COE Analysis Apr '24: Every category is finally below $100k

02 Apr 2024|48,828 views

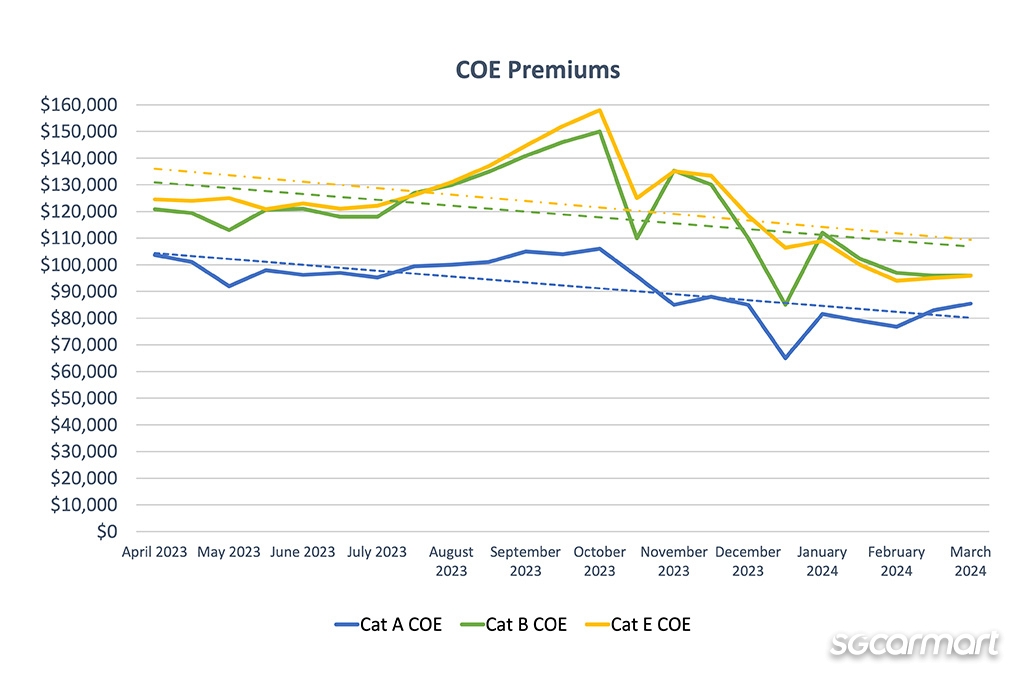

COE price trend over the past quarter: January to March 2024 vs October to December 2023

The fluctuations are still there, but the trendlines do not lie: COE premiums appear to be on a steady decline. This holds across the board - regardless of whether we're talking about Category A, B or E.

Averaged out over January to March this year, COE premiums saw a significant slide across all categories. Cat A is down by 16.5%, while Cat B logged an even steeper fall of 24.7%.

But by far the most significant decline was seen in Cat E - which fell by 27%. Since we're drilling down now into the specific categories, it should be noted that this also marks the first time in a year that COE prices in Cat B and E have fallen quarter over quarter.

In tandem, buyers will also be glad to note: We have finally reached a point - for the time being at least - where that cruel certificate will not cost you more than six figures, regardless of what car you choose to buy today. At the time of writing, Cat A is at $85,489; Cat B, at $96,011; and the open Cat E, at $95,856. (The next bidding round hits this Wednesday.)

For the present and near future at least, all of this appears to indicate that the cut-and-fill approach recently adopted by the authorities is working.

Notably, COE supply has continued to rise as promised. Given the downward trend of COE premiums over the past quarter, it should come as no surprise, too, that no major announcements have been made regarding further tinkering with the system.

Amidst the general trends, we've still witnessed a few interesting outlier events.

For instance, the lowest that we saw COE premiums in Categories A and B go within the first quarter of the year remains the first bidding round in January (and of the entire 2024) - right before the Motor Show weekend. At that point, Cat A slid down to $65,010, while Cat B slid down to $85,010. Both categories have not fallen to those lows since.

As expected, in light of the imminent tightening of the Vehicular Emissions Scheme (VES) in January, a spike in registrations for new cars was also noted in December last year. For the month, Cat A registrations spiked to 2,593 units, while those in Cat B rose to 2,125 units. The last time registrations crossed the 2,000 line for both categories was in January 2021 and September 2021 respectively.

As for what's on the horizon next - keep a look out for The Car Expo, which is set to happen in mid-April...

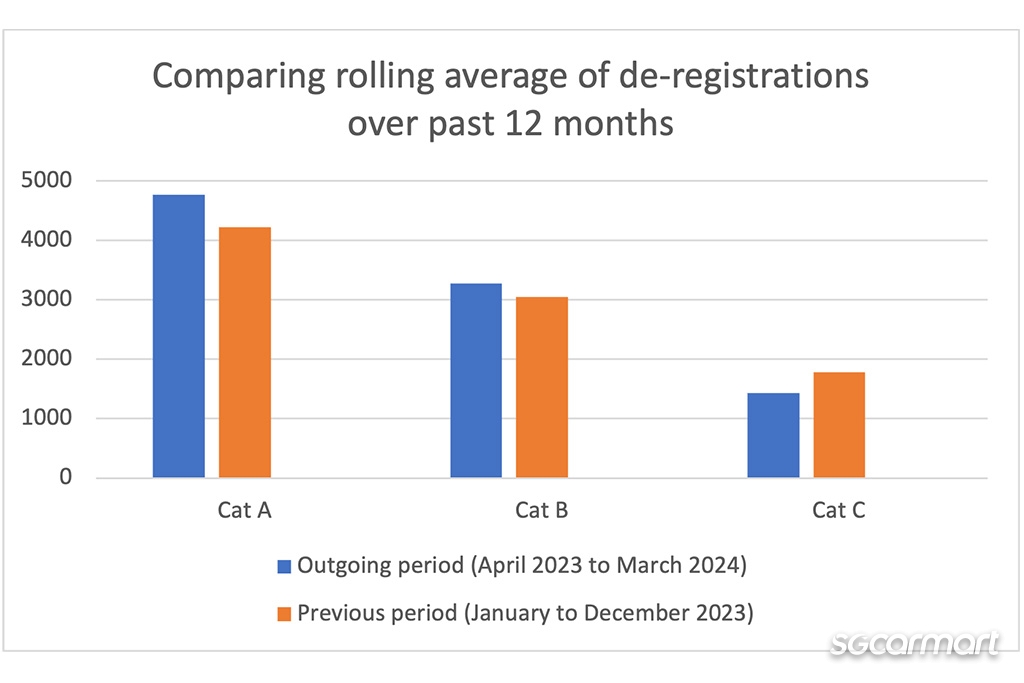

Vehicle de-registrations - still on the rise

As mentioned in our previous analysis, the new cut-and-fill approach completely eliminates any possibility of meaningfully predicting the COE supply for the upcoming period. The only data point we can now work with concerns vehicle de-registrations - which help form the lion's share of certificates returned to the supply pool.

To recap once more, the LTA currently relies on the moving average of de-registrations over the past year (divided by four) to determine the baseline supply pool of COEs for the upcoming quarter. This is then augmented by COEs taken from the impending de-registrations in the coming years, based on the cut-and-fill approach.

By extrapolating data from April 2023 to February 2024 out across 12 months, our data indicates that the overall rolling average of de-registrations for the April 2023 to March 2024 period will be 5% higher than that in the previous 12-month period (January to December 2023).

Once more, the increase in de-registrations should be led by the passenger car categories - albeit with a sharper rise on both fronts this time. The figure for Cat A is projected to rise 13% from 4,229, while the figure for Cat B is projected to rise more gently - by 7%, from 3,044 previously.

Conversely, the figure for Cat C (commercial vehicles) is estimated to dip again - by a more pronounced 19%.

De-registrations from all three categories ultimately contribute to the supply pool in the open Cat E.

Again, without any extra intervention by the LTA, the overall increase in de-registrations is likely to have resulted in a boost to the COE quota in the upcoming quarter.

New car pricing: January to March 2024

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

As COE prices continue to trend downwards, car prices have slid in tandem too. Based on our sample, there was a 3% slide in new car prices over the past quarter (January to March 2024), when compared to the tri-monthly average between October to December 2023.

Considering the extent to which COE premiums appear to have fallen, it might seem surprising at first that prices have not been slashed as sharply.

While we are not privy to the price-setting determinants that influence our authorised dealers, one possible explanation concerns the multitude of factors affecting new car prices in 2024.

These include the kicking in (at last) of the full 9% rate for our Goods and Services Tax (GST); a tightened VES banding scheme, as mentioned earlier; and also revisions to the EV Early Adoption Incentive (EEAI) scheme - all of which affect a proportion of the models we look at to varying degrees.

Moving forward, observing how prices continue to trend in relation to the swing of COE premiums should give us a clearer picture of the response of our dealers - that is, barring any unexpected and major external forces of influence, of course.

Most popular used cars: December 2023 to February 2024

Over the three-month period between December 2023 to February 2024, these were the five most listed used cars on Sgcarmart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $15,430 |

| Mercedes-Benz C-Class C180 Avantgarde | 2016 | $21,964 |

| Nissan Qashqai 1.2A DIG-T | 2016 | $14,042 |

| Honda Civic 1.6A VTi | 2018 | $15,572 |

| Honda Civic 1.6A VTi | 2019 | $16,326 |

As you might expect, used car prices appear to have moved in step with the downward trend of COE premiums. After almost eclipsing the $16,000 line, the annual depreciation figure for our evergreen marker - the 2016-registered Honda Vezel - now seems to be floating gently back down, and stands at approximately $15,400 when averaged out across the period.

Most telling is its February 2024 figure, however. The average annual depreciation figure for the Vezel clocked in at $14,901 for the month, making it the lowest we've seen since April 2023.

It speaks to the frenzied state of the market just half a year ago that an annual depreciation of $15,000 now for a seven-year old Honda Vezel brings some comfort.

If the aforementioned trends hold, however, hopefully this isn't where the slide ends - but you'll have to check back in again in three months.

Here's a look back again on our past three COE analyses!

COE Analysis Jan '24: We don't know how to forecast anymore

Oct '23: COE quota forecast to remain level come November

COE Analysis July '23: COE supply forecast to rise in August

COE price trend over the past quarter: January to March 2024 vs October to December 2023

The fluctuations are still there, but the trendlines do not lie: COE premiums appear to be on a steady decline. This holds across the board - regardless of whether we're talking about Category A, B or E.

Averaged out over January to March this year, COE premiums saw a significant slide across all categories. Cat A is down by 16.5%, while Cat B logged an even steeper fall of 24.7%.

But by far the most significant decline was seen in Cat E - which fell by 27%. Since we're drilling down now into the specific categories, it should be noted that this also marks the first time in a year that COE prices in Cat B and E have fallen quarter over quarter.

In tandem, buyers will also be glad to note: We have finally reached a point - for the time being at least - where that cruel certificate will not cost you more than six figures, regardless of what car you choose to buy today. At the time of writing, Cat A is at $85,489; Cat B, at $96,011; and the open Cat E, at $95,856. (The next bidding round hits this Wednesday.)

For the present and near future at least, all of this appears to indicate that the cut-and-fill approach recently adopted by the authorities is working.

Notably, COE supply has continued to rise as promised. Given the downward trend of COE premiums over the past quarter, it should come as no surprise, too, that no major announcements have been made regarding further tinkering with the system.

Amidst the general trends, we've still witnessed a few interesting outlier events.

For instance, the lowest that we saw COE premiums in Categories A and B go within the first quarter of the year remains the first bidding round in January (and of the entire 2024) - right before the Motor Show weekend. At that point, Cat A slid down to $65,010, while Cat B slid down to $85,010. Both categories have not fallen to those lows since.

As expected, in light of the imminent tightening of the Vehicular Emissions Scheme (VES) in January, a spike in registrations for new cars was also noted in December last year. For the month, Cat A registrations spiked to 2,593 units, while those in Cat B rose to 2,125 units. The last time registrations crossed the 2,000 line for both categories was in January 2021 and September 2021 respectively.

As for what's on the horizon next - keep a look out for The Car Expo, which is set to happen in mid-April...

Vehicle de-registrations - still on the rise

As mentioned in our previous analysis, the new cut-and-fill approach completely eliminates any possibility of meaningfully predicting the COE supply for the upcoming period. The only data point we can now work with concerns vehicle de-registrations - which help form the lion's share of certificates returned to the supply pool.

To recap once more, the LTA currently relies on the moving average of de-registrations over the past year (divided by four) to determine the baseline supply pool of COEs for the upcoming quarter. This is then augmented by COEs taken from the impending de-registrations in the coming years, based on the cut-and-fill approach.

By extrapolating data from April 2023 to February 2024 out across 12 months, our data indicates that the overall rolling average of de-registrations for the April 2023 to March 2024 period will be 5% higher than that in the previous 12-month period (January to December 2023).

Once more, the increase in de-registrations should be led by the passenger car categories - albeit with a sharper rise on both fronts this time. The figure for Cat A is projected to rise 13% from 4,229, while the figure for Cat B is projected to rise more gently - by 7%, from 3,044 previously.

Conversely, the figure for Cat C (commercial vehicles) is estimated to dip again - by a more pronounced 19%.

De-registrations from all three categories ultimately contribute to the supply pool in the open Cat E.

Again, without any extra intervention by the LTA, the overall increase in de-registrations is likely to have resulted in a boost to the COE quota in the upcoming quarter.

New car pricing: January to March 2024

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

As COE prices continue to trend downwards, car prices have slid in tandem too. Based on our sample, there was a 3% slide in new car prices over the past quarter (January to March 2024), when compared to the tri-monthly average between October to December 2023.

Considering the extent to which COE premiums appear to have fallen, it might seem surprising at first that prices have not been slashed as sharply.

While we are not privy to the price-setting determinants that influence our authorised dealers, one possible explanation concerns the multitude of factors affecting new car prices in 2024.

These include the kicking in (at last) of the full 9% rate for our Goods and Services Tax (GST); a tightened VES banding scheme, as mentioned earlier; and also revisions to the EV Early Adoption Incentive (EEAI) scheme - all of which affect a proportion of the models we look at to varying degrees.

Moving forward, observing how prices continue to trend in relation to the swing of COE premiums should give us a clearer picture of the response of our dealers - that is, barring any unexpected and major external forces of influence, of course.

Most popular used cars: December 2023 to February 2024

Over the three-month period between December 2023 to February 2024, these were the five most listed used cars on Sgcarmart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $15,430 |

| Mercedes-Benz C-Class C180 Avantgarde | 2016 | $21,964 |

| Nissan Qashqai 1.2A DIG-T | 2016 | $14,042 |

| Honda Civic 1.6A VTi | 2018 | $15,572 |

| Honda Civic 1.6A VTi | 2019 | $16,326 |

As you might expect, used car prices appear to have moved in step with the downward trend of COE premiums. After almost eclipsing the $16,000 line, the annual depreciation figure for our evergreen marker - the 2016-registered Honda Vezel - now seems to be floating gently back down, and stands at approximately $15,400 when averaged out across the period.

Most telling is its February 2024 figure, however. The average annual depreciation figure for the Vezel clocked in at $14,901 for the month, making it the lowest we've seen since April 2023.

It speaks to the frenzied state of the market just half a year ago that an annual depreciation of $15,000 now for a seven-year old Honda Vezel brings some comfort.

If the aforementioned trends hold, however, hopefully this isn't where the slide ends - but you'll have to check back in again in three months.

Here's a look back again on our past three COE analyses!

COE Analysis Jan '24: We don't know how to forecast anymore

Oct '23: COE quota forecast to remain level come November

COE Analysis July '23: COE supply forecast to rise in August

Thank You For Your Subscription.