Grab and NTUC Income launch critical illness insurance for driver-partners

01 Aug 2019|3,933 views

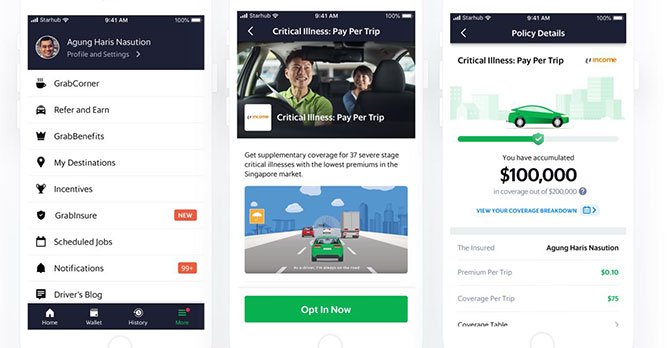

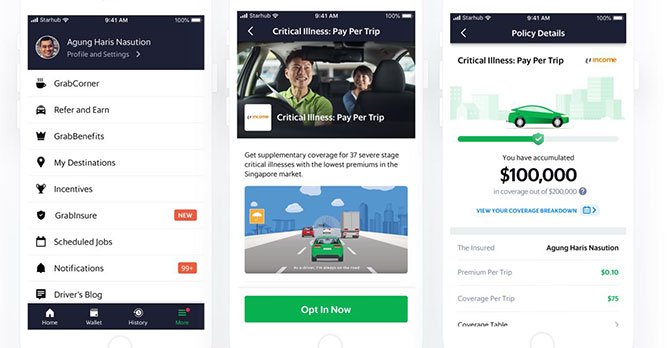

Grab's insurance arm, GrabInsure and NTUC Income, have jointly unveiled Southeast Asia's first micro-insurance plan, Critical Illness: Pay Per Trip (CIPPT), in Singapore. Specially designed to help Grab driver-partners better protect themselves against critical illnesses, CIPPT offers a unique and flexible pay-per-trip micro premium and accumulative coverage proposition.

They can also conveniently subscribe to the plan via the Grab driver-partner app and with each completed trip, and have the CIPPT premiums automatically deducted from their in-app cash wallet.

CIPPT is a critical illness insurance plan that provides Grab driver-partners the option to pay for premiums on a per trip basis. Unlike typical insurance plans that call for a commitment to a fixed premium amount over a set period, CIPPT offers greater flexibility on cash flows to maintain the plan.

For as low as $0.10 per trip completed, Grab driver-partners can accumulate insurance coverage of a sum assured of up to $200,000 for 360 days, in the event that the insured is diagnosed with a critical illness covered under the plan.

The plan is available to all Grab driver-partners who are 18 to 75 years of age. To sign up, driver-partners simply need to apply and choose from three premium rates ($0.10, $0.30 and $0.50 per trip) on the Grab driver app. The premium deducted will then convert to the corresponding amount of coverage earned per trip.

With every ride the driver-partners complete, Grab will deduct the chosen premium rate via the in-app cash wallet, payable to NTUC Income. The plan enables driver-partners to retain a level of flexibility and maintain their accrued coverage on a rolling 360-day period. Driver-partners will stay protected by the accumulated coverage across the 360 days on a rolling basis, even if they choose to take a break from driving. There is no minimum trip requirement per day and they can work anytime.

Grab's insurance arm, GrabInsure and NTUC Income, have jointly unveiled Southeast Asia's first micro-insurance plan, Critical Illness: Pay Per Trip (CIPPT), in Singapore. Specially designed to help Grab driver-partners better protect themselves against critical illnesses, CIPPT offers a unique and flexible pay-per-trip micro premium and accumulative coverage proposition.

They can also conveniently subscribe to the plan via the Grab driver-partner app and with each completed trip, and have the CIPPT premiums automatically deducted from their in-app cash wallet.

CIPPT is a critical illness insurance plan that provides Grab driver-partners the option to pay for premiums on a per trip basis. Unlike typical insurance plans that call for a commitment to a fixed premium amount over a set period, CIPPT offers greater flexibility on cash flows to maintain the plan.

For as low as $0.10 per trip completed, Grab driver-partners can accumulate insurance coverage of a sum assured of up to $200,000 for 360 days, in the event that the insured is diagnosed with a critical illness covered under the plan.

The plan is available to all Grab driver-partners who are 18 to 75 years of age. To sign up, driver-partners simply need to apply and choose from three premium rates ($0.10, $0.30 and $0.50 per trip) on the Grab driver app. The premium deducted will then convert to the corresponding amount of coverage earned per trip.

With every ride the driver-partners complete, Grab will deduct the chosen premium rate via the in-app cash wallet, payable to NTUC Income. The plan enables driver-partners to retain a level of flexibility and maintain their accrued coverage on a rolling 360-day period. Driver-partners will stay protected by the accumulated coverage across the 360 days on a rolling basis, even if they choose to take a break from driving. There is no minimum trip requirement per day and they can work anytime.

Latest COE Prices

August 2025 | 1st BIDDING

NEXT TENDER: 20 Aug 2025

CAT A$102,009

CAT B$123,498

CAT C$70,001

CAT E$122,334

View Full Results Thank You For Your Subscription.