaries, Wayne says, "The technology base in that factory is completely different, and it's still a lot of manual processes that rely on operators building tyres." On the other hand, "a fully automated factory relies on the 100 engineers that are programming the stuff," he continues.

This helps consistency in quality, too - a bugbear that Chinese manufacturers had faced just 15 to 20 years ago.

EVs, as we all already know, will also form the bedrock of the auto industry very, very soon. And in tandem, manufacturing practices that are more environmentally sustainable will also take centrestage. "The Chinese are big on this - zero-waste, to landfill recycling, environmentally safe disposal," Wayne notes.

The duo believes that over the next few years, the divide between those who committed early - and those who are just seeing the light now - will start to show more clearly.

"We were one of the early adaptors of renewable energy among the tyre manufacturers," Adrian notes, pointing out that sustainable initatives the group had implemented early on (the plants run partially on solar power) are more steadily gaining traction today.

Honest value above all

To return to the brand's refusal to slap a 'premium' label onto itself, understanding the duo's reasoning behind this may help explain why.

It's not so much that being perceived as high-end is negative in itself - in fact, the EffeX Sport tyre launched at its recent APAC conference targets the performance segment, and even boasts 'mute technology' on its longitudinal grooves for EV application.

But the company's focus is on value first and foremost.

"To tell people, 'Hey, we are very good, we are this' - I think that's not the point," Adrian adds. "We know where we are and where we stand."

"The good value for this price, on the other hand? Yes, that's our value proposition, that you know you get what you're paying for."

In an industry wherein there appears to be constant, heated competition among the biggest names as to who holds the most prestige, Triangle Tyre isn't bothered with striving towards the premium label.

That's not to say, however, that the company isn't established in its own right.

While it doesn't boast the same century-transcending history of other names, it's nonetheless amassed a fair bit of expertise and experience since its founding in 1976. Annual production stands at around 25 million tyres; its products are sold in close to 180 markets around the world.

Seven years ago - and exactly 40 years after it came into being - the company was even listed on the highly-coveted Shanghai Stock Exchange (SSE).

Rooted in China, but propagated far beyond into the reaches of the world - Singapore included

Prototype winter tyres are taken all the way to the heart of Ivalo, Finland, to get their limits pushed Perhaps more important, however, is the commitment Triangle has shown towards consistent yet also targeted growth since it first broke onto the scene.

Prototype winter tyres are taken all the way to the heart of Ivalo, Finland, to get their limits pushed Perhaps more important, however, is the commitment Triangle has shown towards consistent yet also targeted growth since it first broke onto the scene.

It hasn't forgotten its roots; the company is still headquartered where it first started, in the Chinese city of Weihai, Shandong, where its main research centre is located. But it's also been strategic with its expansion plans.

Another technical centre in the American city of Akron (known as the 'Rubber Capital of the World') has helped serve research and development efforts for a decade now. Special facilities in Spain and Finland are also utilised for testing summer and winter tyres respectively - ensuring that products are pushed to their limits, then refined, before they reach customers.

Triangle Tyre's products go through a strict testing regime before market release to ensure top quality If you ask the team, however, about where the business matters, the answer is even more ambitious: Everywhere. After official inroads into Europe, the U.S.A., the Middle East, and Australia, Triangle set up its first ever Asia Pacific office in Singapore over the pandemic period, signalling that it was becoming even more serious about strengthening its presence in the region.

Triangle Tyre's products go through a strict testing regime before market release to ensure top quality If you ask the team, however, about where the business matters, the answer is even more ambitious: Everywhere. After official inroads into Europe, the U.S.A., the Middle East, and Australia, Triangle set up its first ever Asia Pacific office in Singapore over the pandemic period, signalling that it was becoming even more serious about strengthening its presence in the region.

"Every office that we have around the world is localised - run by people from the region who know the market, who have been well experienced in the market for many years," Adrian Thio, General Manager of Triangle Tyre Asia Pacific (TTAP), tells us. This is crucial to business because even within Southeast Asia, cultures, the way of doing business, and even road and market conditions vary vastly.

Adrian Thio, GM of TTAP (left), believes the attention to specific market needs helps to differentiate Triangle "We collect market information; we bring the right networks and partnership in the market; and also, we bring the market demands and conditions back to headquarters," Adrian says of the globalisation plan. "That actually makes us, over time, more differentiated from the rest of the manufacturers from China."

To take an example hyper-specific to Singapore, the team, like you, has been watching the line between the private-hire vehicle model and the traditional model of strictly private car ownership blur over the past decade.

"In terms of commercially driven consumers, I think [our proposition] complements what they want in their vehicles and their day-to-day driving as well," Adrian says, as he points out that Triangle has always been focused on providing value.

The company already supplies tyres to Grab via its partners. "We need tyres for this kind of application; for fleet running," he asserts, before going to reiterate their presence here helps to translate this specific market trend to Triangle's headquarters for further product development.

The litheness and alertness of a tech-oriented and younger company

Wayne Foster (right), GM Global Marketing and GM Australia NZ, believes the tech that goes into tyres is likely to change dramatically with time Bearing the weight of their own legacies and also the sunk cost of investment in older production methods, some older competitors may be slower to pivot to what the market is shifting towards now.

Wayne Foster (right), GM Global Marketing and GM Australia NZ, believes the tech that goes into tyres is likely to change dramatically with time Bearing the weight of their own legacies and also the sunk cost of investment in older production methods, some older competitors may be slower to pivot to what the market is shifting towards now.

But on the note of changing trends in the industry, Triangle Tyre, as a younger company, is also demonstrating its light-footedness by embracing an ethos of rejuvenation and renewal rather than tradition and prestige.

As the competition only continues to stiffen, both profit margins and quality control have to remain. "Tyres is an industry that doesn't really go away - as long as there's cars, there will be tyres - but I think the technology that goes into them will change dramatically as vehicles change," Wayne Foster, General Manager Global Marketing and General Manager of Australia New Zealand, says.

The firm's manufacturing facility incorporates high levels of smart automation for efficiency and quality He points to one of Triangle's tyre factories: The facility makes 10 million tyres there annually, but employs only 300 people onsite, thanks to a system of automation. Terms like 'machine learning' and 'AI (articial intelligence)' are thrown in.

The firm's manufacturing facility incorporates high levels of smart automation for efficiency and quality He points to one of Triangle's tyre factories: The facility makes 10 million tyres there annually, but employs only 300 people onsite, thanks to a system of automation. Terms like 'machine learning' and 'AI (articial intelligence)' are thrown in.

In reference to Triangle's older contemporaries, Wayne says, "The technology base in that factory is completely different, and it's still a lot of manual processes that rely on operators building tyres." On the other hand, "a fully automated factory relies on the 100 engineers that are programming the stuff," he continues.

This helps consistency in quality, too - a bugbear that Chinese manufacturers had faced just 15 to 20 years ago.

EVs, as we all already know, will also form the bedrock of the auto industry very, very soon. And in tandem, manufacturing practices that are more environmentally sustainable will also take centrestage. "The Chinese are big on this - zero-waste, to landfill recycling, environmentally safe disposal," Wayne notes.

The duo believes that over the next few years, the divide between those who committed early - and those who are just seeing the light now - will start to show more clearly.

"We were one of the early adaptors of renewable energy among the tyre manufacturers," Adrian notes, pointing out that sustainable initatives the group had implemented early on (the plants run partially on solar power) are more steadily gaining traction today.

Honest value above all

To return to the brand's refusal to slap a 'premium' label onto itself, understanding the duo's reasoning behind this may help explain why.

It's not so much that being perceived as high-end is negative in itself - in fact, the EffeX Sport tyre launched at its recent APAC conference targets the performance segment, and even boasts 'mute technology' on its longitudinal grooves for EV application.

But the company's focus is on value first and foremost.

Regardless of which segment it is present in, the firm's focus remains on providing value to customers Wayne points to Samsung's meteoric rise over the years as an example: "When they first started, they were a value brand. They used to make components for other names… Is it perceived as premium now? Yeah, probably. The distinctions will change (naturally) over time."

Regardless of which segment it is present in, the firm's focus remains on providing value to customers Wayne points to Samsung's meteoric rise over the years as an example: "When they first started, they were a value brand. They used to make components for other names… Is it perceived as premium now? Yeah, probably. The distinctions will change (naturally) over time."

"To tell people, 'Hey, we are very good, we are this' - I think that's not the point," Adrian adds. "We know where we are and where we stand."

"The good value for this price, on the other hand? Yes, that's our value proposition, that you know you get what you're paying for."

That's not to say, however, that the company isn't established in its own right.

While it doesn't boast the same century-transcending history of other names, it's nonetheless amassed a fair bit of expertise and experience since its founding in 1976. Annual production stands at around 25 million tyres; its products are sold in close to 180 markets around the world.

Seven years ago - and exactly 40 years after it came into being - the company was even listed on the highly-coveted Shanghai Stock Exchange (SSE).

Rooted in China, but propagated far beyond into the reaches of the world - Singapore included

It hasn't forgotten its roots; the company is still headquartered where it first started, in the Chinese city of Weihai, Shandong, where its main research centre is located. But it's also been strategic with its expansion plans.

Another technical centre in the American city of Akron (known as the 'Rubber Capital of the World') has helped serve research and development efforts for a decade now. Special facilities in Spain and Finland are also utilised for testing summer and winter tyres respectively - ensuring that products are pushed to their limits, then refined, before they reach customers.

"Every office that we have around the world is localised - run by people from the region who know the market, who have been well experienced in the market for many years," Adrian Thio, General Manager of Triangle Tyre Asia Pacific (TTAP), tells us. This is crucial to business because even within Southeast Asia, cultures, the way of doing business, and even road and market conditions vary vastly.

Adrian Thio, GM of TTAP (left), believes the attention to specific market needs helps to differentiate Triangle

To take an example hyper-specific to Singapore, the team, like you, has been watching the line between the private-hire vehicle model and the traditional model of strictly private car ownership blur over the past decade.

"In terms of commercially driven consumers, I think [our proposition] complements what they want in their vehicles and their day-to-day driving as well," Adrian says, as he points out that Triangle has always been focused on providing value.

The company already supplies tyres to Grab via its partners. "We need tyres for this kind of application; for fleet running," he asserts, before going to reiterate their presence here helps to translate this specific market trend to Triangle's headquarters for further product development.

The litheness and alertness of a tech-oriented and younger company

But on the note of changing trends in the industry, Triangle Tyre, as a younger company, is also demonstrating its light-footedness by embracing an ethos of rejuvenation and renewal rather than tradition and prestige.

As the competition only continues to stiffen, both profit margins and quality control have to remain. "Tyres is an industry that doesn't really go away - as long as there's cars, there will be tyres - but I think the technology that goes into them will change dramatically as vehicles change," Wayne Foster, General Manager Global Marketing and General Manager of Australia New Zealand, says.

In reference to Triangle's older contemporaries, Wayne says, "The technology base in that factory is completely different, and it's still a lot of manual processes that rely on operators building tyres." On the other hand, "a fully automated factory relies on the 100 engineers that are programming the stuff," he continues.

This helps consistency in quality, too - a bugbear that Chinese manufacturers had faced just 15 to 20 years ago.

EVs, as we all already know, will also form the bedrock of the auto industry very, very soon. And in tandem, manufacturing practices that are more environmentally sustainable will also take centrestage. "The Chinese are big on this - zero-waste, to landfill recycling, environmentally safe disposal," Wayne notes.

The duo believes that over the next few years, the divide between those who committed early - and those who are just seeing the light now - will start to show more clearly.

"We were one of the early adaptors of renewable energy among the tyre manufacturers," Adrian notes, pointing out that sustainable initatives the group had implemented early on (the plants run partially on solar power) are more steadily gaining traction today.

Honest value above all

To return to the brand's refusal to slap a 'premium' label onto itself, understanding the duo's reasoning behind this may help explain why.

It's not so much that being perceived as high-end is negative in itself - in fact, the EffeX Sport tyre launched at its recent APAC conference targets the performance segment, and even boasts 'mute technology' on its longitudinal grooves for EV application.

But the company's focus is on value first and foremost.

"To tell people, 'Hey, we are very good, we are this' - I think that's not the point," Adrian adds. "We know where we are and where we stand."

"The good value for this price, on the other hand? Yes, that's our value proposition, that you know you get what you're paying for."

Thank You For Your Subscription.