EEAI extension and VES adjustment: Analysing the impact

08 Sep 2025|11,639 views

The Land Transport Authority (LTA) has announced that the EV Early Adoption Incentive (EEAI) will be extended to the end of 2026, while the Vehicle Emissions Scheme (VES) will be extended to the end of 2027 with some notable adjustments to its banding, rebates and surcharges.

This is big news to drivers, especially those who are (or may soon be) in the market for a new car.

Here, we analyse some of the likely effects that these changes will have immediately, as well as when they kick in on 1 January 2026.

1. Car prices are all going up in 2026, and likely again in 2027

The long and short of this announcement is that car prices are all going up in 2026 (not accounting for COE changes).

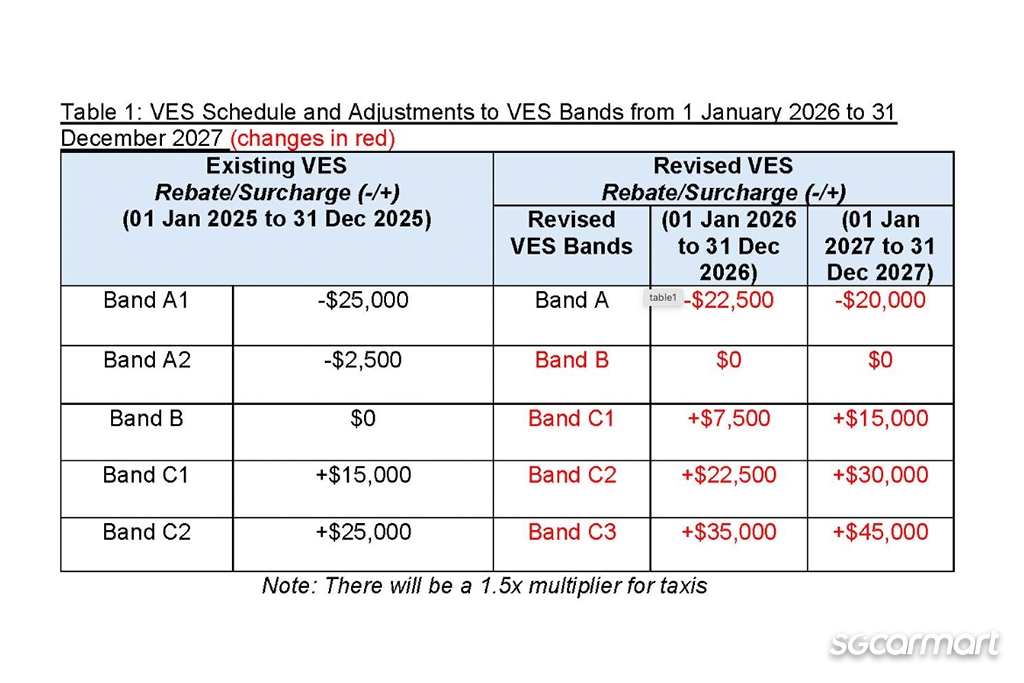

For the VES, the actual banding categories have not changed in terms of the pollutant thresholds. Basically, what as A1, A2, B, C1 and C2 have effectively been renamed A, B, C1, C2 and C3.

What has changed, however, is the dollar value associated to each band. Put simply, rebates have been lowered and surcharges have been raised, meaning everything has effectively gone up from a cost perspective.

The financial impact of the revised EEAI is slightly more complicated. The maximum rebate remains at 45% of the car's ARF, but now capped at $7,500, down from $15,000. Because both VES and EEAI rebates are offset from a car's ARF, with these new adjustments, only EVs with an ARF of no more than $30,000 will not see prices increase due to these changes.

Any EV with ARF higher than $30,000 will see prices increase. Given the tiered ARF structure, that means that a car with an OMV higher than $27,143 will be impacted. A quick search on Sgcarmart indicates that the Aion V Premium, currently priced at $167,888 has an OMV of $28,000. There are presently only 8 EVs (not including parallel imported car) listed that are priced under that price point: BYD Atto 2, JMEV Elight, Dongfeng Box, Omoda E5, Aion Y Plus, Seres 3, Aion ES, and Opel Mokka-e (in descending price order). This means that almost all EVs will be getting more expensive.

Barring a handful of cars like the Aion Y Plus and Dongfeng Box, this is a blanket tax increase across the entire car market

For all other cars, prices will go up, as no non-EV in the market currently will even get close the to minimum $5,000 ARF floor even with current rebate levels. The cheapest current non-EV car (not including PI cars), the Suzuki Swift, has an OMV of $14,000.

So let's be quite clear about this: Barring a handful of cars, this is a blanket tax increase.

2027 will likely see another step up in car prices, as the EEAI is stopped altogether, and the respective VES rebates and surcharges are reduced/increased respectively.

2. COE prices are going to climb immediately

The natural and obvious tie-in consequence will happen immediately: COE is going to go up (again!).

It's even in LTA's press release: "We expect short-term increase in COE prices. Potential car buyers are strongly encouraged to be prudent in bidding for COEs."

Not sure how the second part is going to happen, but the first part is a no-brainer. Customers are going to want to lock in their purchases before these changes kick in, and similarly distributors will want to secure orders by 31 December 2025 (especially those holding a large amount of stock. Those cars will just become more expensive overnight when the calendar turns over).

Expect Cat A premiums to continue to set all-time highs. Cat B is likely to follow.

3. Used car prices will go up

The used car market tends to move in tandem with the new car market. And with new car prices likely to go up, the used car market will probably follow suit.

4. Reduced savings

With these changes, drivers' savings, even if they buy the 'cleanest' cars available, will be reduced. LTA's statement that "buyers will receive combined cost savings of up to $30,000 and $20,000 off the ARF for electric cars registered in 2026 and 2027, respectively" is technically accurate, but also slightly misleading. As we've previously explored, the real-world savings are not as simple as adding up the rebate values.

Those savings will fall further come 2027, when the VES rebate for EVs drop another $2,500, and EEAI is eliminated altogether.

5. A greater EV push

These changes clearly signal that the LTA and NEA (and by extension the Government) are pushing EV adoption relative to all other types of cars.

The one notable victim are hybrid cars - most of them fall into the current A2 banding, and the VES adjustments means they no longer get any rebates. Considering they are being touted as a good in-between solution between EVs and more-pollutive ICE cars, and likely a not small part of that cleaner vehicle vision, it's perhaps a little surprising that the rebate has been eliminated altogether.

Given that the EEAI is set to expire in 2027, 2026 will likely see a big push from distributors to put EVs on the road. Questions persist about whether customers are ready (seemingly more so than ever before), and whether the infrastructure will be ready to support this (60,000 public charging points are slated to be ready by 2030).

6. Lower equipment levels?

One possible (though unlikely) consequence of this is that brands may decide to adapt their model specification choices to account for these new changes. Basically, make a car cheaper by omitting certain equipment and features to bring down its OMV (and accompanying taxes).

However, this strategy will likely only benefit a number of players in the 'entry' segment, and it's also dependent on the brand principal having the flexibility to offer this. We have seen a few models effectively getting a 'Singapore-spec' (usually less performance to duck into Cat A), so this is one to keep an eye on.

The harsh and unavoidable reality is that new cars are going to become more expensive, unless COE premiums take an unexpected turn and start coming down

What comes next?

Is there hope for the end consumer? Well, yes and no. The hope is that EVs become more cost competitive, which is a trend that we've been seeing and most studies/analyses agree will continue. So, the hope is that these cars' basic cost will come down, even as the cost of ICE models are expected to increase over time.

The other hope, of course, is that COE supply increases and helps bring down premiums (we're not going to hold our breaths). As we've previously analysed, the current cut-and-fill method is effectively taking from a pool of "future COEs" and bringing it forward, meaning that pool is already smaller. Given the opaque way that this is currently being implemented, it's impossible to know for sure, but an increase in COE supply would at least place downward pressure on prices.

The likely reality (and one that no one should quite be surprised by) is that unless COE premiums start tumbling in the coming years, everything's just going to become more expensive. Your cai fan, your bubble tea, your groceries, your iPhone, and yup, your next car as well.

The Land Transport Authority (LTA) has announced that the EV Early Adoption Incentive (EEAI) will be extended to the end of 2026, while the Vehicle Emissions Scheme (VES) will be extended to the end of 2027 with some notable adjustments to its banding, rebates and surcharges.

This is big news to drivers, especially those who are (or may soon be) in the market for a new car.

Here, we analyse some of the likely effects that these changes will have immediately, as well as when they kick in on 1 January 2026.

1. Car prices are all going up in 2026, and likely again in 2027

The long and short of this announcement is that car prices are all going up in 2026 (not accounting for COE changes).

For the VES, the actual banding categories have not changed in terms of the pollutant thresholds. Basically, what as A1, A2, B, C1 and C2 have effectively been renamed A, B, C1, C2 and C3.

What has changed, however, is the dollar value associated to each band. Put simply, rebates have been lowered and surcharges have been raised, meaning everything has effectively gone up from a cost perspective.

The financial impact of the revised EEAI is slightly more complicated. The maximum rebate remains at 45% of the car's ARF, but now capped at $7,500, down from $15,000. Because both VES and EEAI rebates are offset from a car's ARF, with these new adjustments, only EVs with an ARF of no more than $30,000 will not see prices increase due to these changes.

Any EV with ARF higher than $30,000 will see prices increase. Given the tiered ARF structure, that means that a car with an OMV higher than $27,143 will be impacted. A quick search on Sgcarmart indicates that the Aion V Premium, currently priced at $167,888 has an OMV of $28,000. There are presently only 8 EVs (not including parallel imported car) listed that are priced under that price point: BYD Atto 2, JMEV Elight, Dongfeng Box, Omoda E5, Aion Y Plus, Seres 3, Aion ES, and Opel Mokka-e (in descending price order). This means that almost all EVs will be getting more expensive.

Barring a handful of cars like the Aion Y Plus and Dongfeng Box, this is a blanket tax increase across the entire car market

For all other cars, prices will go up, as no non-EV in the market currently will even get close the to minimum $5,000 ARF floor even with current rebate levels. The cheapest current non-EV car (not including PI cars), the Suzuki Swift, has an OMV of $14,000.

So let's be quite clear about this: Barring a handful of cars, this is a blanket tax increase.

2027 will likely see another step up in car prices, as the EEAI is stopped altogether, and the respective VES rebates and surcharges are reduced/increased respectively.

2. COE prices are going to climb immediately

The natural and obvious tie-in consequence will happen immediately: COE is going to go up (again!).

It's even in LTA's press release: "We expect short-term increase in COE prices. Potential car buyers are strongly encouraged to be prudent in bidding for COEs."

Not sure how the second part is going to happen, but the first part is a no-brainer. Customers are going to want to lock in their purchases before these changes kick in, and similarly distributors will want to secure orders by 31 December 2025 (especially those holding a large amount of stock. Those cars will just become more expensive overnight when the calendar turns over).

Expect Cat A premiums to continue to set all-time highs. Cat B is likely to follow.

3. Used car prices will go up

The used car market tends to move in tandem with the new car market. And with new car prices likely to go up, the used car market will probably follow suit.

4. Reduced savings

With these changes, drivers' savings, even if they buy the 'cleanest' cars available, will be reduced. LTA's statement that "buyers will receive combined cost savings of up to $30,000 and $20,000 off the ARF for electric cars registered in 2026 and 2027, respectively" is technically accurate, but also slightly misleading. As we've previously explored, the real-world savings are not as simple as adding up the rebate values.

Those savings will fall further come 2027, when the VES rebate for EVs drop another $2,500, and EEAI is eliminated altogether.

5. A greater EV push

These changes clearly signal that the LTA and NEA (and by extension the Government) are pushing EV adoption relative to all other types of cars.

The one notable victim are hybrid cars - most of them fall into the current A2 banding, and the VES adjustments means they no longer get any rebates. Considering they are being touted as a good in-between solution between EVs and more-pollutive ICE cars, and likely a not small part of that cleaner vehicle vision, it's perhaps a little surprising that the rebate has been eliminated altogether.

Given that the EEAI is set to expire in 2027, 2026 will likely see a big push from distributors to put EVs on the road. Questions persist about whether customers are ready (seemingly more so than ever before), and whether the infrastructure will be ready to support this (60,000 public charging points are slated to be ready by 2030).

6. Lower equipment levels?

One possible (though unlikely) consequence of this is that brands may decide to adapt their model specification choices to account for these new changes. Basically, make a car cheaper by omitting certain equipment and features to bring down its OMV (and accompanying taxes).

However, this strategy will likely only benefit a number of players in the 'entry' segment, and it's also dependent on the brand principal having the flexibility to offer this. We have seen a few models effectively getting a 'Singapore-spec' (usually less performance to duck into Cat A), so this is one to keep an eye on.

The harsh and unavoidable reality is that new cars are going to become more expensive, unless COE premiums take an unexpected turn and start coming down

What comes next?

Is there hope for the end consumer? Well, yes and no. The hope is that EVs become more cost competitive, which is a trend that we've been seeing and most studies/analyses agree will continue. So, the hope is that these cars' basic cost will come down, even as the cost of ICE models are expected to increase over time.

The other hope, of course, is that COE supply increases and helps bring down premiums (we're not going to hold our breaths). As we've previously analysed, the current cut-and-fill method is effectively taking from a pool of "future COEs" and bringing it forward, meaning that pool is already smaller. Given the opaque way that this is currently being implemented, it's impossible to know for sure, but an increase in COE supply would at least place downward pressure on prices.

The likely reality (and one that no one should quite be surprised by) is that unless COE premiums start tumbling in the coming years, everything's just going to become more expensive. Your cai fan, your bubble tea, your groceries, your iPhone, and yup, your next car as well.

Thank You For Your Subscription.