COE Results Feb 2025 1st Bidding: Still headed downwards!

05 Feb 2025|7,550 views

| CAT | Premium | Change | Quota | No. of bids |

| A | $85,000 | ▼ $8,601 | 1,138 | 1,446 |

| B | $111,104 | ▼ $5,521 |

748 | 1,007 |

| C | $62,506 | ▼ $2,970 | 260 | 394 |

| E | $110,000 | ▼ $5,112 | 199 | 369 |

The first round of bidding for February saw Certificate of Entitlement (COE) premiums dropping across the board.

The drop in premiums are likely the result of the increase in COE supply available this quarter, which come thanks in part to the injection of supply from the LTA.

While the total number of bids received this session has indeed slipped for categories A and B when compared to the last bidding session, the same values remain basically on par when compared against the total number of bids received each session across the last 12 months. This indicates that while the supply of COE has increased, the demand for new cars remains healthy, even as we ease from the typical high demand periods including the lead up to the Lunar New Year and the weeks following the Singapore Motor Show.

Get data on past COE bidding exercises at our COE bidding results page.

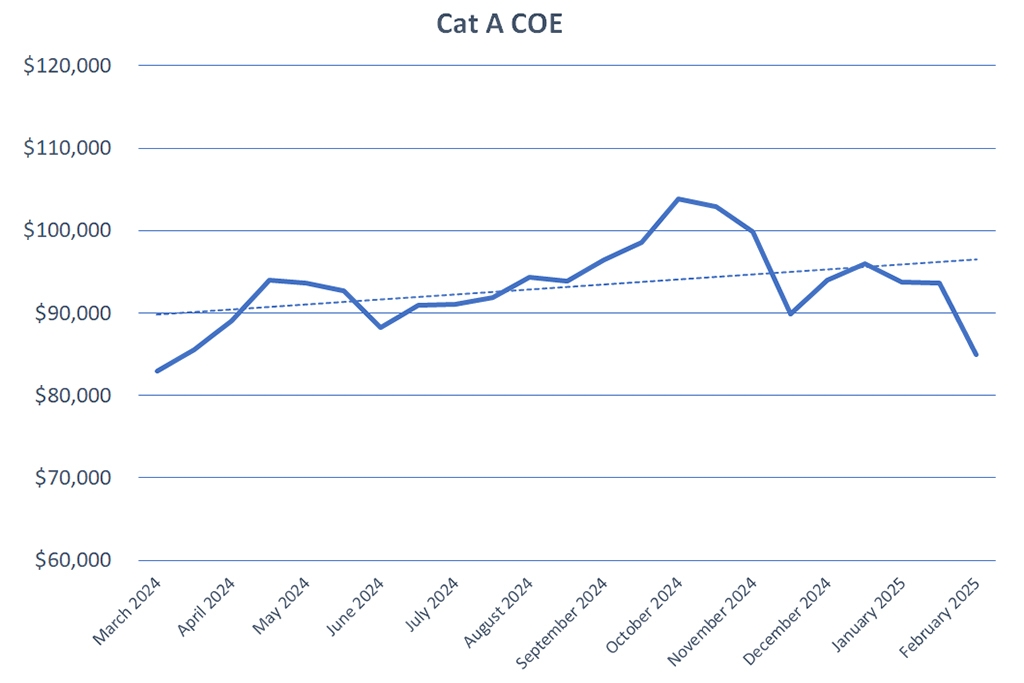

Cat A COE - Slipping by $85,000

Premiums for Cat A, for cars up to 1,600cc in engine capacity and with an output of no more than 130bhp or electric vehicles with a power output of up to 110kW, slipped by a total of $8,601 (9.2%) to reach $85,000. COE premiums have not dipped this low for the category since March of 2024.

The current premium now stands at 7.8% below the 12-month trailing average. The total number of number of bids submitted exceeded the number of successful bids this round by 27%, lower than the 12-month average of 56% for the category.

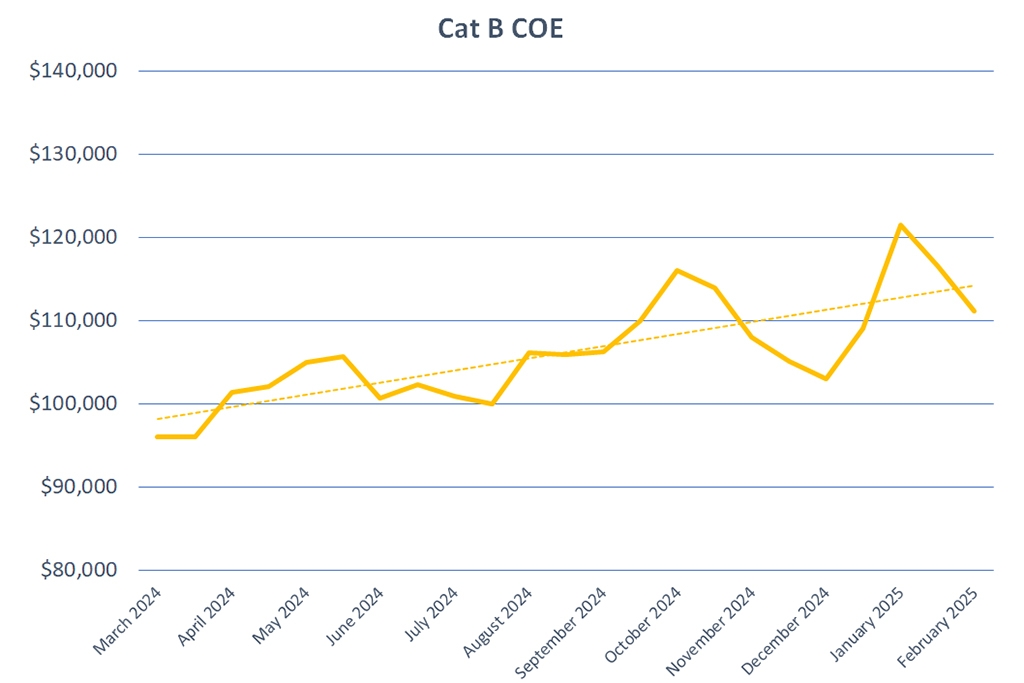

Cat B COE - Also taking a hit

Premiums for Cat B, for larger cars with more than 130bhp or engine displacements larger than 1,600cc or electric vehicles with a power output of more than 110kW, continued to dip this session, dropping by a total of $5,521 (4.7%) to reach $111,104.

This drop means the current premium for the category is now just 5.4% above the 12-month trailing average. The total number of unsuccessful bids this round exceeded the quota available by 35%. This is lower than the 12-month average figure for the category of 54%.

Cat C COE - Dropping by $2,970

Premiums for Cat C, for goods vehicles and buses, slipped this session by $2,970 (4.5%) to close at $62,506. The number of unsuccessful bids this round exceeded the available quota by 52%, lower than the 12-month average for this category of 59%.

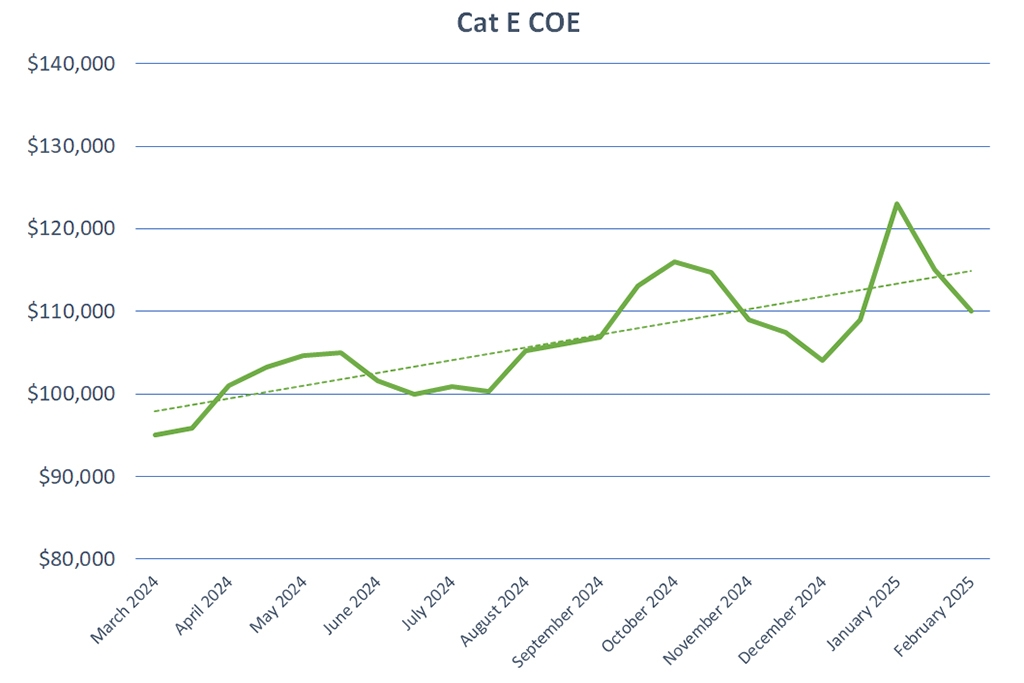

Cat E COE - Also slipping

Premiums for Cat E, the open category, also took a hit session, slipping by $5,112 (4.4%) to reach $110,000.

The current premium for the category is now 4.3% above the 12-month trailing average. The total number of unsuccessful bids this round exceeded the quota available by 85%, higher than the 12-month average figure for the category of 83%.

Prevailing Quota Premium

The Prevailing Quota Premium is the amount to be paid for COE renewal and is computed from the moving average of the previous three-months of COE prices. Those looking to renew the COE on their cars will thus have to pay the following prices for the respective months.

| Category | Prevailing Quota Premium |

| A | $94,513 (Feb) |

| B | $110,537 (Feb) |

| C | $68,481 (Feb) |

If you're looking for a fuss-free option to renew your car's COE, Sgcarmart Connect provides free COE renewal advice, which includes loan sourcing and all paperwork.

✅ Advice and tips on COE renewal

✅ Complimentary Pre-COE Car Inspection

✅ COE renewal loan quote comparisons

✅ Interest Rate typically starts from 2.88%

✅ 100% PQP Financing

✅ Settlement of entire COE renewal paperwork

| CAT | Premium | Change | Quota | No. of bids |

| A | $85,000 | ▼ $8,601 | 1,138 | 1,446 |

| B | $111,104 | ▼ $5,521 |

748 | 1,007 |

| C | $62,506 | ▼ $2,970 | 260 | 394 |

| E | $110,000 | ▼ $5,112 | 199 | 369 |

The first round of bidding for February saw Certificate of Entitlement (COE) premiums dropping across the board.

The drop in premiums are likely the result of the increase in COE supply available this quarter, which come thanks in part to the injection of supply from the LTA.

While the total number of bids received this session has indeed slipped for categories A and B when compared to the last bidding session, the same values remain basically on par when compared against the total number of bids received each session across the last 12 months. This indicates that while the supply of COE has increased, the demand for new cars remains healthy, even as we ease from the typical high demand periods including the lead up to the Lunar New Year and the weeks following the Singapore Motor Show.

Get data on past COE bidding exercises at our COE bidding results page.

Cat A COE - Slipping by $85,000

Premiums for Cat A, for cars up to 1,600cc in engine capacity and with an output of no more than 130bhp or electric vehicles with a power output of up to 110kW, slipped by a total of $8,601 (9.2%) to reach $85,000. COE premiums have not dipped this low for the category since March of 2024.

The current premium now stands at 7.8% below the 12-month trailing average. The total number of number of bids submitted exceeded the number of successful bids this round by 27%, lower than the 12-month average of 56% for the category.

Cat B COE - Also taking a hit

Premiums for Cat B, for larger cars with more than 130bhp or engine displacements larger than 1,600cc or electric vehicles with a power output of more than 110kW, continued to dip this session, dropping by a total of $5,521 (4.7%) to reach $111,104.

This drop means the current premium for the category is now just 5.4% above the 12-month trailing average. The total number of unsuccessful bids this round exceeded the quota available by 35%. This is lower than the 12-month average figure for the category of 54%.

Cat C COE - Dropping by $2,970

Premiums for Cat C, for goods vehicles and buses, slipped this session by $2,970 (4.5%) to close at $62,506. The number of unsuccessful bids this round exceeded the available quota by 52%, lower than the 12-month average for this category of 59%.

Cat E COE - Also slipping

Premiums for Cat E, the open category, also took a hit session, slipping by $5,112 (4.4%) to reach $110,000.

The current premium for the category is now 4.3% above the 12-month trailing average. The total number of unsuccessful bids this round exceeded the quota available by 85%, higher than the 12-month average figure for the category of 83%.

Prevailing Quota Premium

The Prevailing Quota Premium is the amount to be paid for COE renewal and is computed from the moving average of the previous three-months of COE prices. Those looking to renew the COE on their cars will thus have to pay the following prices for the respective months.

| Category | Prevailing Quota Premium |

| A | $94,513 (Feb) |

| B | $110,537 (Feb) |

| C | $68,481 (Feb) |

If you're looking for a fuss-free option to renew your car's COE, Sgcarmart Connect provides free COE renewal advice, which includes loan sourcing and all paperwork.

✅ Advice and tips on COE renewal

✅ Complimentary Pre-COE Car Inspection

✅ COE renewal loan quote comparisons

✅ Interest Rate typically starts from 2.88%

✅ 100% PQP Financing

✅ Settlement of entire COE renewal paperwork

Latest COE Prices

May 2025 | 1st BIDDING

NEXT TENDER: 21 May 2025

CAT A$103,009

CAT B$119,890

CAT C$62,590

CAT E$118,889

View Full Results Thank You For Your Subscription.